Cannon Futures Weekly Newsletter Issue # 1165

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – Trading Contest/Real Cash Prizes

- Trading Resource of the Week – Trading Commodity Spreads

- Hot Market of the Week – December Wheat-Corn Spread

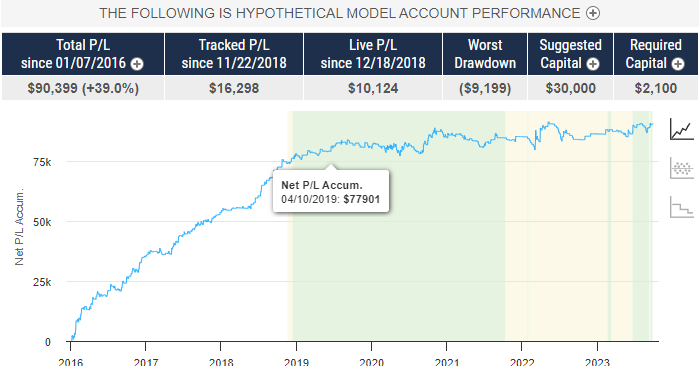

- Broker’s Trading System of the Week – Crude Oil Day Trading System

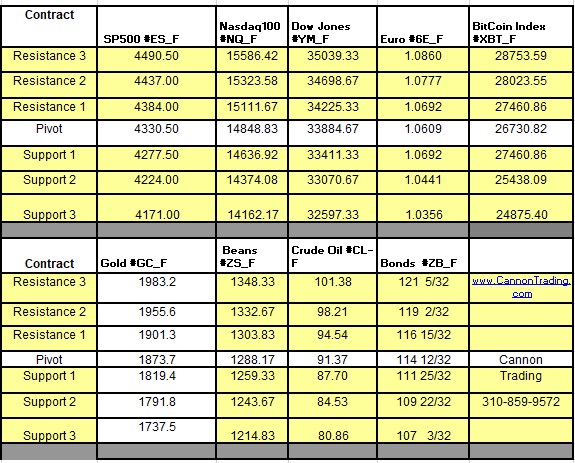

- Trading Levels for Next Week

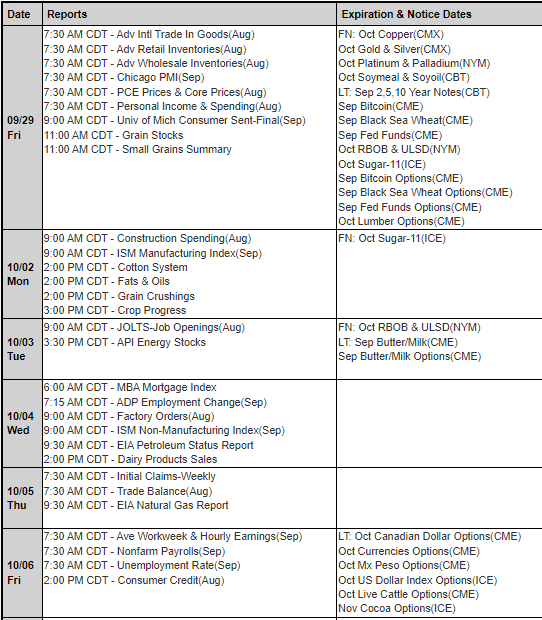

- Trading Reports for Next Week

-

Important Notices

Competition Details

- Trade any Group Energy Futures Products including Crude Oil, Micro Crude Oil, RBOB Gasoline, and Natural Gas

- All Trading will be in the Front-Month Contract

- All trades will be completed in the StoneX Trader Simulated Trading Environment using the white-labeled Contest Trader application

- All traders will begin with a virtual account of $100,000.00 Your goal: increase the balance to as much as possible by the conclusion of the competition.

- Top three traders with the highest P&L balance at the end will get a cash prize.

- One winner will be chosen from the remaining participants to receive a cash prize.

- The prizes to the winners shall be awarded in the form of a check (or any other form as reasonably determined by StoneX) and sent to the winner within ten business days of receiving the required tax documentation.

-

Trading Resource of the Week – Trading Commodity Seasonal Patterns

-

Broker’s Trading System of the Week

-

Trading Levels for Next Week

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

-

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.