|

|

|

|

Trading metal futures? If you are planning to, then it is important to know that in this kind of trading you always have to come prepared. Do your homework and track the indices daily. Take out time and check how metals are doing in different parts of the world.

Take a look at the Eastward market every day. The first markets to open are the Asian ones. Begin your tracking of indices from here. Apart from this you will also have to be regular with reading the business reports. There is much work for you to do before you put your money in metals futures.

Because trading requires one to take out a considerable amount of time for studying and analyzing, and because a lot of people have everything but time, there are traders and brokers. We at Cannon Trading can assist you with trading. If you want to trade yourself, we give you the advice. In short, we are there to help you with whatever you have got. Here we have a category archive that lists some informative blogs on metal futures and trading. Go through these valuable posts to increase your knowledge of metal futures.

|

|

|

|

The futures trading landscape in the United States is at the cusp of significant evolution, driven by advances in technology, changing regulations, and shifting trader demographics. For anyone engaged in futures trading—whether seasoned professionals or novices—understanding the dynamics of this transformation is critical. Futures brokers in the USA, known for providing access to commodities, indices, and currency markets, are navigating this shift with an eye on innovation and adaptability. In this comprehensive exploration, we’ll examine the future of futures brokerages in the U.S. and highlight what traders should anticipate as 2025 approaches. Along the way, we’ll explore the role of Cannon Trading Company, a leading name among futures brokers in the US, and why it stands out in an increasingly competitive field.

Futures trading has a long-standing history of facilitating risk management and speculative opportunities. Traditionally, it was a domain dominated by institutional traders and large-scale hedgers. However, the rise of technology has democratized access to futures trading, enabling retail traders to participate alongside institutional players. Futures brokers in the USA have adapted to this trend by offering diverse platforms, competitive pricing, and robust educational resources.

Take the example of a mid-sized agricultural producer in Kansas. In 2015, they relied on manual trading to hedge their corn production against market volatility. By 2023, with the advent of algorithmic trading and artificial intelligence (AI), they transitioned to automated systems provided by top futures brokers in the US. This shift not only improved their trading efficiency but also reduced human error and enhanced profitability.

By 2025, experts predict that more than 70% of futures trading will be executed through algorithmic systems. This trend underscores the importance of choosing a broker equipped with cutting-edge technology. Cannon Trading Company, for instance, excels in this area, offering platforms like Sierra Chart and MultiCharts, which cater to both discretionary and algorithmic traders.

The futures market is one of the most heavily regulated sectors in the financial industry. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) play pivotal roles in ensuring market integrity. As we approach 2025, several regulatory changes are expected to shape the industry:

In 2021, a small retail trader in California faced challenges navigating margin requirements for crude oil futures. They switched to Cannon Trading Company after discovering its transparent approach to compliance and margin policies. The trader’s success in managing risk through Cannon’s educational resources highlights why compliance and transparency are integral to the best brokers for futures.

Technology continues to revolutionize the futures trading ecosystem. By 2025, brokers will likely integrate even more advanced tools to enhance trading experiences, such as:

Imagine a day trader in New York using a platform equipped with AI analytics and real-time blockchain data verification. This trader identifies a bullish trend in the gold market and executes a profitable trade within seconds. Such scenarios highlight the potential of technological advancements to empower futures trading brokers and their clients.

Cannon Trading Company is well-positioned to lead this charge. Its diverse selection of trading platforms, including the highly rated E-Futures International and Optimus Flow, caters to traders of all experience levels. These platforms offer features like advanced charting, backtesting, and customizable indicators, ensuring traders have the tools they need to succeed.

The demographic profile of futures traders is shifting. Millennials and Gen Z traders, known for their tech-savviness and preference for online platforms, are entering the market in greater numbers. These traders demand:

A college graduate in Florida started trading futures in 2022 using a mobile app. Initially overwhelmed by the complexity of the market, they turned to Cannon Trading Company for guidance. With its robust educational resources and responsive customer support, the broker helped the trader build confidence and execute successful trades. By 2025, such brokers will play a pivotal role in onboarding and nurturing the next generation of futures traders.

Cannon Trading Company exemplifies the qualities of a top-tier futures broker in the US. Here’s why it’s a great choice for trading futures contracts:

As the futures trading industry evolves, traders must adapt to stay competitive. Here are some tips to prepare for the changes ahead:

By aligning with a forward-thinking broker and staying proactive, traders can thrive in the dynamic futures market of 2025 and beyond.

