The futures trading landscape in the United States is at the cusp of significant evolution, driven by advances in technology, changing regulations, and shifting trader demographics. For anyone engaged in futures trading—whether seasoned professionals or novices—understanding the dynamics of this transformation is critical. Futures brokers in the USA, known for providing access to commodities, indices, and currency markets, are navigating this shift with an eye on innovation and adaptability. In this comprehensive exploration, we’ll examine the future of futures brokerages in the U.S. and highlight what traders should anticipate as 2025 approaches. Along the way, we’ll explore the role of Cannon Trading Company, a leading name among futures brokers in the US, and why it stands out in an increasingly competitive field.

The Evolving Landscape of Futures Trading

Futures trading has a long-standing history of facilitating risk management and speculative opportunities. Traditionally, it was a domain dominated by institutional traders and large-scale hedgers. However, the rise of technology has democratized access to futures trading, enabling retail traders to participate alongside institutional players. Futures brokers in the USA have adapted to this trend by offering diverse platforms, competitive pricing, and robust educational resources.

Case Study: The Shift to Algorithmic Trading

Take the example of a mid-sized agricultural producer in Kansas. In 2015, they relied on manual trading to hedge their corn production against market volatility. By 2023, with the advent of algorithmic trading and artificial intelligence (AI), they transitioned to automated systems provided by top futures brokers in the US. This shift not only improved their trading efficiency but also reduced human error and enhanced profitability.

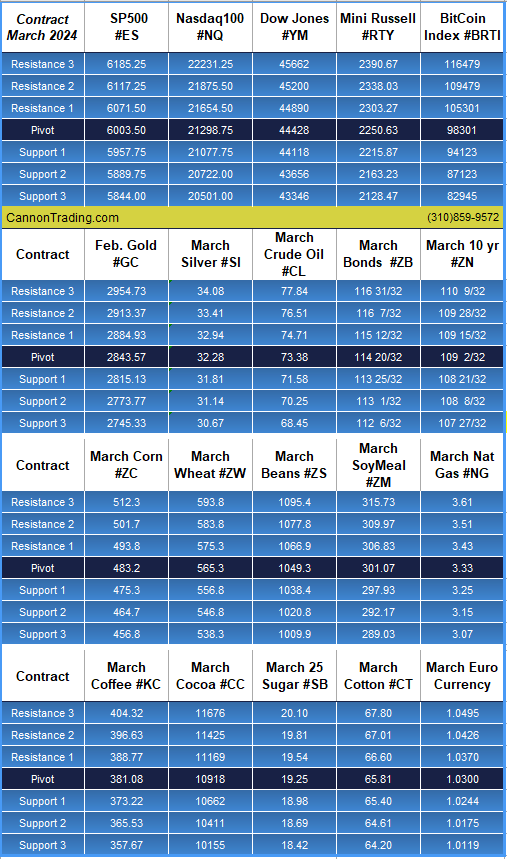

By 2025, experts predict that more than 70% of futures trading will be executed through algorithmic systems. This trend underscores the importance of choosing a broker equipped with cutting-edge technology. Cannon Trading Company, for instance, excels in this area, offering platforms like Sierra Chart and MultiCharts, which cater to both discretionary and algorithmic traders.

Regulatory Changes and Their Impact

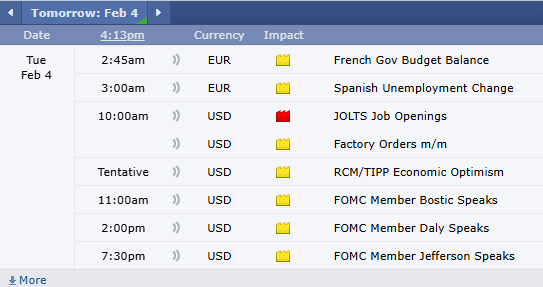

The futures market is one of the most heavily regulated sectors in the financial industry. The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) play pivotal roles in ensuring market integrity. As we approach 2025, several regulatory changes are expected to shape the industry:

- Enhanced Transparency: Regulators are likely to mandate greater transparency in fee structures, ensuring that traders clearly understand the costs associated with their trades.

- Improved Cybersecurity Standards: With the increasing reliance on digital platforms, futures brokers in the USA must comply with stringent cybersecurity measures to protect client data and funds.

- Focus on Sustainability: Regulatory bodies may introduce guidelines encouraging brokers to support environmentally sustainable practices, particularly in commodity markets like energy and agriculture.

Real-Life Anecdote: Adapting to Regulation

In 2021, a small retail trader in California faced challenges navigating margin requirements for crude oil futures. They switched to Cannon Trading Company after discovering its transparent approach to compliance and margin policies. The trader’s success in managing risk through Cannon’s educational resources highlights why compliance and transparency are integral to the best brokers for futures.

The Role of Technology in Futures Trading

Technology continues to revolutionize the futures trading ecosystem. By 2025, brokers will likely integrate even more advanced tools to enhance trading experiences, such as:

- AI-Driven Analytics: Platforms will leverage AI to provide predictive analytics, helping traders identify trends and make informed decisions.

- Blockchain Technology: Futures brokers in the US may adopt blockchain to streamline settlement processes, reduce fraud, and improve transparency.

- Mobile-First Platforms: With the growing number of traders using mobile devices, brokers will prioritize mobile-first designs to ensure seamless trading on the go.

