In the high-stakes, fast-paced world of futures trading, choosing the best futures broker can significantly impact a trader’s trading. The futures broker serves not only as a gateway to the markets but also as a partner in the pursuit of profit and risk management. While many firms compete for the title of best futures broker, few consistently rise above the rest in all aspects that matter—reliability, transparency, platform selection, regulatory compliance, and personalized service.

Among these top-tier firms stands Cannon Trading Company, a brokerage with decades of experience and an unwavering commitment to client satisfaction. With its exemplary reputation, broad suite of trading platforms—including CannonX powered by CQG—and a long list of glowing reviews, Cannon Trading Company has earned its place as one of the most respected and trusted names in futures trading.

What Defines the Best Futures Broker?

Not all brokers are created equal. Here are the defining qualities that distinguish the best futures broker from the rest:

- Regulatory Integrity & Compliance

The best futures broker must maintain an impeccable reputation with both federal and industry regulators. This includes registration with the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). Regulatory compliance isn’t just about following rules—it’s about earning the trust of clients by providing secure, transparent, and ethical service.

- Platform Variety and Cutting-Edge Technology

Successful futures trading requires advanced tools. The best futures brokers offer access to a broad range of platforms suited to every type of trader—from beginners to seasoned professionals. Whether through mobile apps, desktop terminals, or browser-based interfaces, a top futures broker provides seamless connectivity, advanced charting, and lightning-fast execution.

- Exceptional Client Service

Perhaps the most telling sign of the best futures broker is how they treat their clients. Personalized support, proactive problem-solving, and educational guidance are hallmarks of outstanding service. Traders want to feel like more than just an account number—they want a partner in trading futures.

- Transparency in Pricing and Commissions

The best futures brokers provide clear, competitive pricing without hidden fees. From margin requirements to commission structures, transparency builds confidence and trust.

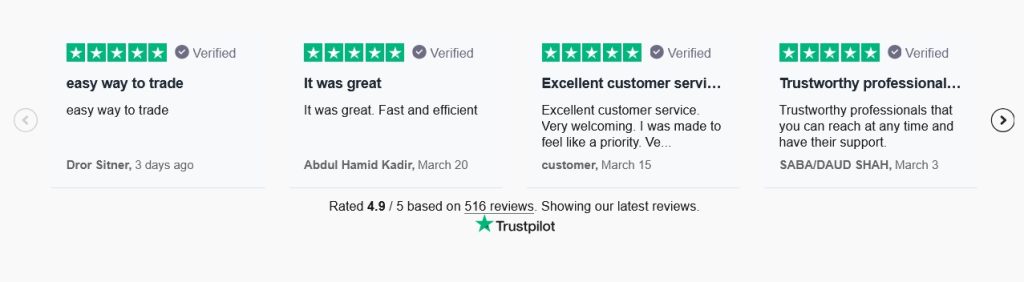

- Client Testimonials & Reputation

No amount of marketing can substitute for real feedback from real clients. Verified reviews, especially those on platforms like TrustPilot, offer a candid look at what working with a broker is truly like. When a broker earns consistently high ratings, it’s a powerful indicator of excellence.

Cannon Trading Company: An Embodiment of Broker Excellence

Cannon Trading Company doesn’t just meet the above standards—it exceeds them. Let’s explore how this futures broker personifies the qualities that define the best futures broker in the industry.

Decades of Proven Experience

Founded in 1988, Cannon Trading has spent over three decades honing its expertise in the futures trading industry. This longevity isn’t accidental—it’s a reflection of adaptability, professionalism, and a relentless commitment to clients’ evolving needs.

Exemplary Regulatory Standing

Cannon Trading is a member of the National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). These affiliations guarantee regulatory oversight, client fund segregation, and adherence to the highest industry standards—hallmarks of the best futures broker.

Powerful Platform Variety: CannonX Powered by CQG

Few brokers offer a broader or more robust selection of platforms than Cannon. Their flagship offering, CannonX powered by CQG, stands out as a premier choice for serious traders. The CQG platform is known industry-wide for its speed, reliability, and professional-grade analytics. By integrating this into their CannonX product, Cannon delivers institutional-quality tools to retail and professional clients alike.

