Get Real Time updates and more on our private FB group!

Bullet Points: Highlights and Announcements

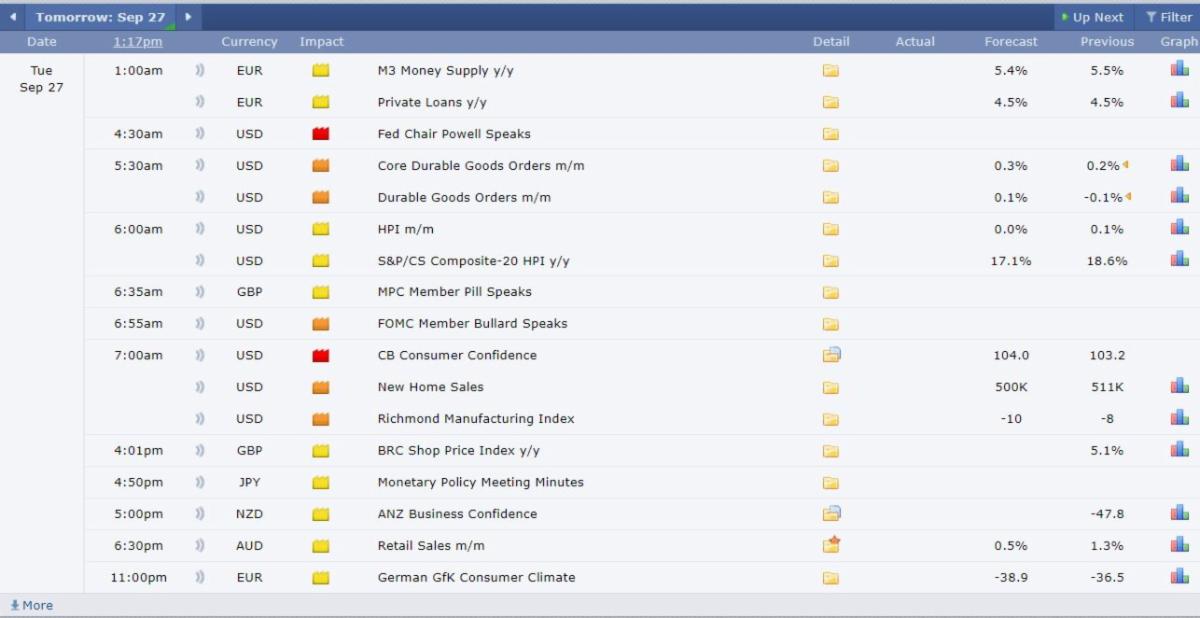

With global recession risks rising, economic reports have become increasingly important and scrutinized and given the importance of the U.S. economy to the rest of the world’s, our U.S. economic reports provide an important perspective. On par with them are the ongoing uncertainty regarding Russia and related energy supply issues in Europe as well as the prevailing COVID-19 containment measures in mainland China.

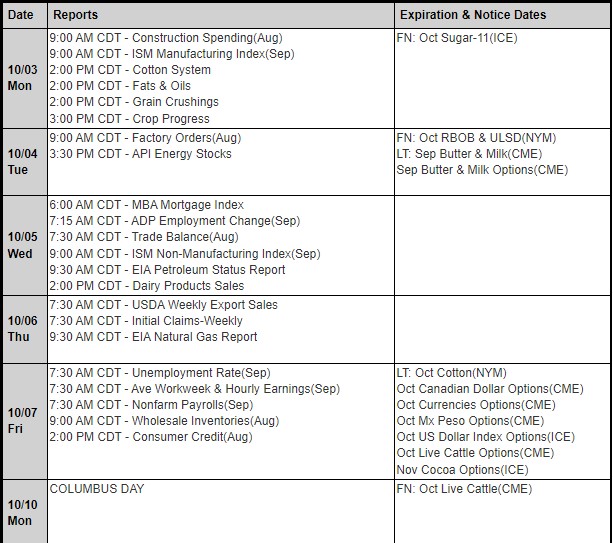

The next big scheduled event: this Friday’s monthly Non-farm payrolls report from the U.S. Labor Department.

If you’re a futures trader and your markets of choice to trade include stock indexes (S&P 500, Nasdaq, Dow Jones, Russell 2000, etc.), or treasuries (30-yr. T-bonds, 2-, 5-, 10-yr. T-notes), currencies, even metals and energies, you know the importance this report. It’s widely considered one of the most important and influential measures of the U.S. economy. To convey its findings, the Labor Dept.’s Bureau of Labor Statistics surveys about 141,000 businesses and government agencies, representing approximately 486,000 individual work sites (the report excludes farm workers, private and domestic household employees and non-profit organization employees). The report also includes other detailed employment data including the overall unemployment rate – as a percentage of the total labor force that is unemployed but actively seeking work – wages, wage growth and average workday hours. The report is released at 7:30 A.M., Central Time. Economists polled expect non-farm payroll growth to slow from a 315K gain in August to 250K in September.

