Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

Important Notices –

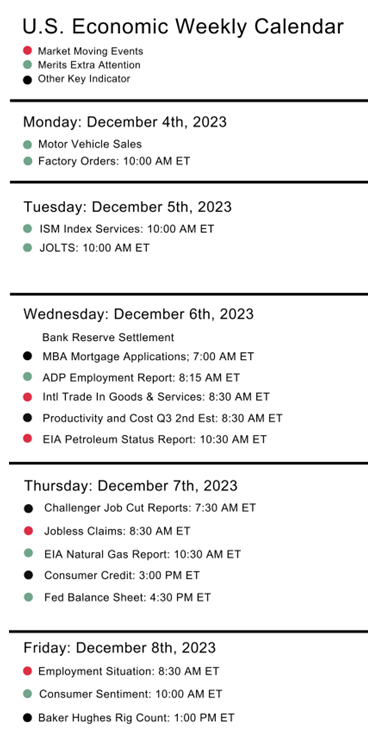

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Many experienced traders say that the stiffest challenge you’ll face in becoming a futures trader is conquering your own psyche. Why? Because losing is part of trading, and people hate to lose.

In this “Trading Psychology” Course you will learn:

Grow Your Trading – Start Now!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

by Mark O’Brien, Senior Broker

General:

The Federal Reserve took center stage today. With inflation proving stickier than expected, the central bank has found itself balancing between a hawkish and dovish view. The policy-setting FOMC held interest rates steady at the 5.25%-5.50% range for the fifth straight meeting. The bigger indicator traders were eager to see was the Fed governors’ so-called dot plot that updated their rate and economic projections – for the first time since December. Turns out, it didn’t deviate from the three rate cuts they previously penciled in by the end of 2024.

Indexes:

As of this typing, the June E-mini S&P 500 is trading at new all-time highs around 5280. As well, the June E-mini Dow Jones is trading at its own all-time highs, barely 100 points away from 40,000!

Metals:

April gold is on the verge of eking out its own all-time high close above last Monday’s closing price of $2,188.60 per ounce. It’s currently trading ±$2,191.00 per ounce

General pt. II:

Over the weekend, Japan ended its negative interest rate policy, marking a historic shift away from an aggressive monetary easing program that was implemented years ago to fight chronic deflation. As part of the decision, the Bank of Japan (BOJ) raised interest rates for the first time in 17 years, lifting its short-term rate to “around zero to 0.1%” from minus 0.1%.

Plan your trade and trade your plan

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

by John Thorpe, Senior Broker

For all of you index traders, you may have noticed the shrinking Open Interest and Volume in the March contracts. It’s that time when volume shifts to the next quarterly expiration contract. June! the symbol is M.

March volume will be drying up quickly, don’t get stuck Friday morning with a March contract at the crack of dawn when the carousel stops. Start trading the June contract today!

According to Bloomberg, the S&P 500 has averaged an 0.8% move on CPI days over the past six months

Today, stocks are sideways, the dollar and gold are both up marginally as investors nervously await tomorrows 7:30 a.m. CDT Consumer Price Index release.

Last Month, on Feb 13th stocks slid sharply following the release and Treasury yields surged higher when a surprise CPI number, an Increase of 0.3% in January, crossed the newswires. Housing costs accounted for much of the price rise.

Overall prices are expected to rise 0.4% percent after increasing 0.3% percent in January. Annual rates, which in January were 3.1% percent overall and 3.9% percent for the core, are expected at 3.1% and 3.7% percent respectively. Per econoday.

Plan your trade and trade your plan

Watch video below on how to rollover from March to June contracts if you are a stock index trader on our E-Futures Platform!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Erik Norland of CMEGroup.com

Is gold a more profitable investment than equities over the long term? Our finding is that the value of gold has mostly held its own against the U.S. equity market since the S&P 500 time series began over 94 years ago (Figure 1). A well-defined picture of their performance through peaks and troughs is evident when the S&P 500 dollar value is repriced in gold, which is done by dividing the S&P 500 by the U.S. dollar price of one troy ounce of bullion (Figure 2).

Figure 1: Overall, gold has nearly held its own versus equities over the past 100 years.

The S&P 500/gold ratio has been subject to extremely strong trends and occasional periods of consolidation which correspond with different economic and geopolitical situations, some of which benefitted equities relative to gold and vice versa. Generally, equities have done better than gold during periods of geopolitical stability, disinflation and steady economic growth, while gold tends to outperform during periods of instability. Switching from one circumstance to another can set off powerful trends in the S&P 500/gold ratio that can last for years, even decades. The same goes for Asian equity markets when compared to gold, although the price history isn’t as long and the patterns differ both in equity market performance and trends in the currency market.

Since the equity market’s peak on September 3, 1929, the S&P 500/gold ratio has been through six distinct eras:

What’s next? The S&P fell 28% versus gold from late 2021 through 2022, and despite its 2023 rebound led by mega-cap companies dubbed the Magnificent Seven, it remains 5% lower versus gold as of late February 2024 despite being about 6% above its 2021 highs when expressed in dollar terms. A few points are clear:

These points have the potential to turn the tide against U.S. equities, which are highly valued (see our related article here), in favor of hard assets like gold. But what about much less expensive equity markets like those in China, Japan and Korea? South Korea’s KOSPI Index, Japan’s Nikkei 225 and Hong Kong’s Hang Seng Index have their own strong trends versus gold.

Plan your trade and trade your plan

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

General / Stock Indexes:

You can’t keep a good index down. When the stock price of a member of the Magnificent Seven Stocks – artificial-intelligence chip leader Nvidia – advances 15% for the day on its quarterly earnings report and the company’s market cap. approaches $2-Trillion, it moves the stock indexes of which it is a component – the Nasdaq 100 and the S&P 500.

Their related futures contracts lead the way with the S&P 500 claiming its largest daily increase in months – over 105 points at this typing – to new all-time highs for the contract, pushing over 5,100. The E-mini Nasdaq advanced ±550 points over 18,000 and the E-mini Dow Jones added over ±500 points to set its own new all-time high near 39,200.

Not to be outdone, Japan’s main stock index, the Nikkei 225, closed at its own new all-time high above 39,000, a level it set 34 years ago before the country fell into the doldrums of a deflationary economy. In fact, the Nikkei has been the world’s best-performing major index in 2024, surging ±17.5% only two months into the year and trouncing the impressive ±5% advance of the S&P 500. Ironically, Japan is still amidst a recession and just fell behind Germany to the no. 4 spot among the world’s leading economies.

Largest economies in the world by GDP (nominal) in 2023

according to International Monetary Fund estimates

Metals:

After a week-long ±$50 break to below $2,000/oz. intraday on Feb. 14, April gold recovered ±$30 and has stayed rangebound over the last few trading sessions as the minutes of the Fed’s late-January meeting released yesterday showed that the bank was in no hurry to begin cutting interest rates.

Grains:

March corn futures dropped to three-year lows today, trading within five cents of $4.00 per bushel on plentiful domestic supply and signals that South America will harvest strong crops this year.

Energies:

Signs of production declines sent natural gas futures contracts into rally mode this week with the front month March contract seeing a ±20-cent increase off its life-of-contract lows – a ±$2,000 move. U.S. exploration and production company Chesapeake Energy signaled it plans to reduce its natural gas production this year by roughly 30% given extremely low prices.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

CME Fees Increase Update:

Effective tomorrow, February 1, the CME Group is raising the exchange fees for a number of futures contracts.

For the CME E-mini equity products: E-mini S&P 500 (ES), E-mini Nasdaq (NQ), E-mini Dow Jones (YM) and E-mini Russelll 2000 (RTY), fees are going up by 5 cents, from $1.33 to $1.38

For the NYMEX energy products: Crude oil (CL), Heating oil (HO), RBOB Unleaded gas (RBOB) and Natural gas (NG) fees are going up by 10 cents, from $1.50 to $1.60

For the COMEX metals products: Gold (GC), Silver (SI), Copper (HG) and Platinum (PL) fees are going up by 5 cents, from $1.55 to $1.60

For the COMEX E-mini metals products: miNY gold (QO), miNY silver (QI), miNY copper (QC) fees are going up by 25 cents, from $0.75 to $1.00

All other products / symbols will remain the same.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

March is front month for stock indices.

Symbol for March is H, so example ESH24

The last few FOMC meetings I looked for trades until around 930 AM Central time and then somewhat “took a step back”.

I would then follow closely around 1 PM Central when the announcement comes out but try to not pull the trigger until 1:15/ 1:30 when the smoke clears.

This is of course just my personal preferences and every trader is different.

Take notes after the trading session so you can look back and refer the next FOMC meeting….

Below are some additional tips/observations I have taken notes of for myself:

· ·Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 4425.00 with a stop at 4419.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 4419.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· The rate announcement comes out exactly at 1 PM central. As of this morning there is a 98% chance of no change in rates.

· Traders will pay EXTRA attention to the language and the Q&A which starts at 1:30 PM Central

· Be patient and be disciplined

· If in doubt, stay out!!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Important Notices –

You are invited to enter the ultimate trading challenge, where some of the world’s best Futures and Forex traders compete.

The World Cup Trading Championships have been held since 1983 and are the most prestigious trading competitions in the industry. The winners of each division will prove that they are the best of the best.

The top profitable Entrants will be eligible to receive a magnificent pewter Bull and Bear trophy or a beautiful crystal Bull and Bear Trophy.

Real-money competitions based on net returns – no entry fee required.

Take on traders from across the globe to compete for coveted Bull & Bear trophies, glory, and new career opportunities.

Do you have what it takes?

Contact us at 1-310-859-9572 or Visit Us on the Web

Available to both Clients and prospects!

In this complimentary call or screen share session, which can last up to 30 minutes, you will have the opportunity to seek guidance and pose questions to our expert on a wide range of topics. These topics include, but are not limited to:

BOOK NOW – Limited Availability

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

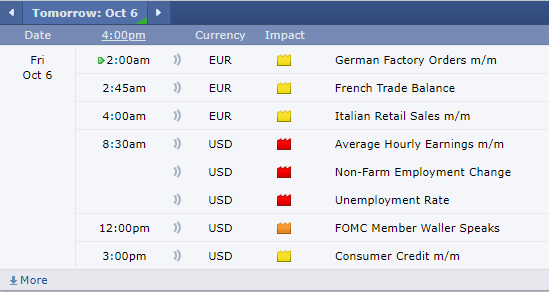

Big NFP / unemployment report tomorrow an hour before the stock market opens.

This is a market moving report and indices, bonds, currencies, metals and other markets will see some large swings.

I personally like to be out before the report, wait a few minutes for the zig zag to relax and then look to re-enter.

Intraday day chart of the NQ from last month below for your review! Dec. 8th NFP report.

Over 100 points move in less than a minute!! that is approx. $2,000 per one contract of the NQ ( against you or in your favor…)

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

01-05-2024

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

Stock Index December contracts (i.e., E-mini and Micro S&P, Nasdaq, Dow Jones and Russell 2000.) expire Friday, December 15th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any December futures contracts through 8:30 A.M., Central Time on Friday, Dec. 15th, they will be offset with the cash settlement price, as set by the exchange.

FRONT MONTH IS NOW MARCH , the symbol is H24, example for mini SP is ESH24

Monday, December 18th is Last Trading Day for December currency futures. It is of the utmost importance for currency traders to exit all December futures contracts by Friday, December 15th and to start trading the March futures. Currency futures are DELIVERABLE contracts.

The month code for March is ‘H.’ Please consider carefully how you place orders when changing over.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-15-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

March is front month for stock indices.

Symbol for March is H, so example ESH24

The following are my PERSONAL OPINION on trading during FOMC days:

Mini SP ( March contract) one possible outlook is below using the daily chart and QT Market Center platform.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-13-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

By John Thorpe, Senior Broker

This week could get wild in a number of markets, stay focused and manage the risk.

You should already be trading the March Indices if you are trading them at all, ask your broker how to roll if you need assistance.

Tuesday morning the telling CPI number will be released early, 7:30 am CST.

Past volatility in index markets as a result of earnings will take a back seat to much anticipated economic numbers this week. We will have a few earnings releases after the close but the highlights for the indices, bonds, crypto, metals and yes even the energy complex may hinge on the CPI and PPI numbers in addition to the somewhat surprising Non Farm Payroll numbers on Friday that reflected uncommon and persistent strength in the wake of the longest string of interest rate increases in 40 years.

PPI Wednesday 7:30 am CST

Any deviation from the consensus will move markets in unnatural ways. The same for the PPI on Wednesday morning and the FED voting members will have a clearer picture of their desires in March, something we will be listening for in the language Chairman Powell uses on Wednesday when he hosts his final for the year Q and A 30 minutes after the Rate decision is announced. That decision is expected to be a no rate change with the CME FedWatch tool weighing in today as a 98.4% probability for rates to remain untouched.

ADBE will be reporting Earnings after the close Wednesday and Costco after the close on Thursday.

Inventories, jobless claims retail sales all early Thursday morning and Friday, a few more data points to throw into the mix. Capacity utilization and Industrial production, all sectors that are dependent on the cost of money.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

*NOTE: if you like to get the March stock index levels (NQ, ES etc.), please reply back to this email and we will send you the levels for March tomorrow morning!

12-12-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

This is a market moving event right at 7:30 Am central that in the past generated some large and volatile moves.

I personally like to be flat 2 minutes before and resume trading a few minutes after the report is out.

If you have notes from previous NFP, now is the time to review…if you don’t have notes, time to start a trading journal and keep notes in it!

10 Minutes chart of the ES, mini SP500 from last NFP, Nov. 3rd below for your review.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-08-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

By John Thorpe, Senior Broker

March (H24) Interest rate products, U.S. T-Bond Futures ZB, Ultra T-Bond Futures UB, 10-Year T-Note Futures ZN, 5-Year T-Note Futures ZF, 2-Year T-Note Futures ZT. are now front month

Earnings watch, Tuesday 12-5 Toll Brothers Builders NYSE (TOL), Thursday 12-7 chipmaker Broadcom NYSE (AVCO)

Reports a variety, Main Focus Friday, NFP 7:30am, WASDE 10am and 1st day of Hanukkah all times CST

The Role of Expectations for the NFP report

Expectations are typically baked into future prices. Rarely can a more direct correlation to this reality be found than in our futures markets as they are affected by expectations of NFP .

There are a number of indicators the Federal Reserve Board and investors watch prior to the NFP release, these all become reflected in asset prices and if there is a surprise NFP release, the market can adjust violently to the new perception of the health of the economy and therefore the affect on future Interest rate decisions. For instance, The Labor Department’s JOLTS report tracks monthly change in job openings and offers rates on hiring and quits. The reporting period lags other employment data including the employment situation report. Then there is the ADP report The national employment report from Automated Data Processing Inc. and is computed from ADP payroll data and offers advance indications on the U.S. private workforce. Are to name but two. Contact your broker for more detail.

This Friday @ 7:30 a.m. CST the BLS will release it’s monthly employment update called the NFP which stands for Non-Farm Payroll and this specific economic event is always released on the first Friday of every month. Rarely, the NFP figure may be postponed to the second Friday if the first Friday is the first of the month or a public holiday. This Friday is one of those rare exceptions. The NFP figure is a report which shows how many individuals are employed within the US but excludes specific industries such as agriculture.

Why is it important to the Dollar?

When individuals wish to invest in stocks, bonds and a currency, they prefer currencies backed by a strong economy with a robust employment sector. In addition, if employment is high, the Federal Reserve is also likely to increase interest rates or keep them high; again, this can support demand for the Dollar.

A higher-than-expected NFP figure is positive for the Dollar.

A lower-than-expected NFP figure is negative for the Dollar. The inverse would be true for the Euro currency

Why is it important to the US Stocks?

ESH24,NQH24,RTYH24,YMH24 + micros

The NFP figure can affect the US Stock Market in 2 ways. A higher-than-expected NFP figure can indicate a resilient economy and higher consumer demand. As a result, companies perform better; earnings are higher, as is investor confidence. This can cause the stock market to rise. But be wary as it can also trigger current belief by the FED that interest rate increases will be necessary to cool the employment trend.

On the other hand, if the Federal Reserve is increasing interest rates, positive employment figures may support a further increase. Interest rates can significantly pressure the stock market. A lower than expected figure during the current environment may rally stocks as the FED would NOT need to raise rates further yet as they wait and see if their tight money policy is being effective

Why is it important to the Gold?

GGCG24, GCG24 + micros

The price of Gold is largely inversely correlated with the cost of the Dollar. As a result, the NFP can influence the price of gold. Whether the horse leads the cart or the cart leads the horse is for you to determine as you lock those contracts onto your trading screens.

Why is it important to Interest Rates?

UBH24,ZBH24,ZTH24,FFF24 + minis

If the NFP is stronger than expectations Bond prices will go lower as the concern of “higher for Longer” persists

If the NFP is weaker than expected Bond Prices will go higher as anticipation for rate cuts sooner wash over the interest rate markets

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-05-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

General:

While the Federal Reserve and its main voice Jerome Powell have been steadfast in declaring that interest rates would not be coming down unless the FOMC saw broad definitive proof that inflation was falling, traders have been pricing in that eventuality since the end of October. In just the last three weeks, the E-mini S&P 500 climbed out of correction territory and the yield on the 10-year T-note slid from the 5.00% it touched prior to the last Fed meeting down to 4.30% overnight. Never mind the CME Fed watch tool pegs the potential for a 25-basis points rate cut at the Fed’s December 13th meeting at a slim 1.1% and at 3.1% at their January 31st meeting. What likely has traders’ attention: the Fed Funds futures contract sees the probability of a 25-basis point cut at the March 20th Fed meeting at 40.6%. Don’t count on to begin to telegraph any sort of pivot until the Fed deems any signs of slowing growth as entrenched and that should take some time. The Fed will turn a cold shoulder to making quick moves as they do not want to reignite the inflation fire before it is extinguished.

Currency:

As the conversation shifts from rate hikes to cuts, the U.S. dollar is on track to hit its lowest level in months.

Metals:

In the scenario that the dollar and treasury yields continue to fall, look for precious metals like gold and silver to continue their ascent. Gold has already climbed over $200 per ounce in less than two months, from its October 5th close at $1850.80 / ounce to its second day closing above $2050 / ounce yesterday and today (basis February) – a ±$20,000 per contract move for the standard 100-oz. futures contract.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-30-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

General:

We have a new futures contract. It started trading on Monday. This is the Micro Henry Hub Natural Gas futures contract and corresponding options.

To quote directly from the CME Group web site, “The introduction of Micro Henry Hub Natural Gas futures and options responds directly to customer demand for a smaller, more precise instrument for managing natural gas price exposure. At one-tenth the size of the benchmark Henry Hub (NG) contract, Micro Henry Hub Natural Gas futures and options offer more granularity and smaller margin requirements with the same robust transparency and price discovery of the larger Henry Hub contracts.”

Follow the link below to the contract’s full contract specifications on the CME Group web site:

https://www.cmegroup.com/markets/energy/natural-gas/micro-henry-hub-natural-gas.contractSpecs.html

Heads up: most FCM’s / clearing firms, including the five FCM’s Cannon Trading Co. partners with, will monitor a new futures contract for sufficient liquidity before making it available to its clients. Give Cannon Trading a call to find out the availability of the contract.

Energy:

Incidentally, natural gas (basis Dec.) dropped ±50 cents (a ±$5,000 move) over the last six trading sessions to ±$3.10 /mmBtu. down to new 2-year lows on forecasts for above-normal temps. across the U.S. for the next fifteen days and continental U.S. production remaining near all-time highs,”

Financials:

Stock index futures are struggling today to extend their longest winning streak in two years – clocking seven straight daily gains – as we approach the close of trading. At this typing, the E-mini S&P 500 is trading just a few ticks either side of unchanged, while the E-mini Dow Jones and E-mini Nasdaq are slightly off.

More energy:

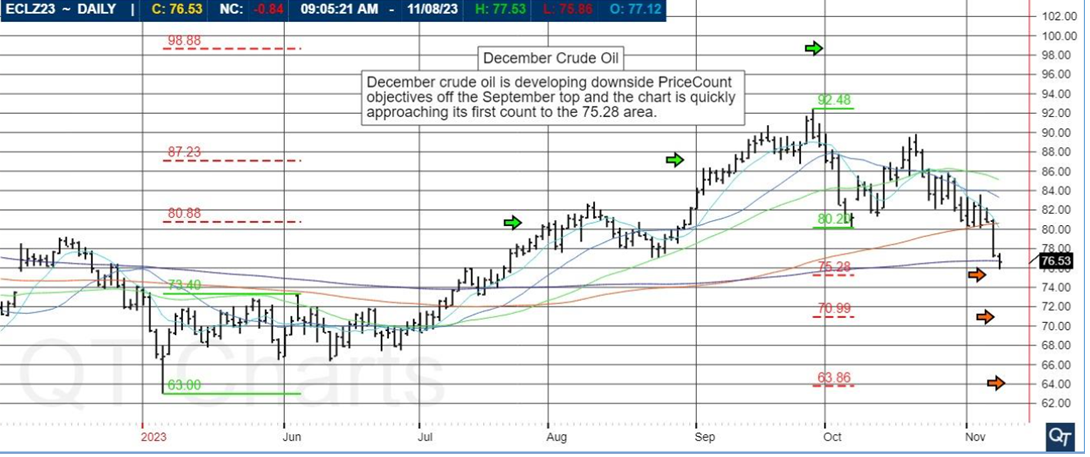

Crude oil extended its more than 2-week sell-off to its lowest level in over three months. From an intraday high of $89.85 per barrel on Oct. 20, the front month traded through $75.00 per barrel this morning – a ±$15.00 per barrel / $15,000 per contract move.

DAILY CHART BELOW

News pushing prices south include global demand worries, record U.S. production and ebbing supply concerns surrounding the Gaza conflict.

Given its ability to create a ripple effect, the ±15% price decline dragged U.S. pump prices down to levels not seen since March. It has also helped rein in inflation expectations and worrisome bond yields.

While this paints a picture that fears are subsiding that a wider conflict could be emerging in the Middle East and disrupt supplies, traders should remain on high alert for signs to the contrary.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-09-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Senior Broker, Mark O’Brien

General:

It will likely be challenging to predict the next stage of the Israel/Hamas war in terms of how broadly it draws in other participants. For now, diplomatic efforts – negotiating for the release of hostages, calls for a cease fire, bringing humanitarian aid to civilians in Gaza – have toned down the severity of the fighting. Concurrently, Israel is softening up the opposition by bombing of targets thought to be Hamas military strongholds and the markets are anticipating the launch of a ground war.

Even with the conflict entering its 20th day and seeing how commodities have already reacted in that time, the start of ground fighting and/or a broadening of participants would likely see sharper moves in particular futures contracts, i.e., gains in energies, flight-to-quality upward movement in gold and the Swiss franc and even food-related commodities like wheat. Conversely, equity index futures – U.S. and more broadly – will be vulnerable to draw-downs. Note that the E-mini Nasdaq already fell into correction territory on Wednesday following the latest tech earnings.

Financials:

One instrument at a potential cross-roads – it’s current 6-month / ±$11K per contract decline a dominant catalyst for dragging shares around the world to multi-month lows – is the 10-year T-note futures contract. Its correspondent benchmark yield is hovering at a 15-yr high of 5%. Already vulnerable to information on the pace of the U.S. economy, the conflict uncertainty poses a new agitator to the market.

Crypto:

After trading down to 3-year lows below 15,000 last October, on Tuesday, Bitcoin futures traded through 35,000, a 17-month high, a ±$10,000 move for a Micro Bitcoin futures contract (contract size: 1/50 Bitcoin), a ±$100,000 for the “adult” / Bitcoin futures contract (contract size: 5 Bitcoin).

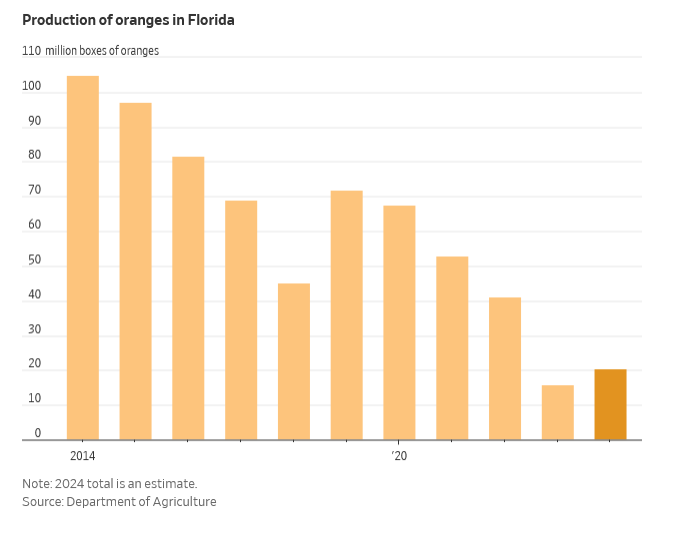

Softs:

With new all-time highs being set all year – almost weekly – orange juice futures (basis Nov.) are poised to break through $4.00/lb. (contract size: 15,000 lbs, 1 cent = $150), more than double its ±$1.85 levels in January, a ±$32,000 per contract move. Florida orange growers harvested their smallest crop in nearly 90 years, the result of an ill-timed freeze, two hurricanes and the citrus psyllid, a tiny invasive winged insect that has spread citrus greening disease and is laying waste to Florida’s groves.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-27-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

The past two weeks have seen very choppy price action especially in stock indices futures, with sudden and sharp swings from highs and lows.

This contrasts with the smoother and steadier price action we witnessed before the terrible October 7 attack on Israel. As a trader, you need to evaluate the market conditions and the instruments you are trading, and how they respond to geopolitical events and overall market rhythm and price action.

You also need to adapt and be alert to what is changing, because what worked six weeks ago may need some adjustment in order for it to work for the next six weeks. Day trading is challenging, and many times price movement is just noise in a trending or non-trending environment. Some people try to use order flow to get clues and capture a small part of the market, while others trade based on the news and overall market feel.

In my opinion, using counter trend techniques and respecting the VWAP has been more effective in these past two weeks than other methods. Plan your trade, trade your plan!

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-25-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Senior Broker, John Thorpe

This is the last week for Fed policy makers to “Stir the Drink” before the communication’s blackout period that begins at midnight Saturday the 21st and runs through Nov. 2nd. the Rate decision will be announced on Nov. 1 In lieu of that, the Fed Fund futures market has been bouncing around between 80 and 93% probability of a no change decision.

There will be no less than 8 fed speakers for the remainder of this week, Wednesday will be the heavy day with 5 .

Wednesday will also feature Housing starts and permits @ 7:30 CDT, with the Beige Book @ 1PM. Earnings reports will be picking up as well with TSLA reporting after the close on Wednesday with Analysts expect the company’s Q3 2023 revenue to rise 13% year-over-year to $24.3 billion.

However, they project adjusted earnings per share (EPS) to decline by about 30% to $0.73 due to lower margins. NFLX will also be reporting after the close As a group, industry analysts expect Netflix to report third-quarter earnings of $3.49 per share (+12.6% YoY) on revenue of $8.5 billion (+9.0% YoY).

Wednesday should provide plenty of excitement for traders in the Stock Indices , Bonds and precious metals markets.

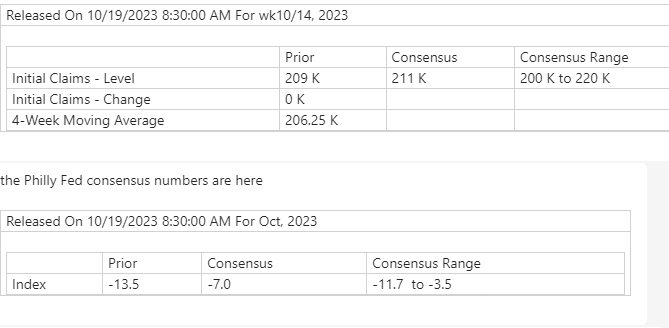

Thursday brings the Philly Fed and Jobless claims both earmarks for the Fed Folks to watch, ponder and 7;30 CDT is blast off time in the markets for these two numbers. react to. Econoday.com’s consensus is here

Existing Home sales released at 9am CDT are expected to report Year over year sales greater than -16%

Watch your blindside and expect more volatility!

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-18-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Download your FREE copy of Order Flow Essentials!

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Tomorrow @ 7:30 CDT Producer Price Index values will be released: Producer prices in September are expected to rise 0.3 percent on the month versus a 0.7 percent increase in August. The annual rate in September is seen at 1.7 percent versus August’s 1.6 percent increase. September’s ex-food ex-energy rate is seen rising 0.2 percent on the month and 2.1 percent on the year versus August’s 0.2 percent on the month and 2.2 percent yearly rise.

Also tomorrow, The Fed minutes will be released @ 1:00 PM CDT: Detailing the issues of debate and consensus among policymakers, the Federal Open Market Committee issues minutes of its latest meeting three weeks after the meeting.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-11-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Download your FREE copy of Order Flow Essentials!

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

by Ilan Levy-Mayer, VP

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-06-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Download your FREE copy of Order Flow Essentials!

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

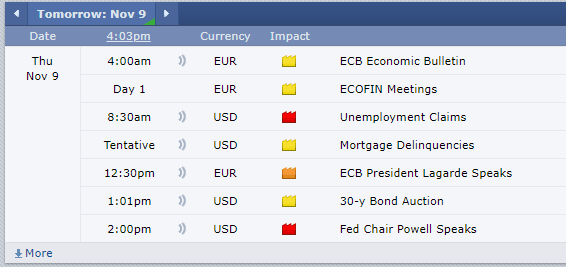

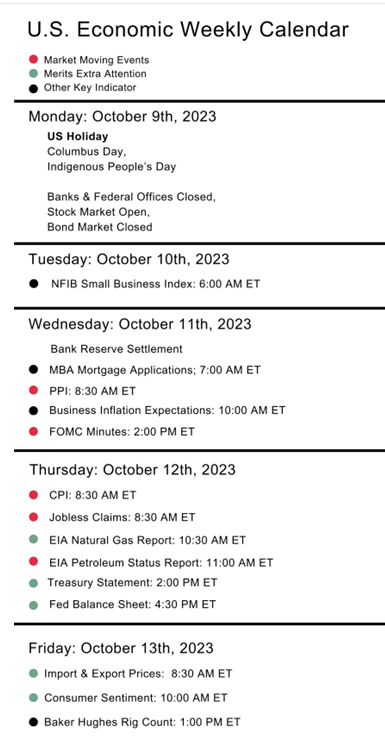

Tomorrow traders need to pay attention to multiple reports, fed members speaking and more!

Should be a busy day across the board, make sure to know which reports are coming and what time, scroll down to see reports and times!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-04-2023

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Last day of the month tomorrow.

PCE and a few other reports are out.

Nasdaq 100 ( NQ and MNQ) sitting on decision levels in my opinion.

A break below 14720 can trigger a visit to the 14220 area. A close above 14930 can open the door for an oversold rally towards the 15300 area.

See daily chart below.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-29-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Mini SP 500 futures are approaching an important support levels on the daily chart as seen below.

4325-4350 zone.

The big question is “Will support hold or will price break through towards the next levels?”

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-22-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

FOMC tomorrow and the markets are expecting NO CHANGE in rates tomorrow, however, traders will pay close attention in an attempt to predict future hikes the rest of 2023.

The following are suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 4425.00 with a stop at 4419.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 4419.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-20-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

Sign up to win up to $2500 in cash prize and practice your rate futures trading skills ( bonds, ten years, 5 years etc.)

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

by John Thorpe, Senior Broker

With over 500 companies reporting earnings this week it is near the end of the reporting season. The market will focus Wednesday on the elephant in the room, Nvidia (NVDA Nasdaq).

The boom in Nvidia’s AI-focused business has increased more than 200% year to date, giving it a $1.1 trillion market valuation. Watch for the NQU23 to dance around in a range until AFTER Wednesday’s cash market close.

EPA Estimates are +$2.07 . future guidance will be big for the “internet Index” as AI has been leading the way and Nvidia is the leading GPU maker in the space.

BUT WAIT! that’s not all for the week, it’s time for the Annual “Jackson Hole” conference, a 3 day meeting of top bankers and the FED.

Friday morning @ 10:00am CDT Jerome Powell will set the tone with a speech that could provide a case for the Feds next Fed Rate decision September 20-21st. This is an important meeting next month as it also sets projections by the FED members for GDP, Unemployment rate, Inflation for each year 2023,2024 and 2025.

Watch for increased volatility in the stock indices the last half of the week!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

08-22-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

Have a safe Memorial Day Weekend. Trading Schedule HERE

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Weekly Levels

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

General:

The answer is: Germany, Denmark, Netherlands, Sweden, Norway, Switzerland, Luxembourg, Singapore and Australia.

The question is: name the remaining countries whose credit is rated AAA by all three ratings companies – S&P Global, Fitch and Moody’s – after Fitch downgraded the United States’ debt rating from its top-tier AAA, down to AA+.

Among the contributing factors leading to the downgrade, Fitch cited, “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance . . . that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Remember in 2011, even though at that time a debt-limit deal was reached, S&P Global lowered the U.S.’s credit rating from AAA down to AA+ and it has not recovered since.

Canada is rated AAA by two of the ratings companies.

Stock Indexes:

Probably not surprisingly, as of this typing, stock indexes reacted negatively to the ratings news with the E-mini Dow Jones losing more than 300 points, roughly a 2% haircut. The E-mini Nasdaq is off ±325 points, a similar 2% correction.

Energy:

As the stock market foundered, crude oil felt weak in the knees as well and by mid-session, the September contract had sold off $3.00 per barrel from its Sunday opening. This despite today’s EIA crude oil stocks report showing a 17 million barrel reduction in U.S. crude stocks; the largest drop in inventories since 1982.

Grains:

After trading within 13 cents of its April 2022 highs last week, November soybeans factored in an expected conga line of wet weather fronts moving broadly over the U.S. Midwest and sold off ±$1.00 down to ±$13.25/bushel, a $5,000 per contract move, the bulk of which comprised just three trading sessions. Estimates for this year’s crop are a virtual wild card given the approach of August, its most critical growing period, so expect volatile price movement throughout.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

08-03-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.