Highlights and Announcements for 7.15.2022

By Mark O’Brien, Senior Broker

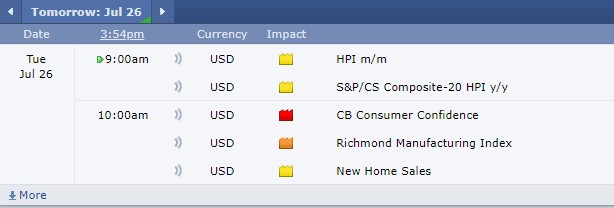

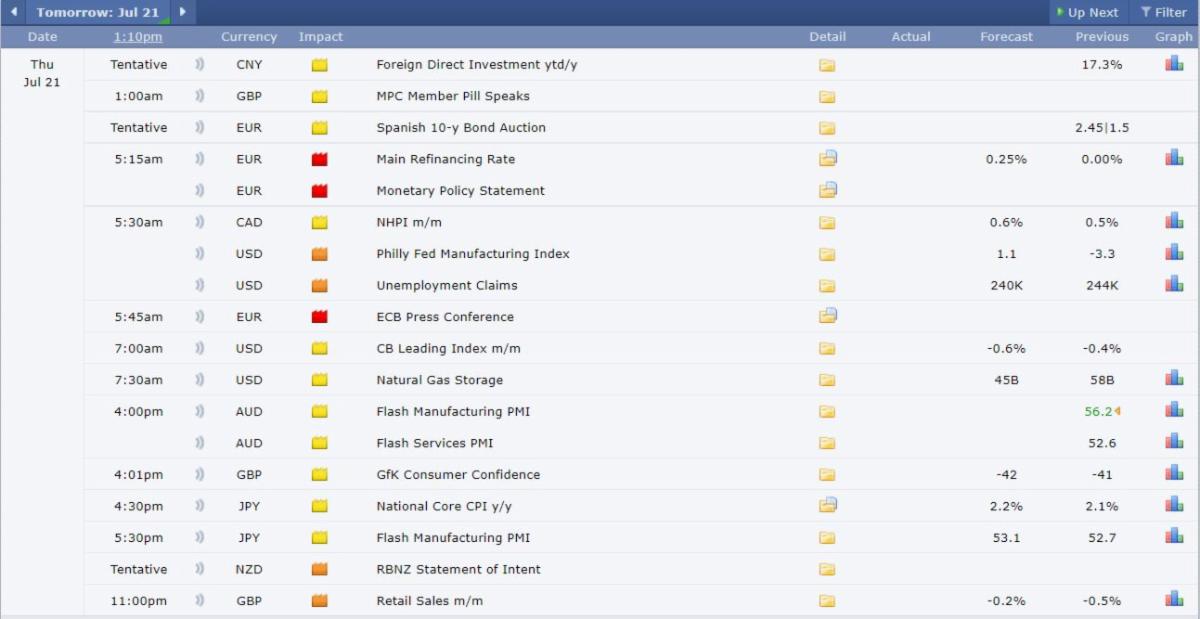

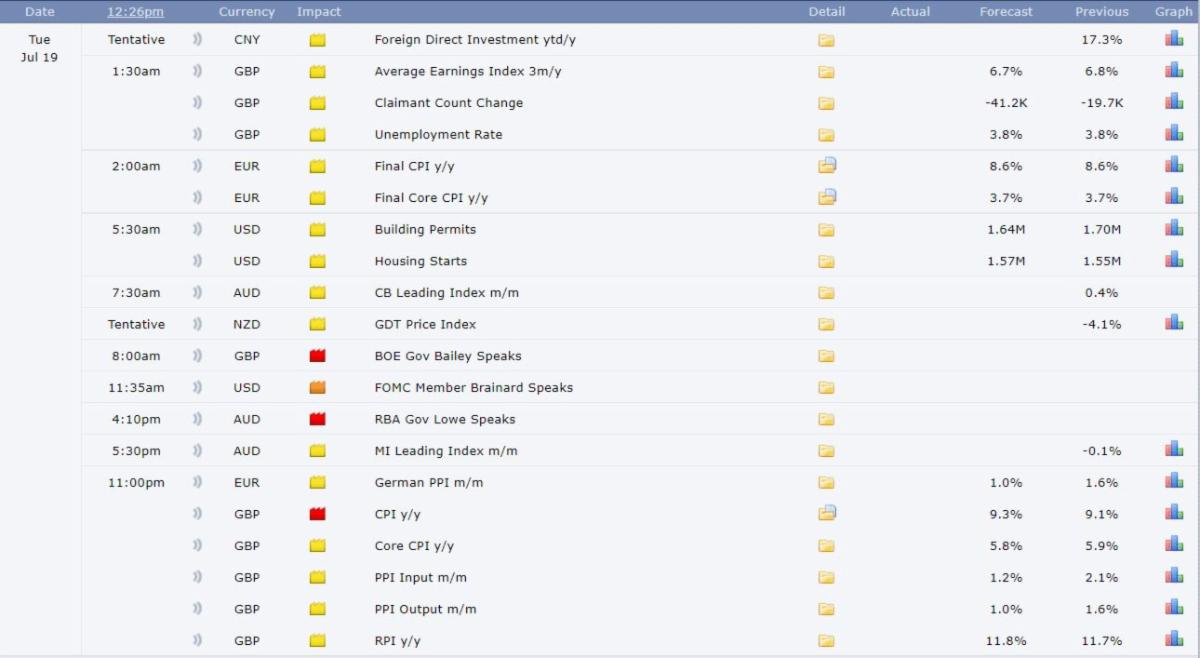

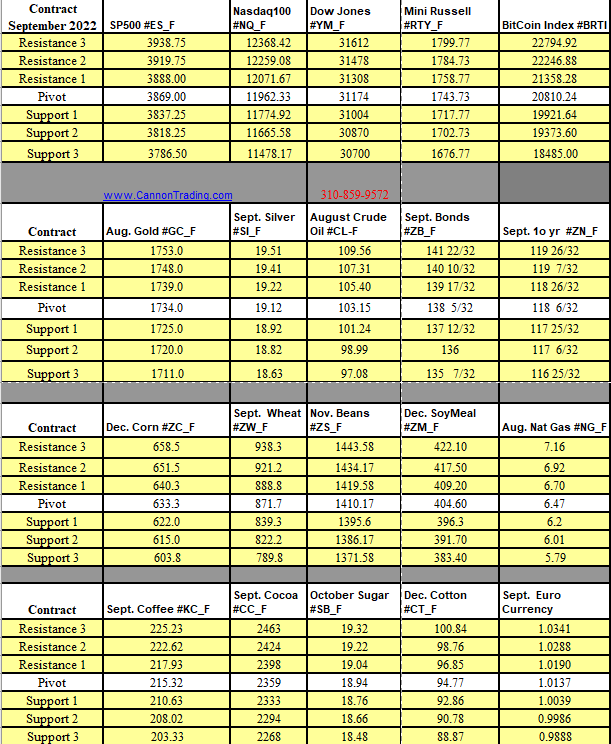

Financials: Yesterday’s release of the Labor Department’s Consumer Price Index showed prices that consumers pay directly climbed to 9.1% in June, a pace not seen in more than four decades. A broad array of food and energy categories rose by double digits year-over-year.

