Cannon Futures Weekly Newsletter Issue # 1177

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices

- Trading Alerts Via Email

- Broker’s Trading System of the Week – Mini Nasdaq Day Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices

-

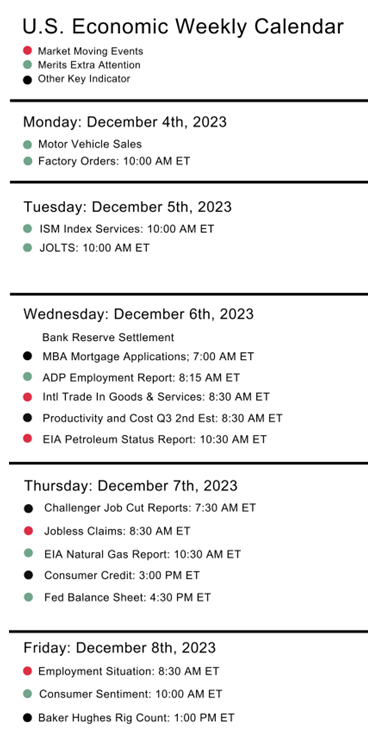

- We are not seeing any Fed Speakers on the Calendar for next week, this could change.

- Volatility should be a feature mid to late week

- Wholesale trade (Wed), CPI (Thur), jobless claims(Thur), PPI (Fri) All@ 7:30 a.m. CST

- Over 1 Trillion $$ in Market Cap report Q4 ’23 earnings on Friday the 15th.

- Those reporting: JPM(Chase), UNH (United Healthcare), BAC (Bank of America), WFC (Wells Fargo), C (Citibank), BLK (BlackRock)

- In the Ag sector, what is touted as “the biggest USDA data dump of the year, presenting the opportunity for the most market-moving surprises” by Arlan Suderman StoneX lead Ag analyst.

- USDA Supply/Demand and Annual Crop production numbers to be released @11:00 a.m. CST

-

-

Real Time Email Alerts

Directly to your Phone!

- You will receive an email each time there is an entry or exit in a simple language along with the current price for that specific market.

- A licensed series 3 broker at your fingertips

- Email alerts available to US and Canada and Int’l clients

- Alerts available for: Stock Indices, Grains, Metals, Rates, Currencies, Meats & Softs

- Open an account* and receive the Trade Alerts free for 3 months ($357 value)

- See an example of a recent trade alert for Gold Futures in the image below

-

Broker’s Trading System of the Week

-

Trading Levels for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.