Cannon Futures Weekly Newsletter Issue # 1045

Dear Traders,

Get Real Time updates and more on our private FB group!

Trading 102: Tight Stops? Wide Stops? Which One Should I Use?

Entry Signals Are Very Important But Just As Important If Not More Is Trade Management.

By: Ilan Levy-Mayer, Cannon Trading Commodities Broker & VP

This article was published on FinanceMagnates.com back a couple years ago but is defintely a timeless article.

Today I decided to touch more on an educational feature rather than provide a certain market outlook. Many of my clients and blog readers know that when it comes to short term trading I am a fan of adjusting your trading technique/ game plan according to your assessment of the type of trading day that is developing in front of you.

Many new and advanced traders spend HOURS on looking for entry signals. Back testing historical data, creating algorithms to use and much more. I know. I am one of these traders.

Trade management consists of many factors. Some are psychological and some are more mathematical and many are in between. Some of the basic elements of trade management before even entering the trade are: What will my stop loss be**? will i use a stop loss**? What will my target be? will I use a target or just trail the trade if it goes my way?

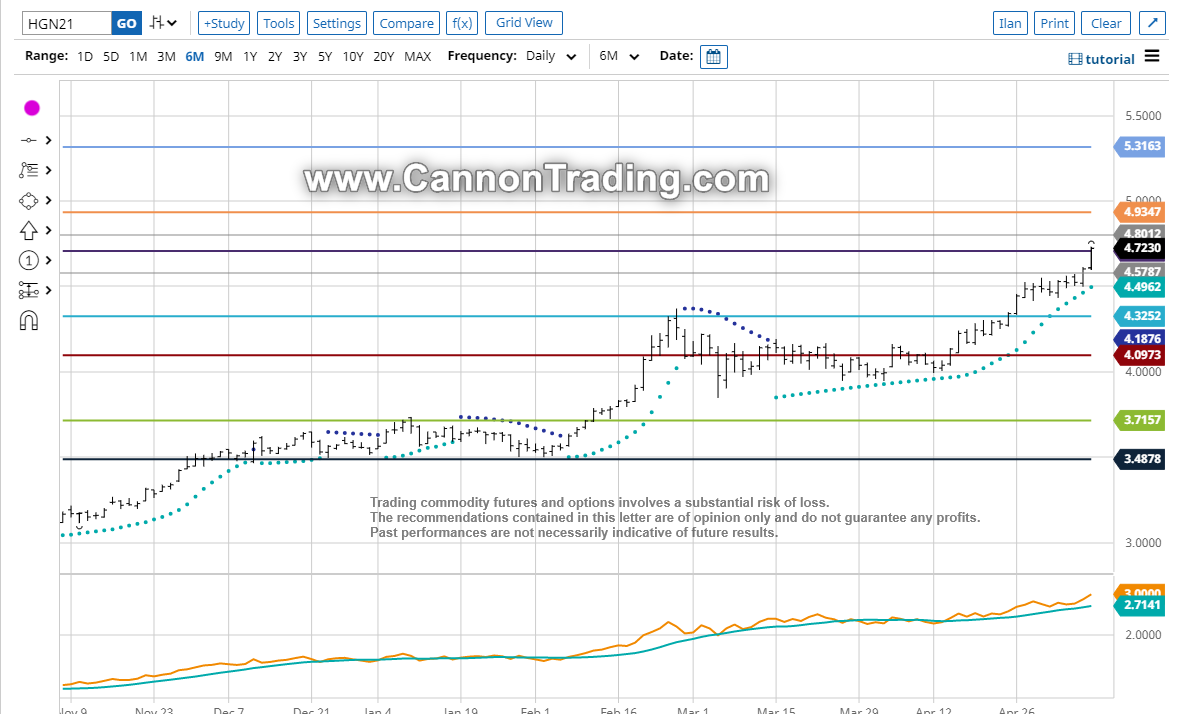

The bond market, more specifically, interest rate and yield projections, have been the big force behind the moves in many other futures markets. Bonds and the U.S. dollar have been key markets to watch, regardless of whether you are trading the E-mini S&P 500, gold, crude oil or soybeans. The way “big money” flows between asset classes, the allocation of assets, as well as the hedging interests in different markets are the main forces behind most of the markets we trade here.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

