Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday January 8, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

The recent sell off and volatility in crude oil grabbed many headlines these past few months.

Crude oil has been one of my favorite markets for day trading over the last 10 years or so because of it’s volatility and the fact that it either rewards you or punishes you very quickly…

I wrote an article about day-trading crude oil futures which you can read here.

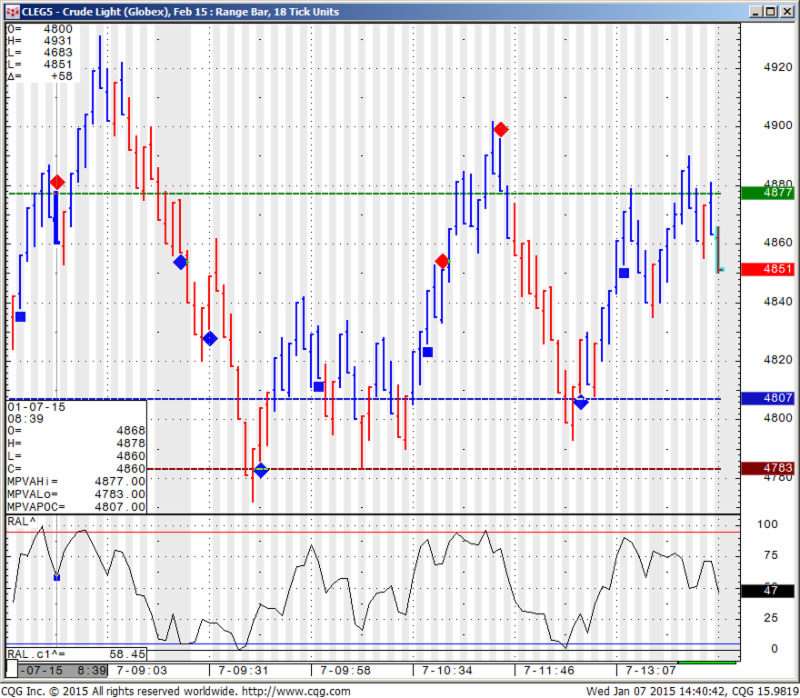

Below is a screen shot from my chart for today’s session.

I use 18 ticks range bar chart in addition to my 15 minutes charts.

CLEG5, – Crude Light (Globex), Feb 15: Range Bar, 18 Tick Units

The signals that appear are based on proprietary indicators developed by Ilan Levy-Mayer of LEVEX Capital Mgmt Inc. and VP of Cannon Trading Co, Inc.

The concept is a simple concept that looks for exhaustion in either buying/ selling and reversal. The signals that appear on the charts are alerting you for potential buy or sell IF/ONCE price confirmation occurred (crossing of the hull moving average). Full explanation along with chart samples included in the 23 page PDF booklets that comes with the free trial.

Would you like to have access to the DIAMOND and TOPAZ and 5T ALGOs as shown above and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where the ALGO is enabled along with few studies for your own sierra/ATcharts. The trial comes with a 23 page PDF booklet which explains the concepts, risks and methodology in more details.

To start your free 3 weeks trial, click here.

Please vote for our blog at:

Once there, scroll to the blog category and select

Daily Futures Trading Levels and Insight as your first place and submit at bottom of the page!

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract March 2015 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2057.75 | 4235.58 | 17805 | 1190.23 | 93.13 |

| Resistance 2 | 2040.75 | 4199.42 | 17664 | 1181.37 | 92.82 |

| Resistance 1 | 2029.75 | 4175.08 | 17582 | 1176.13 | 92.52 |

| Pivot | 2012.75 | 4138.92 | 17441 | 1167.27 | 92.21 |

| Support 1 | 2001.75 | 4114.58 | 17359 | 1162.03 | 91.91 |

| Support 2 | 1984.75 | 4078.42 | 17218 | 1153.17 | 91.60 |

| Support 3 | 1973.75 | 4054.08 | 17136 | 1147.93 | 91.30 |

| Contract | Feb. Gold | Mar.Silver | Feb. Crude Oil | Mar. Bonds | March Euro |

| Resistance 3 | 1228.3 | 17.06 | 52.16 | 150 7/32 | 1.1989 |

| Resistance 2 | 1223.9 | 16.86 | 50.73 | 149 15/32 | 1.1946 |

| Resistance 1 | 1218.0 | 16.70 | 49.68 | 148 25/32 | 1.1894 |

| Pivot | 1213.6 | 16.50 | 48.25 | 148 1/32 | 1.1851 |

| Support 1 | 1207.7 | 16.34 | 47.20 | 147 11/32 | 1.1799 |

| Support 2 | 1203.3 | 16.14 | 45.77 | 146 19/32 | 1.1756 |

| Support 3 | 1197.4 | 15.98 | 44.72 | 145 29/32 | 1.1704 |

| Contract | March Corn | March Wheat | March Beans | March SoyMeal | March bean Oil |

| Resistance 3 | 409.4 | 582.0 | 1068.08 | 363.53 | 33.61 |

| Resistance 2 | 406.6 | 581.5 | 1062.92 | 360.47 | 33.51 |

| Resistance 1 | 401.4 | 580.5 | 1059.58 | 357.23 | 33.33 |

| Pivot | 398.6 | 580.0 | 1054.42 | 354.17 | 33.23 |

| Support 1 | 393.4 | 579.0 | 1051.1 | 350.9 | 33.1 |

| Support 2 | 390.6 | 578.5 | 1045.92 | 347.87 | 32.95 |

| Support 3 | 385.4 | 577.5 | 1042.58 | 344.63 | 32.77 |

| Date | 4:04pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| ThuJan 8 | 2:00am | EUR | German Factory Orders m/m | -0.6% | 2.5% | ||||

| 3:00am | GBP | Halifax HPI m/m | 0.3% | 0.4% | |||||

| 5:00am | EUR | Retail Sales m/m | 0.3% | 0.4% | |||||

| EUR | PPI m/m | -0.2% | -0.4% | ||||||

| Tentative | EUR | French 10-y Bond Auction | 1.11|2.4 | ||||||

| 7:00am | GBP | Official Bank Rate | 0.50% | 0.50% | |||||

| GBP | Asset Purchase Facility | 375B | 375B | ||||||

| Tentative | GBP | MPC Rate Statement | |||||||

| 7:30am | USD | Challenger Job Cuts y/y | -20.7% | ||||||

| 8:30am | CAD | NHPI m/m | 0.2% | 0.1% | |||||

| USD | Unemployment Claims | 291K | 298K | ||||||

| 10:30am | USD | Natural Gas Storage | -120B | -26B | |||||

| 3:00pm | USD | Consumer Credit m/m | 15.1B | 13.2B | |||||

| 4:45pm | NZD | Building Consents m/m | 8.8% | ||||||

| 5:30pm | AUD | AIG Construction Index | 45.4 | ||||||

| 7:30pm | AUD | Retail Sales m/m | 0.3% | 0.4% | |||||

| 8:30pm | CNY | CPI y/y | 1.5% | 1.4% | |||||

| CNY | PPI y/y | -3.1% | -2.7% | ||||||

| 8th-15th | NZD | REINZ HPI m/m | 3.3% |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.