The future of futures brokerages in the USA is bright, marked by technological innovation, regulatory advancements, and changing trader demographics. Brokers like Cannon Trading Company exemplify the adaptability and excellence needed to succeed in this evolving landscape. Whether you’re a novice exploring futures trading or a seasoned professional seeking advanced tools, Cannon Trading offers the platforms, expertise, and support to help you achieve your trading goals.

By understanding the trends shaping the industry and aligning with a trusted partner, traders can navigate the complexities of the futures market with confidence. As 2025 approaches, the opportunities for growth and success in futures trading are more abundant than ever.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

The futures trading market, known for its high risk and high reward potential, is not only a game of skill and strategy but also one that requires choosing the right futures broker. For novice and seasoned traders alike, navigating the world of future brokers can be fraught with challenges, especially when determining who to trust. With so much at stake—both financially and emotionally—it is crucial to recognize the signs of a reliable futures broker versus the red flags of an unreliable one. This guide will dive into the top ten signs of a trustworthy broker and the ten glaring warning signs to avoid, drawing on real-world cases, hypotheticals, and practical advice. We will also explore how traders can minimize their risks and why firms like Cannon Trading Company stand out as exceptional choices in the futures trading landscape.

Case Study: A trader working with a broker fully licensed by the NFA avoided significant losses when the broker promptly alerted clients to regulatory changes affecting margin requirements. This transparency showcased the firm’s commitment to protecting its clients’ interests.

Hypothetical: A beginner is torn between two brokers. One offers a free demo account and extensive learning material, while the other provides no educational resources. The beginner chooses the former and gains valuable experience in futures trading without risking real money.

Real Example: Cannon Trading Company is known for its transparency, offering clients detailed breakdowns of trading costs, ensuring there are no surprises.

Hypothetical: A trader faces a platform error during a critical market movement. The broker’s 24/7 support resolves the issue within minutes, preventing significant losses.

Case Study: A trader using a platform provided by a reliable broker successfully executed a stop-loss order during a market crash, avoiding catastrophic losses thanks to the platform’s reliability.

Example: Cannon Trading Company, with over 30 years in the industry, has built a stellar reputation for reliability and integrity.

Hypothetical: A trader works with an unregulated broker who disappears overnight with their funds—a devastating yet avoidable situation.

Case Study: A novice trader was persuaded to over-leverage their account, resulting in significant losses when the market turned against them.

Example: One trader discovered after a year that their broker charged monthly inactivity fees, eroding their profits.

For those new to trading futures, separating the reliable from the questionable can be daunting. Follow these steps to minimize financial and emotional risk:

Cannon Trading Company exemplifies the qualities of a reliable futures broker. With over 30 years in the industry, it is regulated by the CFTC and a proud member of the NFA. The company is renowned for its transparency, offering clear fee structures and a range of account options. Its free trading platform allows beginners to learn the ropes without financial pressure, while its exceptional customer service ensures clients receive timely support.

Moreover, Cannon Trading Company’s stellar reputation on TrustPilot, with numerous 5-star ratings, speaks volumes about its reliability. The firm prioritizes client education through webinars and detailed market analyses, enabling traders to make informed decisions. Its dedication to ethical practices and robust regulatory compliance sets it apart in a crowded market.

The future trading market is filled with opportunities, but success begins with choosing the right futures broker. Recognizing the signs of a reliable broker—such as regulatory compliance, transparent fees, and quality support—while avoiding red flags like hidden charges, poor customer service, and unregulated operations can save traders from costly mistakes. For beginners, starting small, asking questions, and leveraging educational resources can help navigate this challenging yet rewarding field. Brokers like Cannon Trading Company stand out for their decades of experience, ethical practices, and commitment to client success, making them a top choice for trading futures.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

The S&P 500 Index Futures, also known as standard & poor’s 500 index futures, is a financial derivative that allows traders to speculate on the future value of the S&P 500 Index, one of the most widely followed stock market indices in the world. These futures contracts serve as a means of managing risk, offering both hedging capabilities and speculative opportunities. The s and p 500 futures contract provides exposure to the U.S. stock market’s performance without requiring traders to hold the actual underlying stocks. This contract’s prominence has made it one of the most traded assets globally, reflecting trends, economic indicators, and market sentiment.

The standard and poor’s 500 futures contract has its roots in the financial markets of the early 1980s. Developed by the Chicago Mercantile Exchange (CME), it was officially introduced for trading in 1982. The concept was initially designed to give institutional and retail investors an efficient way to hedge their portfolios against fluctuations in the S&P 500, which represents approximately 80% of the total U.S. market capitalization.