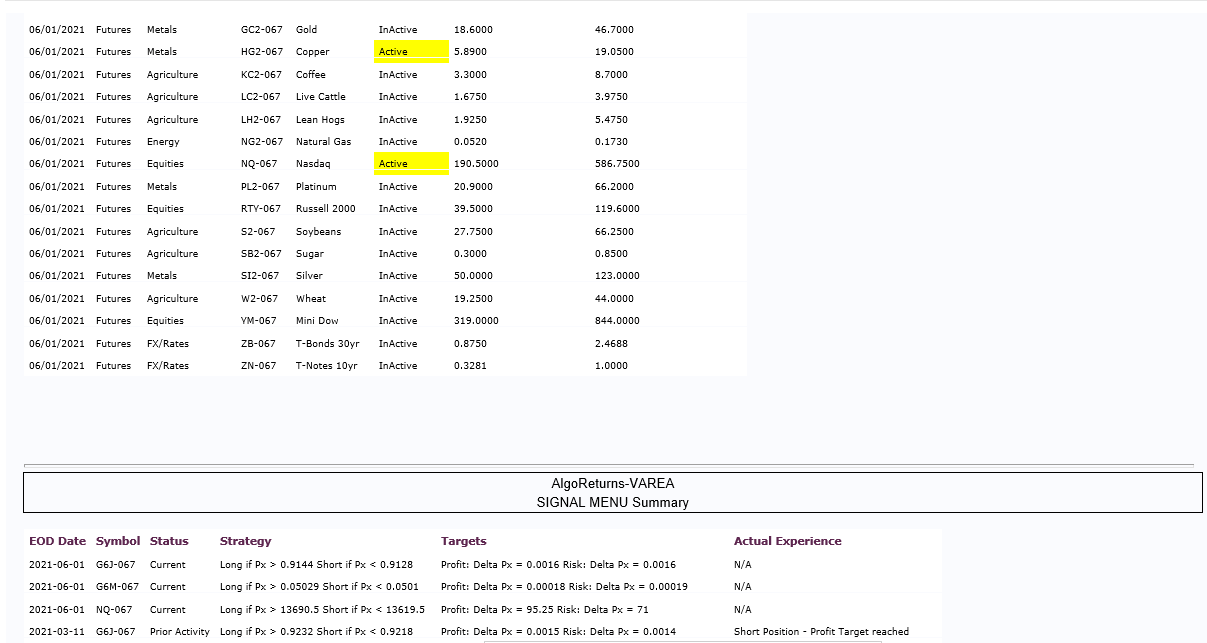

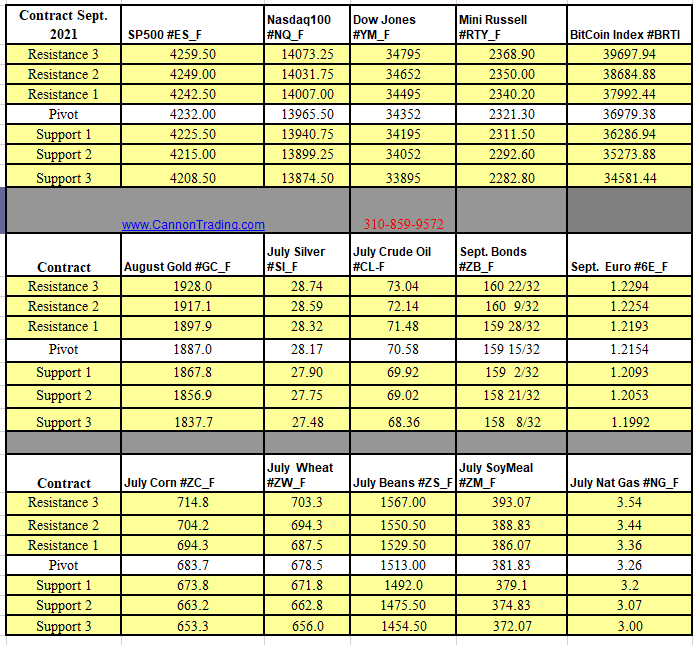

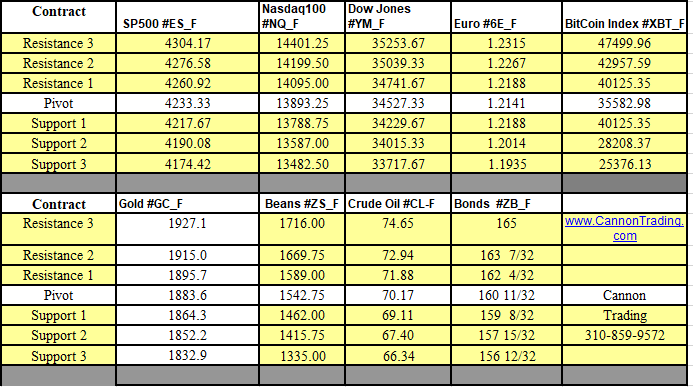

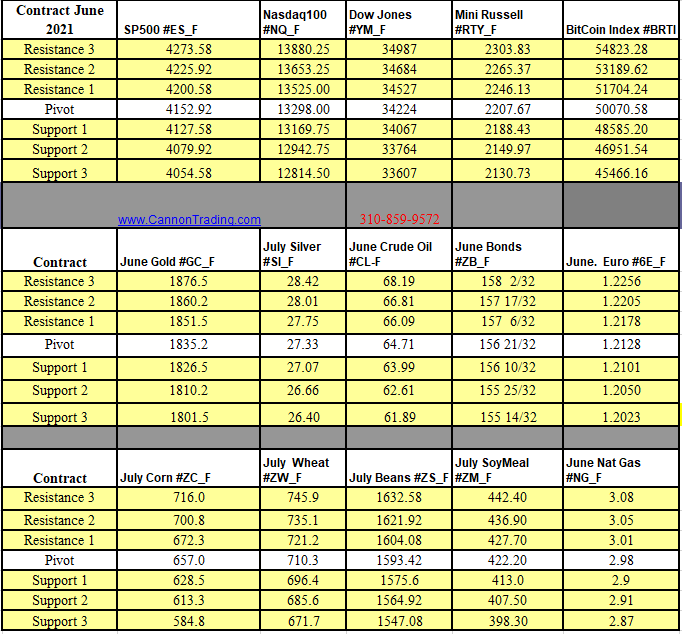

