The Week Ahead: Federal Reserve Board Black Out Period Dec 2-14

By John Thorpe, Senior Broker

March (H24) Interest rate products, U.S. T-Bond Futures ZB, Ultra T-Bond Futures UB, 10-Year T-Note Futures ZN, 5-Year T-Note Futures ZF, 2-Year T-Note Futures ZT. are now front month

Earnings watch, Tuesday 12-5 Toll Brothers Builders NYSE (TOL), Thursday 12-7 chipmaker Broadcom NYSE (AVCO)

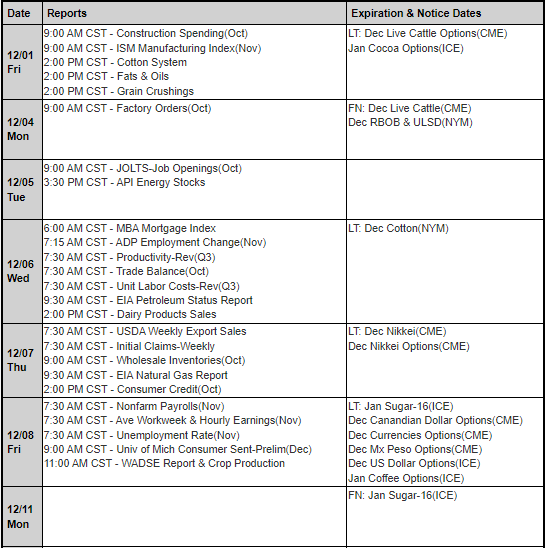

Reports a variety, Main Focus Friday, NFP 7:30am, WASDE 10am and 1st day of Hanukkah all times CST

The Role of Expectations for the NFP report

Expectations are typically baked into future prices. Rarely can a more direct correlation to this reality be found than in our futures markets as they are affected by expectations of NFP .

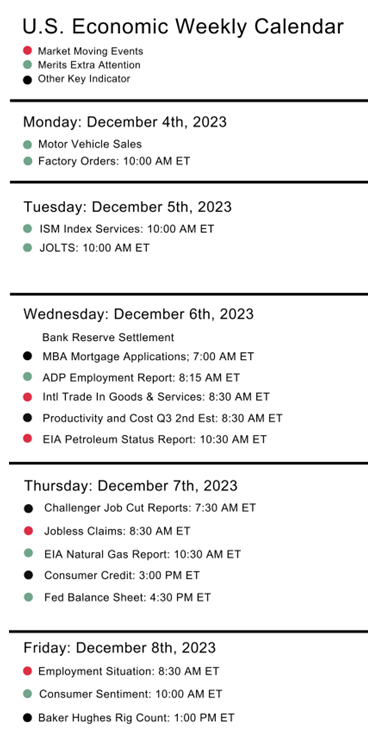

There are a number of indicators the Federal Reserve Board and investors watch prior to the NFP release, these all become reflected in asset prices and if there is a surprise NFP release, the market can adjust violently to the new perception of the health of the economy and therefore the affect on future Interest rate decisions. For instance, The Labor Department’s JOLTS report tracks monthly change in job openings and offers rates on hiring and quits. The reporting period lags other employment data including the employment situation report. Then there is the ADP report The national employment report from Automated Data Processing Inc. and is computed from ADP payroll data and offers advance indications on the U.S. private workforce. Are to name but two. Contact your broker for more detail.

This Friday @ 7:30 a.m. CST the BLS will release it’s monthly employment update called the NFP which stands for Non-Farm Payroll and this specific economic event is always released on the first Friday of every month. Rarely, the NFP figure may be postponed to the second Friday if the first Friday is the first of the month or a public holiday. This Friday is one of those rare exceptions. The NFP figure is a report which shows how many individuals are employed within the US but excludes specific industries such as agriculture.

Why is it important to the Dollar?

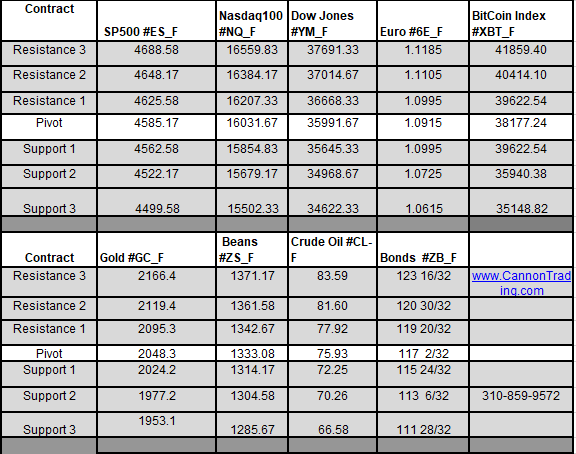

DXH24, 6EH24 (eurocurrency)

When individuals wish to invest in stocks, bonds and a currency, they prefer currencies backed by a strong economy with a robust employment sector. In addition, if employment is high, the Federal Reserve is also likely to increase interest rates or keep them high; again, this can support demand for the Dollar.

A higher-than-expected NFP figure is positive for the Dollar.

A lower-than-expected NFP figure is negative for the Dollar. The inverse would be true for the Euro currency

Why is it important to the US Stocks?

ESH24,NQH24,RTYH24,YMH24 + micros

The NFP figure can affect the US Stock Market in 2 ways. A higher-than-expected NFP figure can indicate a resilient economy and higher consumer demand. As a result, companies perform better; earnings are higher, as is investor confidence. This can cause the stock market to rise. But be wary as it can also trigger current belief by the FED that interest rate increases will be necessary to cool the employment trend.

On the other hand, if the Federal Reserve is increasing interest rates, positive employment figures may support a further increase. Interest rates can significantly pressure the stock market. A lower than expected figure during the current environment may rally stocks as the FED would NOT need to raise rates further yet as they wait and see if their tight money policy is being effective

Why is it important to the Gold?

GGCG24, GCG24 + micros

The price of Gold is largely inversely correlated with the cost of the Dollar. As a result, the NFP can influence the price of gold. Whether the horse leads the cart or the cart leads the horse is for you to determine as you lock those contracts onto your trading screens.

Why is it important to Interest Rates?

UBH24,ZBH24,ZTH24,FFF24 + minis

If the NFP is stronger than expectations Bond prices will go lower as the concern of “higher for Longer” persists

If the NFP is weaker than expected Bond Prices will go higher as anticipation for rate cuts sooner wash over the interest rate markets