Dear Traders,

Get Real Time updates and more on our private FB group!

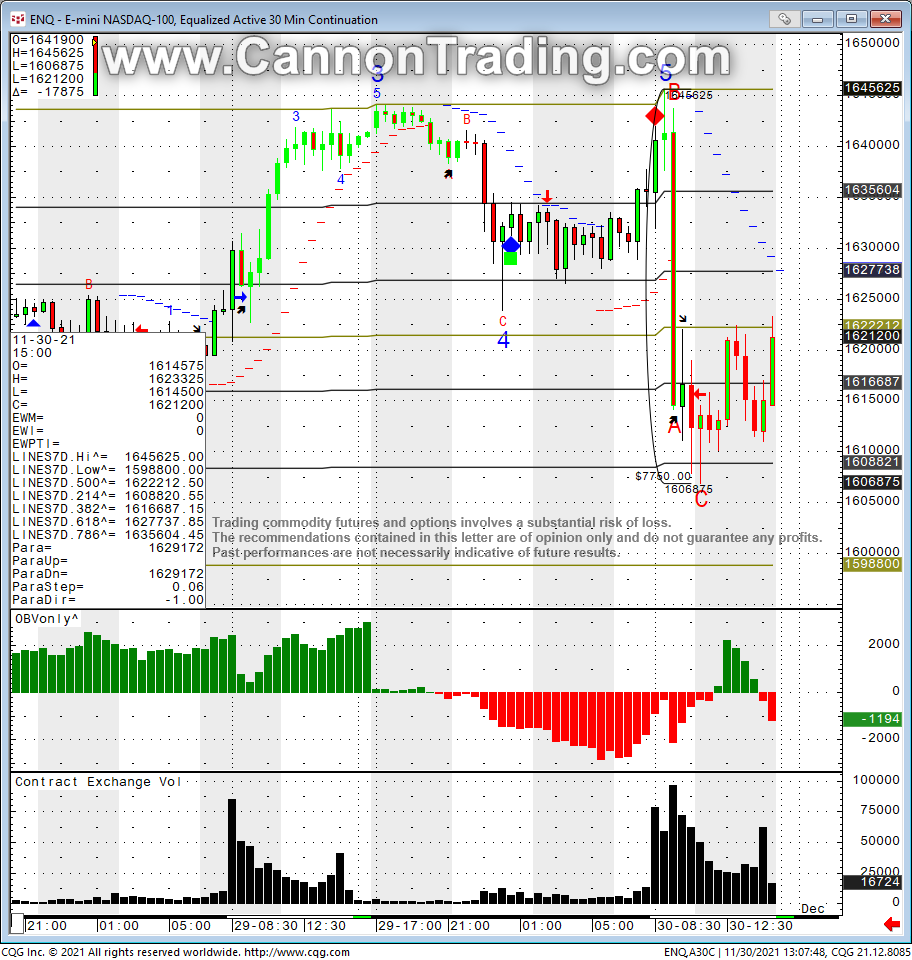

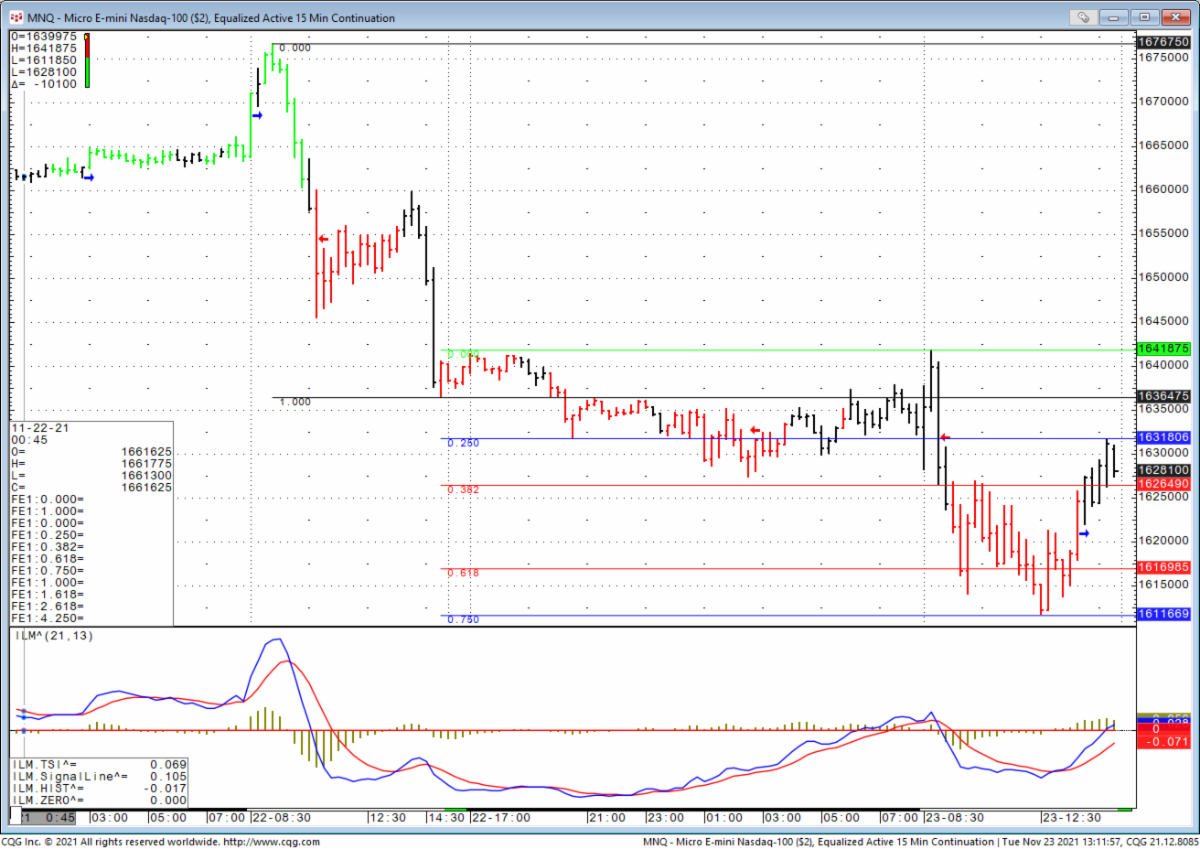

Some very large swings and intra-day moves across more than a few markets!

Volatility is increasing.

When that happens, my personal opinion says:

*Reduce trade size

*Be a bit more stubborn in entry points with the thought of, “No trade is better than a bad trade”

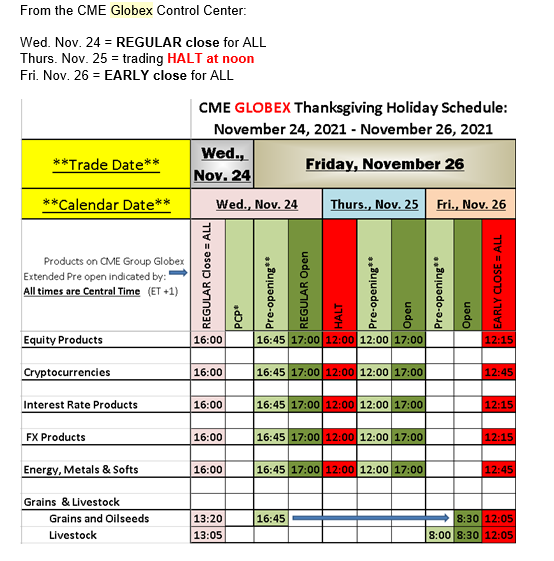

Just in case….Here is a refresher about limit moves and circuit breakers:

A price limit is the maximum price range permitted for a futures contract in each trading session. When markets hit the price limit, different actions can occur depending on the product being traded. Markets may temporarily halt until price limits can be expanded, they may remain in a limit condition or they may stop trading for the day, based on regulatory rules.

CME Group U.S. equity index price limits (and corresponding CME and CBOT rules) are designed to coordinate with circuit breakers provisions as applied by the New York Stock Exchange (NYSE).

- 7%, 13%, and 20% price limits are applied to the futures fixing price and are effective from 8:30 a.m. CT – 2:25 p.m. CT. Mondays through Fridays. From 2:25 p.m. to 3:00 p.m. CT, only the 20% price limit will be applied to the futures price fixing.

- 7% up-and-down limits are effective 5:00 p.m. – 8:30 a.m. CT. Sundays through Fridays; and 3:00 p.m. – 4:00 p.m. CT, Mondays through Fridays. Between 3:00 p.m. – 4:00 p.m. the 7% price limit will not be allowed to breech the 20% daily limit.

- The fixing price is the volume weighted average price, VWAP, calculated during the 30 seconds of trading from 2:59:30 p.m. – 3:00:00 p.m. CT. View Equity Index Fixing Prices page

If you don’t understand how the circuit breakers/ price limits work…make sure you call us and talk to a broker at + 1 310 859 9572, feel free to reach out even if you are not a current client – we will be happy to assist.

So we went from 6 weeks of lower volatility, overall higher stock prices to Dow being down over 1000 points at one point today!!

This is MAJOR alert in my opinion that market sentiment may have changed.

Be aware and if the below applies, you are in a better spot….

If you know how to take a loss.

If you know how to reduce trading size based on volatility.

If you know how to trade spreads ( NQ vs ES?)

If you understand options spreads.

THAN there are some very interesting set ups out there ( STILL with HIGHER RISK than normal). However if none of the above applies to you, the risks outweighs the potential opportunities. – PERSONAL opinion

Bookmap Real-Time Order Flow Analysis Webinar

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

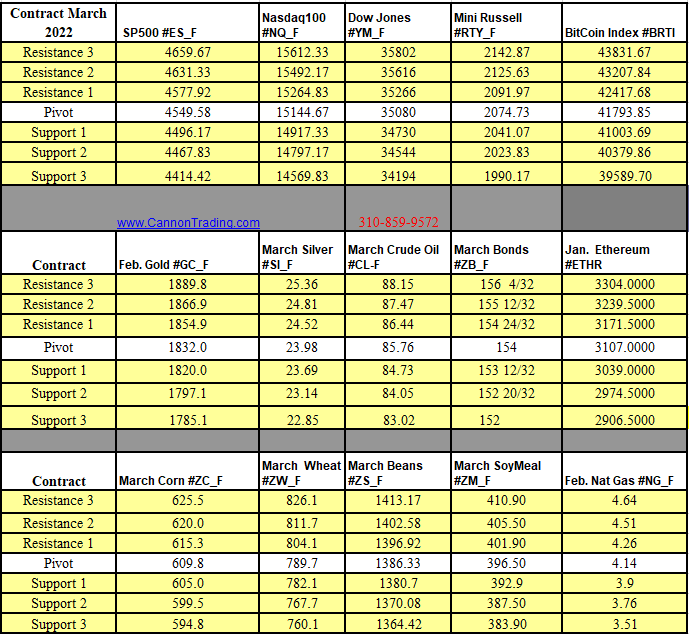

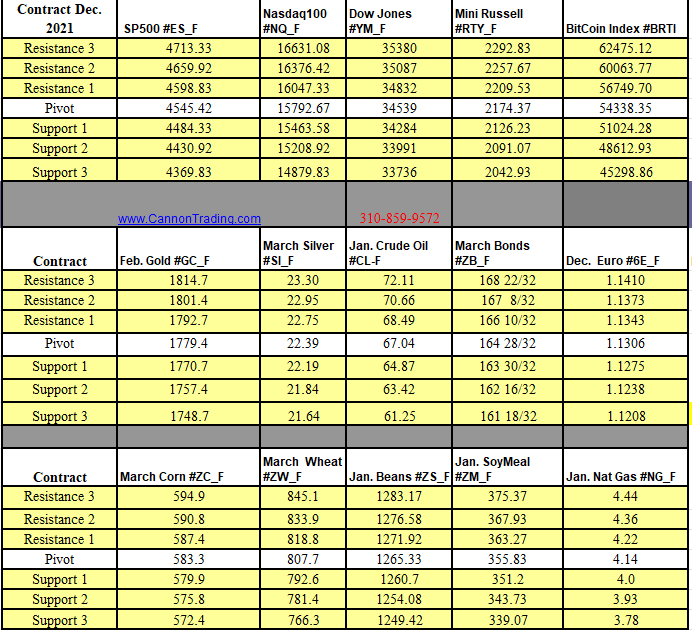

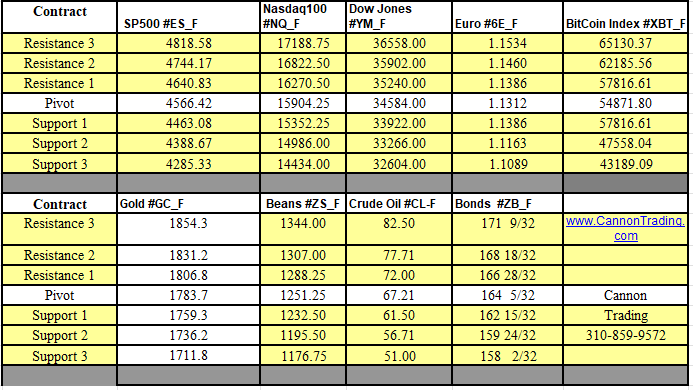

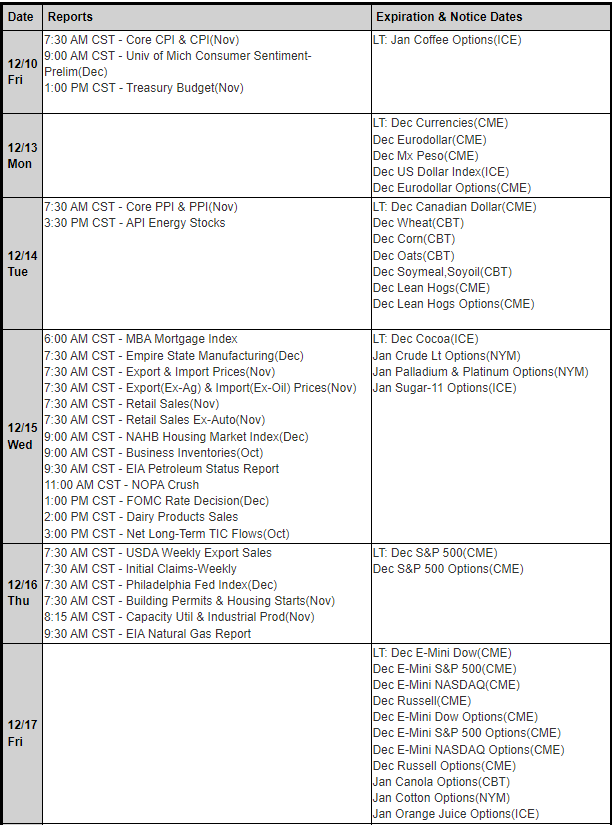

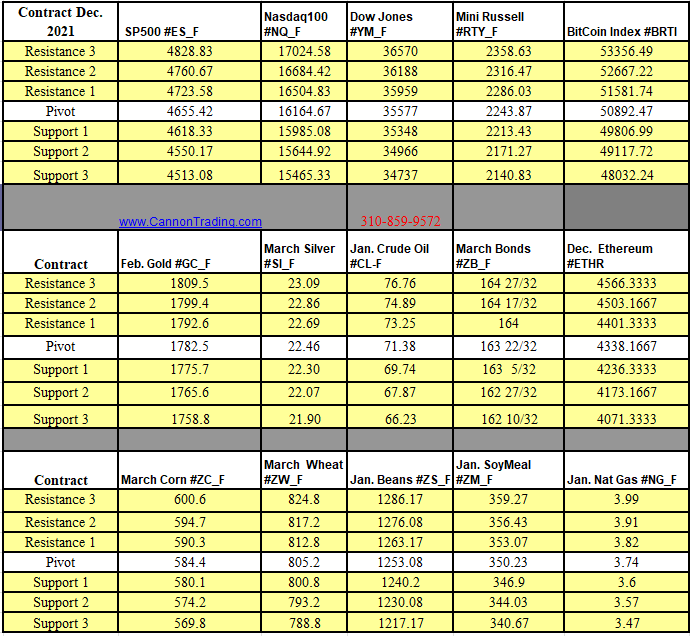

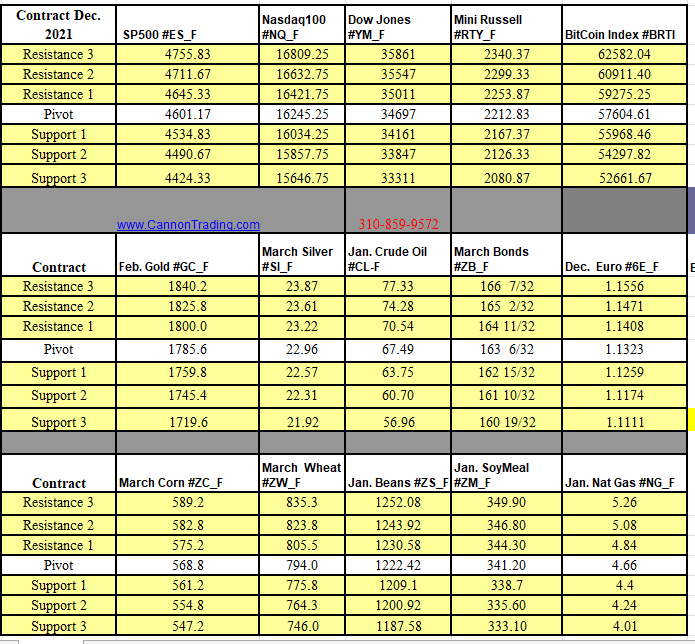

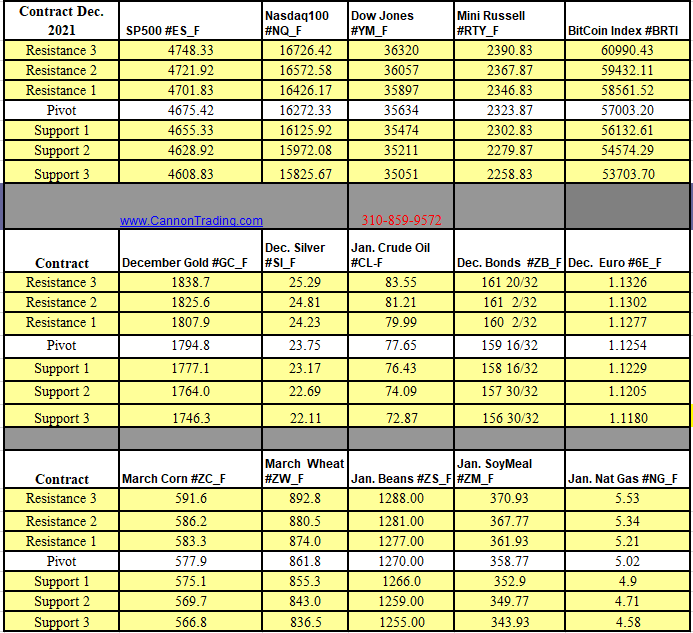

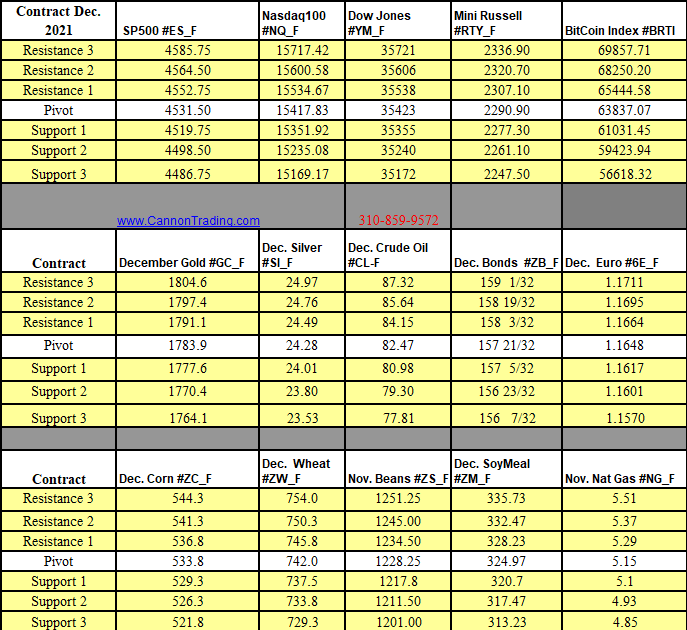

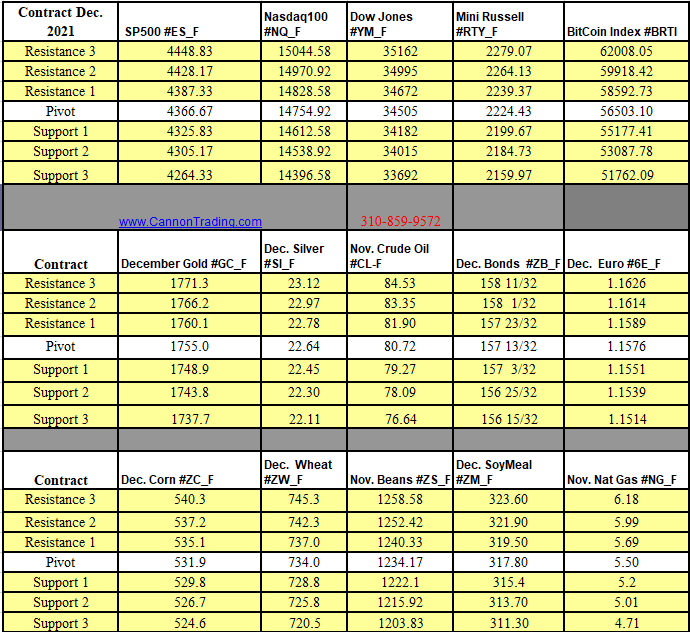

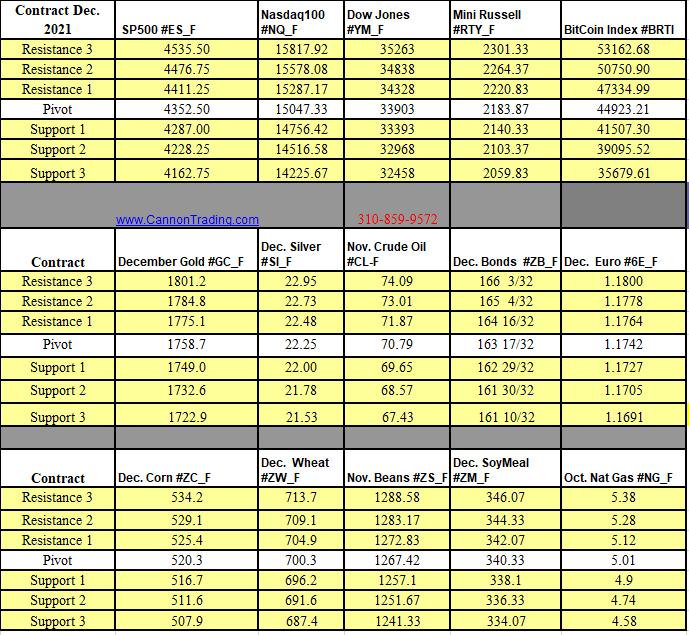

Futures Trading Levels

9-21-2021

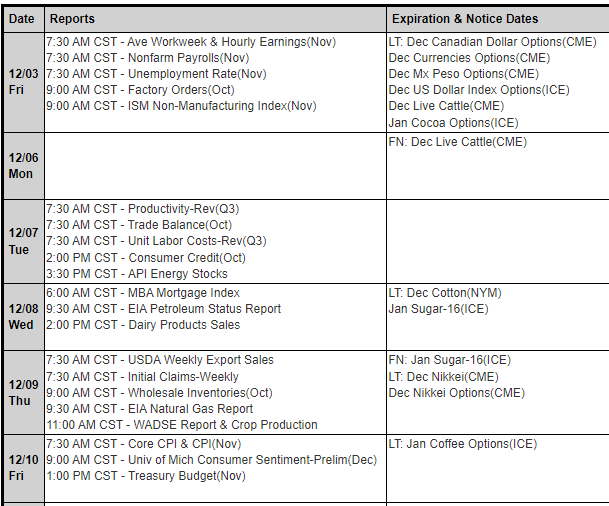

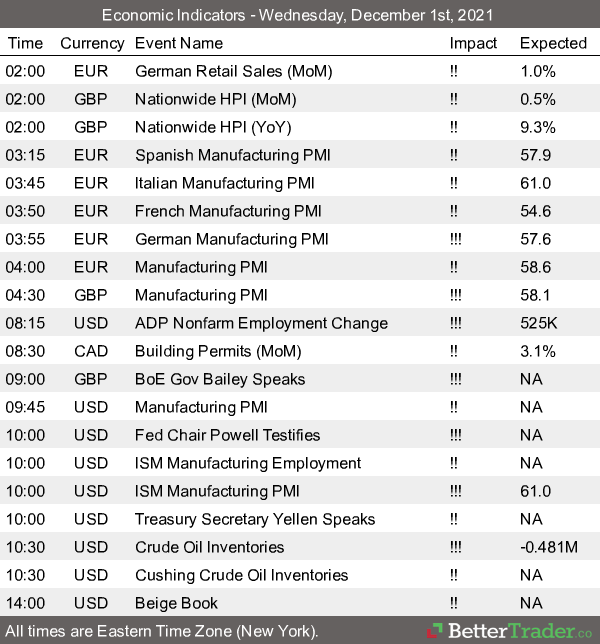

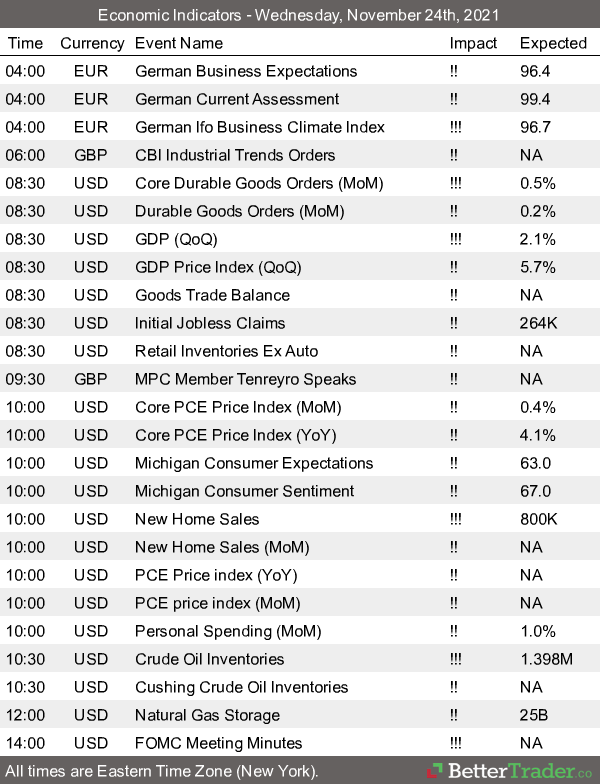

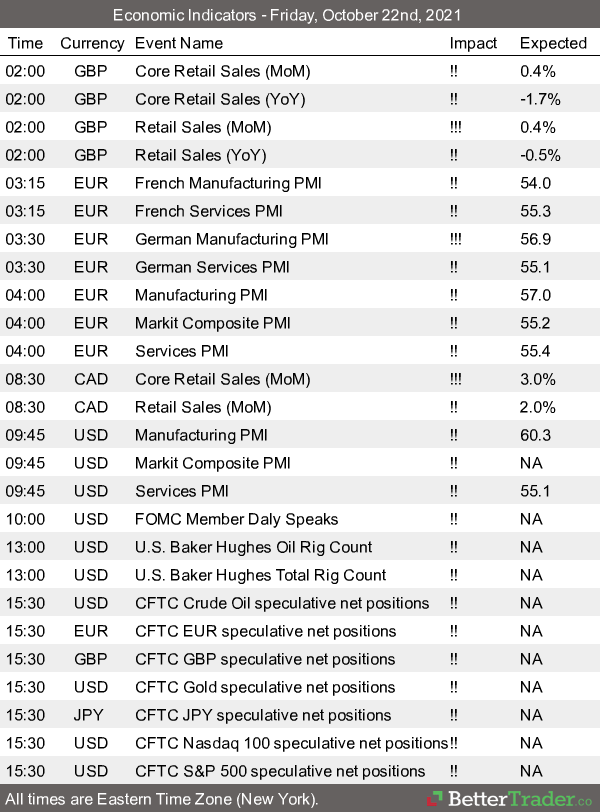

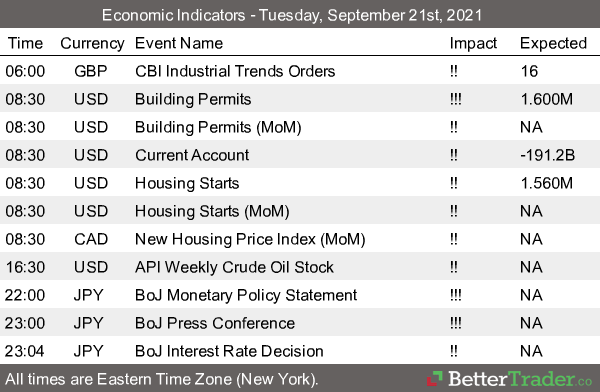

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.