Other platforms offered include:

- NinjaTrader

- TradingView

- MetaTrader 5

- Rithmic-based platforms

- MultiCharts

- MotiveWave

- Bookmap

- VolFix

- And more…

This expansive offering ensures every trader can find the ideal futures trading environment, whether focused on discretionary trading futures, algorithmic strategies, or futures contract trading.

Client Support that Goes the Extra Mile

What truly differentiates Cannon is its deeply personalized service. This is not a faceless brokerage. Clients regularly speak directly with senior brokers and benefit from decades of cumulative industry experience. Education, platform training, and strategy discussions are part of the service—not upsells.

As one TrustPilot reviewer stated:

“They always take the time to walk me through my questions, no matter how busy they are. That kind of service is unheard of these days.”

Another 5-star review reads:

“Cannon Trading provides professional, personalized service that is tailored to my trading style. They genuinely care about my success.”

These quotes embody the human element that defines the best futures broker—real relationships, not just transactions.

Cannon Trading’s TrustPilot page is a testament to client satisfaction. With numerous 5 out of 5-star ratings, the brokerage clearly delivers on its promises. Importantly, these reviews come from real traders sharing their real experiences.

Here are just a few glowing examples (all 5-star ratings):

- “Cannon Trading is easily the best futures broker TrustPilot has seen. Transparent, honest, and incredibly responsive.”

- “CannonX is a dream platform. Combined with the CQG backbone, it’s the most stable system I’ve ever used. Execution is flawless.”

- “I’ve worked with several brokers in my 10+ years of trading futures. None compare to Cannon. These guys are the real deal.”

These reviews not only reinforce Cannon’s reputation—they make a compelling case for why Cannon Trading is among the top contenders for best futures broker TrustPilot searches.

Transparent Pricing & Educational Resources

Cannon Trading excels in clarity. Whether you’re opening a basic self-directed account or engaging a full-service broker, the pricing structure is easy to understand and competitive. Clients aren’t bombarded with hidden fees, vague margins, or complex fine print.

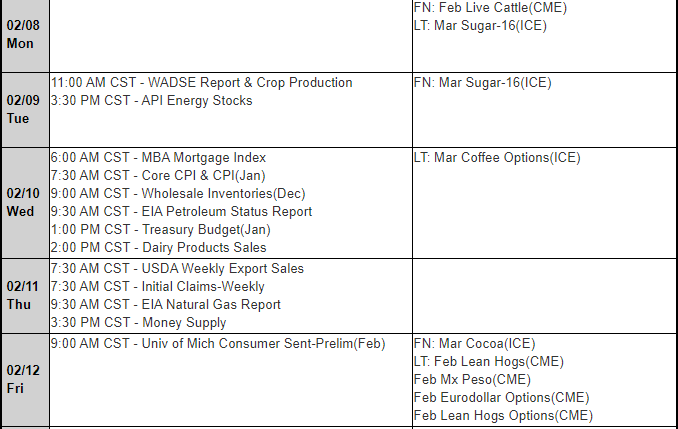

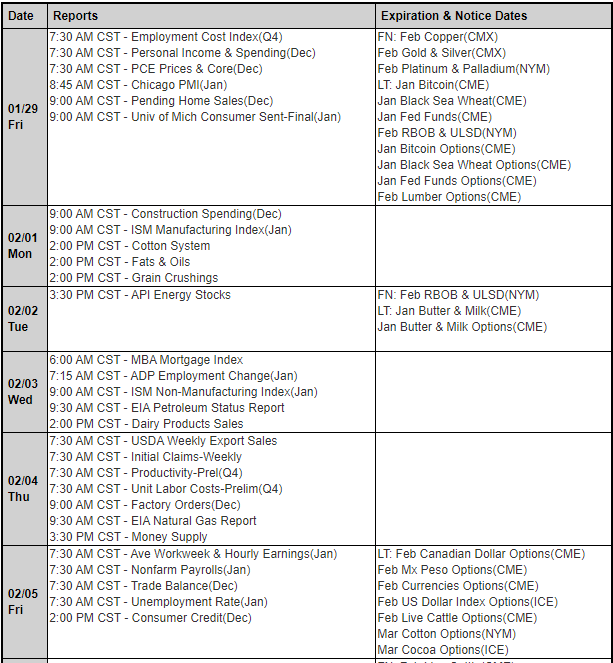

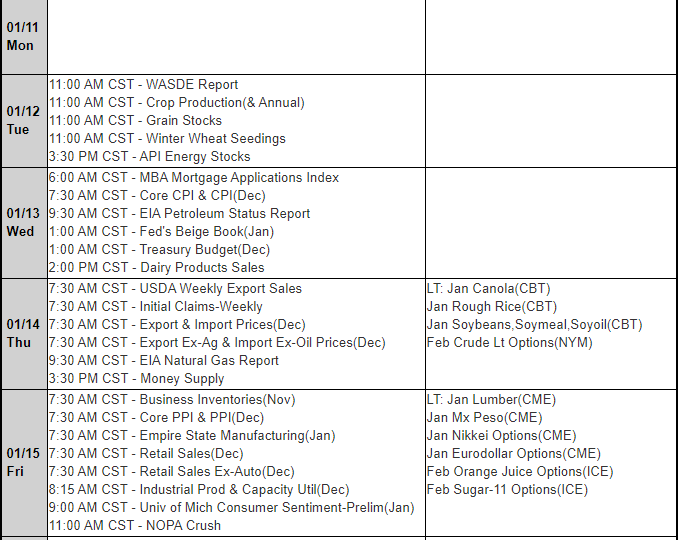

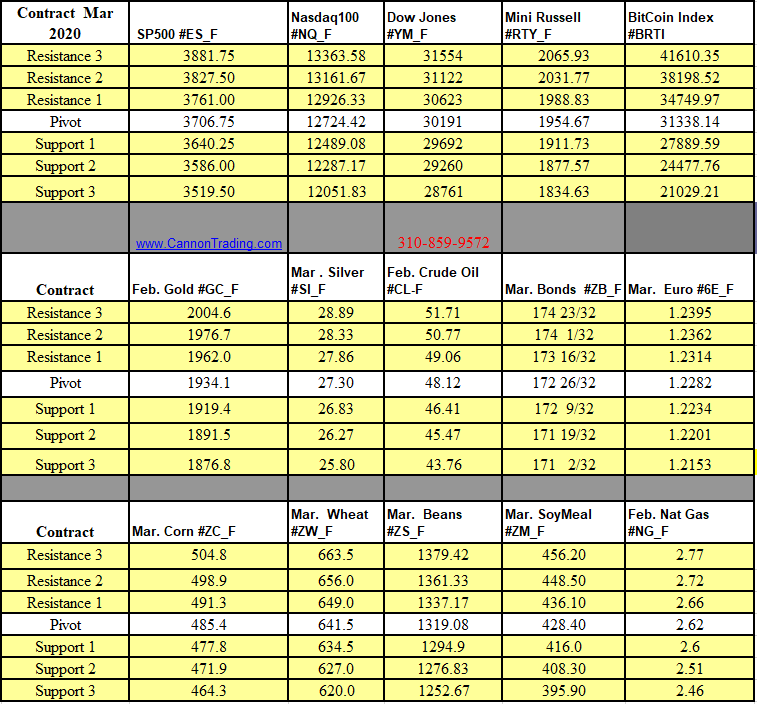

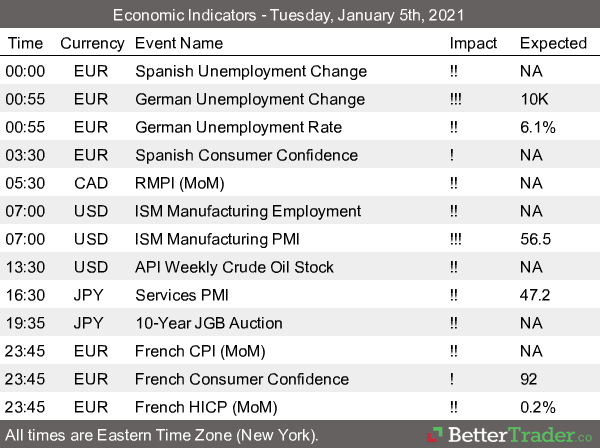

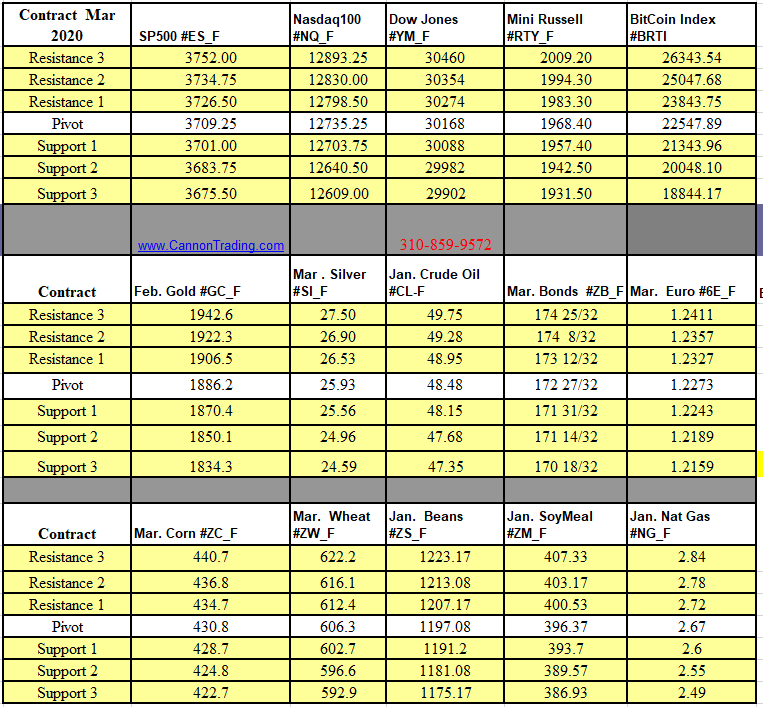

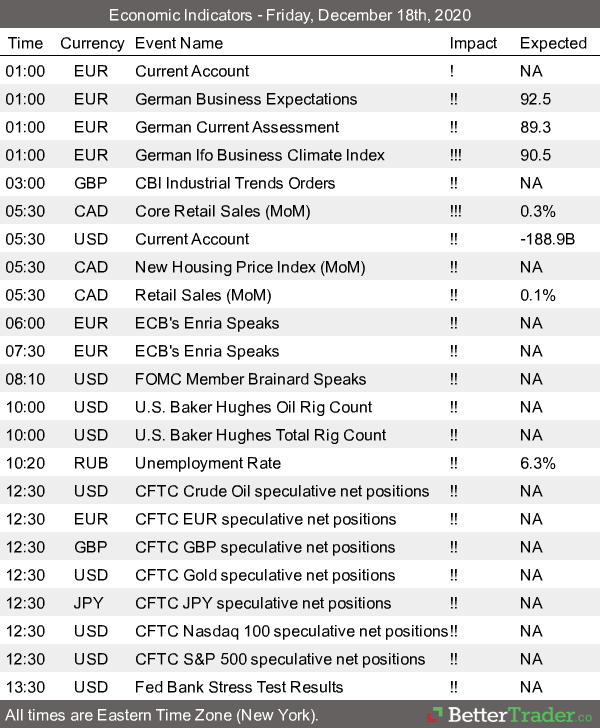

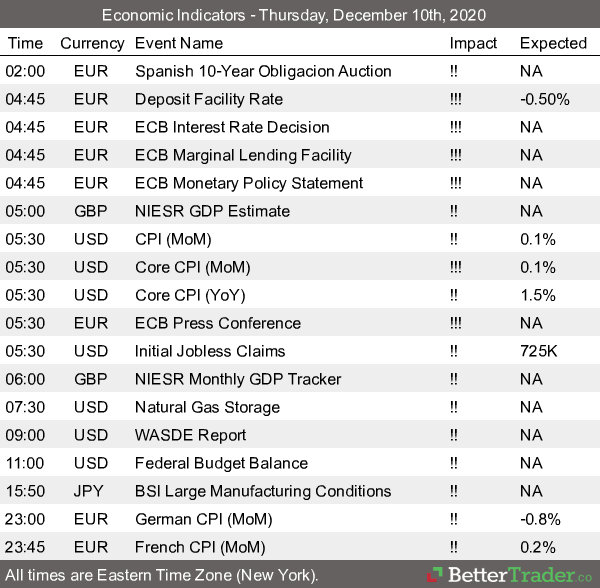

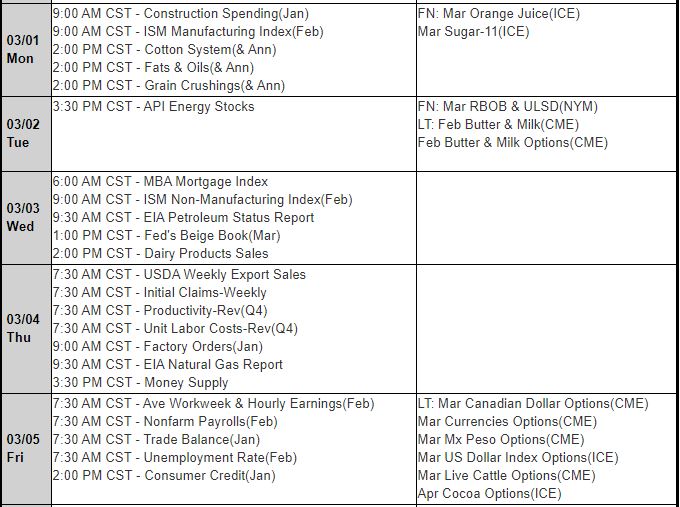

Moreover, Cannon provides a wealth of educational materials—daily market commentary, webinars, platform tutorials, and newsletters—all designed to empower clients to make informed decisions in their futures trading journey.

CannonX: Where Innovation Meets Execution

The CannonX powered by CQG platform deserves special attention. By integrating the robust CQG platform into its infrastructure, Cannon Trading gives clients access to:

- Real-time, high-speed market data

- Precision order routing

- Advanced charting and analytics

- Custom algorithmic strategy deployment

- Historical market replay for backtesting

Whether for scalping, swing trading, or longer-term strategies, CannonX provides everything a trader needs to engage in professional-grade futures contract trading.

Why Cannon Trading Ranks Among the Best Futures Brokers

To summarize, here’s how Cannon checks every box:

| Broker Attribute | Cannon Trading Company |

| Regulatory Trustworthiness | CFTC & NFA Registered, Clean Record |

| Platform Variety | 15+ Platforms Including CannonX powered by CQG |

| Client Support | Personalized, Experienced, 24/7 Accessibility |

| Technology & Execution | CQG Backbone, High-Speed Data, Low Latency |

| Pricing Transparency | Clear Commission Structures, No Hidden Fees |

| Client Feedback | Dozens of 5-Star TrustPilot Reviews |

| Education & Resources | Webinars, Daily Market Reports, Platform Guides |

Final Thoughts: Trust, Tools, and Tradition

The world of futures trading is complex and challenging—but with the right broker, it doesn’t have to be intimidating. Cannon Trading Company exemplifies every trait that defines the best futures broker today. With its comprehensive platform options, transparent business practices, professional support, and glowing TrustPilot reviews, it’s clear why many traders refer to Cannon as their long-term partner in trading futures.

In an industry often marred by overpromises and underdelivery, Cannon Trading offers a refreshing alternative: integrity, reliability, and cutting-edge tools like CannonX powered by CQG. Whether you’re a new trader exploring futures contract trading or a seasoned professional seeking a reliable edge, Cannon Trading is the kind of futures broker that delivers service at a level only a legacy futures broker can provide.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

_Weekly_Continuation.png)