Dear Traders,

Get Real Time updates and more on our private FB group!

Are Inter Commodity Spreads Right for you?

By John Thorpe, Senior broker

Used alone as a strategy or as a

hedge over the weekend or longer..

You can still hold volatile positions at reduced

margins by employing exchange recognized

spreads.

You can trade similar products but from different sides of the ledger, long vs short

Some traders use these as stand alone strategies, others use them as hedges to straddle a time period, perhaps you don’t want full exposure during an important report but still like your entry price on one leg.

If this is the case you may offset a part of the risk with a different but similar product and receive a margin break for reducing your overall risk.

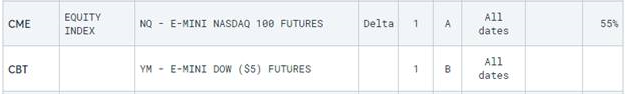

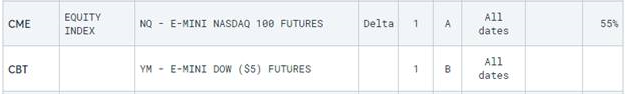

Inter Spreads are calculated as a percentage of Credit off the top of the full outright margin of the products that make up the legs of the spread.

Outright rates

NQ 17,000 YM 9,000

17,000+9.000= 26,000 outright margin before SPAN inter spread credit is applied

With the inter spread credit applied to each leg of the spread, there is a savings of $11,750

( 17,000 x .55) = 9350 + (9000 x .55) = 4950 = 14,300

Of course, you can apply the same logic to the micro contract at 1/10th the size.

MNQ vs MYM = overnight requirement of $1430.00 rather than 1700.00 for the outright MNQ

There are hundreds if not thousands of combination based on correlated relationships that are recognized by the exchange. Please call your Broker or ,if you don’t have an account yet and would like to know more, call Cannon +1 310 859 9572 and we will be happy to spend time with you about this different way to manage your trading risk.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

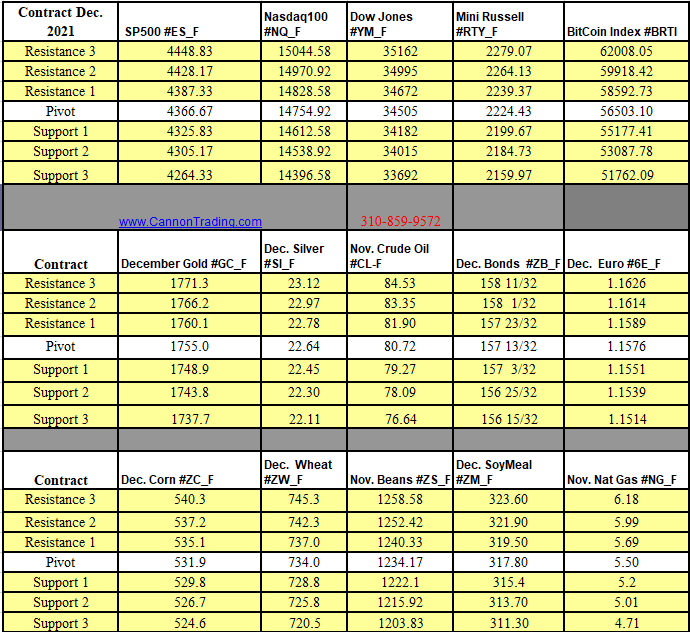

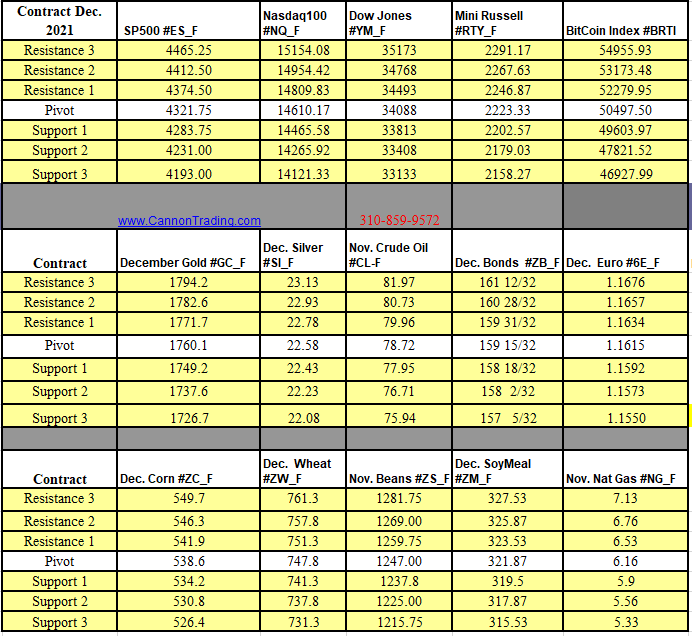

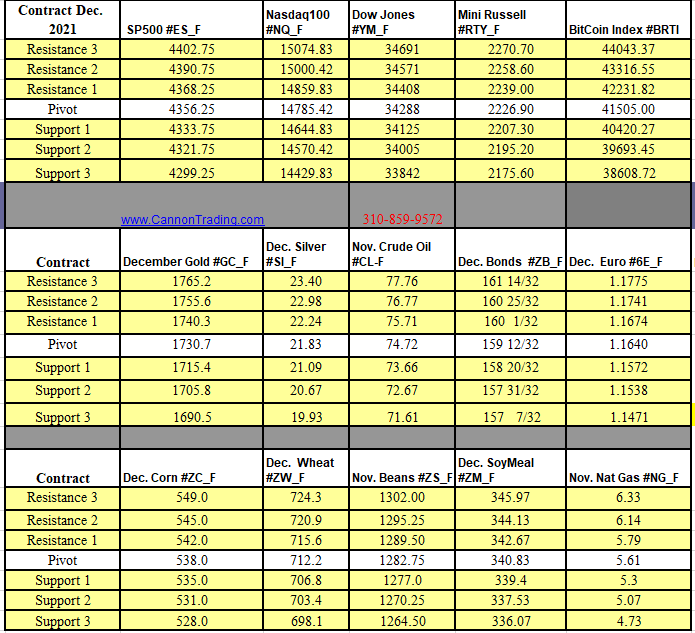

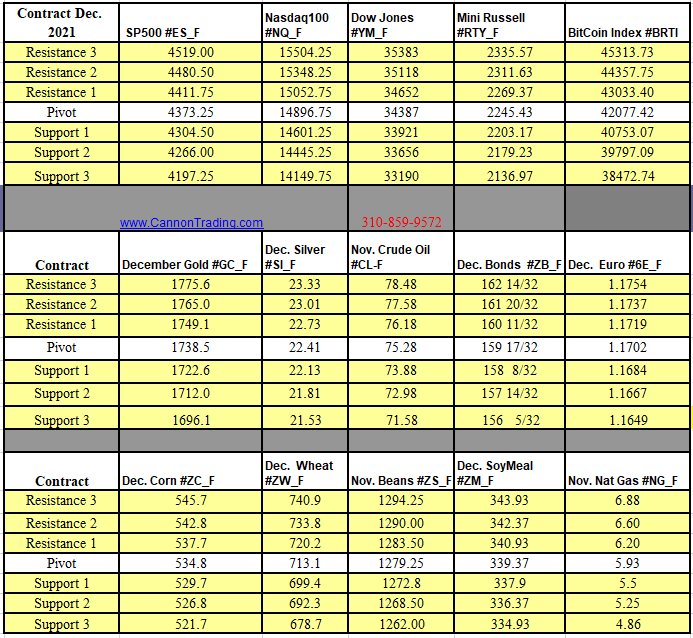

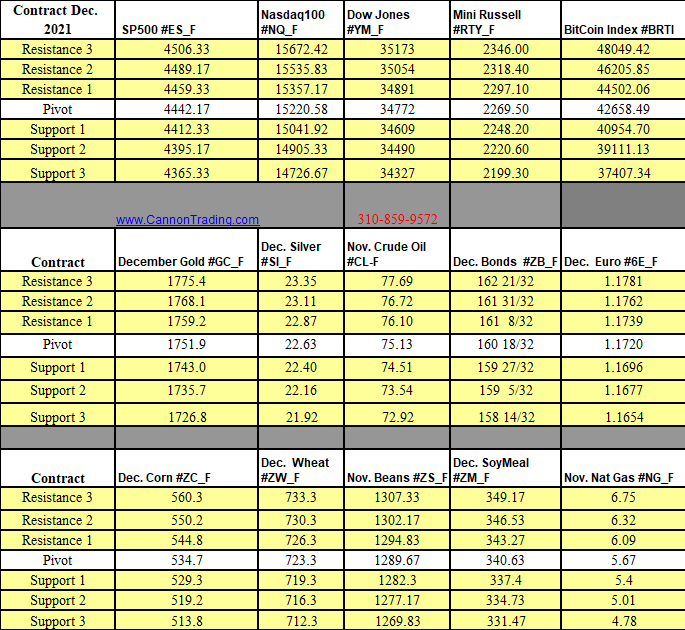

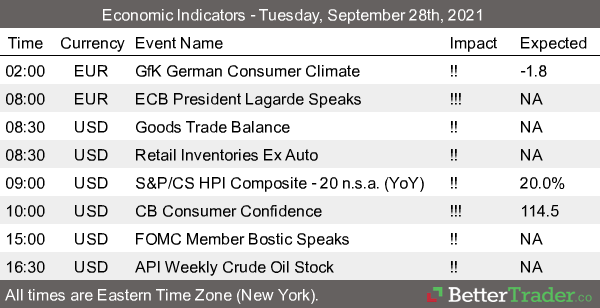

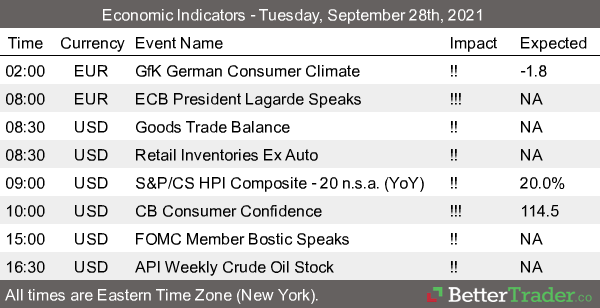

Futures Trading Levels

9-28-2021

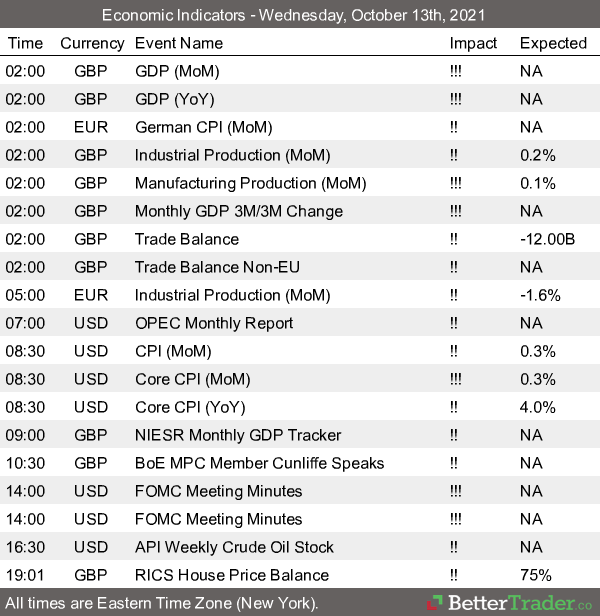

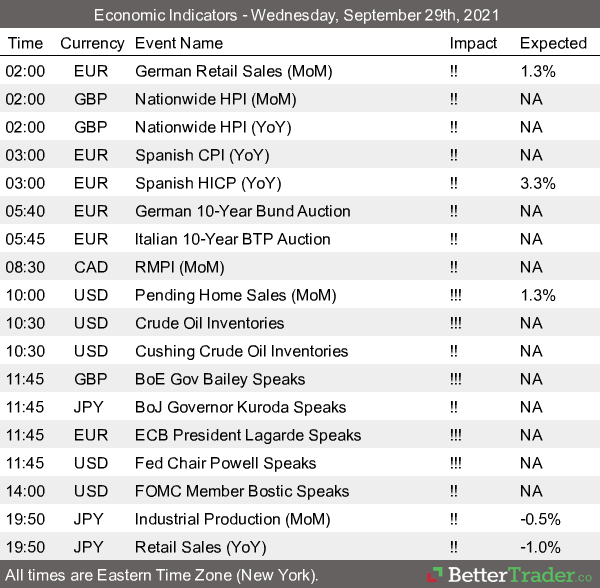

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.