Cannon Futures Weekly Newsletter Issue # 1056

Dear Traders,

Get Real Time updates and more on our private FB group!

Trading 201: Trading Futures Spreads – Basic But Important Strategy

“A Basic And Important Strategy For Commodities Traders Using Spread Trading.”

By: Mark O’Brien, Cannon Trading Commodities Broker

Over my 20+ year career as a commodities broker, I have studied and traded a wide range of approaches to trading the futures markets. From candlestick formations to the commodity channel index, from condors to turtle trading, there’s an enormous catalog of tools and methods available for traders to consider.

One method I have noticed is surprisingly underrepresented among retail traders is futures spread trading, where a single position in the market consists of the simultaneous purchase of one futures contract and sale of a related futures contract as a unit. I call it surprising because some of the most invested players in futures trading – and arguably the most sophisticated – include large speculators and commercial firms who regularly employ spreads. This includes traders in the markets who often actually buy and sell the physical commodities we trade. Farmers, ranchers and other food growers along with food producers, petroleum companies who either drill for oil or natural gas or refine these products – or both, financial institutions with enormous holdings in treasuries, equities or currencies, mining interests and their buyers – all these areas of production and distribution employ spreads from time to time as an important aspect of their businesses. Indeed, spread trading is a fundamental and essential part of the commodities futures markets.

At the same time, despite the remarkable increase in interest and in the growth in the volume of the futures markets over the years, spread trading is typically dismissed by most other traders in search of a trading strategy. With so much attention focused on other approaches related to straightforward directional trading (and within that category, day-trading) it’s not difficult to see how spread trading can be overlooked.

To read the remaining article on Trading Futures Spreads by Mark O’brien, please click here.