Although it has proved to be a fairly unreliable precursor, this morning, the private payroll services firm ADP reported companies added 208,000 jobs for the month of September, slightly above the 200,000 economists polled by Dow Jones estimated.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

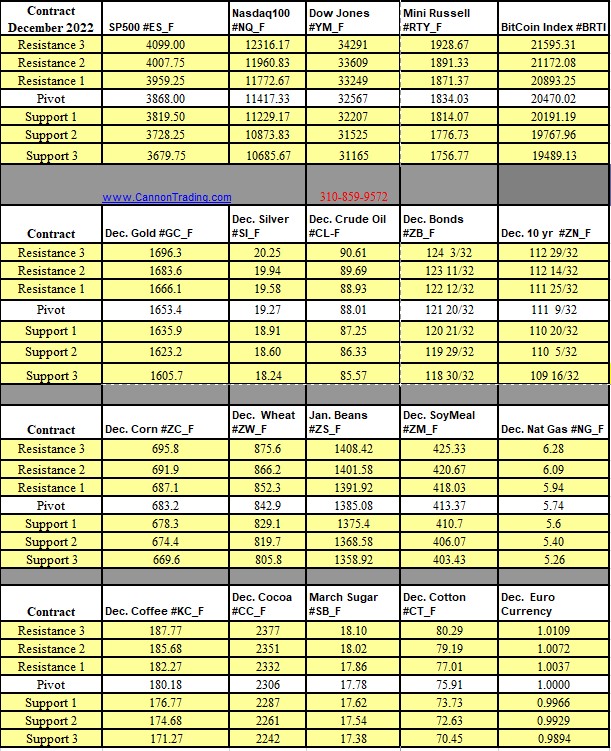

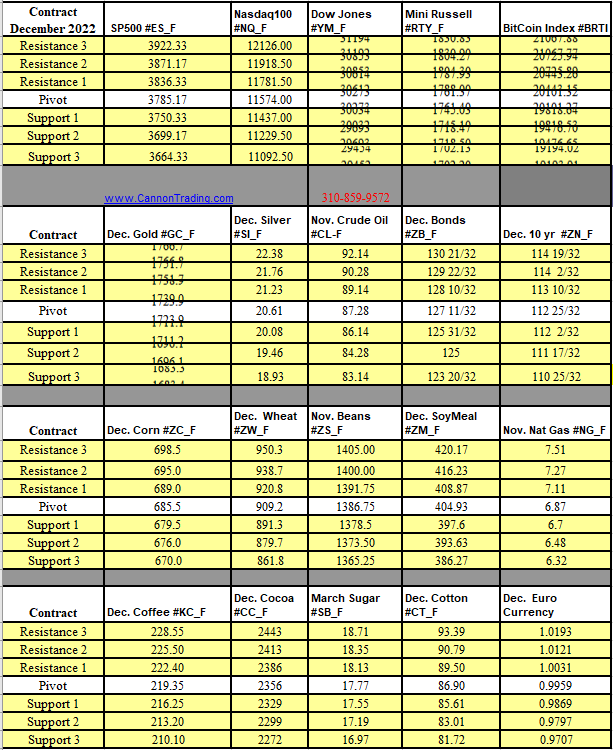

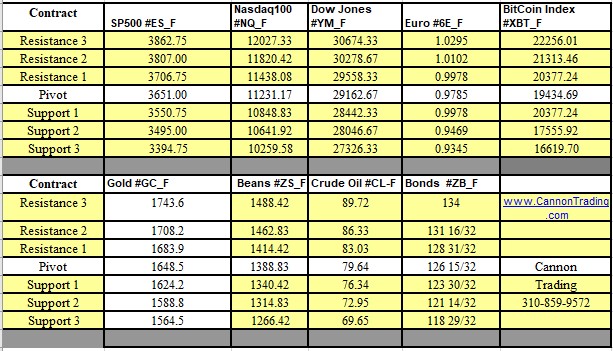

Futures Trading Levels

for 10-06-2022