In the late 1970s, U.S. markets were becoming increasingly volatile due to various economic factors, such as inflation and changes in monetary policy. The S&P 500 index, established decades earlier, had gained a solid reputation for accurately representing the U.S. economy’s performance. As a result, financial professionals and individual investors alike were seeking new ways to protect their investments. The development of spx index futures was a direct response to these demands, providing an innovative tool for managing equity risk.

Since its inception, standard & poor’s 500 index futures have experienced significant price fluctuations, reflecting changes in market sentiment, macroeconomic factors, and global events. Initially, these futures contracts began trading at levels near the index’s value, allowing investors to gain exposure to the market’s performance with minimal capital. Throughout the 1980s and 1990s, the S&P 500 index experienced steady growth as the economy expanded, with notable milestones in the technology and internet boom of the late 1990s.

The early 2000s, however, marked a significant downturn in the market due to the dot-com bubble. This period saw the s and p 500 futures contract decline sharply as technology stocks collapsed. The S&P 500 index futures reached their lowest levels during the early 2000s recession, but the market eventually rebounded due to monetary policy changes and renewed investor confidence. The 2008 global financial crisis led to another significant decline in standard and poor’s 500 futures, reflecting the uncertainty and economic strain at the time. However, aggressive fiscal policies and quantitative easing measures helped stabilize the market, leading to a prolonged recovery.

In the 2010s, the s&p 500 futures index saw remarkable growth, reaching new highs as technology stocks led the way and economic conditions improved. The introduction of automated and algorithmic trading contributed to increased liquidity and trading volume, propelling the futures contracts’ popularity further. Most recently, futures s&p 500 experienced unprecedented volatility due to the COVID-19 pandemic, which led to sharp declines and a rapid recovery as governments and central banks around the world implemented economic stimulus measures. By 2024, the futures sp trades at an impressive level of 5,994, reflecting the resilience and sustained growth of the U.S. economy.

Several factors have influenced the price movement of sp500 index futures, including:

Current Trading Level and Market Position

As of now, futures s&p 500 are trading at approximately 5,994. This level represents years of market growth driven by strong corporate performance, advances in technology, and accommodative monetary policies. The current price level also suggests investor optimism and confidence in the U.S. economy’s resilience, despite recent economic challenges.

Cannon Trading Company stands out as an ideal broker for trading spx index futures due to several key factors:

For traders looking to navigate the complexities of this market, Cannon Trading Company stands as a reliable partner, offering decades of experience, a free trading platform, exceptional customer service, and a stellar regulatory reputation. With Cannon Trading, traders can confidently access the s and p 500 futures contract, making it an excellent choice for those seeking a robust and reputable brokerage.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

In this issue:

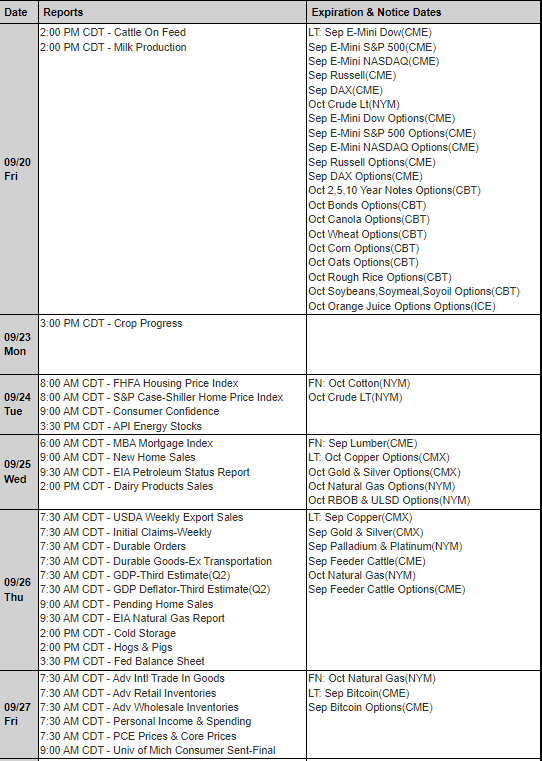

Important Notices – Next Week Highlights:

The Week Ahead

Heavy Fed Speak Week, active data and a few earnings highlight the week ahead.

Light Earnings, by largest Market Cap

Fed Speak schedule

Big Economic Data week:

How to Rollover on the E-Futures Platform video below

All futures contracts have a minimum price fluctuation also known as a tick. Tick sizes are set by the exchange and vary by contract instrument.

