In the fast-paced world of futures trading, where milliseconds can mean the difference between profit and loss, traders need robust, agile, and highly customizable tools. One such platform that continues to stand out is the MultiCharts futures platform. Known for its precision, speed, and deep technical analysis capabilities, MultiChartshas solidified its place among top-tier institutional trading platforms.

In this comprehensive piece, we will explore what makes the MultiCharts trading platformunique in the increasingly crowded market of futures trading platforms. We’ll examine how the right futures broker, particularly one as distinguished as Cannon Trading Company, can help maximize your success when trading on MultiCharts. We’ll also take a forward-looking perspective on what traders can expect from MultiCharts during the second half of the 2020s.

Try a FREE Demo!

What Is MultiCharts?

MultiCharts is a professional-grade futures trading platform that caters to retail, institutional, and algorithmic traders alike. Launched with the vision of delivering high-performance charting, backtesting, and automated trading capabilities, the platform has evolved into a powerhouse favored by traders worldwide. It supports a wide range of data feeds and broker connections, including Rithmic, CQG, Interactive Brokers, and more.

Whether you’re engaged in futures contract trading, emini trading, or deploying custom indicators and strategies, MultiCharts provides a flexible, powerful framework that delivers consistent results. It’s not just another charting platform—it’s a complete trading environment.

What Makes MultiCharts Unique Among Futures Trading Platforms?

- Advanced Charting and Analytics

At the core of the MultiCharts futures platform is its advanced charting system. With support for multi-timeframe analysis, hundreds of built-in indicators, and user-customizable chart types, traders can gain a highly detailed and nuanced view of the markets. Time-based, volume-based, and tick-based charts are all available.The MultiCharts trading platform also supports Renko, Kagi, Point and Figure, and Range bars—tools highly valued by discretionary and systematic traders alike.

- PowerLanguage Scripting

MultiCharts includes PowerLanguage, a powerful scripting language similar to EasyLanguage. This feature empowers users to create custom indicators, strategies, and alerts tailored to their trading style. Whether you’re building a mean-reversion system or trend-following strategy for emini contracts, the platform adapts seamlessly.

- Institutional-Grade Performance

Unlike some retail platforms, MultiCharts is built with institutional trading platform quality in mind. It allows for high-frequency order execution, low-latency data processing, and robust server integration. Traders who require real-time responsiveness for trading futures—especially in volatile emini markets—can count on MultiCharts to deliver.

- Multi-Broker and Multi-Data Feed Support

The platform offers broad compatibility with top data feeds and brokers. This interoperability is crucial for serious futures trading, especially for traders diversifying their strategies across platforms like Rithmic, CQG, and others.

- Strategy Backtesting and Optimization

MultiCharts supports both historical and real-time backtesting. The optimization engine lets traders fine-tune parameters using a range of algorithms—including genetic and brute-force optimization. This is a game-changer for trading futures using algorithmic methods, especially across futures contract trading portfolios.

- One-Click Trading and DOM Interface

For scalpers and intraday traders focused on emini trading, the one-click trading interface and DOM (Depth of Market) ladder are indispensable. These tools allow for ultra-fast entries and exits, an essential feature in high-speed markets.

Try a FREE Demo!

How a Futures Broker Helps You Trade with MultiCharts

Having access to a high-powered platform like MultiCharts is only part of the equation. The other half lies in choosing the right futures broker to help you execute efficiently, securely, and competitively.

Here’s how a quality futures broker like Cannon Trading Company enhances the MultiCharts experience:

- Seamless Integration

Cannon Trading offers native support for MultiCharts, ensuring that your platform connects effortlessly with data feeds and order routing systems. Whether you’re using CQG, Rithmic, or other feeds, the integration is plug-and-play.

- Professional Support and Setup

Getting the most out of the MultiCharts futures platform often requires guidance—especially during initial setup. Cannon’s technical support team offers one-on-one help, platform tutorials, and troubleshooting for both new and experienced users.

- Institutional-Level Data Feeds

High-quality data is critical for futures contract trading, and Cannon Trading offers direct access to premium data feeds. This is especially important for real-time analysis, scalping, and emini trading, where delays can be costly.

- Regulatory Protection and Transparency

As a broker with nearly 40 years of history and a sterling reputation with the CFTC and NFA, Cannon Trading Company provides a layer of trust and accountability that is essential for serious futures trading.

- Variety of Account Options

Whether you are trading a self-directed account, running automated systems, or managing money for clients, Cannon offers customized solutions that align with your trading style and goals on the MultiCharts trading platform.

The Future of the MultiCharts Trading Platform: 2025 and Beyond

As the financial markets continue to evolve rapidly—driven by artificial intelligence, quantum computing, and decentralized technologies—MultiCharts is well-positioned to remain at the forefront of institutional trading platforms.