Improve Your Trading Skills

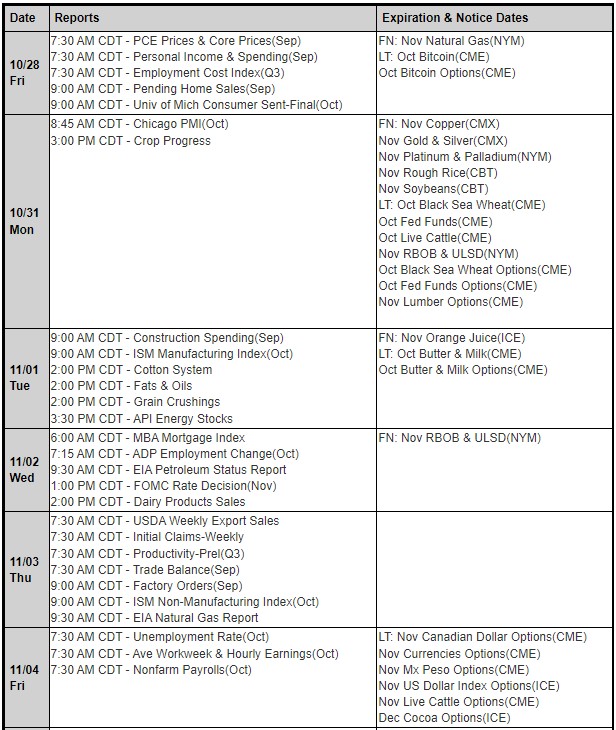

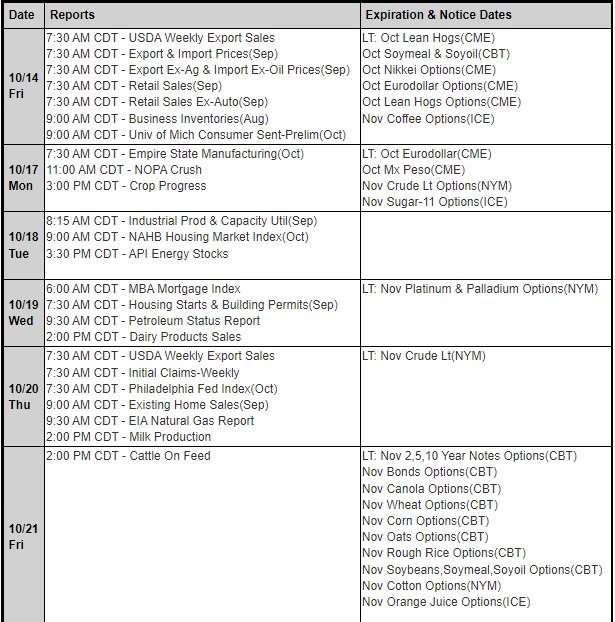

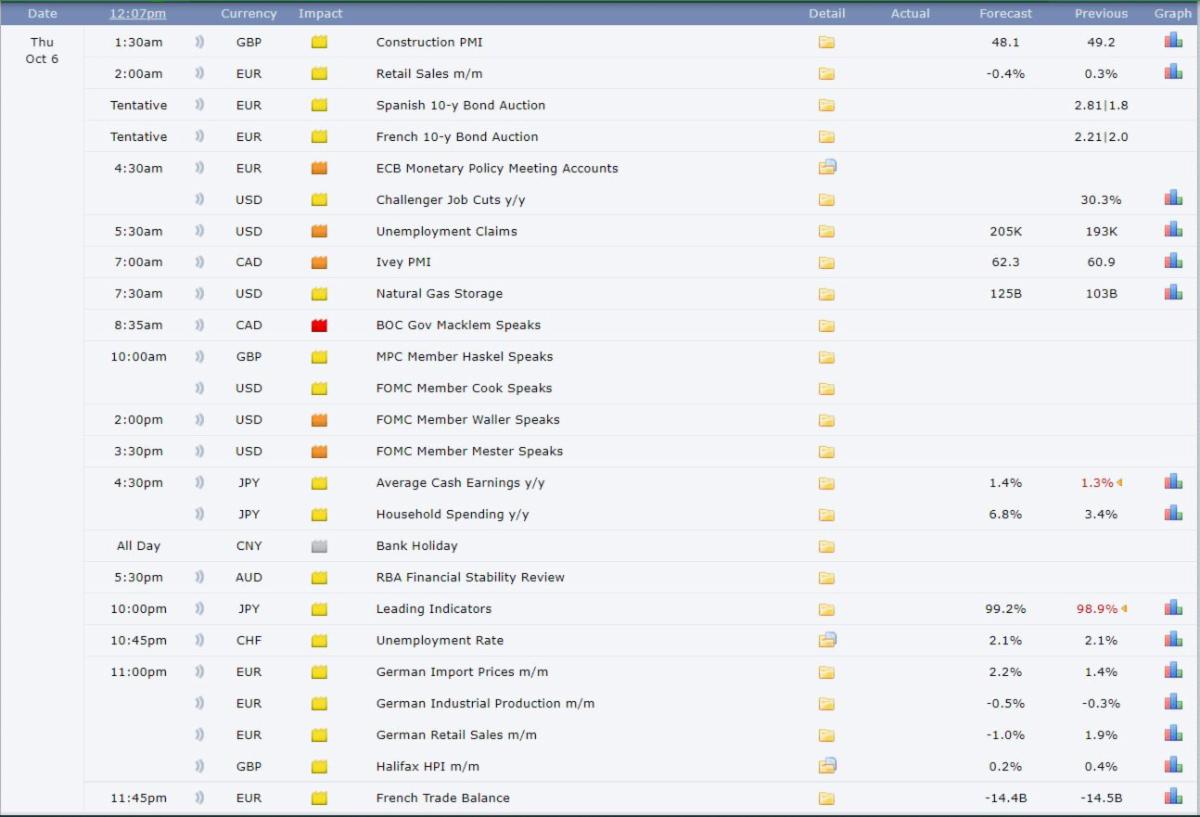

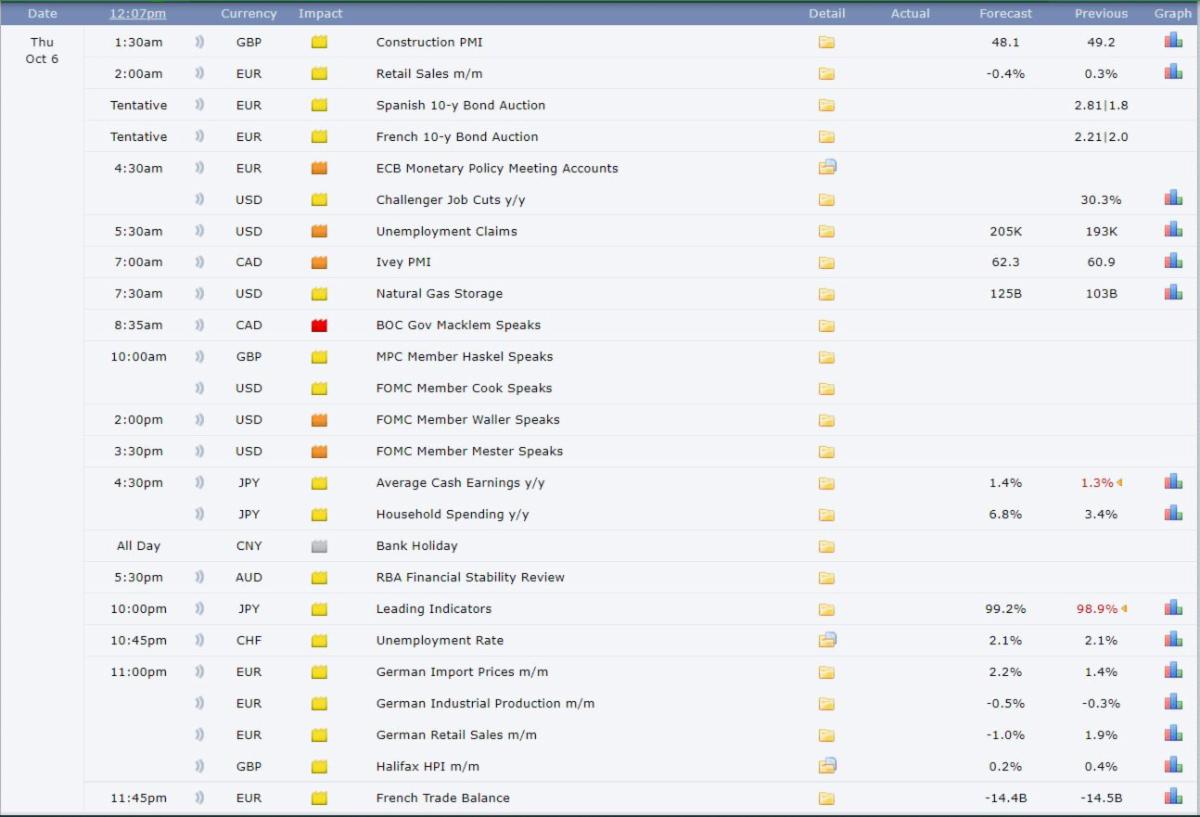

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.