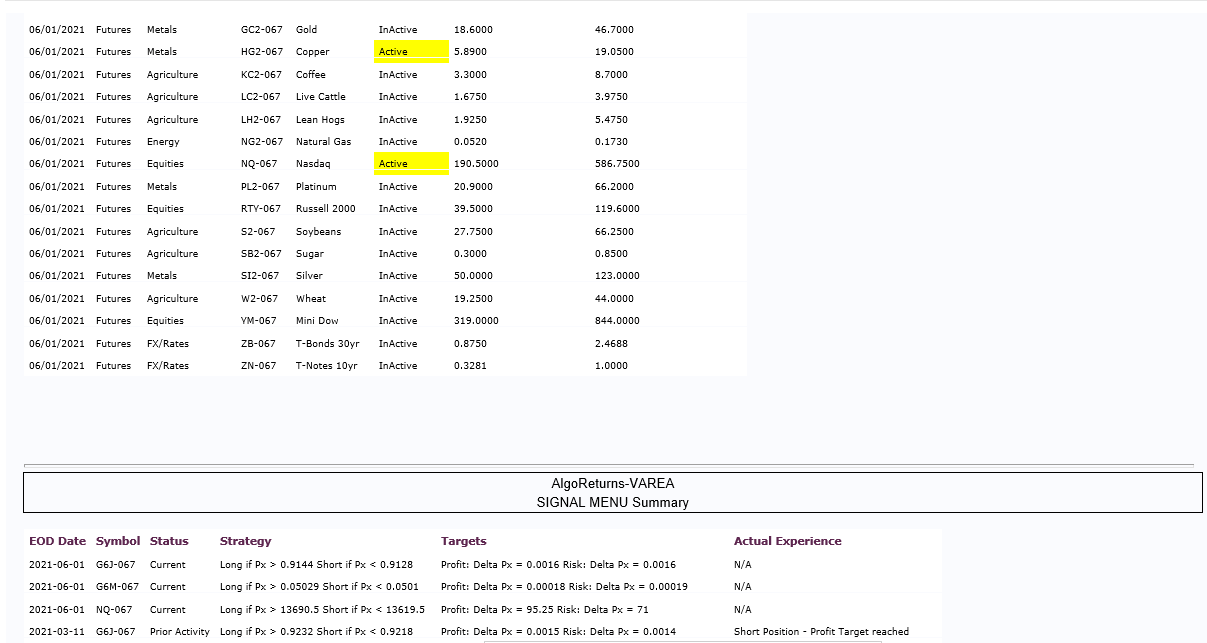

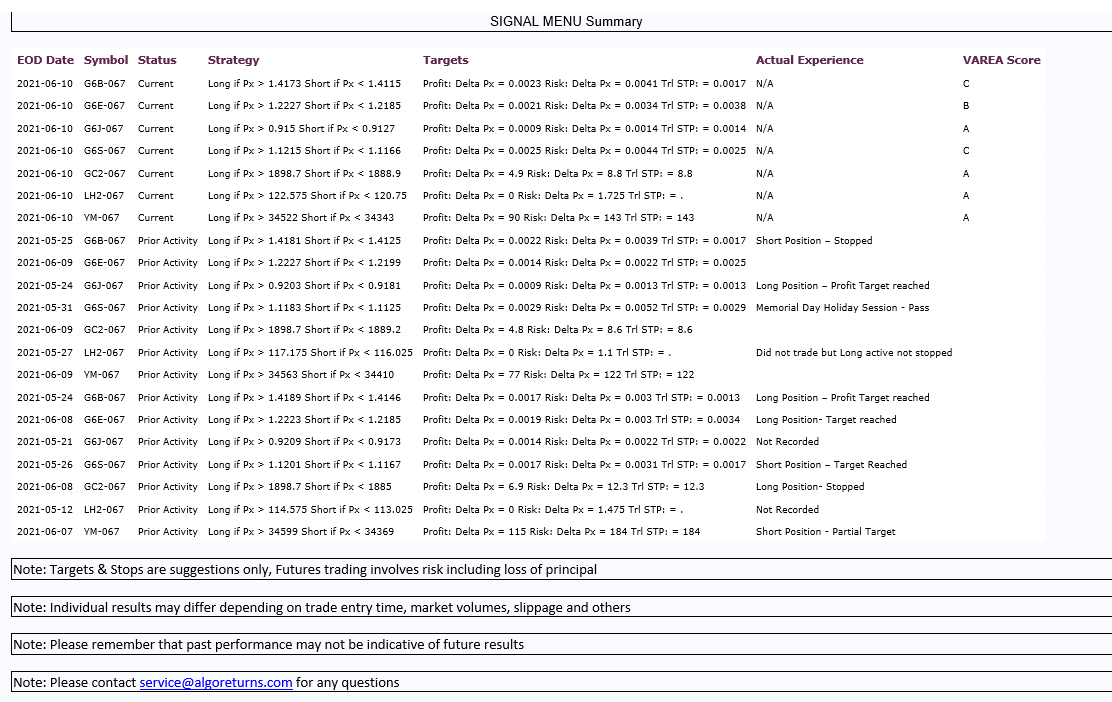

Market Pick Review for the Week:

Sept. 2021 Corn vs. May 2022 Corn

To access a free trial to the ALGOS shown in the chart along with other tools? (Arrows possible buy/sell, diamonds = possible exit/ tighten stops) visit and

sign up for a free trial for 21 days with real-time data.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

