|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (141)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (431)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Category: Economic Trading

Tomorrow’s Market Lineup: Existing Home Sales, Beige Book, and Crude Oil Reports

|

|

AI: The Next Gold Mine or Money Pit? Insights on Markets, Earnings, and Economic Trends

|

Weekly Newsletter: Hogs Outlook, Mini Russell System+ Trading Levels for Oct. 21st

Cannon Futures Weekly Letter Issue # 1213

In this issue:

- Important Notices – Earnings & Fed Speakers

- Futures 101 – Ask a Broker: Day trading Futures? Margins?

- Hot Market of the Week – December Hogs

- Broker’s Trading System of the Week – Mini Russell Day Trading System

- Trading Levels for Next Week

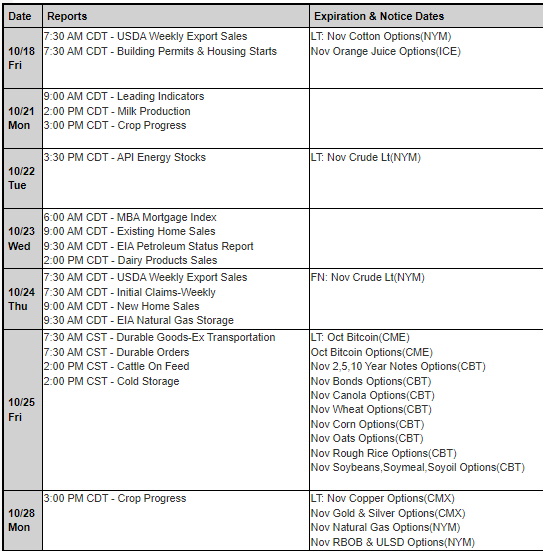

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

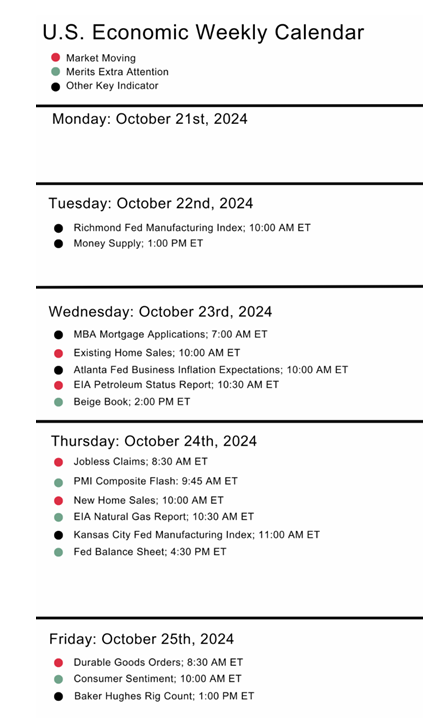

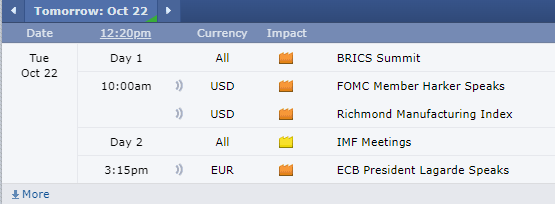

The Week Ahead

By John Thorpe, Senior Broker

A fair amount of Speakers, Data and Earnings .

Just 2 ½ weeks to the U.S. Presidential Election. Nov 5th.

Economic Data:

Mon. CB Leading Indicators

Tue. Redbook, Richmond Fed

Wed. Mortgage Index

Thu. Chicago Fed Activity Index, Weekly Initial Jobless Claims, New Home Sales

Fri. Durable Goods, Michigan Consumer Sentiment.

Fed and ECB Speakers:

Mon. Logan, Kashkari, Schmid

Tue. 9A.M. Central ECB President Lagarde, Harker

Wed. Bowman, LaGarde 9 A.M. Central, Barkin

Thu. Hammack

Fri. quiet

Earnings: 608 3rd QTR. Reports this week

Prominent Companies reporting

Wed. Tesla, IBM, Coca-Cola

- Thu. UPS

|

|

|

“Trading Around Key Economic Reports” FREE SHORT Course you will learn:

- What is GDP?

- About the Retail Sales Report

- What is NFP ( non farm payroll) Report?