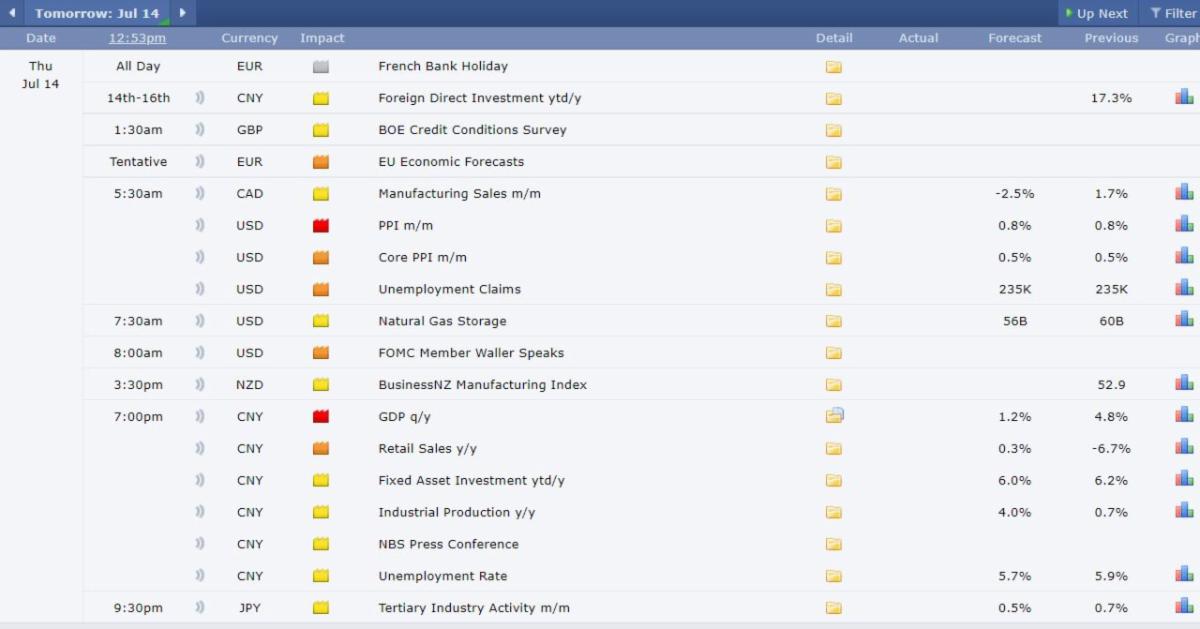

This morning, the Labor Department released the June Producer Price Index (PPI) showing the cost of wholesale goods and services jumped 1.1% in June and 10.8% year-over-year. The PPI report reflects what companies pay for supplies such as grains, fuel, metals, lumber, packaging and so forth.

Yet within the “headline” number, a few glimmers of hope that inflation might be abating surfaced. If food, gas and retail trade margins are omitted the so-called core PPI rose just 0.3% in June. That’s the smallest increase in the core rate in four months. In another good sign, wholesale food prices rose a scant 0.1% in June – the smallest advance in six months.

Economists still caution that steady progress has to be shown before it can be called a trend and households still devote a large share of their budgets to fuel and meals. And notwithstanding these hints that inflation is starting to recede, there is still pressure on the Federal Reserve to act more aggressively to slow rapid price increases throughout the economy.

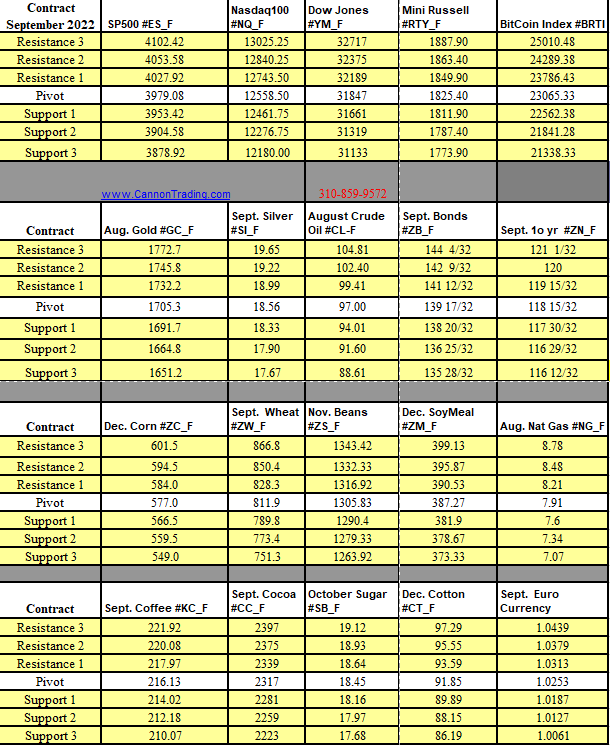

Energies: Also yesterday, the U.S. Energy Information Administration reported

crude oil inventories added 3.3 million barrels over the week to July 8. After falling ±7% on Tuesday – below $100 per barrel – and further yesterday,

August crude oil touched $90.56 intraday today, certainly in part due to continued concern about the immediate future of the economy, both in the U.S. and globally.

Softs: Today

Dec. cotton closed down its current daily price limit of 4 cents (a $2,000 per contract move) to $0.8371 (83.71 cents per pound), its lowest price since Sept. ’21. This marks a ±50-cent ($25,000) decline from its May 19 intraday high of $1.3379. Other softs such as

coffee and

sugar are seeing price declines in recent weeks as the

U.S. dollar continues to strengthen, making U.S. dollar denominated commodities less attractive to international buyers.

Dollar: Speaking of

U.S. dollar strength, this morning the

September Euro FX futures contract traded down to an intraday low of exactly 1.0000, putting it briefly right on par with the U.S. dollar for the first time in two decades. The

euro has been losing ground against the dollar since the start of the year, when it hovered near $1.13 and well off its peak of nearly $1.60 in 2008.