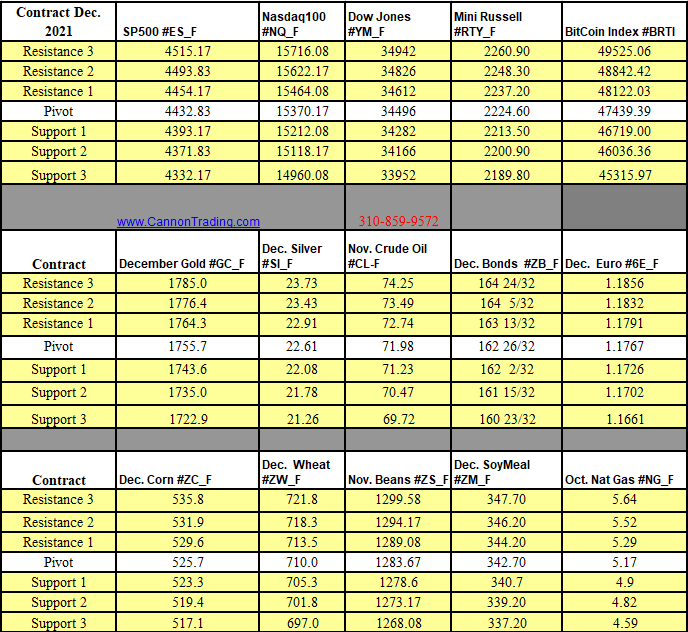

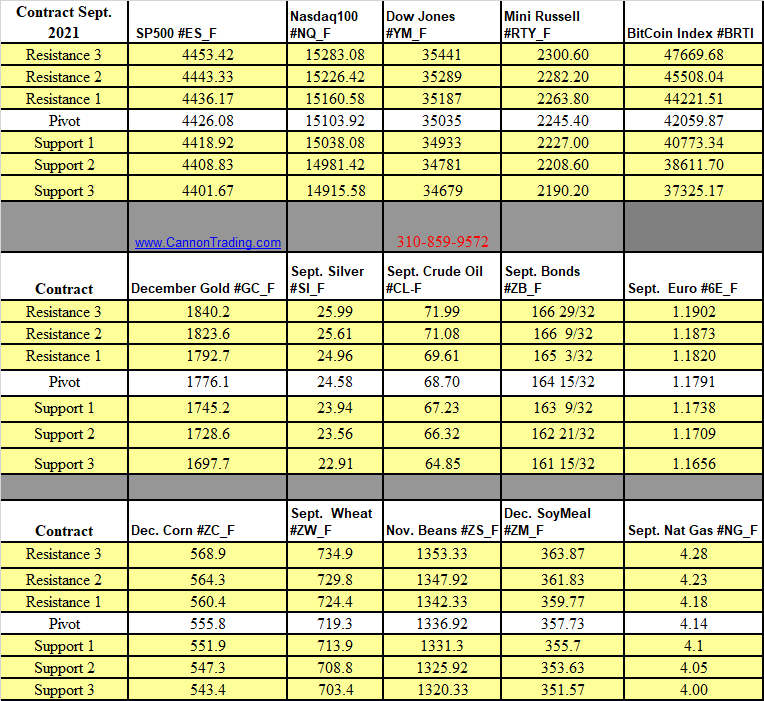

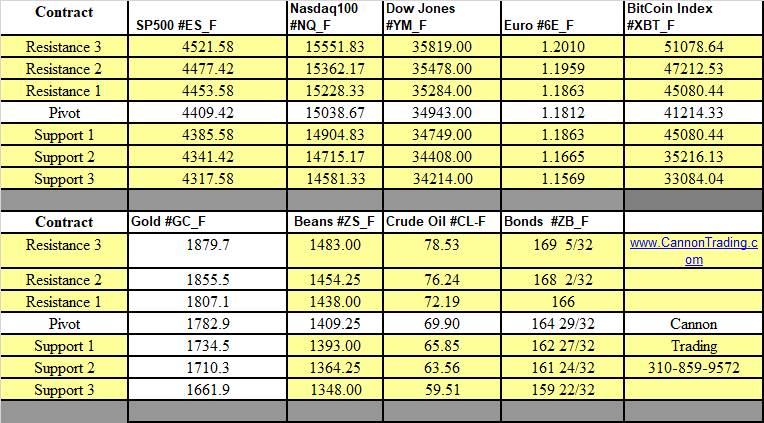

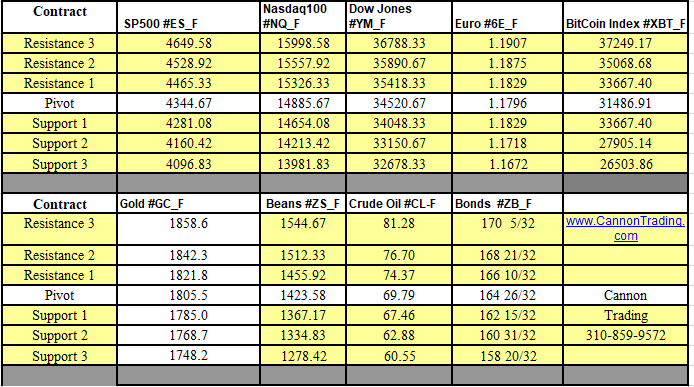