- AI-Driven Enhancements

We anticipate that MultiCharts will integrate machine learning modules into its core platform by the late 2020s. These tools will help traders automate pattern recognition, anomaly detection, and adaptive strategies—especially useful for futures contract trading across multiple markets.

- Greater Cloud Integration

Expect to see MultiCharts embrace hybrid cloud functionality. This will allow traders to backtest on high-performance servers, store strategies remotely, and run simulations on-demand—all without taxing their local machines.

- Expanded Data Partnerships

To maintain its edge, the MultiCharts futures platform is likely to expand its partnerships with emerging data providers, including sentiment analysis tools, blockchain-based market data, and alternative datasets.

- Enhanced Mobile and Web Interfaces

While MultiCharts is currently desktop-centric, there are clear indications that mobile and web-based modules are on the roadmap. This will cater to modern traders who demand flexibility and access anytime, anywhere.

- User-Driven Feature Development

MultiCharts maintains a strong community of users who actively contribute to platform evolution. As this community grows, expect more trader-driven innovations—from strategy repositories to open-source indicator libraries.

Why Cannon Trading Company Is the Ideal Brokerage for MultiCharts Users

Selecting a futures broker isn’t just about low commissions—it’s about trust, technology, support, and reputation. Cannon Trading Company excels in all these areas and is particularly well-suited for traders using the MultiCharts futures platform.

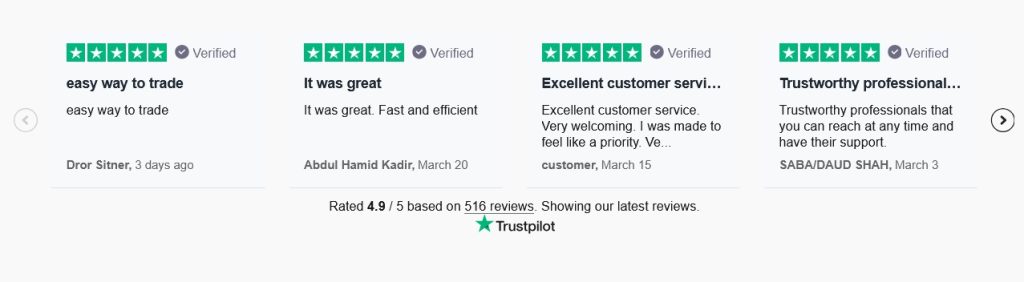

- TrustPilot-Rated 5 Stars by Thousands of Satisfied Clients

Cannon’s customer reviews speak volumes. With countless 5-star ratings on TrustPilot, it’s clear that traders—from novice to professional—feel valued, supported, and empowered.

- Nearly 40 Years of Proven Experience

Founded in 1988, Cannon Trading has weathered every major financial storm of the past four decades. This institutional knowledge is priceless, especially when you’re involved in volatile markets like emini trading or futures contract trading.

- Wide Range of Supported Platforms

While this article focuses on MultiCharts, Cannon supports a wide array of platforms, including CQG, RTrader, TradingView, MotiveWave, Bookmap, and more. This means you can diversify strategies and access different tools as your trading journey evolves.

- Regulatory Excellence

Cannon maintains exemplary relationships with key regulators like the CFTC and NFA. This assures traders that their funds are secure, transactions are transparent, and ethics are never compromised.

- Personalized Service

Whether you’re an algorithmic trader executing complex futures contract trading strategies or a beginner dipping into emini trading, Cannon assigns dedicated professionals to assist you every step of the way.

- Deep Educational Resources

With blogs, webinars, daily trading tips, and platform tutorials, Cannon goes above and beyond to educate its clients. This level of commitment is rare in the futures broker space.

MultiCharts and Cannon Trading: A Winning Combination for All Traders

The synergy between the MultiCharts trading platform and Cannon Trading Company offers a complete solution for modern futures trading. Together, they provide cutting-edge technology, trustworthy execution, and personalized support that suits traders of all levels.

Whether you’re backtesting a new strategy, scalping e mini contracts in volatile markets, or deploying fully automated systems across asset classes, you’ll find everything you need with MultiCharts and Cannon Trading.

In a landscape filled with promises and pitfalls, these two industry leaders stand as pillars of innovation, reliability, and trader empowerment. The second half of the 2020s will undoubtedly bring rapid change, but one thing remains clear: partnering with a world-class broker and using a professional-grade institutional trading platform like MultiCharts is a strategic decision that can elevate your trading outcomes to new heights.

The MultiCharts futures platform stands apart as one of the most dynamic, powerful, and future-ready tools for professional futures trading. Combined with the expert services of Cannon Trading Company, traders are equipped not just to survive but to thrive in today’s markets and tomorrow’s innovations.

From technical precision to broker-backed execution, from real-time analytics to future-facing upgrades, this combination is tailor-made for traders who demand more.