- Understanding US housing Data

- FOMC

- Understanding Oil Data Report

- Importance of Consumer Confidence Survey

-

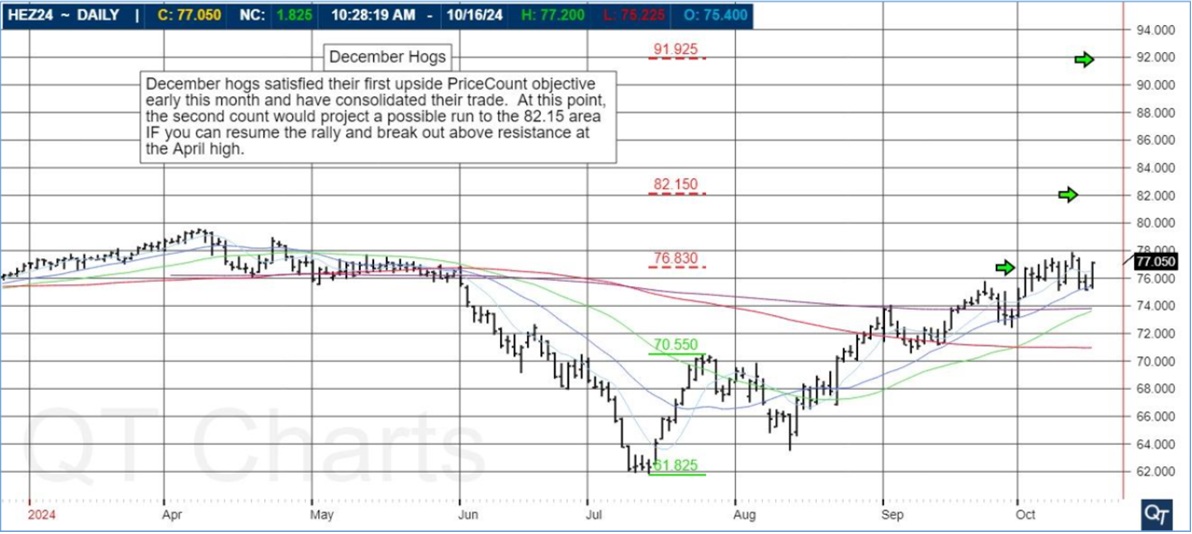

- Hot Market of the Week – December Hogs

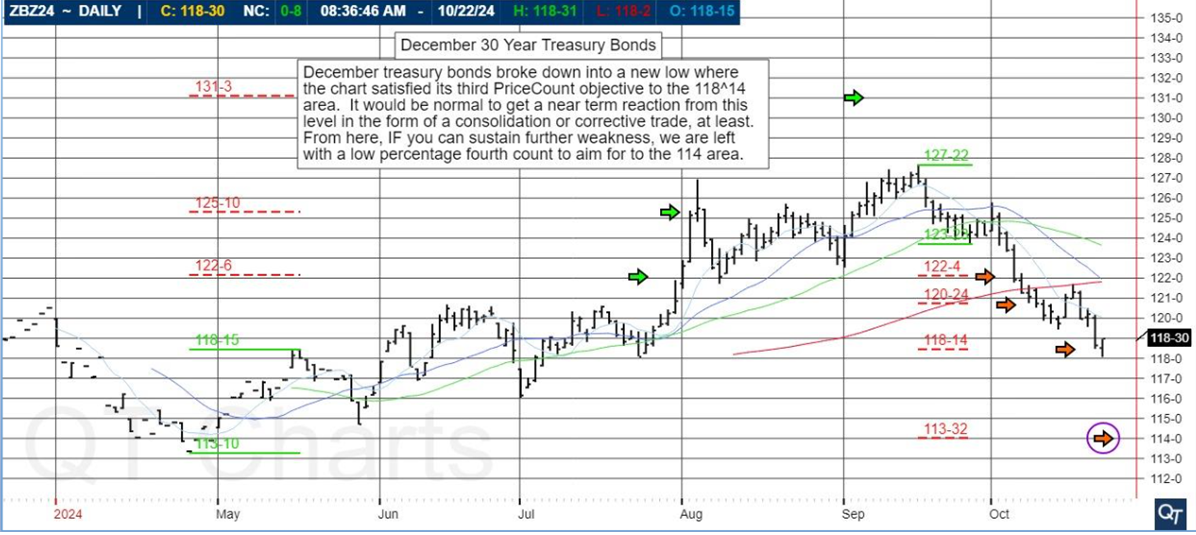

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Hogs

December hogs satisfied their first upside PriceCount objective early this month and have consolidated their trade. At this point, the second count would project a possible run to the 82.15 area IF you can resume the rally and break out above resistance at the April high.

PriceCounts – Not about where we’ve been , but where we might be going next!

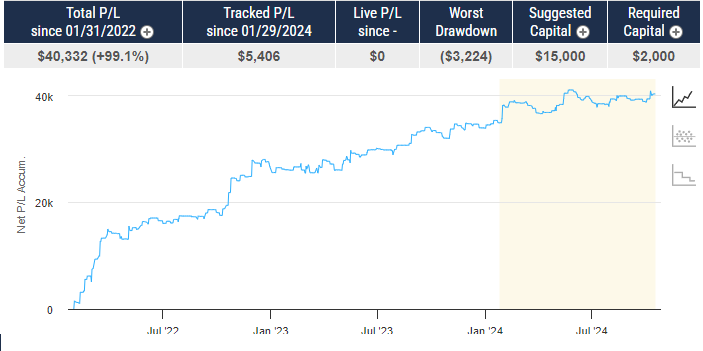

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

MVA 998 RTY 208

PRODUCT

RTY – Mini Russell 2000

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$10,000

COST

USD 80 / monthly

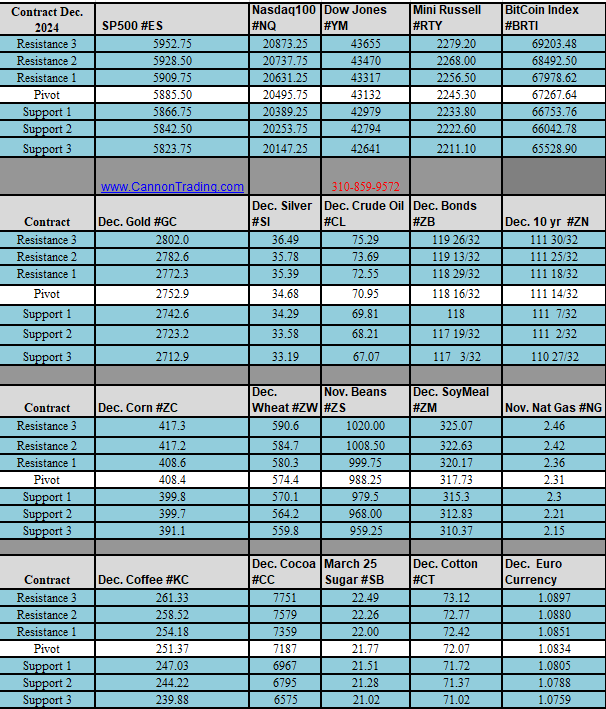

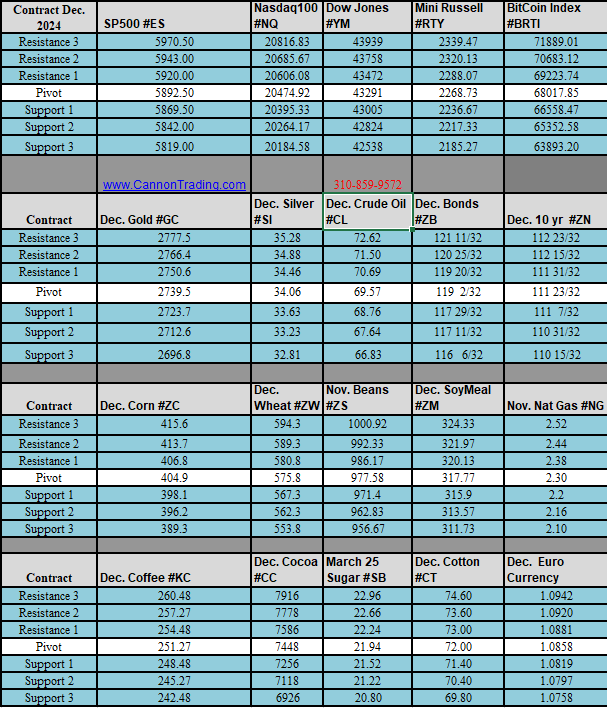

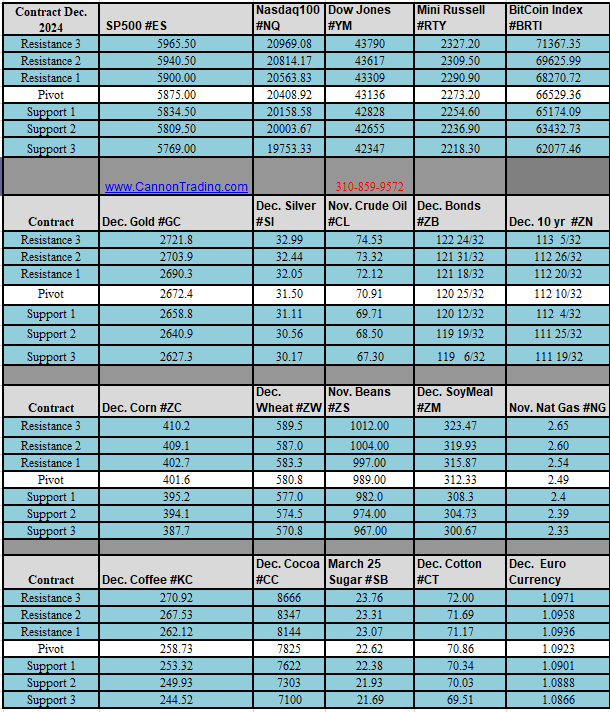

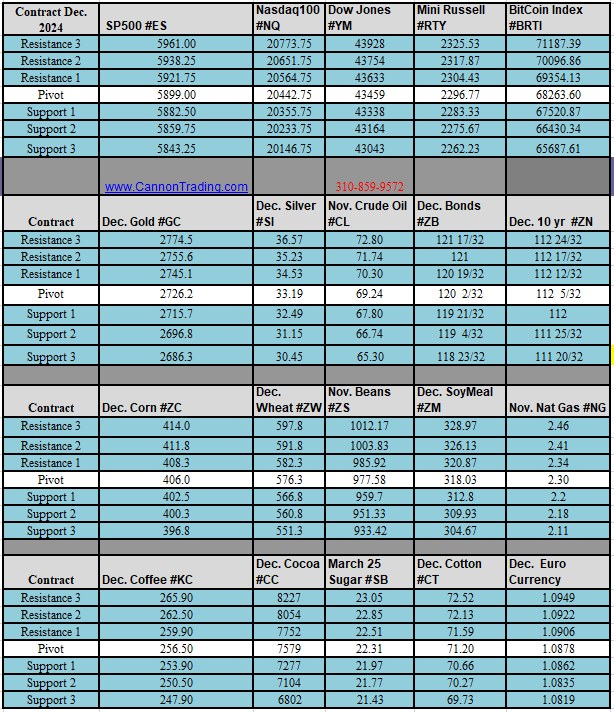

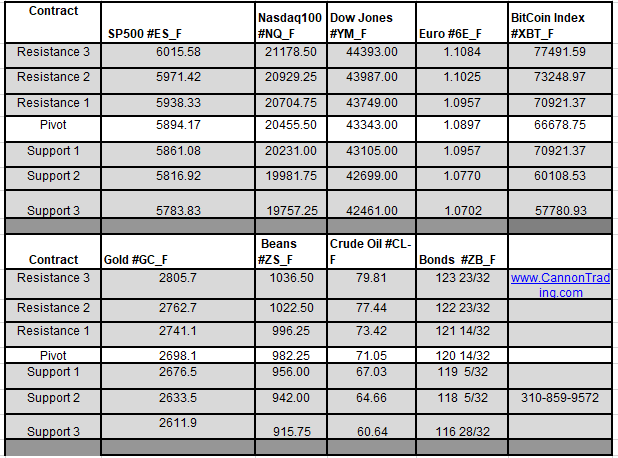

Daily Levels for October 21st, 2024

Weekly Levels for the week of October 21st, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Oil Slumps on OPEC Demand Downgrade, Metals Rally as Fed Rate Cut Hopes Grow

|

|

CPI, FOMC Minutes + Futures Trading Levels for 04.10.2024

CPI and FOMC minutes Tomorrow

CPI Tomorrow! The CPI will be critical to the inflation outlook for Fed policymakers.

Previous CPI reports have created velocity logic events in the stock indices at the CME.