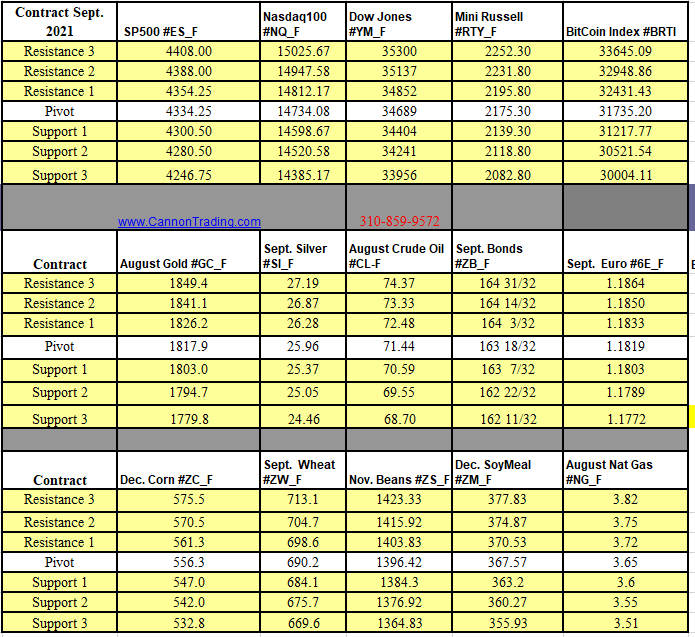

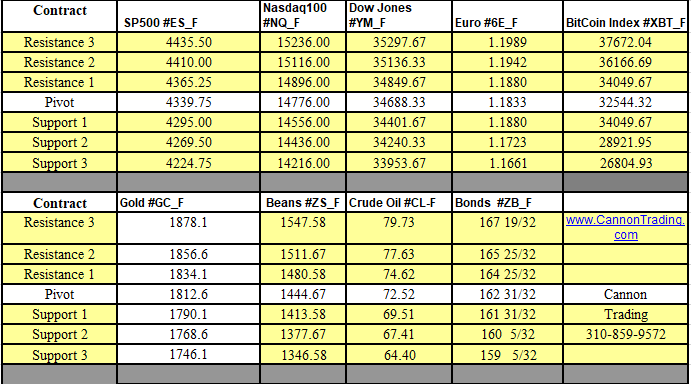

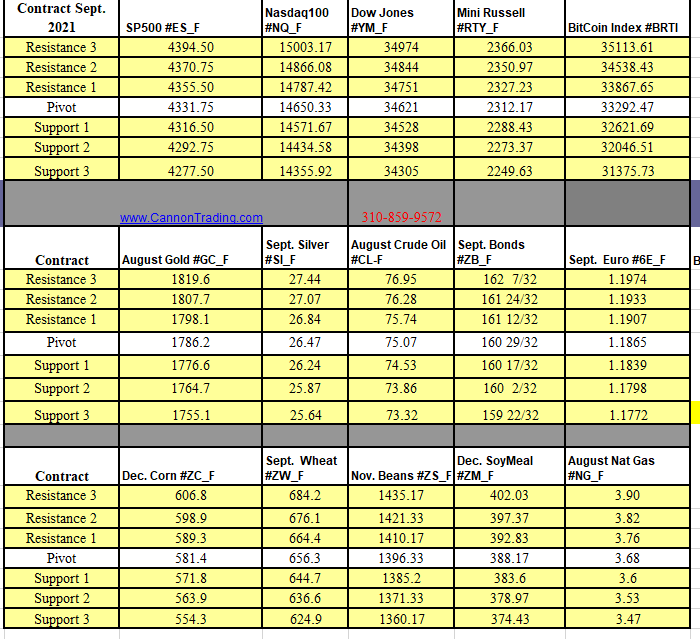

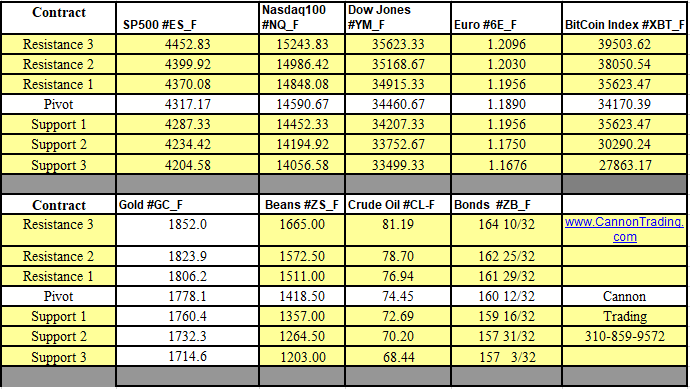

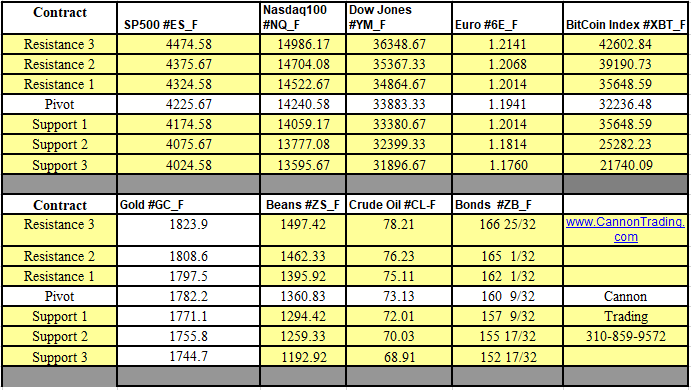