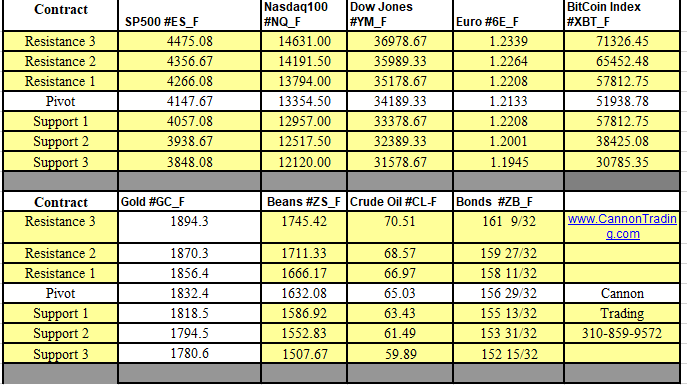

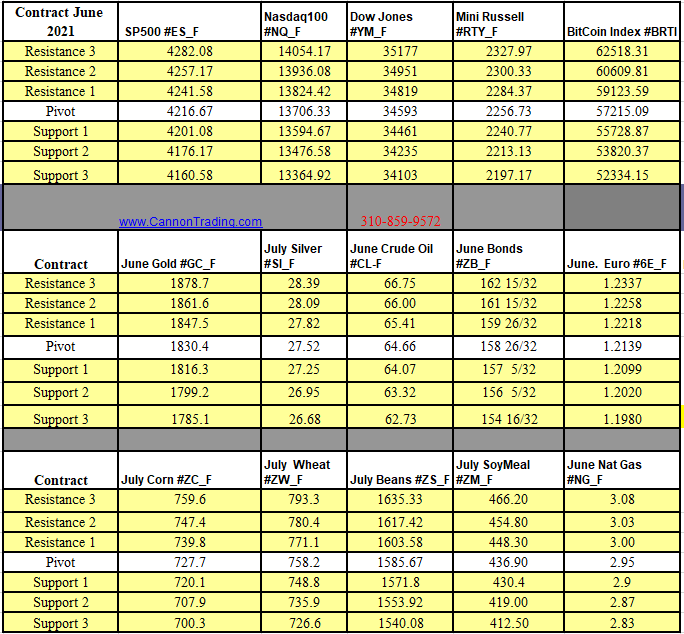

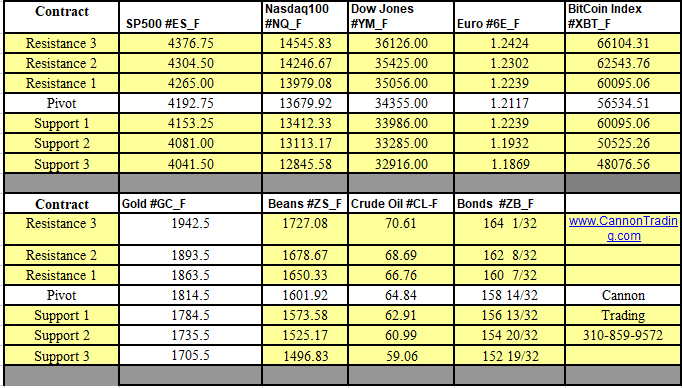

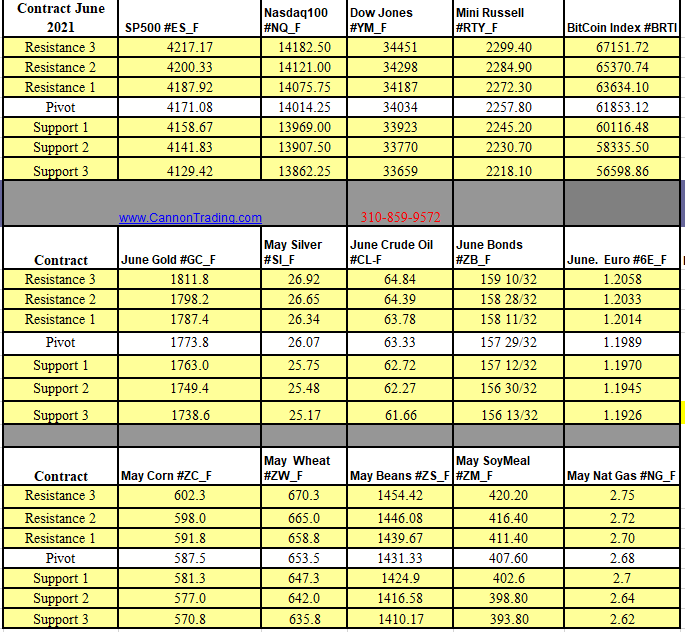