E-min S&P 500 tick

For example, the tick size of an E-Mini S&P 500 Futures Contract is equal to one quarter of an index point. Since an index point is valued at $50 for the E-Mini S&P 500, a movement of one tick would be

.25 x $50 = $12.50

NYMEX WTI Crude Oil

The tick size of the NYMEX WTI Crude Oil contract is equal to 1 cent and the WTI contract size is 1,000 barrels. Therefore, the value of a one tick move is $10.

Tick sizes are defined by the exchange and vary depending on the size of the financial instrument and requirements of the marketplace. Tick sizes are set to provide optimal liquidity and tight bid-ask spreads.

The minimum price fluctuation for any CME Group contract can be found on the product specification pages.

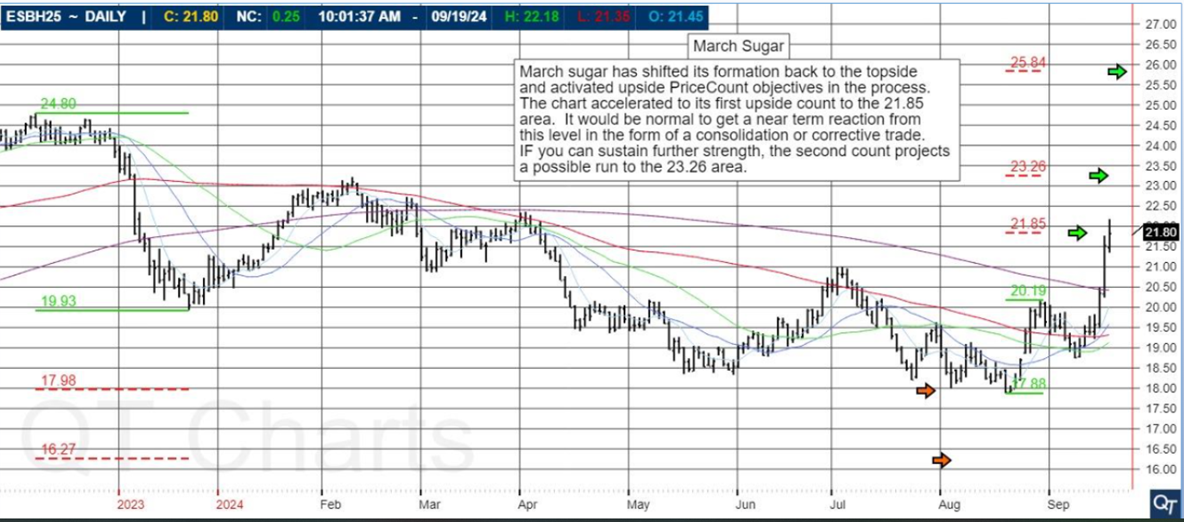

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March 2025 Sugar

March sugar has shifted its formation back to the topisde and activated upside PriceCount objectives in the process. The chart accelerated to its first upside count to the 21.85 area. It would be normal to get a near term reaction form theis level in the form of a consolidation or corrective trdae. IF you can sustain further strength, the second count projects a possible run to the 23.26 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

