Trading Crude Oil Futures in the USA Amidst Middle East Conflict

Learn more about trading Crude Oil Futures with E-Futures.com here.

Trading oil futures, particularly crude oil futures, plays a pivotal role in the global energy market and is influenced by a multitude of factors. This article explores the dynamics of trading oil futures in the United States and delves into the impact of Middle East conflicts, with a specific focus on recent events in Israel and Gaza. These geopolitical tensions have far-reaching implications for oil futures, as the Middle East remains a crucial source of crude oil production.

Crude Oil Futures in the USA

Crude oil is a fundamental component of the global economy, and the United States, as one of the largest consumers and producers of oil, is deeply entrenched in the world of oil futures trading. Crude oil futures are standardized contracts that allow traders to buy or sell a specified amount of crude oil at a predetermined price on a future date. In the USA, these futures are primarily traded on the New York Mercantile Exchange (NYMEX) under the ticker symbol CL.

The demand for crude oil futures in the USA is driven by various factors, including:

- Energy Consumption: The USA is one of the world’s largest consumers of energy, and oil is a primary source. Crude oil futures provide a way for energy companies, airlines, and other sectors to hedge against price fluctuations.

- Speculation: Speculators in the commodities market often trade crude oil futures, hoping to profit from price movements. This speculative activity can increase market liquidity and influence short-term price changes.

- Global Events: Geopolitical events, especially those in oil-producing regions, have a significant impact on oil futures trading. The Middle East, being a major source of oil production, has been a focal point for oil market participants.

Middle East Conflicts and Oil Futures

The Middle East is known for its volatile geopolitical environment, often stemming from religious, territorial, and political disputes. Recent events in Israel and Gaza have further highlighted the role of geopolitical tensions in influencing oil futures prices.

- Supply Disruptions: The Middle East, particularly the Persian Gulf, is home to some of the world’s largest oil reserves. Ongoing conflicts in the region can disrupt oil production, leading to supply shortages. These disruptions can cause a surge in oil prices, impacting crude oil futures.

- Market Sentiment: Even the perception of conflict or potential supply disruptions can drive market sentiment. Traders closely monitor developments in the Middle East, and any escalation of tensions can lead to increased speculation and higher trading volumes in crude oil futures.

- OPEC and Non-OPEC Nations: The Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC nations in the Middle East play a pivotal role in global oil production. Geopolitical tensions can influence OPEC’s decision-making, leading to production cuts or increases, directly impacting oil futures prices.

Impact of Recent Israel-Gaza Conflict

The Israel-Gaza conflict, a long-standing and deeply rooted conflict in the Middle East, has repeatedly led to fluctuations in oil prices and, consequently, crude oil futures. Recent escalations in the region have had the following effects:

- Oil Price Volatility: The Israel-Gaza conflict has added uncertainty to global oil markets, causing crude oil futures to exhibit increased volatility. Traders react to events in the Middle East by adjusting their positions in response to the shifting geopolitical landscape.

- Safe-Haven Assets: Investors often turn to commodities like gold and oil as safe-haven assets during times of geopolitical turmoil. This shift in investor sentiment can drive up demand for crude oil futures.

- Production Risk: Israel is not a major oil producer, but it is geographically close to critical oil transit routes, such as the Suez Canal. Any disruption to these routes can have a domino effect on global oil supply, impacting crude oil futures prices.

- Influence on OPEC: The Israel-Gaza conflict can exert pressure on OPEC member nations, some of which are involved in the conflict. Geopolitical considerations, including their economic and political interests, can affect OPEC’s oil production decisions.

Risk Management in Oil Futures Trading

Given the inherent volatility in oil markets, traders in crude oil futures must employ effective risk management strategies. These include:

- Diversification: Traders can spread their risk by diversifying their investment portfolio, not focusing solely on crude oil futures. This can mitigate losses during periods of heightened geopolitical tensions.

- Stop-Loss Orders: Setting stop-loss orders allows traders to define their maximum acceptable loss. If the market moves against them, the position is automatically closed when the stop-loss level is reached.

- Fundamental Analysis: Staying informed about geopolitical events and oil market fundamentals is essential. Traders need to understand how these factors can influence oil futures prices.