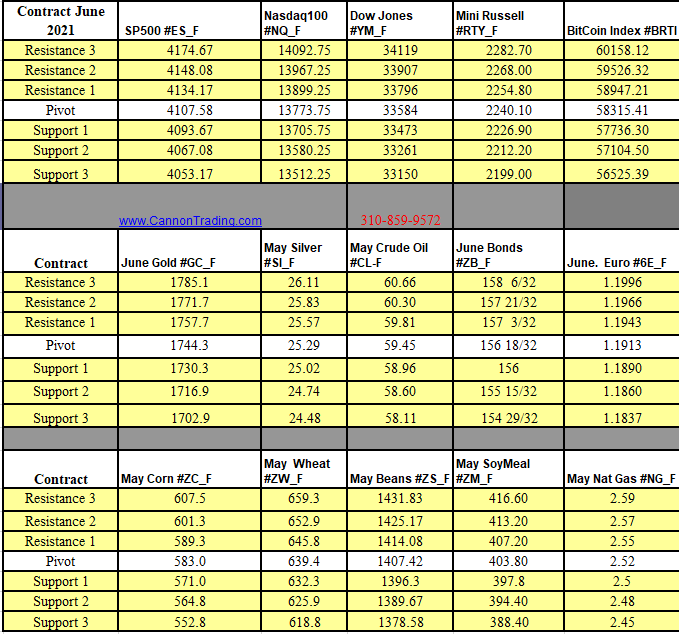

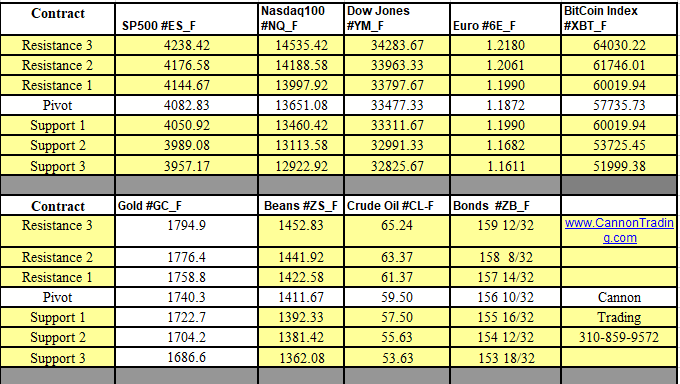

Futures Trading Levels

3-29-2021

Weekly Levels

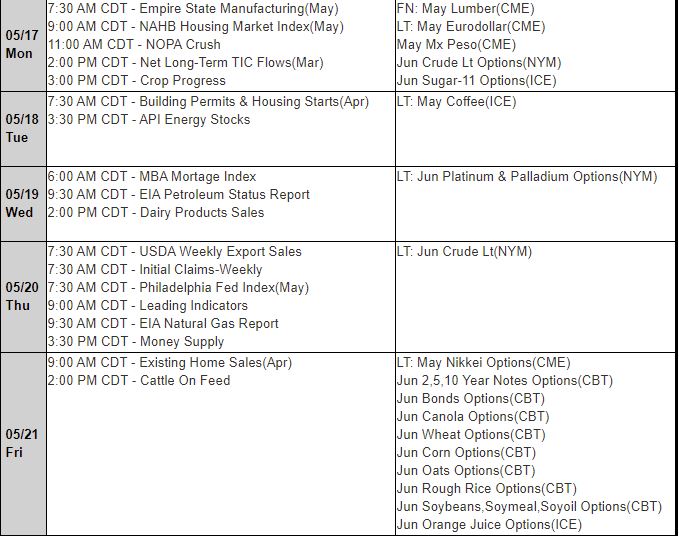

