Trading in futures

- How futures contracts function as agreements to buy or sell assets at a future date.

- The mechanics of entering and exiting futures positions.

Trading with futures

- Using futures as tools for speculation, hedging, or portfolio diversification.

- Leveraging futures contracts to manage risk and pursue opportunities in different markets.

The importance of skilled brokers

- Guidance on navigating complex futures markets.

- Expertise in execution, strategy, and risk management.

- Personalized support tailored to traders’ needs.

Cannon Trading Company’s advantages

- Decades of industry expertise and trusted reputation.

- Verified 5-star ratings on TrustPilot, showcasing client satisfaction.

- Access to cutting-edge platforms, including CannonX powered by CQG, for professional-grade futures trading.

Try a FREE Demo!

The Landscape of Futures Trading

Trading in futures and trading with futures are at the core of modern financial markets. Futures contracts allow traders to speculate on price movements of commodities, indices, currencies, bonds, and digital assets. These markets attract participants ranging from institutional investors hedging risk to individual retail traders seeking leverage and opportunity.

But while the potential of futures trading is immense, it also carries significant complexity and risk. Here is where the role of a skilled futures broker becomes critical. A futures broker is not simply a middleman executing trades; rather, they are a partner in helping futures traders succeed by providing access to technology, liquidity, market education, and—most importantly—timely support in moments of urgency.

Among leading firms, Cannon Trading Company has set itself apart for decades. With a sterling reputation among regulators, many 5-star TrustPilot reviews, and a diverse range of top-performing futures trading platforms—including CannonX powered by CQG—Cannon Trading embodies what traders seek in a brokerage.

This article explores the essentials of trading in futures and trading with futures, why brokers are indispensable, and how Cannon Trading Company’s unique approach supports traders across every stage of their journey.

Trading in Futures: A Brief Overview

What Does It Mean to Trade Futures?

Trading in futures involves buying or selling standardized contracts that obligate the trader to buy or sell an asset at a predetermined price on a specified date. These contracts are highly regulated, traded on exchanges, and cover a vast range of markets, including:

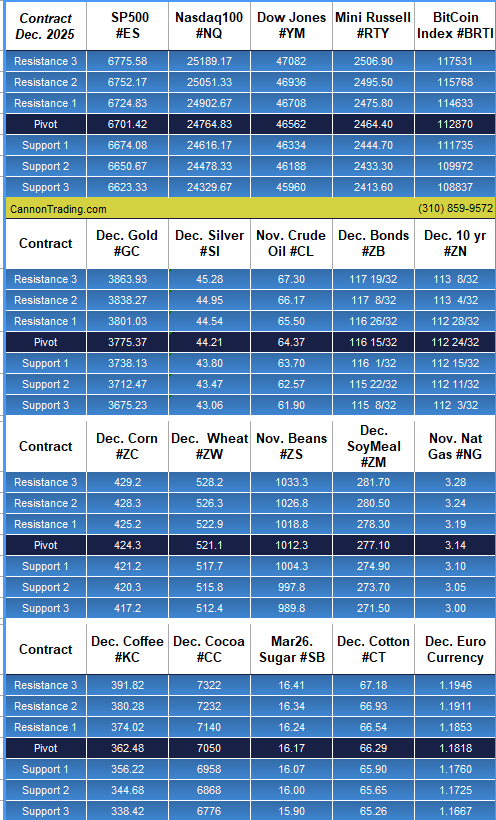

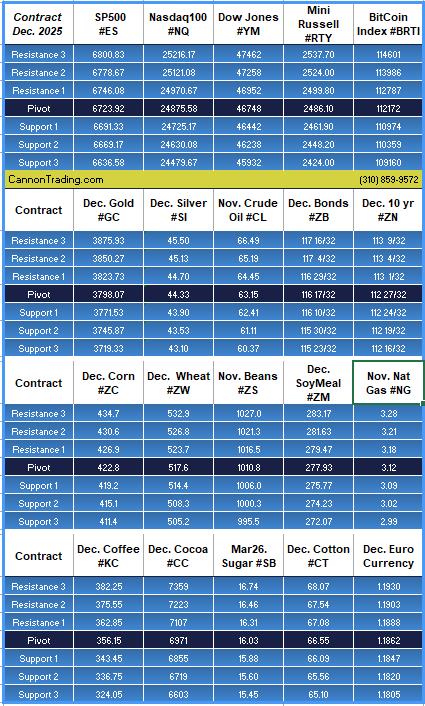

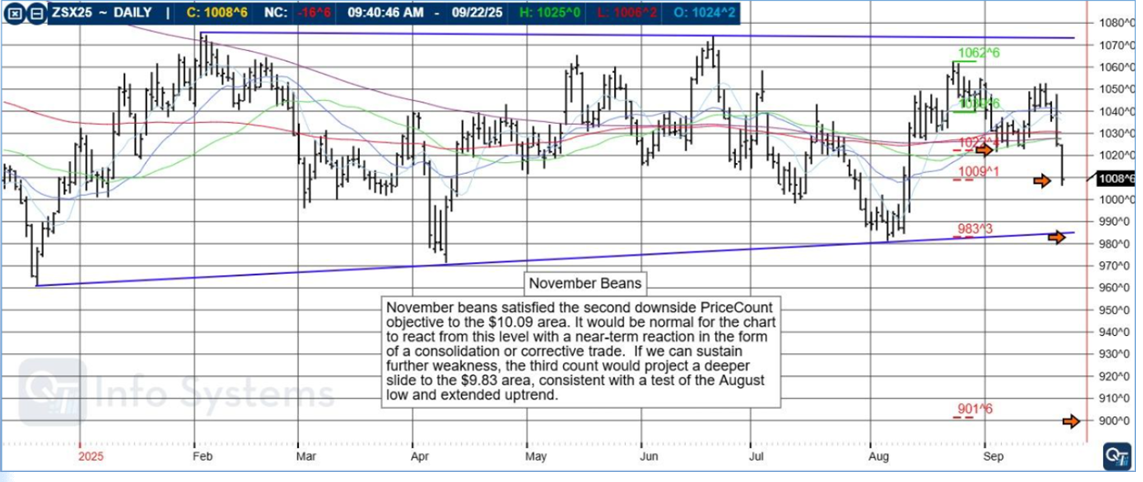

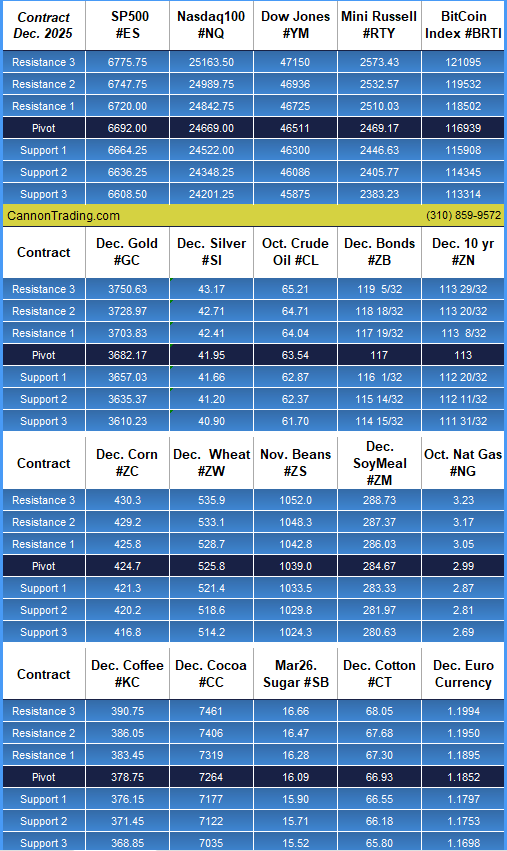

- Commodities such as oil, gold, and wheat

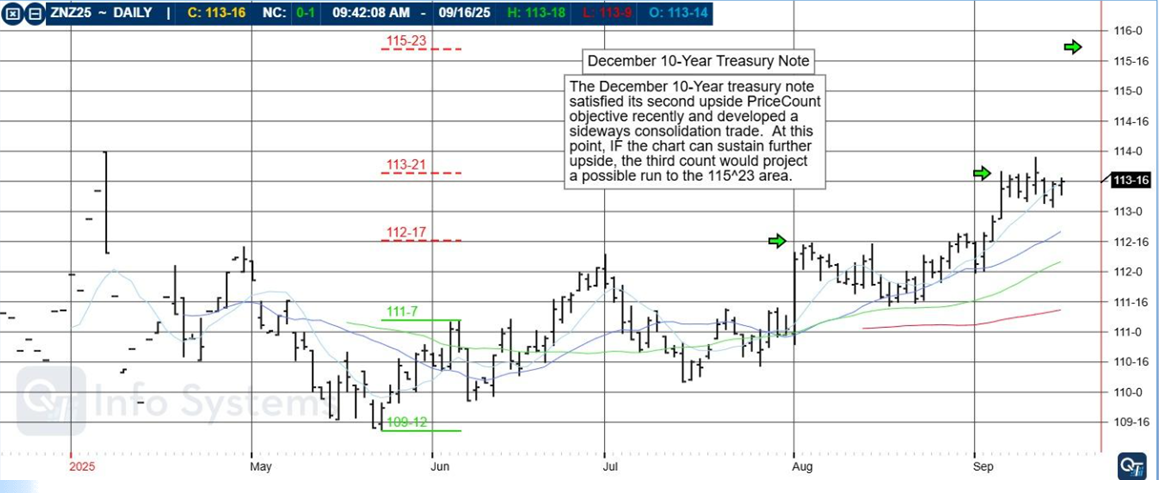

- Financial instruments like U.S. Treasury bonds

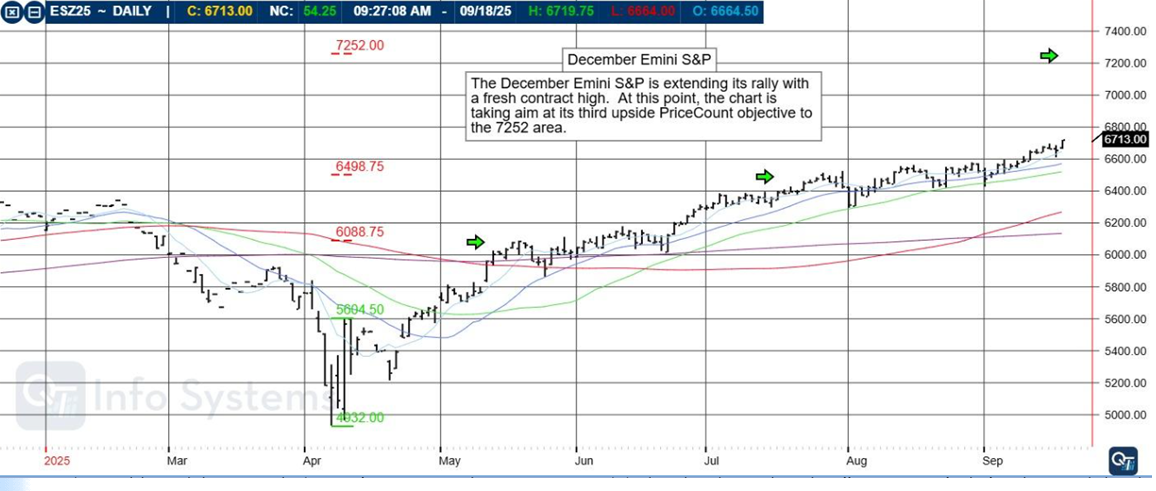

- Stock indices such as the S&P 500

- Currencies including euro, yen, and emerging market pairs

- Cryptocurrency derivatives like micro ether futures

Unlike stocks or bonds, futures contracts are leveraged products, which means traders can control a large notional value with relatively little upfront capital.

Why Do Traders Engage in Trading in Futures?

There are three primary motivations:

- Speculation – Traders attempt to profit from price movements.

- Hedging – Businesses, investors, and funds use futures to offset risks in underlying assets.

- Diversification – Futures give access to asset classes that may not be accessible through conventional stock or bond portfolios.

Trading in Futures: How It Works in Practice

The Mechanics of Trading in Futures

Trading with futures requires opening a brokerage account that supports futures products, funding the account, and gaining access to an electronic trading platform. Futures brokers provide traders with the platform, execution services, and clearing through an exchange.

Key components include:

- Margin and Leverage – Futures traders can control large positions with smaller capital commitments, amplifying both potential gains and losses.

- Liquidity – Futures markets, especially in contracts like the S&P 500 E-mini, are among the most liquid in the world.

- Round-the-Clock Markets – Futures trading operates nearly 24 hours, allowing global participation and responsiveness to news events.

Risks and Rewards of Trading in Futures

While leverage and liquidity create opportunity, they also heighten risks. A sudden move against a futures position can cause outsized losses. For this reason, professional support from a futures broker is not a luxury—it is a necessity.

The Vital Role of a Skilled Futures Broker Supporting Your Trading in Futures

A broker’s value extends far beyond order routing. Below are key reasons why futures traders rely heavily on skilled brokers:

- Access to Leverage

Futures brokers provide traders with access to leverage. However, responsible brokers like Cannon Trading Company guide clients in understanding the risks of leveraged products, ensuring they manage margin appropriately.

- Diversification Opportunities

By offering access to multiple markets—commodities, indices, bonds, and currencies—brokers help traders diversify beyond traditional equities.

- Hedging Support

Futures brokers help clients design and execute hedging strategies, whether protecting against currency risk, commodity price fluctuations, or portfolio drawdowns.

- Emergency Execution: One Call Away

When technology fails, systems go down, or internet connections are lost, a skilled broker can literally save a trader’s account. Cannon Trading Company, for example, ensures that traders can reach a licensed professional with one phone call to liquidate or adjust a position in real time.

- Guidance and Education

Top brokers provide ongoing education, analysis, and resources to help traders sharpen their skills and stay ahead of market shifts.

- Platform Expertise

From CannonX powered by CQG to other top-performing platforms, skilled brokers match traders with technology that fits their style—whether day trading, swing trading, or algorithmic trading.

How Cannon Trading Company Embodies Broker Excellence

A Tradition of Decades Trading in Futures

Founded decades ago, Cannon Trading Company has earned its reputation by guiding generations of traders through evolving futures markets. The firm’s longevity itself is a testament to reliability and consistent client satisfaction.

Five-Star Reputation on TrustPilot

TrustPilot reviews consistently rate Cannon Trading Company as 5 out of 5 stars. Traders frequently highlight the firm’s responsiveness, professionalism, and personalized service.

Regulatory Trust and Compliance

Cannon Trading maintains exemplary standing with both federal regulators and independent futures industry watchdogs. This demonstrates a culture of compliance, transparency, and ethical client service.

Wide Selection of Futures Trading Platforms

Cannon Trading offers multiple leading platforms, including its flagship CannonX powered by CQG. This platform combines deep liquidity access, advanced order routing, and sophisticated analytics, making it a top choice for traders seeking speed and precision.

Other platforms offered by Cannon Trading accommodate futures traders at every level, from beginner-friendly solutions to advanced institutional-grade platforms.

Human Support of your Trading in Futures That Stands Out

When systems go down, Cannon Trading’s team remains one phone call away—providing emergency order execution or strategy adjustments that can make the difference between success and disaster. This personalized support defines Cannon Trading’s broker-client relationship.

CannonX Powered by CQG: A Competitive Edge

CannonX powered by CQG has become a centerpiece of Cannon Trading Company’s offerings. With cutting-edge charting, market depth analysis, and direct exchange connectivity, it empowers traders to execute their strategies seamlessly.

The platform stands out for:

- Speed of execution

- Robust risk management tools

- Flexible customization for active traders

By combining Cannon Trading’s broker support with CQG’s technology, CannonX powered by CQG creates a unique advantage for futures traders seeking precision and reliability.

Why Traders Trading in Futures Choose Cannon Trading Company

- Decades of market expertise

- Top-rated client reviews

- Broad selection of platforms

- Immediate support in emergencies

- Reputation for compliance and integrity

For traders serious about trading in futures and trading with futures, these qualities are indispensable.

Related Reading from Cannon Trading Company Blog to Support Your Trading in Futures

- Futures Trading: Beginner’s Guide To Trading | Cannon Trading

- Hedging Futures: Managing Risk in Financial Markets | Cannon Trading

- Best Futures Trading Platform Guide | Cannon Trading

- How to Invest in Commodities – Guide & Tips | Cannon Trading

Frequently Asked Questions regarding Trading in Futures

- What is the difference between trading in futures and trading with futures?

Trading in futures refers to the act of buying and selling futures contracts, while trading with futures emphasizes the practical strategies and tools used to trade them effectively. - Why is a futures broker essential?

A broker provides access to leverage, diversified markets, hedging strategies, and emergency execution services—benefits that technology alone cannot guarantee. - What makes Cannon Trading Company stand out?

Decades of experience, a 5-star TrustPilot reputation, regulatory excellence, and a range of platforms—including CannonX powered by CQG—set Cannon apart. - How does leverage work in futures trading?

Leverage allows traders to control larger contract values with smaller capital, amplifying both potential gains and losses. - What happens if my trading system goes down?

With Cannon Trading Company, one call to a licensed broker ensures positions can be closed or adjusted immediately, protecting traders in emergencies.

Trading in futures and trading with futures offer tremendous opportunities for speculation, hedging, and diversification. Yet these opportunities come with complexity and risk that require more than just technology—they require trusted human expertise.

A skilled futures broker is essential to managing leverage responsibly, executing strategies effectively, and being available when systems fail. Cannon Trading Company exemplifies these qualities, combining decades of experience, 5-star TrustPilot reviews, and advanced platforms like CannonX powered by CQG. For traders seeking reliability, speed, and personalized service, Cannon Trading remains a benchmark in the futures industry.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading