Hedging Futures Price Risk Through the Futures Market

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Hedging Futures Price Risk Through the Futures Market

Written by John Thorpe, Senior Broker

Would you pay $700.00 for a one way airplane ticket between Chicago and Dallas? Economy? How about $650.00 one way between Oakland and Seattle in a middle seat? What if the price of your favorite coffee-chino increased by 50% or even 90%, how much will you be willing to pay to get that same fix? Or would you buy a lesser product? Is it rational we as consumers are forced to change our buying habits due to unexpected price increases?

A jeweler needs to buy resources (platinum, silver, gold, etc.) to make what he is going to sell, even when resources are sparse and costs are high. A farmer may be forced to sell his product when there is an abundance and prices are low. This doesn’t seem fair to the jeweler, who needs his supplies even when their costs skyrocket, or the farmer, who toils through a growing season and takes on the risks of weather, insects, and disease. These prices can fluctuate dramatically on the world market, and yet it is important for sellers to keep their prices a steady as possible to please their customer base. Perhaps where it is most apparent how important these fixed prices are is with your daily cup of coffee. A coffee roaster like Starbucks must try to control the cost of inputs even when the price for raw coffee bean fluctuates, sometimes dramatically, on the world market. If they couldn’t control the cost of the coffee, then you would not be able to depend on your daily $5.00 fix. Even Airlines are subjected to price variability in the form of costs for jet fuel. As fuel costs rise, the ticket price needs to cover the expense, and a rational increase in the price of a coach ticket should be expected; Budget prices no more. Irrational market price moves for the basic inputs of industry are long and storied throughout human history.

All of the above hedge price risk, to try to offset some of that price risk. But where do they begin?

Futures markets temper and offset price risk for producers of products, shippers, retailers, and end users. But why is price risk so important to understand, and how can you protect yourself buy hedging or how can you lock in a price for future delivery of goods? You will through the futures market.

What is a Futures Contract?

A futures contract is a contract between two parties where both parties agree to buy and sell a particular standardized asset of specific quantity and at a predetermined price, on a specified date in the future. These legal contractual obligations can be offset at any time prior to contract expiration. A good faith deposit or performance bond equal to approximately 5% of the notional value is required and is called the margin requirement.

Who trades in the futures markets?

Well, the farmer, the jeweler, the airlines and Starbucks all do. Large corporations, farm cooperatives, import/export companies and even your next-door neighbor might. These are all entities who could be hedging, so we call them Bona Fide Hedgers.

There are other participants that we call speculators. These could be banks or individual investors who use the markets as a supplement and compliment to their investment portfolio.

The History of Futures

The History of Futures markets and hedging is long and varied.

- “Many individuals grew suddenly rich. A golden bait hung temptingly out before the people, and, one after the other, they rushed to the tulip marts, like flies around a honey-pot. Every one imagined that the passion for tulips would last forever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them. The riches of Europe would be concentrated on the shores of the Zuyder Zee, and poverty banished from the favoured clime of Holland. Nobles, citizens, farmers, mechanics, seamen, footmen, maidservants, even chimney sweeps and old clotheswomen, dabbled in tulips.”

- Mackay, Charles (1841), Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, London: Richard Bentley

“When Tokugawa Yoshimune became Japan’s shogun in 1716, he sought to reform the state’s finances. Rice played an important role in his reforms, since it accounted for 90 percent of the government’s revenues. The shogunate also paid the bannermen (an important group of samurai who formed the civil and military administrations) fixed amounts of rice each year to secure their support.a Low rice prices in the late 1720s strained the samurai’s finances, which had already deteriorated significantly over the previous century. Potentially as a result of several good harvests, the price of rice in 1729 was only 40 percent of what it had been in 1721, and samurai incomes had thus dropped sharply. In fact, since 1710 the nominal income of the bannermen had fallen by nearly 50 percent, and their real income had also decreased significantly, though less so since other prices had dropped as well.”

-Moss, David, Professor at The Harvard Business School, “The Dojima Rice Market and the Origins of Futures Trading” (2010)

Simply, from these two examples we can see that the need for price stability of commodity costs drove the creation of futures markets.

Getting Started in Futures

Currently, hundreds of different Futures contracts are available for hedgers. View some, not all markets used for hedging

The mechanics of a hedge are varied and a hedging professional can help you with your unique situation.

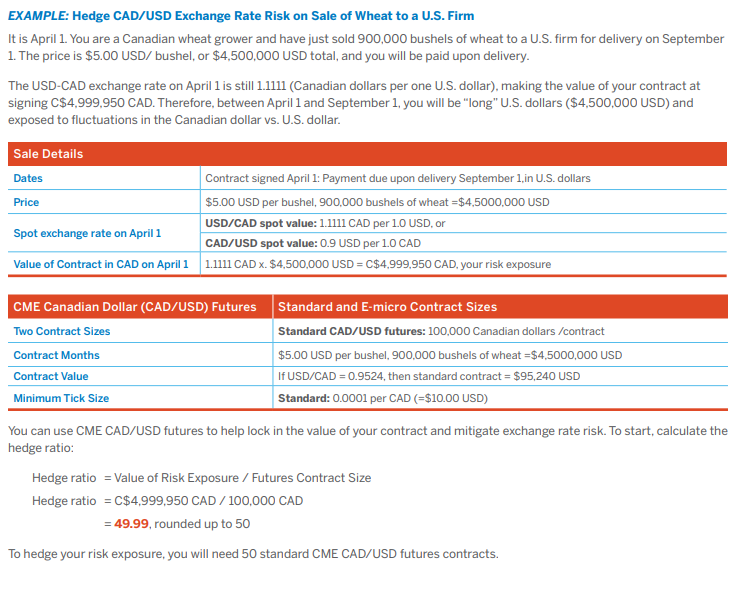

People always ask me if they have to take delivery of the product they are hedging and the answer is no. However, you can take delivery of many of the futures contracts if it happens to be suitable for the strategy you are engaged in. Some futures contracts are financially or cash settled. For instance, if you buy a mini crude oil contract at $55.00 per barrel and on expiration day, the contract is priced at $57.50 and your account will be credited with a $2.50 x 500 barrels or $1250.00 per contract. Which brings us to a few hedging examples I would like to share. The first one is a currency hedge utilized buy grain processors between Canada and the U.S.

(The following example is compliments of the CME “Hedging Foreign Exchange Rate Risk with CME FX Futures” 2014)

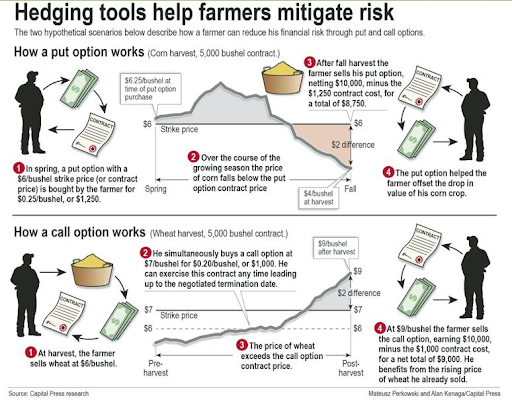

Capital Press research put this clear example together on how farmers use futures options as price insurance in their hedge.

If you would like to know more about hedging or simply how to use the futures markets for price risk mitigation or speculation, please contact a futures Professional at www.cannontrading.com to walk you through the steps to open an account and begin the process of protecting your commerce.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.