Hypothetical Scenario: The Day Trader’s Advantage

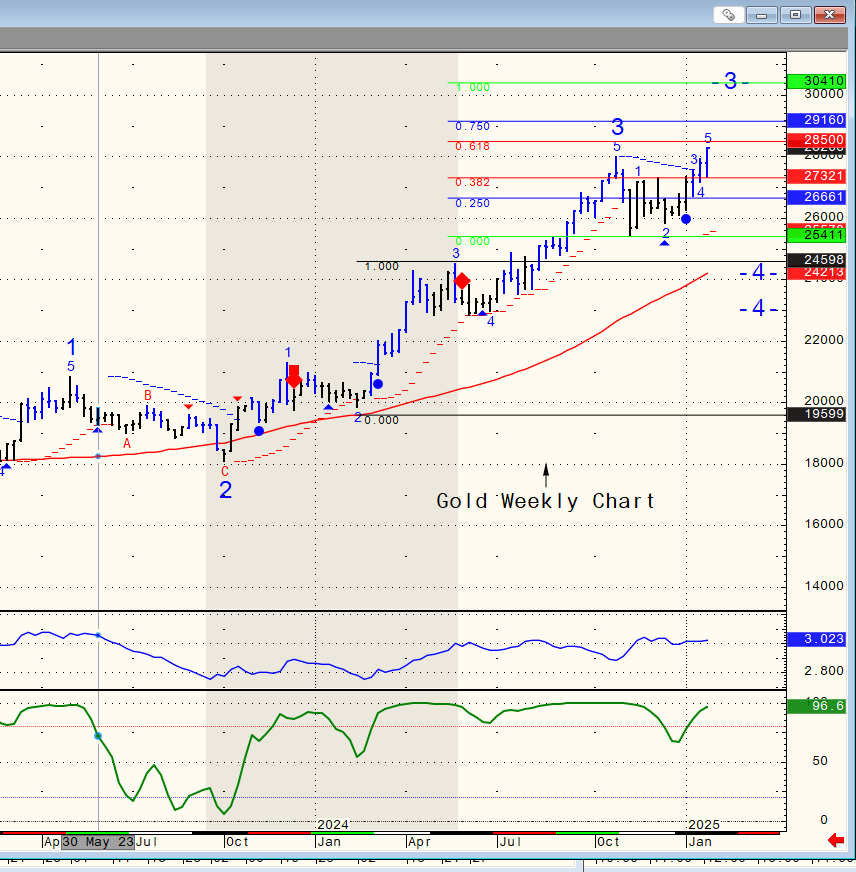

Imagine a day trader in New York using a platform equipped with AI analytics and real-time blockchain data verification. This trader identifies a bullish trend in the gold market and executes a profitable trade within seconds. Such scenarios highlight the potential of technological advancements to empower futures trading brokers and their clients.

Cannon Trading Company is well-positioned to lead this charge. Its diverse selection of trading platforms, including the highly rated E-Futures International and Optimus Flow, caters to traders of all experience levels. These platforms offer features like advanced charting, backtesting, and customizable indicators, ensuring traders have the tools they need to succeed.

Demographic Shifts and Trader Preferences

The demographic profile of futures traders is shifting. Millennials and Gen Z traders, known for their tech-savviness and preference for online platforms, are entering the market in greater numbers. These traders demand:

- Educational Resources: Interactive tutorials, webinars, and market analysis to enhance their trading knowledge.

- Social Trading Features: Tools that allow them to follow and replicate the strategies of successful traders.

- Low-Cost Access: Competitive pricing with minimal commissions and fees.

Case Study: The Novice Trader’s Journey

A college graduate in Florida started trading futures in 2022 using a mobile app. Initially overwhelmed by the complexity of the market, they turned to Cannon Trading Company for guidance. With its robust educational resources and responsive customer support, the broker helped the trader build confidence and execute successful trades. By 2025, such brokers will play a pivotal role in onboarding and nurturing the next generation of futures traders.

Why Cannon Trading Company Stands Out

Cannon Trading Company exemplifies the qualities of a top-tier futures broker in the US. Here’s why it’s a great choice for trading futures contracts:

- Wide Selection of Platforms: From beginner-friendly options like E-Futures to advanced platforms like Sierra Chart, Cannon Trading caters to diverse trading styles and preferences.

- Regulatory Excellence: With decades of experience and a stellar reputation with the NFA and CFTC, the company ensures compliance and trustworthiness.

- Customer-Centric Approach: The broker’s 5-star ratings on TrustPilot reflect its commitment to exceptional service and support.

- Competitive Pricing: Cannon Trading offers transparent fee structures, ensuring traders know exactly what they’re paying for.

- Educational Support: The company provides a wealth of resources, including market analysis, webinars, and personalized consultations, to help traders succeed.

Preparing for 2025: Key Takeaways for Traders

As the futures trading industry evolves, traders must adapt to stay competitive. Here are some tips to prepare for the changes ahead:

- Embrace Technology: Leverage advanced platforms and tools to enhance your trading efficiency.

- Stay Informed: Keep up with regulatory developments and adjust your strategies accordingly.

- Choose the Right Broker: Opt for a broker like Cannon Trading Company that offers a comprehensive suite of services and a proven track record.

- Invest in Education: Continuously enhance your trading knowledge through courses, tutorials, and market analysis.

By aligning with a forward-thinking broker and staying proactive, traders can thrive in the dynamic futures market of 2025 and beyond.

The future of futures brokerages in the USA is bright, marked by technological innovation, regulatory advancements, and changing trader demographics. Brokers like Cannon Trading Company exemplify the adaptability and excellence needed to succeed in this evolving landscape. Whether you’re a novice exploring futures trading or a seasoned professional seeking advanced tools, Cannon Trading offers the platforms, expertise, and support to help you achieve your trading goals.

By understanding the trends shaping the industry and aligning with a trusted partner, traders can navigate the complexities of the futures market with confidence. As 2025 approaches, the opportunities for growth and success in futures trading are more abundant than ever.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.