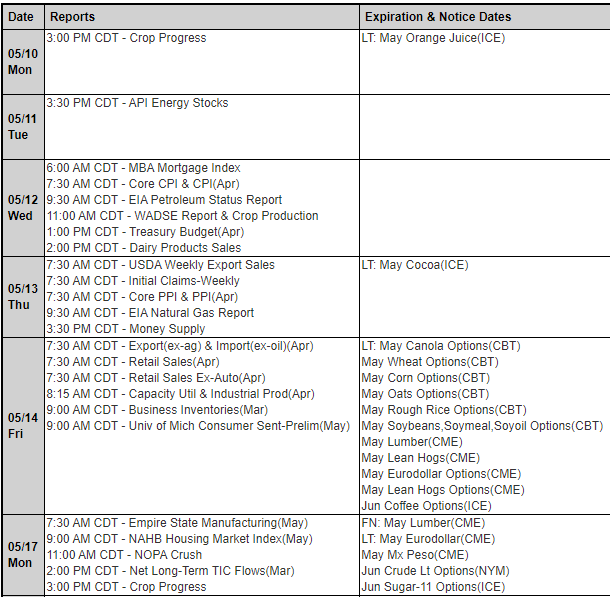

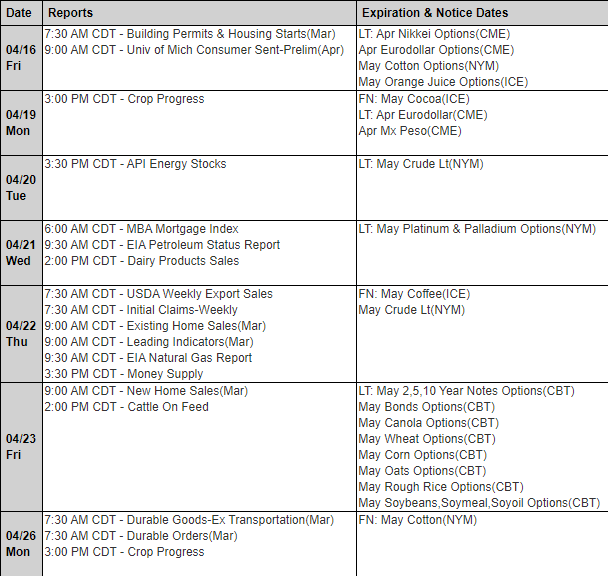

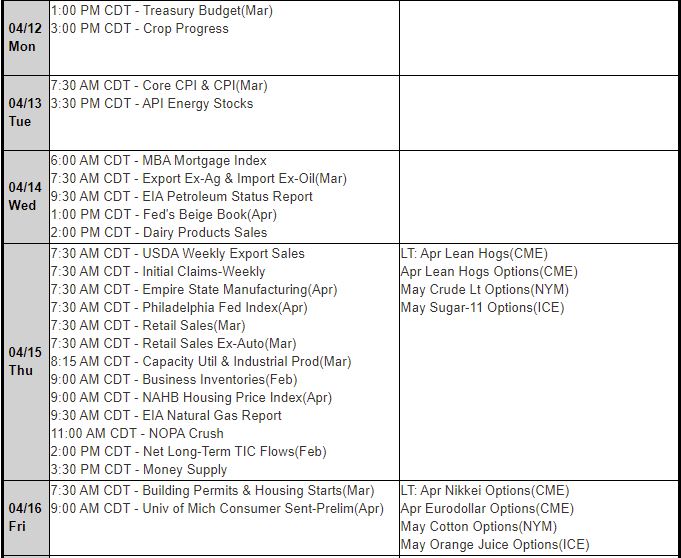

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading