The Benefits of Trading Stock Index Futures

Read more about trading stock index futures with Cannon Trading Company here.

Trading stock index futures instead of individual stocks is a strategy that offers several advantages to investors and traders. Stock index futures, such as Nasdaq 100 futures, S&P 500 futures, and Dow Jones futures, allow market participants to gain exposure to a broad market index rather than investing in individual stocks. This approach has gained popularity for several reasons, making it an attractive choice for those looking to diversify their portfolios, manage risk, and potentially achieve better results.

- Diversification: One of the primary benefits of trading stock index futures is diversification. Instead of investing in a single stock, which can be subject to company-specific risks, trading futures on a stock index provides exposure to a basket of stocks. The Nasdaq 100, S&P 500, and Dow Jones Industrial Average (DJIA) are well-known stock indices, and trading futures on these indices allows traders to benefit from the collective performance of multiple companies. This diversification spreads risk and can reduce the impact of negative news or events affecting individual stocks.

- Liquidity: Stock index futures are highly liquid, making it easier for traders to enter and exit positions. Liquidity is essential for executing trades at desired prices and minimizing slippage, which can be more challenging when dealing with less liquid individual stocks. The liquidity of index futures also ensures that there are typically tighter bid-ask spreads, reducing transaction costs for traders.

- Leverage: Stock index futures often require a smaller capital outlay compared to buying a portfolio of individual stocks. This allows traders to leverage their positions, potentially amplifying their returns. However, it’s important to note that leverage also comes with increased risk, so traders should use it judiciously and be aware of the potential for substantial losses.

- Risk Management: Stock index futures are valuable tools for managing risk. They can be used to hedge an existing stock portfolio or to speculate on market movements. For instance, if an investor owns a portfolio of technology stocks and believes there may be a market downturn, they can use Nasdaq futures to hedge their exposure. If the market declines, gains on the futures position can offset losses in the stock portfolio.

- Lower Company-Specific Risk: By trading stock index futures, investors can avoid the company-specific risk associated with individual stocks. While stocks can be impacted by events like earnings reports, management changes, or product recalls, these factors have a limited impact on stock index futures. Traders can focus on broader market trends and economic factors when trading futures contracts.

- 24-Hour Trading: Stock index futures often have extended trading hours, allowing traders to react to global events and news outside regular market hours. This can be advantageous for those who want to stay informed and make trading decisions around the clock.

- Transparency and Regulation: Stock index futures are traded on regulated exchanges, providing a high level of transparency and oversight. This can instill confidence in traders, knowing that their transactions are conducted in a well-regulated environment.

In conclusion, trading stock index futures offers several advantages over trading individual stocks. These futures contracts provide diversification, liquidity, leverage, and risk management benefits. They are especially popular for traders looking to gain exposure to broad market indices like the Nasdaq, S&P 500, and Dow Jones. By trading stock index futures, investors can reduce company-specific risk, manage their portfolios more efficiently, and potentially achieve better risk-adjusted returns. However, like any investment, it is essential for traders to understand the complexities and risks associated with futures trading and to employ sound risk management practices.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any ti

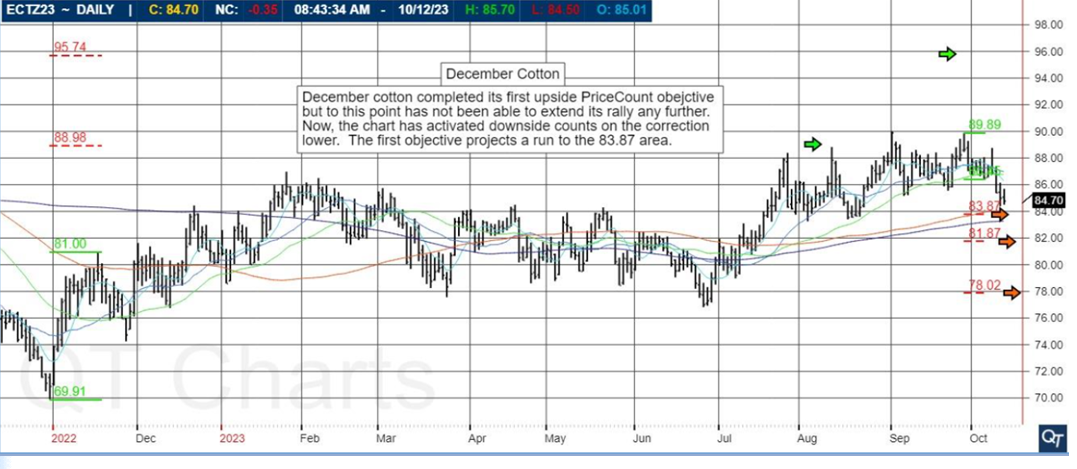

Plan your trade and trade your plan.

Download your FREE copy of Order Flow Essentials!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

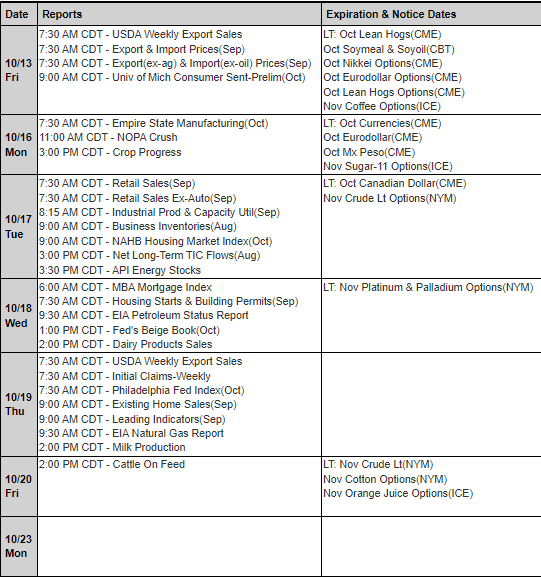

10-20-2023

Improve Your Trading Skills

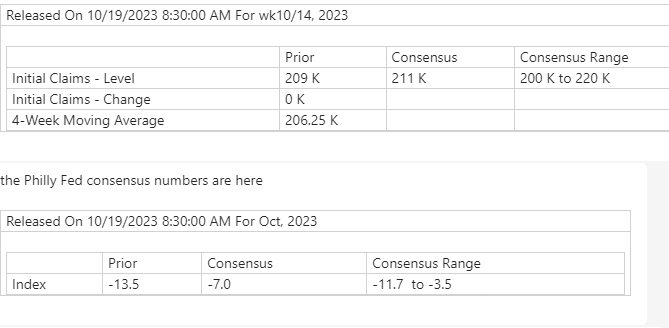

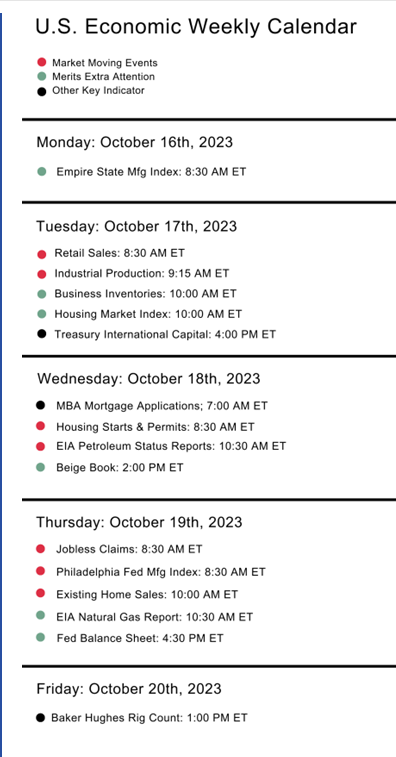

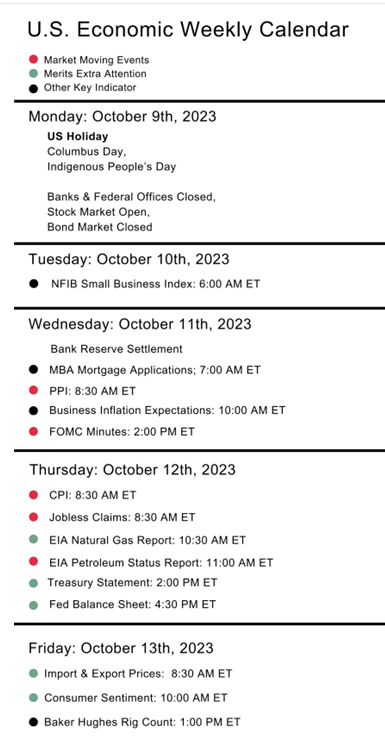

Economic Reports,

Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.