|

Futures Markets Data 101By John Thorpe, Senior Broker |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Markets Data 101By John Thorpe, Senior Broker |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* Keep in mind that Crude Oil numbers WILL NOT come out tomorrow since Monday was a holiday ( MLK Day). The crude oil numbers will come out on Thursday at 8 AM pacific or 10 Am Central. Natural gas numbers will come out Thursday as well at 7:30 AM Pacific.

** Good read about what you need to look at from the fundamental/ global perspective for the next few weeks: https://www.cannontrading.com/community/newsletter/Global-Market-Outlook-for-January-and-February-Trump-and-the-markets#two

Continue reading “Winter is Coming – Global Perspective on the Markets 1.18.2017”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday October 27, 2016

Greetings!

This resource I am about to share is very valuable in my eyes. I use it daily when assisting clients who are in different markets and different time frames to go along with my own analysis. If you take the completely free trial below, make sure you take a few minutes daily to listen, plot the lines on your charts and keep a short log of how and if it helped you. I think it will.

Artac Advisory has provided exceptional market guidance to the independent and professional trading community for over 20 years. Their daily research is technical in nature, blending time-tested, discretionary charting methods with a systematic analysis of customized indicators, the results presented in a cohesive, tradable framework. They consider it their mission to identify and effectively communicate all profitable trading opportunities generated through their complete analysis, and encourage you to see for yourself by taking their daily newsletters for a test drive.

Continue reading “Free Trial to Professional Technical Analysis Service 10.27.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday August 04, 2016

Hello Traders,

Stock index futures have been choppy recently and “counter trend” methods seem to work better than others. That will change once the market breaks down sooner or later and volatility returns.

On the other hand we have markets like gold and crude that make big moves more often than not…just different type of personalities of different markets.

One tool I have been using more and more recently, is the Edge. A daily newsletter published by ExitPoints.com which provides you what markets to pay attention to and WHICH direction to attack that specific market from.

Today they provided me with two good ones, gold from the short side and crude oil from the long side.

If you have not had a trial for this service, I recommend signing up for the FREE TRIAL and then UTILIZING a Cannon broker to get a better feel on how one might use this newsletter and information.

Continue reading “What Market to Trade? Which Direction to Attack?”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday June 14, 2016

Hello Traders,

Cannon Trading’s new eBook

Fresh off the press is Cannon Trading’s new eBook! Written by our very own staff of brokers, this eBook is designed as a guide to the commodities market for both beginners and veterans alike.

Inside you can find:

The futures industry is complex and risky, which is why you need someone to be forthright with you….

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

I have shared the feature below a while back but feel it is worth reading even if you read before. Make sure you are prepared for the trading day, part of the preparation is to know what reports are coming, when they are coming and if they are market movers or not for the specific market you are trading…..

WE DO HAVE MORE THAN A FEW MARKET MOVING REPORTS TOMORROW FOR DIFFERENT MARKETS, SEE ECONOMIC CALENDAR BELOW

By: Cannon Trading Commodities Broker

Every trader has done it. You’ve done it, your friends have done it, even your broker has done it at one point early in their career.

Here’s the scenario:

You’ve finally finished your futures education at Cannon Trading Company. You’ve done you’re homework on stops, limits, indicators and price movements for the market you’re trading. You’re ready to go, you enter your limit order and you wait.

**DING**

You get filled. Your heart rate picks up, a wry smile crosses your face and you begin to imagine the possibilities of the one trade you’re in: How much can I make? How much can I lose before it’s too much? You’ve waited through months of technical trading and deep meditation to get here, and now it’s finally paying off with one of your first trades in the live market. Sayonara paper trading; aloha live futures.

Then, all of a sudden, the top of the hour hits and the market starts acting up. It’s getting more volatile and more volatile; it’s picking up speed and taking an unforgiving turn against you. You can’t think straight, all you can think about is your losing position that could get worse and worse as the seconds go by. You race to put in a stop order, but you finally have to settle for a market order just to stop the bleeding. You stare.

**DING**

Continue reading “30 Futures Market Moving Events & Economic Reports 11.05.2014”

In this post:

1. Market Commentary

2. Support and Resistance Levels

3. December Mini S&P 500 Continuous Futures chart

4. Economic Reports

5. Highlighted Earnings Releases

FRONT MONTH FOR EQUITIES AND BONDS IS DECEMBER

SYMBOL FOR DECEMBER IS Z

We started the new week, right where we left off. With volatile moves in both directions.