Please read more details about velocity logic and price banding HERE.

The above reports will Bookend the FOMC minutes release @1pm CT on tomorrow.

My previous notes suggest to do the following if you are an index day trader:

Get out before the 730 AM CPI.

Wait for the smoke to clear.

Resume trading.

Look at market volume and behavior after 9:30 AM Central time to decide if and how to resume trading.

I usually stop trading and resume after 1 PM once FOMC minutes are out.

AGAIN…This is just my PERSONAL preferences…

Daily Levels for April 10th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Weekly Hueber Report: Now is it time to worry? Trading Levels for March 27th

The Following is analysis from Dan Hueber. You can find his analysis on Our QT Market Trading platform

Weekly Hueber Report: Now is it time to worry?

According to the Federal l Reserve Bank of New York, household debt in the United States grew by $212 billion to reach $17.5 trillion in the fourth quarter of last year. The lion’s share of this debt is wrapped up in mortgages and home equity lines of credit, which grew $112 billion during the quarter and reached $12.25 trillion. Auto loans rose $12 billion to $1.61 trillion, and student loans were flat at around $1.6 trillion, but the most significant percentage growth came via credit cards, which jumped $50 billion to $1.13 trillion.

Do keep in mind that as the overall population continues to grow, it is only natural for debt to expand along with it. Still, when you add in the fact that savings went backward during that same period, it would appear that the American consumer is increasingly relying on debt to meet day-to-day needs and wants. I should point out that savings balances have not slipped to as low as they were during the second quarter of 2022 and remain relatively consistent with the period between 2010 and 2018. However, both the amount being tucked away and the personal savings rate have been trending lower again.

There is one more telling chart that we need to throw into the mix—the delinquency rate on credit cards. While nowhere near the nearly 7% level witnessed during the Great Recession or even the averages seen throughout much of the 1990s, it has been climbing steadily for the past two years and has risen to the highest level since the second quarter of 2011.

Granted, not all of this news has been bleak, at least not if you are in the banking sector. Last year, they reported an estimated $92 billion in earnings, and this after taking into account funding costs and loan losses. This is more than double what they were earning from credit cards a decade ago. As the old proverb says, one man’s poison is another man’s pleasure. While there are a number of other elements that factor into this, it should come as no surprise that recent surveys find that 41% of Americans believe they are worse off than four years ago. In case you were wondering, 24% say they are better off, and 34% said they were about the same. That still leaves the majority of people thinking that at least they have been holding their own, but these debt trends would appear to suggest that number may shrink in the months ahead.

**The views expressed above are entirely those of the author.

DH

Plan your trade and trade your plan

Daily Levels for March 27th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

What to expect on this short trading week? Trading Levels for March 26th

What to expect on this short trading week?

With Good Friday coming up we will only have 4 days trading week.

Fed Chair Jay Powell said Wednesday that central bank officials discussed a strategy for how to slow the shrinking of the Fed’s balance sheet,

The plan to slow down the balance-sheet runoff could come as soon as May.

The Fed’s securities holdings topped out at $9 trillion in 2022 — the year it decided to pivot and act aggressively to tamp down rising inflation. The strategy is known as quantitative tightening, or QT. QE refers to the Fed buying assets to lower longer-term interest rates, and QT means the Fed is selling assets to put upward pressure on longer-term rates. QE is used when the Fed wants to stimulate the economy and reduce interest rates on longer-term securities. The Fed tried QT once before, starting in 2017, when Janet Yellen oversaw the central bank. That shrinking of its portfolio drained bank reserves held at the central bank and led to some unexpected turbulence in 2019 after Powell had taken over.

Expectations that the Fed would cut rates by June rose to around 75% in futures markets later Wednesday, up from closer to 50% earlier this week, according to CME Group.

What about the hot PPI and CPI reports that came in last week? The latest data haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes-bumpy road toward 2%.

Many economists and some inside the Fed anticipated that the central bank’s rate increases to bring inflation down would lead to higher unemployment and a recession. But economic growth has shown surprising resilience even as wage and price increases have slowed thanks to healed supply chains and an influx of workers into the labor force.

Using the Fed’s preferred gauge, inflation excluding volatile food and energy prices has fallen to around 2.8% recently, down from 4.8% one year ago.

FED said while officials didn’t “see this in the data right now,” a significant slowdown in the labor market “could also be a reason for us to begin the process of reducing rates.

Wage growth has continued to slow, and unemployment has steadily inched up, from 3.4% last April to 3.9% in February.

The stakes are high for Fed officials, who are trying to navigate two risks. One is that they ease too soon, allowing inflation to become entrenched at a level above their 2% target. The other is that they move too slowly and the economy crumples under the weight of higher rates.

The Summary of Economic Projections expects gross domestic product growth to hit 2.1% by the end of 2024, up from December’s 1.4% forecast.

Higher housing prices and stock-market gains are boosting wealth and thus supporting consumption, especially of high-income households. The price of bitcoin has recently surged to records, a sign of exuberant risk-taking.

Homebuilders ETF: XHB. Stocks – KBH, TOL, LEN.

Plan your trade and trade your plan

Daily Levels for March 26th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

PPI & Retails Sales + Trading Levels for March 14th

Market Overview for the last 2 trading days of the week

By Mark O’Brien

Heads up:

Keep an eye out for the second of this week’s inflation reports: the Bureau of Labor Statistics’ Producer Price Index. The report will be released tomorrow, 7:30 A.M., Central Time.

Energy:

This morning, the Energy Information Agency released its weekly crude oil stocks report and the data was a bullish curveball showing a surprise withdrawal in U.S. crude inventories and a bigger-than-expected drop in U.S. gasoline stocks. April RBOB gasoline futures rose over seven cents as of this typing – a ±$3,000 per contract move – up to ±$2.66 per gallon, close to 6-month highs. Spurring the price increase, Ukrainian drone attacks struck several oil refining facilities in Russia for the second day, damaging its refining capacity

Metals:

In concert with the month-long slump in the U.S. dollar and a lingering expectation the Fed will reduce borrowing costs this June, today gold is chipping away at its ±$20 sell-off Monday and poised to around its prior all-time high close (basis April): $2,188.60/oz. As of this typing, April gold is ±$2,177.00.

Indexes:

All three major stock indexes have sustained trading near their all-time highs this week – after the Personal Consumption & Expenditures Price Index on April 1st (the Fed’s preferred U.S. inflation gauge), February’s non-farm payrolls last Friday and Tuesday’s higher-than-expected CPI reading yesterday. As of this typing, prices are mixed ahead of tomorrow’s release of the Bureau of Labor Statistics’ Producer Price Index.

Softs:

So far, the king of all-time highs this week is not Bitcoin (see below). It’s Cocoa. The May cocoa contract broke above $7,000/ton, nearly $2,000/ton higher over the last month – a ±$20,000 per contract move, including today’s 361-point ($3,6010) move today – with “no top in sight,” stated by The Hightower Report.

Crypto:

March Bitcoin futures are set to close at a new all-time high above 73,000 today. With the Bitcoin ETF now trading, remember that the world’s largest futures and options exchange – the CME Group – offers Bitcoin and Micro Bitcoin futures and options with efficient price discovery in transparent futures markets, prices based on the regulated CME CF Bitcoin Reference Rate (BRR) and easily traded on your supported trading platform. Make it your choice for managing cryptocurrency risk.

Plan your trade and trade your plan

Watch video below on how to rollover from March to June contracts if you are a stock index trader on our E-Futures Platform!

Daily Levels for March 14th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

NFP Tomorrow, Bitcoin Futures+ Futures Trading Levels for 03.08.24

NFP Tomorrow.

Non Farm payrolls – market moving report.

I personally like to be out few minutes before the report and look to get back in after the “smoke clears”.

I know some traders who try to play the extremes by placing buy orders on the lower bands and/or sell orders on the upper bands and attach automated brackets to these orders, trying to take advantage of the fast market moves.

Refer back to your journal and keep notes.

Bitcoin Futures on The Chicago Mercantile Exchange

With Bitcoin reaching unprecedented levels, investors are seeking dependable ways to participate. Apart from ETFs and complex offshore entities, the CME Group offers straightforward access to Futures on Bitcoin, Micro Bitcoin, Ether, and Micro Ether futures. Utilize a licensed broker to trade these futures on the esteemed CME Group exchange. Opportunities for engagement range from 1. self-directed trading 2. demo trials 3. opening an account seeking advice from a seasoned broker.

Plan your trade and trade your plan

Daily Levels for March 8th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010