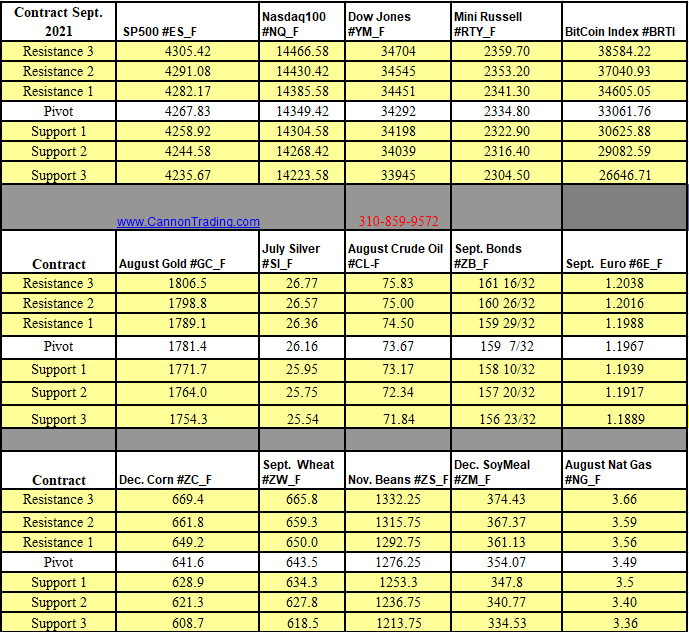

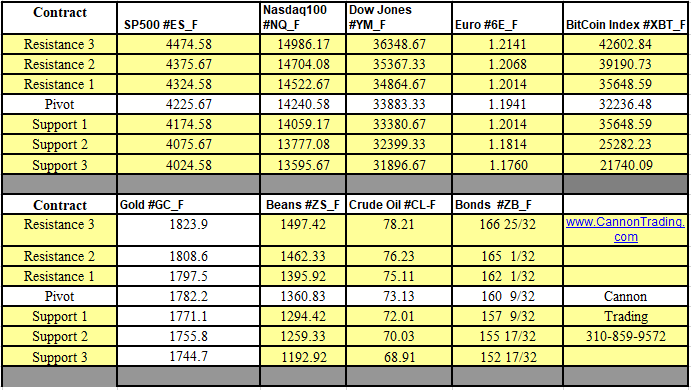

Futures Trading Levels

6-28-2021

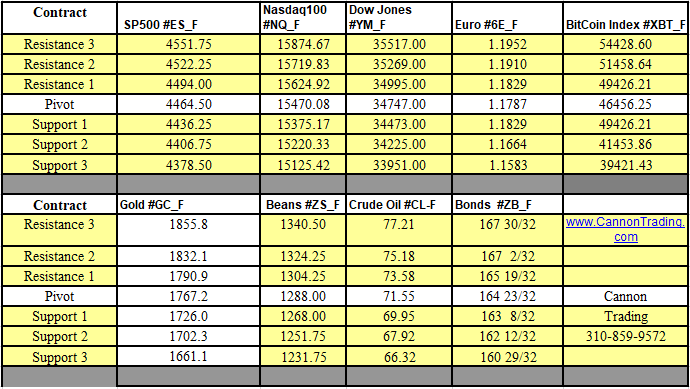