HG – Copper

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$25,000.00

COST

USD 150 / monthly

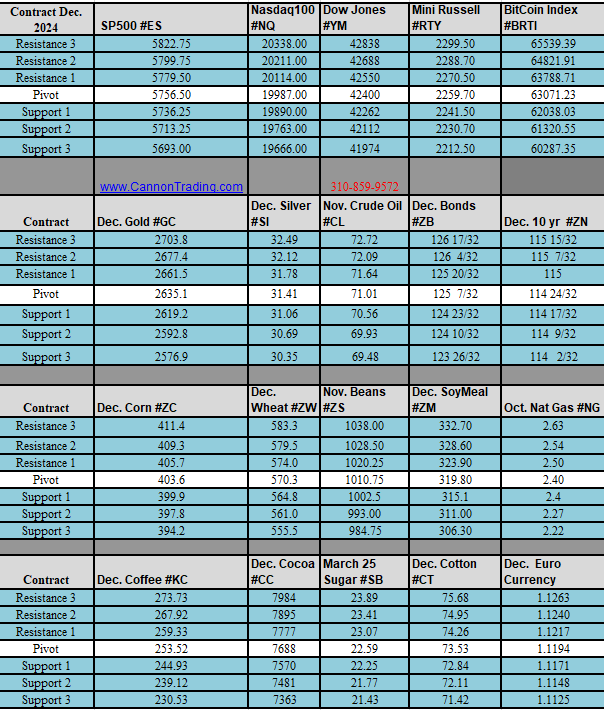

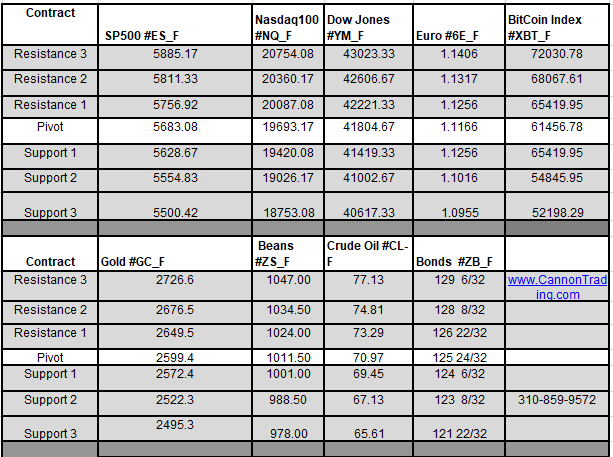

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

by Mark O’Brien, Senior Broker

General:

It’s been ten months since the central bank paused its rate hike cycle. It seems as though Jay Powell’s motto throughout his entire tenure as chairman of the Fed has been, “The data will guide our decisions,” and today the Bureau of Labor Statistics released another chunk of data: its March Consumer Price Index (CPI) report, which measures the prices paid by consumers for a basket of consumer goods and services. The consumer-price index rose 0.4% in March and 3.5% on an annual basis. Economists had expected 0.3% and 3.4%. Core CPI, which removes the volatile food and energy categories, was up 0.4% from February, topping an expected 0.3%. Now, after strong prints in January and February, are these new readings stronger evidence of a “sticky” inflation situation?

At their March meeting, according to its minutes released later this morning, Federal Reserve officials expressed concern that inflation wasn’t moving lower quickly enough. The CPI report likely didn’t moderate those concerns and the timing for the first long-anticipated rate cut has presumably drifted further out on the calendar.

Energies:

Speaking of inflation, the first three months of 2024 saw crude oil jump ±$17 per barrel – a ±$17,000 move for the main 1,000-barrel futures contract – with the front-month May contract trading to the year’s high of $87.63 intraday just last Friday.

Softs:

After a one-day 321-point/$3,210 move up on March 12 to close above $7,000/ton – its latest all-time high – May cocoa continued its “no top in sight,” rally, closing today at $10,476/ton, a staggering ±$34,700 per contract move in twenty trading sessions.

Metals:

While cocoa retained its “king of the all-time highs” crown for the month, gold did not disappoint bulls in this market, setting its own new all-time high yesterday, trading up to $2,384.50/oz. intraday (basis the June futures contract). This is a $199.00/oz. move ($19,900 per contract for the standard 100-oz. futures contract) over the same 20-sesson span as the move in cocoa referenced above.

Grains:

Keep an eye out for tomorrow’s U.S. Department of Agriculture’s two main reports: its monthly Crop Production and World Agricultural Supply and Demand Estimates (WASDE). These serve as the primary informers of the fundamentals underlying domestic and global agricultural futures markets.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

by John Thorpe, Senior Broker

CPI Report Wednesday

The CPI report for March 2024 will be released by the Bureau of Labor Statistics on Monday at 7:30 a.m. CDT. As of February’s CPI report, annual inflation is 3.2%, or 3.8% excluding food and energy. That data compares with the FOMC’s annual inflation target of 2%.

What To Expect

These data set move the Equity, Bond, Metals and currency markets the most as the market drivers are directly related to what the FED will do next with Interest rates this summer. Provided inflation comes at a monthly rate close to 0.3% or lower for March, that should be sufficient for the FOMC to keep its plan to start cutting interest rates this summer. If the report shows a 0.4% monthly increase or greater, that would be a concern. It would suggest relatively high inflation readings seen in January, and to a lesser extent in February, are perhaps more of a trend. Here is your BLS CPI Data center https://www.bls.gov/cpi/

Monthly inflation at or below 0.2% would generally be considered positive news, perhaps giving more conviction to rate cutting plans. Still the CPI release is just one data point that the Fed will use to assess how inflation is trending. The FOMC will also keep a close eye on the jobs market, which so far has been strong enough to enable the Fed to be patient in considering interest rate cuts. A slowdown in job growth might matter for the Fed’s plans as much as upcoming inflation data releases.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Important Notices –

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.