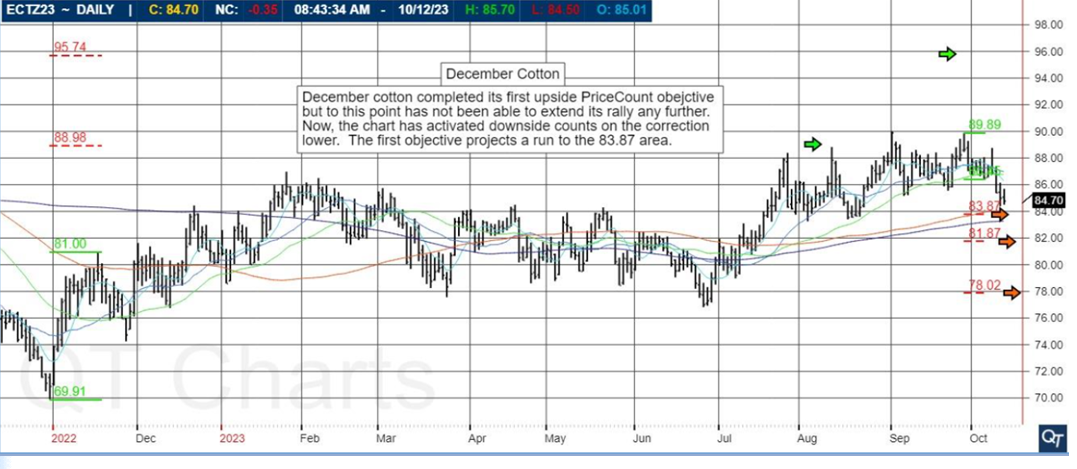

- Technical Analysis: Utilizing technical analysis tools can help traders identify price trends, entry and exit points, and potential price targets.

Trading crude oil futures in the USA is a complex and dynamic process that is deeply interconnected with global geopolitics. Recent events in the Middle East, especially the Israel-Gaza conflict, highlight the significant influence of geopolitical tensions on oil futures prices. Traders and investors must remain vigilant, stay informed, and employ effective risk management strategies to navigate the ever-changing landscape of crude oil futures trading. As the world continues to rely on oil as a primary energy source, the impact of geopolitical conflicts on oil futures remains a critical consideration in the financial markets.

Ready to start trading futures? Call

1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey at E-Futures.com today.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

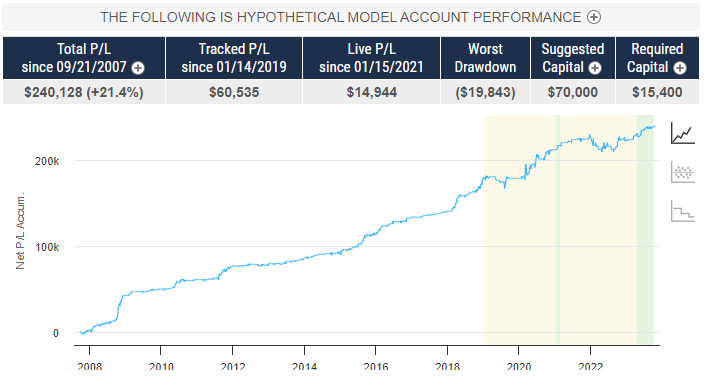

Futures Trading Levels

10-17-2023

Download your FREE copy of Order Flow Essentials!

Improve Your Trading Skills

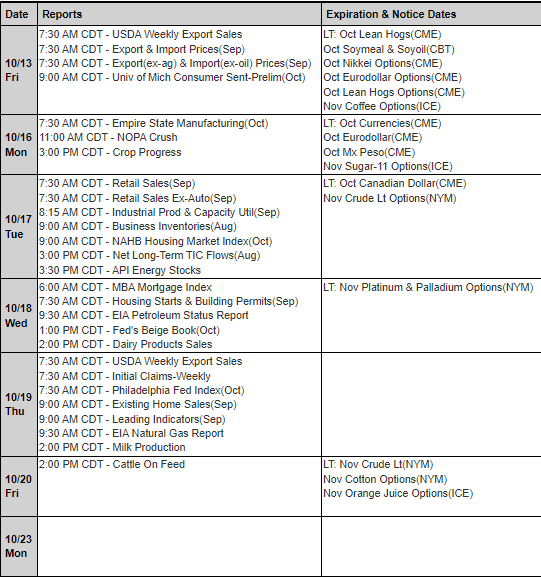

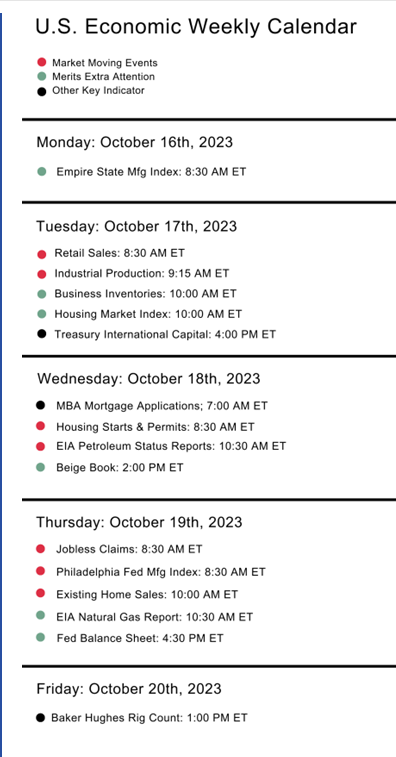

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.