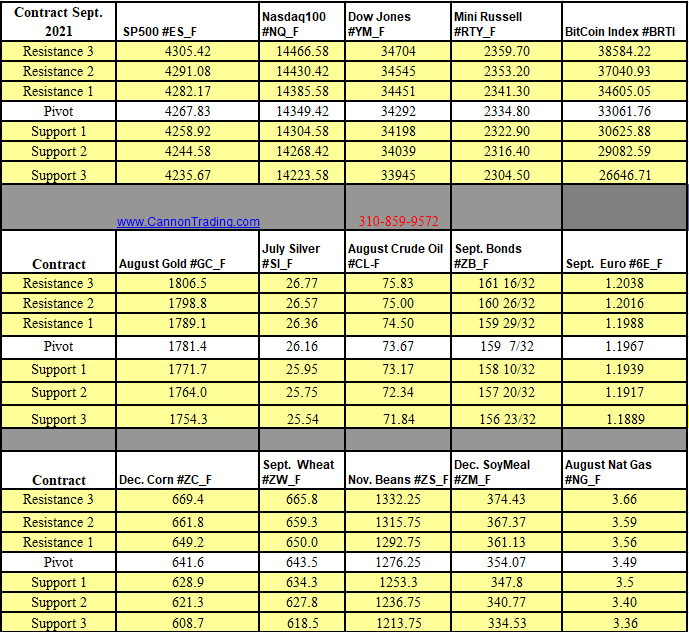

Weekly Levels

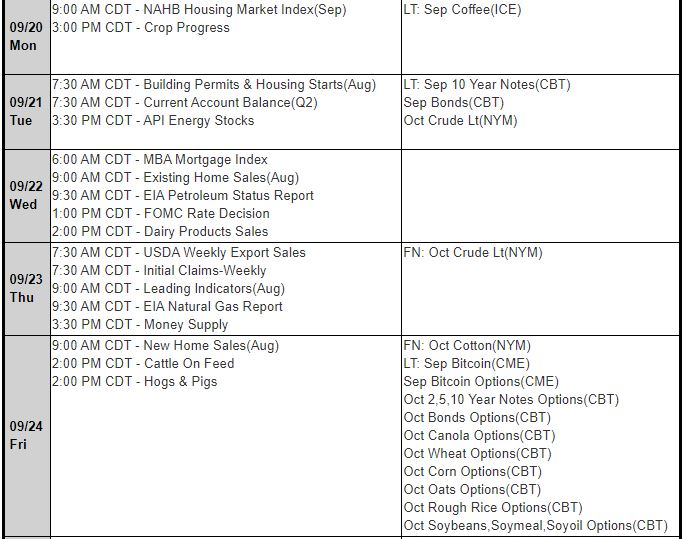

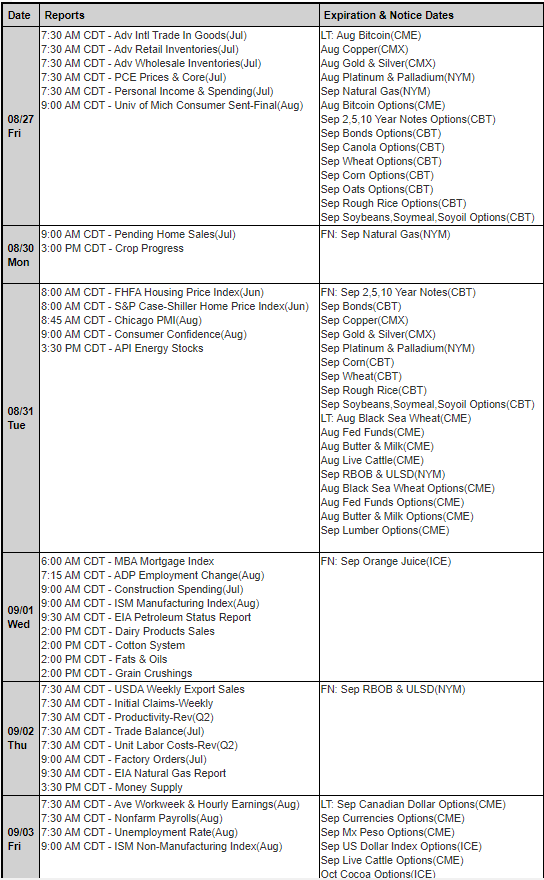

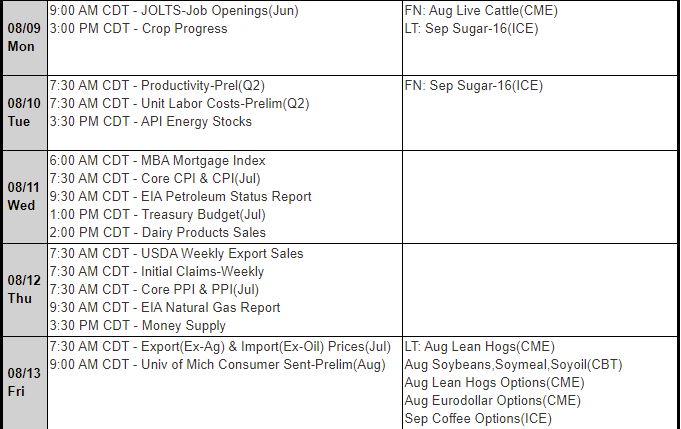