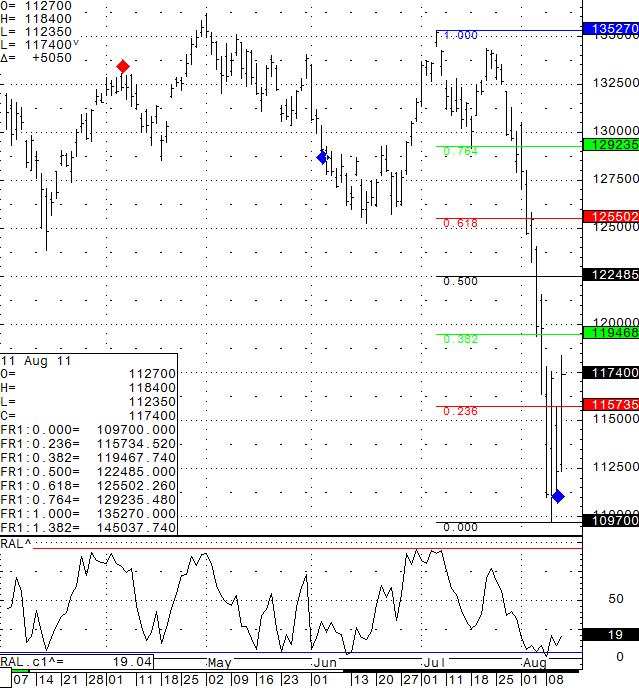

I am sharing my daily Dec. mini Russell 2000 chart with you below.. It seems that at times, the Russell 2000 index has been the leader in the moves of the general stock market. We are currently in a very wide range (volatility definitely expands the “bands”) 739 on top and 654 below.

We are currently closer to the bottom level, hence we may see some more upside before we see sellers step back in. In all honesty, I do NOT have a strong feel for the market right now and do NOT have a preferred way of trading it based on swing or overnight time frame. When I do have a better feel or direction, i will be happy to share with you.

You can also sign up for my real time intraday charts service. Continue reading “New Week Begins With Continued Futures Market Volatility | Support and Resistance Levels”

Big up day after what I feel was short term oversold conditions. Daily chart of the BIG SP 500 ( pit session ) for your review below. I think that the 1194 to 1200 psychological level will be the first test to see if this bounce is just a bounce or if it has legs to become a more meaningful recovery. Time will tell…..Either way I think tomorrow, being Friday, before the weekend after a volatile week, will be another high volatility day.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Continue reading “Futures Trading Levels, High Volatility Futures Markets See Gain Today”

Cannon Trading / E-Futures.com

The following is taken from a guide I have written that helps subscribers to my daily chart service. You can have a 2 week free trial to the daily live charts service along with buy/sell triggers and get the full guide along with chart examples, rules and much more by signing up at:

Cannon Trading Inc. Day Trading Webinar

General Notes:

At any given day, one must understand the trading environment that specific day has to offer and adjust their trading style accordingly. In our case it relates more to the size of stops and target based on volatility. Some days the market gives us many opportunities; some not as much; and some days it provides us with mostly risks…….take what the market gives you and not what you want it to give…..

I think if a trader understands early enough what type of trading day it is, he or she can choose which tools from the webinar are most suited for that days trading. If one can do that successfully (which is not easy), I think that is half the battle.

Not taking a trade is better than a bad trade.

My opinion is that there are 3 main types of trading days.

Continue reading “Futures Trading Levels, Types of Trading Days”

Cannon Trading / E-Futures.com

Wishing you all a great weekend. Amazing how fast short February went by and Monday will be the last trading day of the month.

I expect the higher volatility we have seen over the last few days to stay with us for a while….so as mentioned before be aware of it, adjust your trading parameters accordingly and stay disciplined!

Below you will see a screen shot from the crude oil futures chart I share intraday. We also execute this crude day-trading system in-house as an “auto traded ” trading system with letter of direction.

The day-trading system is up slightly more than $1,000 NET per contract traded since we launched live trading on Jan. 28th 2011.*

*These are risky markets and only risk capital should be used.

Past performances are not necessarily indicative of future results.

If you are interested in more information, would like to see detailed LIVE results, please send me an email or speak with your broker.

Continue reading “Futures Trading Levels Feb 28th and Crude Oil Futures Chart”

Continue reading “Futures Trading Levels Feb 28th and Crude Oil Futures Chart”