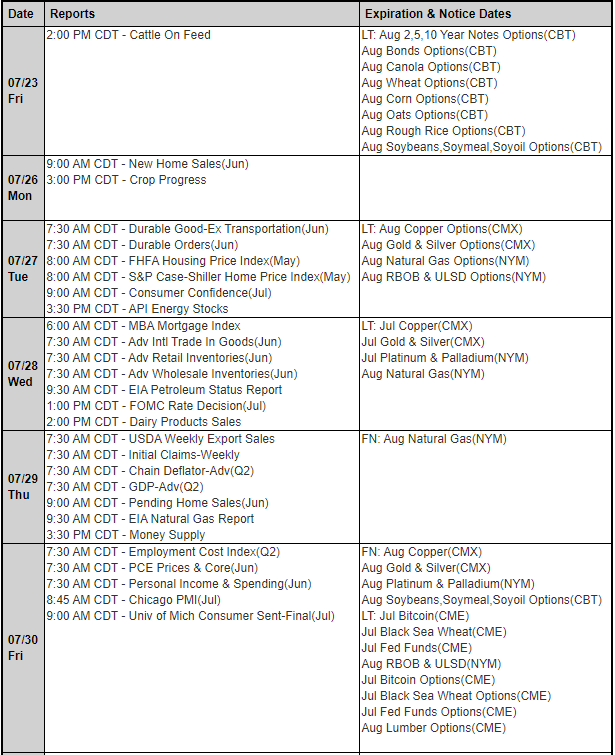

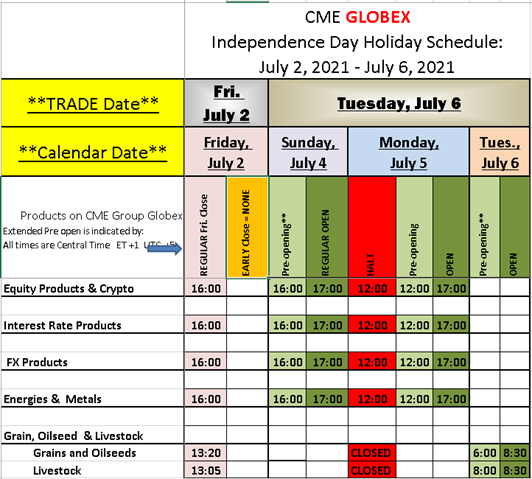

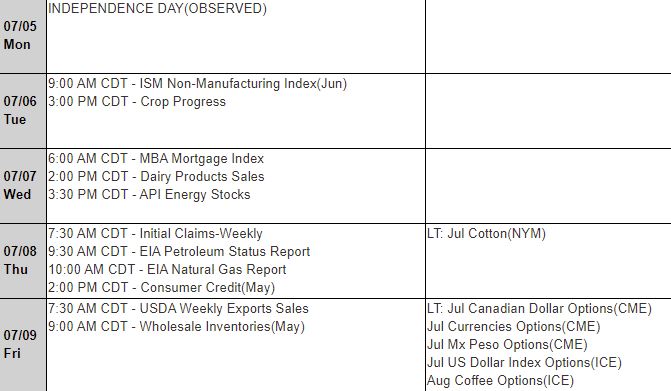

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading