Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

By Senior Broker, Mark O’Brien

General:

It will likely be challenging to predict the next stage of the Israel/Hamas war in terms of how broadly it draws in other participants. For now, diplomatic efforts – negotiating for the release of hostages, calls for a cease fire, bringing humanitarian aid to civilians in Gaza – have toned down the severity of the fighting. Concurrently, Israel is softening up the opposition by bombing of targets thought to be Hamas military strongholds and the markets are anticipating the launch of a ground war.

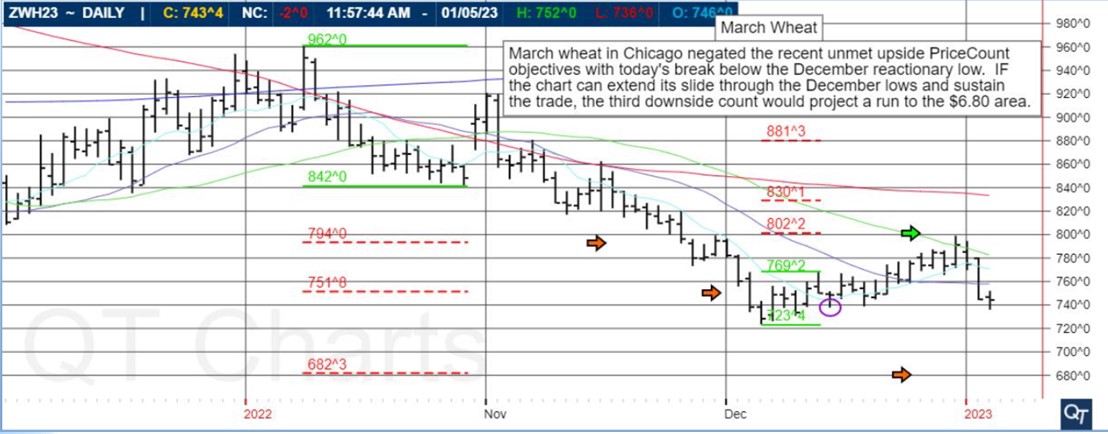

Even with the conflict entering its 20th day and seeing how commodities have already reacted in that time, the start of ground fighting and/or a broadening of participants would likely see sharper moves in particular futures contracts, i.e., gains in energies, flight-to-quality upward movement in gold and the Swiss franc and even food-related commodities like wheat. Conversely, equity index futures – U.S. and more broadly – will be vulnerable to draw-downs. Note that the E-mini Nasdaq already fell into correction territory on Wednesday following the latest tech earnings.

Financials:

One instrument at a potential cross-roads – it’s current 6-month / ±$11K per contract decline a dominant catalyst for dragging shares around the world to multi-month lows – is the 10-year T-note futures contract. Its correspondent benchmark yield is hovering at a 15-yr high of 5%. Already vulnerable to information on the pace of the U.S. economy, the conflict uncertainty poses a new agitator to the market.

Crypto:

After trading down to 3-year lows below 15,000 last October, on Tuesday, Bitcoin futures traded through 35,000, a 17-month high, a ±$10,000 move for a Micro Bitcoin futures contract (contract size: 1/50 Bitcoin), a ±$100,000 for the “adult” / Bitcoin futures contract (contract size: 5 Bitcoin).

Softs:

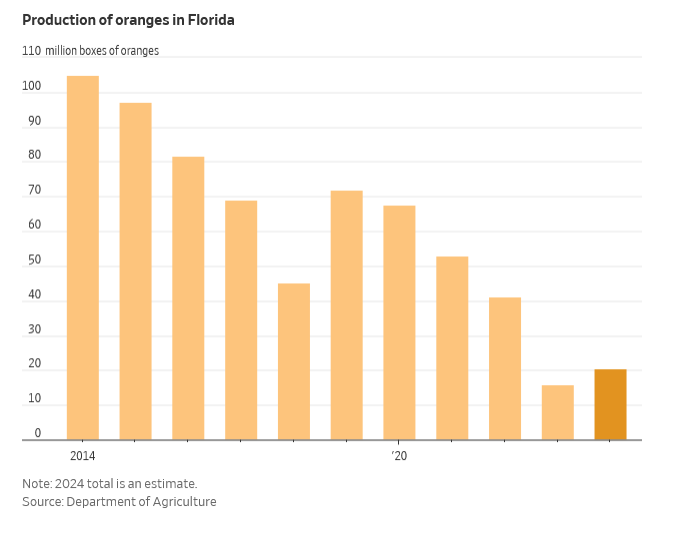

With new all-time highs being set all year – almost weekly – orange juice futures (basis Nov.) are poised to break through $4.00/lb. (contract size: 15,000 lbs, 1 cent = $150), more than double its ±$1.85 levels in January, a ±$32,000 per contract move. Florida orange growers harvested their smallest crop in nearly 90 years, the result of an ill-timed freeze, two hurricanes and the citrus psyllid, a tiny invasive winged insect that has spread citrus greening disease and is laying waste to Florida’s groves.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

10-27-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

General:

Thanks in large part to higher yield opportunities, foreign purchases of dollars to buy U.S. treasuries have pushed the U.S. Dollar Index (basis Dec.) to a 10-month high today – trading to an intraday high of 106.24 – a climb of over $7,000 per contract since mid-July. The Federal Reserve held interest rates steady at their September meeting, but chairman Powell reiterated the Central Bank’s goal of bringing inflation down to its 2% target, so further rate hikes were still on the table and “higher for longer,” remained the clarion call.

Currencies:

Conversely, the Euro hit 6-month lows today, down to 1.0538 intraday, marking a ±$9,500 per contract move in a little over two months. The Japanese yen is threatening its key 150 level, where Japanese officials are seen as potentially intervening to shore up the currency (divide the futures price by 1 to find the conversion rate).

Metals:

New highs in the dollar have also translated to new lows in precious metals, particularly gold, which lost ±$29 per ounce today (basis Dec.) and broke through $1,900 per ounce, approaching early-February lows near $1883. This is a ±$225 per ounce decline (±$22,500 per contract) from its May 4 highs.

Energies:

Despite China’s tenuous economy – a key measure of demand for crude oil globally – the supply side of the ledger has been the driving force behind rising energy prices. Production cuts made by OPEC+ and continuing through year’s end have contributed to a plunge in storage levels in Europe and the U.S. to multi-month lows. Today the Energy Information Administration reported a crude oil inventory draw of 2.2 million barrels for the week to September 22, spurring a ±$3.50 per barrel advance above $94.00 per barrel intraday (basis Nov.) Yesterday, the American Petroleum Institute estimated that stocks at the Cushing, Oklahoma hub – where West Texas oil futures deliveries are processed – had slipped to below 22 million barrels, which is on the brink of the minimum operating level for that important terminal. The crude oil tanks around Cushing have approximately 91 million barrels of storage capacity.

Summary:

Futures traders remember the practical rule of thumb to keep an eye on the U.S. dollar. A stronger dollar in the global market will increase the price of commodities relative to foreign currencies. The higher price of commodities in foreign currency will work to lower demand and dollar-priced commodities. For a first-rate overview, check out the piece by Hannah Baldwin with the CME Group and contributed to Reuters: “How a strong dollar affects international currencies & commodities.”

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-28-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Then here is your golden opportunity. CME Group will be launching the Go for Gold Precious Metals Trading Challenge coming this June.

You’ll have the opportunity to practice trading highly liquid Precious Metals products while competing against other traders for the chance to win the grand prize of a 1 oz. bar of gold*.

During the challenge, you’ll explore our suite of precious metals contracts and test-drive strategies in a simulated environment. We’ll send you exclusive, daily education materials on precious metals contracts in order for you to feel prepared to trade and confidently compete against your peers.

*Participants will only be eligible to receive a 1 oz. gold bar if permitted in accordance with the applicable laws of their jurisdiction.

START DATE: June 4, 2023

END DATE: June 9, 2023

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 05-17-2023

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

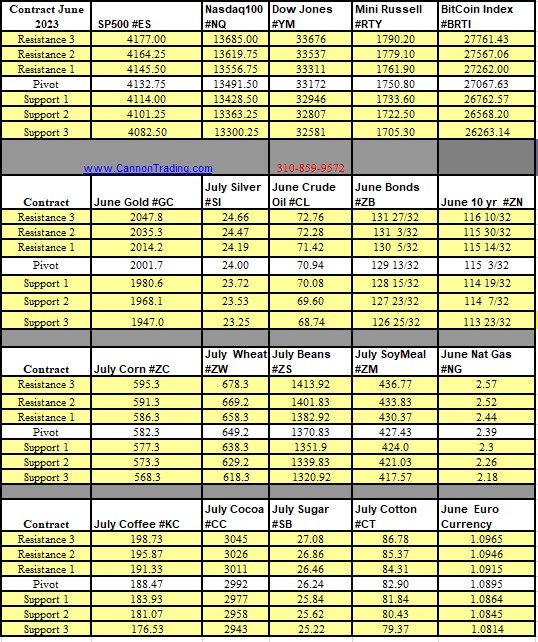

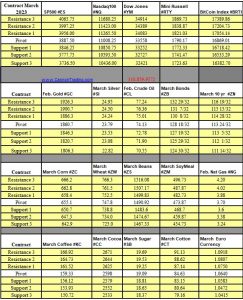

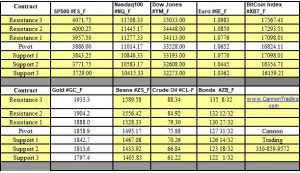

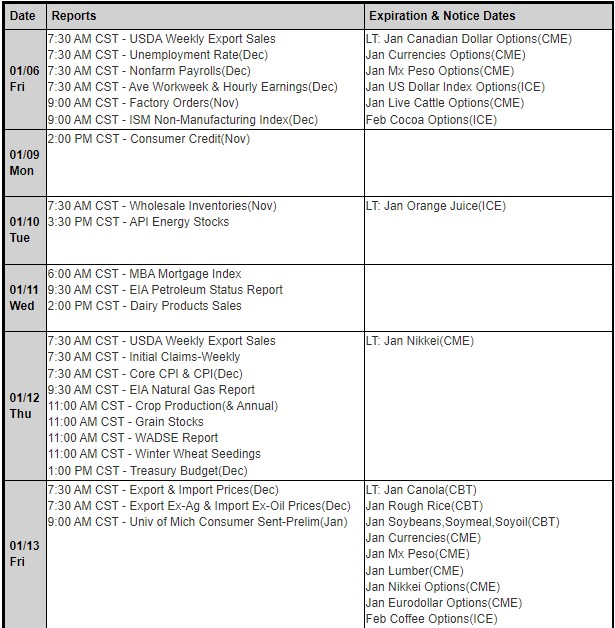

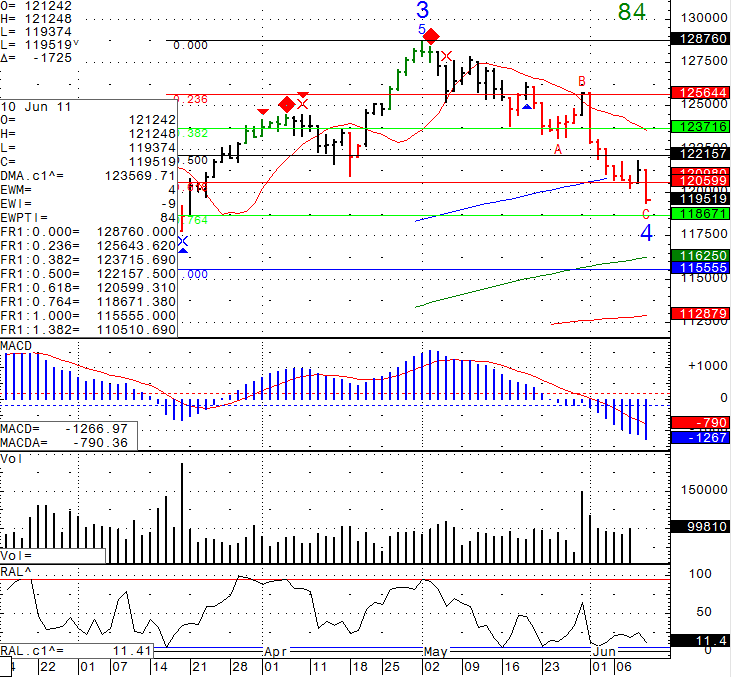

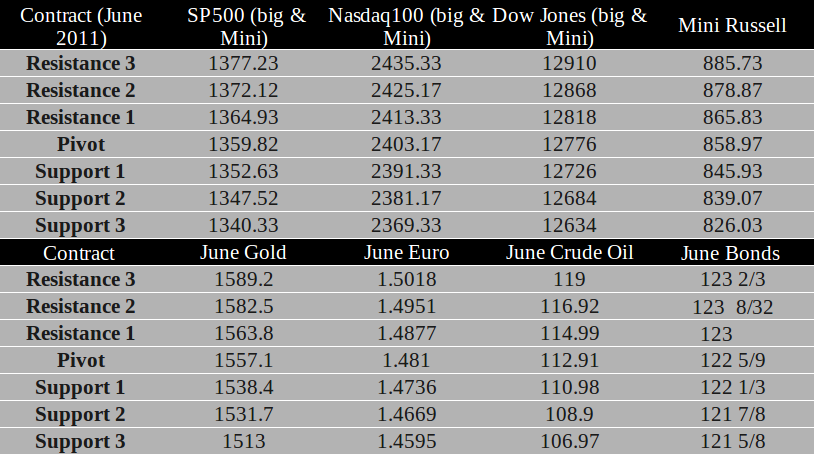

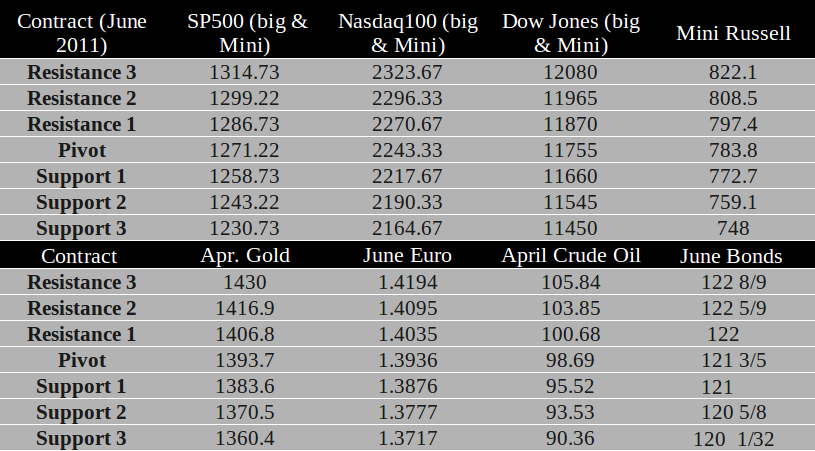

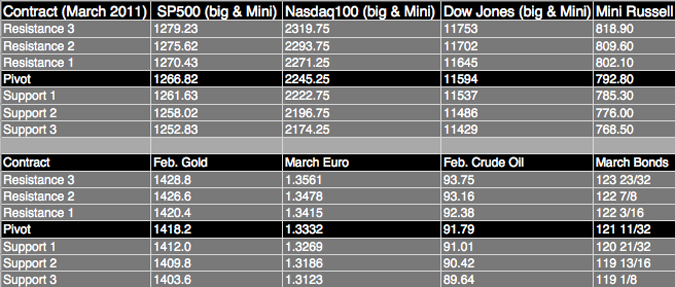

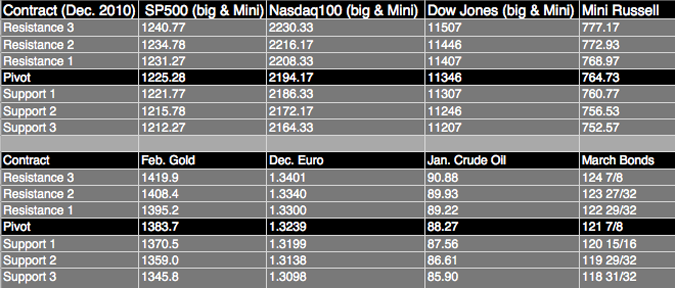

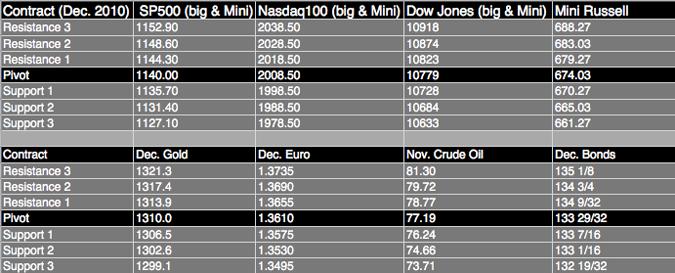

Weekly Levels

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Providing exposure to 30 of the largest companies in the U.S., the Dow-Jones futures market is directly correlated to the value of the Dow-Jones Industrial Average. Among the most liquid contracts on the exchange, the Dow futures are a favorite for all types of traders. Whether you are a scalper live streaming online, or you’re a position trader placing phone orders, the Dow futures are a diverse landscape with traders participating from all over the world.

Real time quotes are widely available across media outlets, trading platforms, and brokerages. The E-Mini Dow futures(YM) trade on the CBOT as part of the CME Group. Minimum tick size is one point with a value of $5.00 per point, per contract. The notional value of the E-Mini Dow contract can be calculated using the value of the Dow Jones Industrial Average times $5. A smaller alternative, the E-Micro Dow(MYM) contract trades at one-tenth the format of the former, or $0.50 per tick.

Dow-Jones futures offer competitive margin requirements and leverage, allowing responsible investors and traders the opportunity to hedge larger positions with less capital. For U.S. Traders, the IRS classifies broad based index futures such as the Dow Futures under the 60/40 rule which allows trading profits to be taxed at 60% the more favorable capital gains rate, and only 40% as ordinary income (Check with a CPA before trading.)

As an investment device, the Dow-Jones futures provide real time leveraged exposure to the index value, which promotes capital efficiency for investors and traders. This means that skilled risk managers, like yourself, will no doubt find competitive and creative solutions to manage risk.

The Dow Jones Futures market is a competitive market for tools and platforms to trade with. Hence, a plethora of options are available to both retail and professional traders. The Dow-Jones Futures are traded on by many brokerages, software, and platforms, with access to real time data quotes being provided from the exchange through several different data providers.

The Dow-Jones futures market shares a strong correlation to the other U.S. Index futures such as the Nasdaq 100, S&P500, and Russell 2000 contracts. This means that the U.S. markets tend to reflect the movement of one another with additional correlations to the bond markets, currencies, and many other commodities such as gold, silver, etc. Notably, the futures trade nearly 24 hours a day through the week, from Sunday evening until Friday. It’s arguable that if you consider the ease of shorting, capital efficiency, etc. it makes futures a much more valuable tool than ETF’s. Additionally, also available are the Dow Futures Options contracts which expire monthly. Be sure to understand your risks, and consult with your broker before trading.

You can download one of our trading platforms with live data and the options board here

E-Futures International | Futures Trading Platform & Broker Demo Account (cannontrading.com).

We will be happy to screen share with you and answer any questions you may have about futures related inquiries.

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

When looking at the Dow, NASDAQ, and S&P futures, there are similarities and differences between stock ETF’s and these Futures. Depending on how much leverage you would like to employ, the Futures numbers are below. If you are looking at the futures prices and had questions about the valuations, we have included a quick key below:

Dow futures symbol YM, Stock ETF Equivalent symbol DIA

Nasdaq Futures symbol NQ, Stock ETF Equivalent symbol QQQ

S&P Futures symbol ES, Stock ETF Equivalent symbol SPY

Both Mini and Micro E-Mini (1/10th size of the E-Mini)

Mini Dow futures price X $5 = Notional Value

Micro Emini Dow (MYM) futures price X .50 = Notional Value

Mini Nasdaq 100 futures price X $20.00 = Notional value

Micro E-Mini Nasdaq (MNQ) 100 futures price x $2.00 = Notional value

Mini S&P futures price X $50.00 = Notional Value

Micro E-Mini S&P (MES) Futures price X 5.00 = Notional value

If Dow @ 32000 Notional Value of YM = $160,000.00 Margin to hold $ 8800.00

E-Micro 32000 Notional value of MYM = $16,000.00 Margin to hold $ 880.00

If Nasdaq @ 13500.00 Notional Value of NQ = $270,000.00 Margin to hold $16,500.00

E-Micro 13500.00 Notional value of MNQ = $27,000.00 Margin to hold $ 1650.00

If S&P @ 4250.00 Notional value of ES = $212,500.00 Margin to hold $11,800.00

E-Micro 4250.00 Notional value of MES = $21,250.00 Margin to hold $1180.00

Dow Nasdaq S&P futures also offer options, Weekly Options for E-Mini S&P 500 Futures | Cannon Trading.

You can download one of our trading platforms with live data and the options board here

E-Futures International | Futures Trading Platform & Broker Demo Account (cannontrading.com).

We will be happy to screen share with you and answer any questions you may have about futures related inquiries.

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

Taking a closer look at gold futures analysis, price and prediction, the CME gold futures contract (GC) is one of the most actively traded on the exchange marketplace. Each contract represents 100 troy ounces (see contract for specs) with a tick value of $10 or .10 per ounce. The CME continues to provide accessibility for smaller traders by offering contract sizes such as the Micro gold futures (MGC). Standing at 1/10th the size of the aforementioned, with a tick value of $1, the MGC provides accessibility to those who may size their positions incrementally. Both contracts are actively traded, providing good liquidity to market participants.

Whether the standard applies or not, gold continues to be a popular choice for investors and traders alike. In gold futures analysis, the market participants of gold futures are diverse. People across the world hedging, speculating, and doing business with the hope of a better future. Though volatile at times, gold has a record of recovery after periods of price adversity. Inflationary concerns and looming world conflict have once again sent gold futures careening toward all-time highs. In a time where Bitcoin and other cryptos continue to draw attention from those pursuing extraordinary returns, metal investors seem to have enjoyed relative stability and growth since the COVID-19 crisis. Gold looks poised to once again push upward as investors and traders seek financial solace from the anticipated Russia/Ukraine military conflict.

From a technical analysis perspective, gold appears to be testing the upper side of a price consolidation that’s lasted for nearly a year. Assuming continued strength, one could argue that gold will top $2,000 an ounce this year and possibly make a new all-time high. If conflict materializes and broad-market weakness presents, the negative beta correlation of gold to the S&P500 may create buying pressure.

Taking this into consideration, it’s important for traders like you to brace for multiple scenarios when doing a gold futures analysis, with price and prediction. All signs point upward for gold, which means it can be useful to reflect and prepare for something less obvious. Ironically, like a punishment for the preemptive celebration of traders and investors, when things seem a shoo-in, adversity reveals itself. Make a plan for when things don’t go your way. Gold may retest $2,000/ounce and fall back into price consolidation, or reverse and press downward. Any number of scenarios could play out, and only time will tell. You must consider these and more factors when looking at gold futures analysis, price and prediction. Those prepared with reactive risk management solutions, active at finding low risk/high reward trading opportunities will succeed.

Within the gold futures, speculative traders skilled in order flow/tape reading should find intraday opportunities. While swing traders and portfolio-style risk managers may utilize gold futures to hedge or manage their broad market exposure. Directionally focused swing/position trading continues to be viable option for disciplined traders as well. The critical element to success tends to be risk management, regardless of trading style.

Nowadays cryptocurrency has taken the world by storm. Outsized returns and the hope of instant success draw a crowd. It seems an era of new-school vs. old-school, but caution is advised. For millennia our species has valued gold. Bitcoin was created in 2009. It can be argued that the cryptocurrency market is still in its initial price discovery phase. Please consider that strong value can be found outside of what’s considered trendy or popular. It’s ironic that gold seems less glamorous these days. Be sure to do your due diligence, and remember what they say about all that glitters….Happy Trading!

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

Like all commodity futures, gold futures are derivative financial contracts. A derivative is a type of contract whose value is determined by or derived from the value of another asset. In the case of gold futures contracts, the other asset is an amount of gold. The major gold futures contracts traded on the CME Group’s COMEX Exchange are derived from the value of 100 ounces, 50 ounces, and 10 ounces of gold with a rated fineness of 995. What this means is the underlying metal’s purity is at least 99.5% or more. In turn, because of the reflective relationship between gold futures contracts and gold itself, understandably the price of a futures contract is valued similarly to and fluctuates with the price of gold.

Gold futures, such as those traded on the CME Group’s COMEX Exchange, are an efficient means for you as a trader to participate in the directional movement of the price of gold. The exchange is essentially the marketplace where these futures are traded. By means of electronic networks, an exchange’s market participants can be apprised of vital information like this futures contract’s current price, competing bids and offers, the number of contracts changing hands (volume), the total number of outstanding contracts (open interest), and more. It’s also the means by which participation in the gold futures marketplace takes place. It’s where buyers and sellers, or futures traders like you, meet.

Gaining access to the gold futures market generally calls for a trading account to be opened with a registered brokerage. It is through this arrangement that market participation is facilitated and orders to buy and sell gold futures can be placed to the exchange via an electronic trading platform – called Globex at the CME. The exchange is responsible for the execution of trades between buyers and sellers. This is possibly the most important function of the exchange, in that it serves as the buyer to every seller and the seller to every buyer, thus virtually eliminating credit risk for each market participant.

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

Micro gold futures contracts are useful in bearish equity environments, where gold is showing its strength. It can serve as a portfolio stabilizer when markets are stressed. While the metal is not always immune to selling pressure, like when it sold off when the world went into “lockdown mode” in March 2020, it can outperform typical risk assets in these market environments.

With micro gold futures you have a greater ability to pinpoint scale, since the notional value is price times quantity, or 1890.00/oz X 10 Ounces. You can use them along side the 100 oz gold contract to control $250,000.00 of the metal. Here’s a great breakdown example of what that might mean for a trader like you:

Gold contracts provide global price discovery and opportunities for portfolio diversification by presenting an alternative to gold bullion, coins, and mining stock investments. Gold also offers ongoing trading opportunities, as gold prices respond quickly to political and economic events. Micro gold futures is 1/10th the size of the standard 100 troy ounce contract but, price action nearly mirrors it’s big brother 100% of the time.

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

Trading currency futures offer the perks of a central exchange and transparency regarding the flow of orders as they come into the market. Market participants share a level playing field with volume transparency and the information they use to trade. Traders are provided with peace of mind and can unabashedly focus on improving their performance, which promotes a diverse and liquid trading environment. Confident traders in turn create liquidity in the financial markets.

Trading liquidity persists across many major USD futures currency pairs, including the Euro(6E,) Yen(6J,) British Pound(6B,) Canadian Dollar(6C,) Australian Dollar(6A,) Mexican Peso(6M,) and more. The reasonable margin requirements and competitive trading fees and commissions of the futures market make trading currency futures an attractive option for many styles and types of traders.

However, even though it’s transparent, don’t underestimate the challenge provided by the market itself. Liquidity and tight bid-ask spreads are created from voluminous markets. Importers and exporters hedging their currency risk, financial institutions conducting business, and speculators hoping to earn a living, are all hoping for a better future. This creates a competitive atmosphere with participants jockeying for the best position. It’s definitely an environment to prepare for carefully.

The exchange continues to provide accessibility for traders of many different capital amounts. Trading at 1/10th the size of the larger contract, the E-Micro FX Futures provides a smaller alternative than their larger relative. Although the fees and commissions tend to scale more economically for the larger sized contracts, the micro contracts allow traders more flexibility to size their positions. In addition, they also provide opportunity for creative hedging, spreads, and pairs trading with the bigger contract sizes. A savvy trader may find themselves geographically tracking interest rates.

It’s common for traders to have a favorite instrument. It can be argued that a trader’s favorite instrument is one that they’re most familiar with. Currency futures traders tend to find niches as each pair or futures contract will have behaviors unique to itself. As technology advances and the markets continually become more efficient, instrument correlation is more obvious. Though correlated at times, the volatility, price behavior, liquidity, and volume of each instrument or currency will be unique.

For novice currency futures traders, the excitement of “giving it a try” will often outpace their strategic planning phase. Most traders can remember the thrill of their first few trades. Before long, the reality of the market tends to encroach on a trader’s psyche. Beginners learn that the market is not as easy as they would’ve hoped and they wish they had been more thorough in their planning stages.

It’s obvious and underutilized that a trader’s discipline will slip when it’s least expected. The best tools, plan, education, and commission structure will be of no help to an undisciplined currency trader. At the pinnacle of adversity, when asked about discipline, traders tend to smile. It’s a sensitive subject.

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.

By Matt Kang, Senior Broker

FOREX (foreign exchange market or currency market) refers to an international exchange market where currencies(pairs) are bought and sold. For instance, EUR/USD, GBP/USD, AUD/USD and more. If you are trading forex, you can hold your positions as long as you want because it doesn’t have any expiration date. But there is a cost associated with keeping the position over night, it can either be a credit or debit depending on the interest difference between two countries.

Currency futures are in one currency such as EURO FX or Canadian Dollar. Unlike FOREX, there is an expiration date which means you can only hold the position until that time. For example, if you are trading Mexican Peso and South African Rand but carry the position after the expiration date, these currencies are physically delivered four times in a year on the third Wednesday of March, June, September, and December.

Liquidity and Centralized Market?

The FOREX market is the largest and most liquid market in the world. There is no centralized location for FOREX, which means there is no one physical location which is supervising this market. Therefore, traders must check the quotes of various currency pairs from each dealer.

The currency futures market has a respectable daily average closer to $100 billion. Compared to the 4 trillion FOREX daily volume. Currency futures are not as liquid as forex, but sufficient enough to trade. Currency futures are a centralized market, and one key aspect of centralized markets is that all traders and investors are able to see same quotes and the existence of a clearing house, it guarantees the integrity of the transactions. The resulting benefit of reduced risk from not dealing with variable counterparties is a key aspect of this.

Cost of Trading and Commission?

Some people say “I trade FOREX because there is no exchange, no regulatory fees and no commissions” but it is not true. If you trade currency futures, you will see all of these fees exist, such as NFA fees, exchange fees and commission fees. It will cost around $5-8 (buy and sell) for a self-directed account. If you are trading FOREX, then all of these fees are included in a bid/ask spread. A typical spread for EUR/USD is 1.2 pips which is equivalent to $12.

So Should I Trade FOREX or Currency Futures?

For the average investor who trades an account of $2,500 to $500,000 it is probably wiser, and more cost effective to trade Currency futures. The cost of trading will be lowest with this amount of funding and the roll-over rate will not dramatically impact your trading.

If you are working with very little money ($250 to $2,000) OR trading with more than $1 million OR trading some exotic pairs, then you will be better off with FOREX because it offers mini as well as micro trading sizes. Also, if you are investing over $1 million, then it is possible to earn interest and lower spread (fees).

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

______________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

|

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

06-03-2019

|

|

|

|

|

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

In the past I shared some markets I like to look at for day trading opportunities when stock index futures are in dead/ manipulated periods….Today I would like to talk a little about the currency futures markets. I personally prefer currency futures over FOREX any day. More than a few reasons but the main ones are: currency futures trade on one, regulated main exchange ( CME) while FOREX trades through different inter banks and other means of transactions that are not necessarily regulated.FOREX are “commission free” but in reality there is a spread built in that dealer marks up each time you buy or sell which makes FOREX more expensive than futures.

The main ones I like to follow are:

The Euro , The Yen, The British Pound, The Australian. All are paired versus the US$.

Each market will have different times of higher volume which can allow for traders in all time zones to pick their market. Simply open an hourly chart, like the example I am showing below of the Australian $ and add the volume indicator to observe what times the market has the most action.

Currency futures will often trend better than other segments and will experience different levels of volatility during economic reports in the different parts of the world.

If you plan on following any currencies, start in demo mode, know what reports are coming that affect the specific currency you are trading, take a look at the daily, weekly charts to get a feel and monitor the action for a while.

Any questions and I will be happy to assist.

Hourly chart of the Australian Dollar below for reference:

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

|

Contract Dec. 2014 |

SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

|

Resistance 3 |

2060.17 |

4260.50 |

17798 |

1184.30 |

89.12 |

|

Resistance 2 |

2050.33 |

4242.50 |

17720 |

1179.40 |

88.59 |

|

Resistance 1 |

2044.92 |

4227.50 |

17668 |

1171.60 |

88.29 |

|

Pivot |

2035.08 |

4209.50 |

17590 |

1166.70 |

87.76 |

|

Support 1 |

2029.67 |

4194.50 |

17538 |

1158.90 |

87.47 |

|

Support 2 |

2019.83 |

4176.50 |

17460 |

1154.00 |

86.94 |

|

Support 3 |

2014.42 |

4161.50 |

17408 |

1146.20 |

86.64 |

|

Contract |

Dec. Gold | Dec.Silver | Dec. Crude Oil | Dec. Bonds | Dec. Euro |

|

Resistance 3 |

1205.3 |

16.83 |

77.68 |

143 5/32 |

1.2676 |

|

Resistance 2 |

1199.4 |

16.64 |

76.93 |

142 23/32 |

1.2628 |

|

Resistance 1 |

1192.5 |

16.39 |

76.21 |

142 1/32 |

1.2542 |

|

Pivot |

1186.6 |

16.20 |

75.46 |

141 19/32 |

1.2494 |

|

Support 1 |

1179.7 |

15.95 |

74.74 |

140 29/32 |

1.2408 |

|

Support 2 |

1173.8 |

15.76 |

73.99 |

140 15/32 |

1.2360 |

|

Support 3 |

1166.9 |

15.51 |

73.27 |

139 25/32 |

1.2274 |

|

Contract |

Dec Corn | Dec. Wheat | Jan. Beans | Dec. SoyMeal | Dec. bean Oil |

|

Resistance 3 |

383.7 |

553.0 |

1062.33 |

409.07 |

33.24 |

|

Resistance 2 |

381.3 |

552.8 |

1049.42 |

399.03 |

32.94 |

|

Resistance 1 |

379.4 |

552.3 |

1042.83 |

393.07 |

32.69 |

|

Pivot |

377.1 |

552.0 |

1029.92 |

383.03 |

32.39 |

|

Support 1 |

375.2 |

551.5 |

1023.3 |

377.1 |

32.1 |

|

Support 2 |

372.8 |

551.3 |

1010.42 |

367.03 |

31.84 |

|

Support 3 |

370.9 |

550.8 |

1003.83 |

361.07 |

31.59 |

| Date | 3:45pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueNov 18 | 5:00am | EUR | German ZEW Economic Sentiment | 0.9 | -3.6 | ||||

| EUR | ZEW Economic Sentiment | 4.3 | 4.1 | ||||||

| 8:30am | USD | PPI m/m | -0.1% | -0.1% | |||||

| USD | Core PPI m/m | 0.2% | 0.0% | ||||||

| 10:00am | USD | NAHB Housing Market Index | 55 | 54 | |||||

| 1:30pm | USD | FOMC Member Kocherlakota Speaks | |||||||

| 4:00pm | USD | TIC Long-Term Purchases | 41.3B | 52.1B |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

After a frustrating trading day, I read this one again and thought it is worth sharing:

Educational Feature: Dealing With Losing Trades

A main tenet of success in futures trading is the ability to accept losing trades as part of the overall trading process. This is not an easy undertaking–especially since many futures traders tend to be of a more competitive nature in the first place. Traders certainly don’t have to enjoy losing trades, but they must accept the fact and move on. Those who can’t accept the fact that losing trades are a part of futures trading usually don’t stay in the business very long.

My wife is a school teacher, and one of her favorite acronyms–ADM–can be applied to losing futures trades. “Accept” it. “Deal” with it. “Move” on. (This is a part of the important psychological aspect of trading, and deserves much more discussion than I can provide in this feature.)

I had lunch with one of my trading mentors a while back. We discussed losing trades. I asked my mentor how many losing trades in a row he has had to endure during his long and successful trading career. His reply was 13 in a row. I asked him how he coped with that. He said that while it was certainly not easy, he knew that losing trades are a part of the business and that he was in the business “for the long haul,” and that his trading methodology was sound. He added, “Ninety-percent of futures trading profits are made on 10% of the trades, which means most of the other trades are either small losers or break-even-type trades.” This is an important fact for all traders to keep in mind.

My lunch meeting with my mentor was good for me because, even though we made no “break-through” discoveries on the path to increased futures trading success, we did reaffirm our own philosophies on trading and markets. My passion for trading and market analysis is fed immensely every time I talk with people in my profession, or attend the quality trading seminars.

For many of you, the futures trading arena can be more fulfilling (and more fun) if you have someone, or some support group, with which to share your thoughts and strategies. If you are passionate about futures trading and markets, finding someone who shares that passion is a great trading tool within itself!

That’s it for now. Next time, we’ll discuss another important issue on your path to trading success.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Dec. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 1998.33 | 4083.00 | 17212 | 1136.40 | 85.37 |

| Resistance 2 | 1993.17 | 4072.00 | 17161 | 1131.30 | 85.12 |

| Resistance 1 | 1982.83 | 4054.75 | 17062 | 1121.40 | 84.95 |

| Pivot | 1977.67 | 4043.75 | 17011 | 1116.30 | 84.71 |

| Support 1 | 1967.33 | 4026.50 | 16912 | 1106.40 | 84.54 |

| Support 2 | 1962.17 | 4015.50 | 16861 | 1101.30 | 84.29 |

| Support 3 | 1951.83 | 3998.25 | 16762 | 1091.40 | 84.12 |

| Contract | December Gold | Dec.Silver | Nov. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1257.8 | 18.37 | 93.67 | 138 9/32 | 1.2957 |

| Resistance 2 | 1247.4 | 18.18 | 92.88 | 137 28/32 | 1.2932 |

| Resistance 1 | 1235.5 | 17.99 | 92.16 | 137 22/32 | 1.2899 |

| Pivot | 1225.1 | 17.80 | 91.37 | 137 9/32 | 1.2874 |

| Support 1 | 1213.2 | 17.61 | 90.65 | 137 3/32 | 1.2841 |

| Support 2 | 1202.8 | 17.42 | 89.86 | 136 22/32 | 1.2816 |

| Support 3 | 1190.9 | 17.23 | 89.14 | 136 16/32 | 1.2783 |

| Contract | Dec Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 330.7 | 476.7 | 944.67 | 315.77 | 32.88 |

| Resistance 2 | 329.3 | 476.3 | 942.08 | 313.83 | 32.74 |

| Resistance 1 | 327.4 | 476.2 | 939.17 | 311.37 | 32.53 |

| Pivot | 326.1 | 475.8 | 936.58 | 309.43 | 32.39 |

| Support 1 | 324.2 | 475.7 | 933.7 | 307.0 | 32.2 |

| Support 2 | 322.8 | 475.3 | 931.08 | 305.03 | 32.04 |

| Support 3 | 320.9 | 475.2 | 928.17 | 302.57 | 31.83 |

| Date | 4:17pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedSep 24 | 4:00am | EUR | German Ifo Business Climate | 105.9 | 106.3 | ||||

| 9:00am | EUR | Belgian NBB Business Climate | -7.1 | -7.3 | |||||

| 10:00am | USD | New Home Sales | 432K | 412K | |||||

| 10:30am | USD | Crude Oil Inventories | 0.7M | 3.7M | |||||

| 12:05pm | USD | FOMC Member Mester Speaks |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

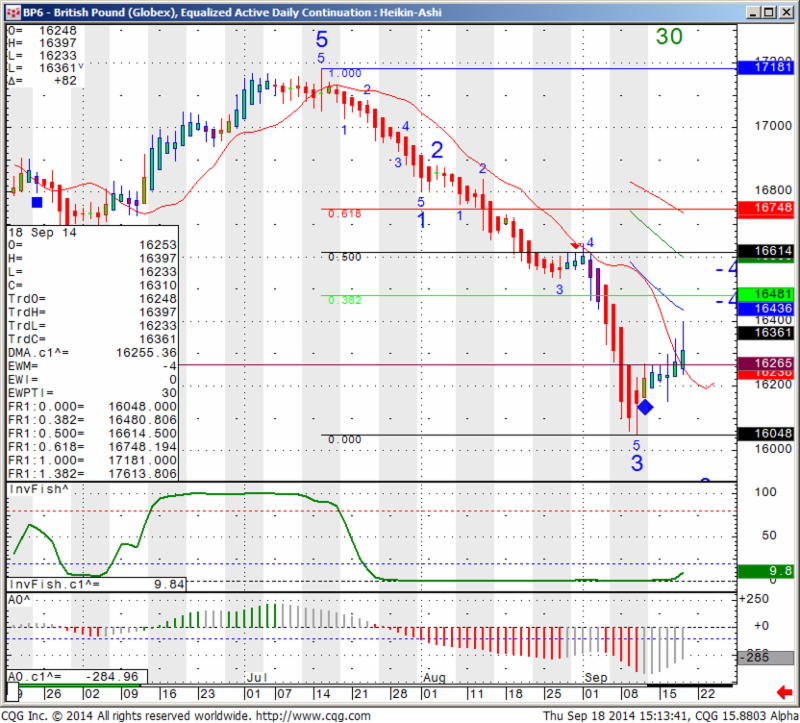

British Pound waiting for the Scottish Vote for clues on next move

On Thursday, after a 307-year-old union with England and Wales, Scottish voters age sixteen and over will decide in a referendum that will ask the question: Should Scotland be an independent country?

Most opinion polls show more Scots want to remain in the U.K. than leave it, but enough voters are undecided to swing it either way.

The “Better Together” campaign says Scotland should remain part of a larger country that has a greater say in the world and can better withstand financial shocks. Voting “no” to secession would also ensure it keeps the British pound after the U.K. government ruled out sharing the currency with an independent Scotland.

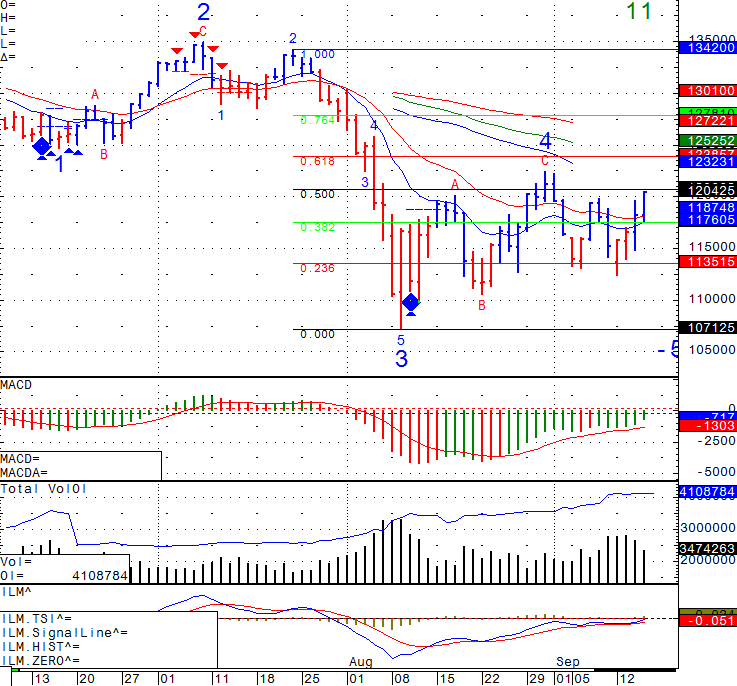

From the technical perspective I did get a possible buy signal ( see the blue diamond in the chart below). My diamond indicators are an output of an extreme overbought/ oversold along with price action that suggests a good counter trend move. In this case we saw an extreme sell off starting July 15th , falling over 11 points, I think if the market can take the 162.65 level , the door is open for a move up to 164.81 and 166.14!

BP6 – British Pound (Globex), Equalized Active Daily Continuation : Heikin Ashi

One thing for sure, volatility may be QUITE HIGH and it’s really hard to tell the immediate affect. Make sure you have a solid money management/ risk plan in tact!!

Read the rest of the analysis at:

http://experts.forexmagnates.com/british-pound-waiting-scottish-vote-clues-next-move/

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Date | 4:18pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriSep 19 | 2:00am | EUR | German PPI m/m | -0.1% | -0.1% | ||||

| 4:00am | EUR | Current Account | 14.3B | 13.1B | |||||

| 10:00am | USD | CB Leading Index m/m | 0.4% | 0.9% | |||||

| Day 1 | ALL | G20 Meetings |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

As of tomorrow make sure you are trading DECEMBER stock indices and CURRENCIES…..

I know many of you have read this one before but many others have not….

While it is not a “magic formula” I think the steps outlined should provide you the trader with some what of a base/ foundation of what you need to have in order to succeed in day-trading:

8 Steps to succeed in futures trading:

Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, futures brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Understanding this information is essential to futures trading. The second type of education is ongoing: learning about trading techniques, the evolution of futures markets, different trading tools, and more.

I am definitely not advising you to go on the web and subscribe to a “black box” system (using buy/sell triggers if don’t know why they are being generated). What I am advising is developing a trading technique: a general set of rules and a trading concept. As you progress, you may want to put the different rules and indicators into a computerized system, but the most important factor is to have a focus and a plan. Don’t just wake up in the morning and trade “blank.”

This is the key! Do what you need to do in order to survive this brutal business and give yourself the chance of being here down the road with more experience and a better chance of success. Survival is probably the biggest key for beginning traders. There is a saying in this business: “live to trade another day.” It is so true!

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Sept. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2013.33 | 4136.17 | 17163 | 1195.93 | 84.71 |

| Resistance 2 | 2005.42 | 4114.83 | 17111 | 1184.77 | 84.53 |

| Resistance 1 | 2000.83 | 4102.67 | 17076 | 1178.53 | 84.43 |

| Pivot | 1992.92 | 4081.33 | 17024 | 1167.37 | 84.26 |

| Support 1 | 1988.33 | 4069.17 | 16989 | 1161.13 | 84.16 |

| Support 2 | 1980.42 | 4047.83 | 16937 | 1149.97 | 83.98 |

| Support 3 | 1975.83 | 4035.67 | 16902 | 1143.73 | 83.88 |

| Contract | December Gold | Dec.Silver | Oct. Crude Oil | Dec. Bonds | Sept. Euro |

| Resistance 3 | 1265.9 | 19.35 | 97.29 | 137 28/32 | 1.3005 |

| Resistance 2 | 1258.5 | 19.17 | 95.37 | 137 25/32 | 1.2979 |

| Resistance 1 | 1250.2 | 18.93 | 94.28 | 137 12/32 | 1.2949 |

| Pivot | 1242.8 | 18.75 | 92.36 | 137 9/32 | 1.2923 |

| Support 1 | 1234.5 | 18.52 | 91.27 | 136 28/32 | 1.2893 |

| Support 2 | 1227.1 | 18.34 | 89.35 | 136 25/32 | 1.2867 |

| Support 3 | 1218.8 | 18.10 | 88.26 | 136 12/32 | 1.2837 |

| Contract | Dec Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 351.8 | 525.2 | 1017.67 | 347.50 | 32.26 |

| Resistance 2 | 347.7 | 521.3 | 1005.83 | 342.20 | 32.10 |

| Resistance 1 | 344.3 | 515.4 | 993.67 | 335.70 | 31.91 |

| Pivot | 340.2 | 511.6 | 981.83 | 330.40 | 31.75 |

| Support 1 | 336.8 | 505.7 | 969.7 | 323.9 | 31.6 |

| Support 2 | 332.7 | 501.8 | 957.83 | 318.60 | 31.40 |

| Support 3 | 329.3 | 495.9 | 945.67 | 312.10 | 31.21 |

| Date | 4:22pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriSep 12 | 2:00am | EUR | German WPI m/m | 0.2% | 0.1% | ||||

| 4:00am | EUR | Italian Industrial Production m/m | -0.1% | 0.9% | |||||

| 5:00am | EUR | Industrial Production m/m | 0.6% | -0.3% | |||||

| EUR | Employment Change q/q | 0.1% | 0.1% | ||||||

| All Day | EUR | Eurogroup Meetings | |||||||

| 8:30am | USD | Core Retail Sales m/m | 0.2% | 0.1% | |||||

| USD | Retail Sales m/m | 0.3% | 0.0% | ||||||

| USD | Import Prices m/m | -0.8% | -0.2% | ||||||

| 9:55am | USD | Prelim UoM Consumer Sentiment | 83.2 | 82.5 | |||||

| USD | Prelim UoM Inflation Expectations | 3.2% | |||||||

| 10:00am | USD | Business Inventories m/m | 0.5% | 0.4% |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, Sept.11th, is rollover day.

Starting Sept. 11th, the December 2014 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the December 2014 contract as of Sept. 11th. Volume in the Sept. 2014 contracts will begin to drop off until its expiration on Friday September 19th.

The month code for December is Z4.

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Thursday morning.

Please close any open September Currency positions by the close on Friday the 12th.

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Sept. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2014.92 | 4149.58 | 17214 | 1181.23 | 84.96 |

| Resistance 2 | 2005.58 | 4122.92 | 17146 | 1173.27 | 84.77 |

| Resistance 1 | 2000.17 | 4108.08 | 17104 | 1168.93 | 84.58 |

| Pivot | 1990.83 | 4081.42 | 17036 | 1160.97 | 84.39 |

| Support 1 | 1985.42 | 4066.58 | 16994 | 1156.63 | 84.20 |

| Support 2 | 1976.08 | 4039.92 | 16926 | 1148.67 | 84.01 |

| Support 3 | 1970.67 | 4025.08 | 16884 | 1144.33 | 83.82 |

| Contract | December Gold | Dec.Silver | Oct. Crude Oil | Dec. Bonds | Sept. Euro |

| Resistance 3 | 1272.0 | 19.34 | 94.66 | 138 18/32 | 1.3038 |

| Resistance 2 | 1265.3 | 19.23 | 93.84 | 138 8/32 | 1.3001 |

| Resistance 1 | 1258.0 | 19.12 | 92.85 | 137 23/32 | 1.2958 |

| Pivot | 1251.3 | 19.01 | 92.03 | 137 13/32 | 1.2921 |

| Support 1 | 1244.0 | 18.89 | 91.04 | 136 28/32 | 1.2878 |

| Support 2 | 1237.3 | 18.78 | 90.22 | 136 18/32 | 1.2841 |

| Support 3 | 1230.0 | 18.67 | 89.23 | 136 1/32 | 1.2798 |

| Contract | Dec Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 349.8 | 521.3 | 1003.08 | 344.63 | 32.34 |

| Resistance 2 | 348.3 | 520.9 | 1000.92 | 343.07 | 32.17 |

| Resistance 1 | 347.0 | 520.3 | 997.33 | 340.13 | 32.00 |

| Pivot | 345.5 | 519.9 | 995.17 | 338.57 | 31.83 |

| Support 1 | 344.3 | 519.3 | 991.6 | 335.6 | 31.7 |

| Support 2 | 342.8 | 518.9 | 989.42 | 334.07 | 31.49 |

| Support 3 | 341.5 | 518.3 | 985.83 | 331.13 | 31.32 |

| Date | 3:31pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| ThuSep 11 | 2:00am | EUR | German Final CPI m/m | 0.0% | 0.0% | ||||

| 2:45am | EUR | French CPI m/m | 0.4% | -0.3% | |||||

| 4:00am | EUR | ECB Monthly Bulletin | |||||||

| Tentative | EUR | Spanish HPI q/q | -0.5% | ||||||

| 8:30am | USD | Unemployment Claims | 306K | 302K | |||||

| 10:30am | USD | Natural Gas Storage | 84B | 79B | |||||

| 1:01pm | USD | 30-y Bond Auction | 3.22|2.6 | ||||||

| 2:00pm | USD | Federal Budget Balance | -132.8B | -94.6B | |||||

| 3:00pm | EUR | ECB President Draghi Speaks |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Friday June 8, 2012

Hello Traders,

Today our latest weekly newsletter is available. Please click here to view.

GOOD TRADING!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract Sept. 2012 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1340.33 | 2594.67 | 12616 | 788.43 | 83.01 |

| Resistance 2 | 1334.92 | 2582.33 | 12580 | 782.57 | 82.73 |

| Resistance 1 | 1323.83 | 2557.67 | 12510 | 771.03 | 82.52 |

| Pivot | 1318.42 | 2545.33 | 12474 | 765.17 | 82.24 |

| Support 1 | 1307.33 | 2520.67 | 12404 | 753.63 | 82.02 |

| Support 2 | 1301.92 | 2508.33 | 12368 | 747.77 | 81.74 |

| Support 3 | 1290.83 | 2483.67 | 12298 | 736.23 | 81.53 |

| Contract | Aug Gold | June Euro | July Crude Oil | Sept. Bonds | |

| Resistance 3 | 1674.1 | 1.2702 | 89.22 | 150 7/32 | |

| Resistance 2 | 1652.4 | 1.2665 | 88.13 | 149 20/32 | |

| Resistance 1 | 1622.8 | 1.2615 | 86.03 | 149 7/32 | |

| Pivot | 1601.1 | 1.2578 | 84.94 | 148 20/32 | |

| Support 1 | 1571.5 | 1.2528 | 82.84 | 148 7/32 | |

| Support 2 | 1549.8 | 1.2491 | 81.75 | 147 20/32 | |

| Support 3 | 1520.2 | 1.2441 | 79.65 | 147 7/32 |

| Contract | July Corn | July Wheat | July Beans | July Silver | |

| Resistance 3 | 616.0 | 654.0 | 1457.67 | 3068.2 | |

| Resistance 2 | 608.5 | 649.3 | 1443.33 | 3017.8 | |

| Resistance 1 | 601.3 | 645.5 | 1435.67 | 2936.7 | |

| Pivot | 593.8 | 640.8 | 1421.33 | 2886.3 | |

| Support 1 | 586.5 | 637.0 | 1413.7 | 2805.2 | |

| Support 2 | 579.0 | 632.3 | 1399.33 | 2754.8 | |

| Support 3 | 571.8 | 628.5 | 1391.67 | 2673.7 |

5. Economic Reports

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Economic Reports for Tuesday, December 6, 2011

1. Market Commentary

December 2011 to March 2012 Rollover Notice

Please note that Equity Indices products; TF, ES, NQ, EMD and YM roll on Thursday the 8th at 8:30 am Chicago time from the December 2011 contract to the March 2012 contract. The month code for March is ‘H’.

It is recommended that all new positions be placed in the March contract as of Thursday’s trade date.

Please close any open December Currencies positions by the close on Friday, December 16th.

Should you have any further questions please contact your futures broker.

On a different topic

The first video of a series of trading videos Cannon Trading is planning to produce is on the air!

This specific video shares a set up of overbought/oversold Algorithm and how you can set up one of our trading platforms to have automatic exits. Worth taking a few minutes of your time to watch.

If after you watch the video , you would like a trial of the custom studies/ charts or trading platform shown, please let me know.

If you have any specific topics you would like to see videos of, please email me.

http://www.youtube.com/watch?v=qhP-mtpTvE4

| Contract (Dec. 2011) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1294.70 | 2380.33 | 12485 | 779.63 |

| Resistance Level 2 | 1280.60 | 2355.67 | 12365 | 766.27 |

| Resistance Level 1 | 1272.30 | 2341.83 | 12295 | 756.73 |

| Pivot Point | 1258.20 | 2317.17 | 12175 | 743.37 |

| Support Level 1 | 1249.90 | 2303.33 | 12105 | 733.83 |

| Support Level 2 | 1235.80 | 2278.67 | 11985 | 720.47 |

| Support Level 3 | 1227.50 | 2264.83 | 11915 | 710.93 |

| Contract | Feb. Gold | Dec. Euro | Jan. Crude Oil | March. Bonds |

| Resistance Level 3 | 1774.0 | 1.3568 | 104.11 | 143 15/32 |

| Resistance Level 2 | 1759.7 | 1.3511 | 103.03 | 142 23/32 |

| Resistance Level 1 | 1752.7 | 1.3465 | 101.84 | 142 6/32 |

| Pivot Point | 1738.4 | 1.3408 | 100.76 | 141 14/32 |

| Support Level 1 | 1731.4 | 1.3362 | 99.57 | 140 29/32 |

| Support Level 2 | 1717.1 | 1.3305 | 98.49 | 140 5/32 |

| Support Level 3 | 1710.1 | 1.3259 | 97.30 | 139 20/32 |

French Final Non-Farm Payrolls

1:30am

Italian Bank Holiday

All Day

Minimum Bid Rate

7:45am

ECB Press Conference

8:30am

Unemployment Claims

8:30am

Wholesale Inventories

10:00am

Natural Gas Storage

10:30am

Treasury Currency Report

Tentative

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Economic Reports for Monday, November 14 2011

This week’s “Top 5 Commodities to Watch”, an article written by Cannon Trading’s senior broker John D. Thorpe, was featured on the Financial Edge section of Investopedia. John introduces Gold, Live Cattle, Corn, Sugar, and energies like Crude Oil, Unleaded Gas and Heating Oil as the commodities to watch over the next month. He then breaks down why investors should be paying attention, citing a variety of international price pressures, seasonal tendencies, and recent government data.

Also below is a daily chart of Canadian Dollar along with the trade reco I sent subscribers yesterday:

Long Dec. Canada

Long at 98.03 limit

stop 97.20

target 99.18

If you would like to be included on Swing Trade Alerts such as this one,

please send me an email with the following information:

1. Are you currently trading futures?

2. Charting software you use?

3. If you use sierra or ATcharts, please let me know the user name so I can enable you

4. Markets you currently trading?

| Contract (Dec. 2011) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1278.53 | 2435.00 | 12303 | 775.70 |

| Resistance Level 2 | 1271.52 | 2397.50 | 12217 | 759.90 |

| Resistance Level 1 | 1266.63 | 2375.00 | 12163 | 751.30 |

| Pivot Point | 1259.62 | 2337.50 | 12077 | 735.50 |

| Support Level 1 | 1254.73 | 2315.00 | 12023 | 726.90 |

| Support Level 2 | 1247.72 | 2277.50 | 11937 | 711.10 |

| Support Level 3 | 1242.83 | 2255.00 | 11883 | 702.50 |

| Contract | Dec. Gold | Dec. Euro | Nov. Crude Oil | Dec. Bonds |

| Resistance Level 3 | 1823.9 | 1.4056 | 101.54 | 142 1/32 |

| Resistance Level 2 | 1806.6 | 1.3926 | 100.37 | 141 21/32 |

| Resistance Level 1 | 1798.0 | 1.3839 | 99.69 | 141 4/32 |

| Pivot Point | 1780.7 | 1.3709 | 98.52 | 140 24/32 |

| Support Level 1 | 1772.1 | 1.3622 | 97.84 | 140 7/32 |

| Support Level 2 | 1754.8 | 1.3492 | 96.67 | 139 27/32 |

| Support Level 3 | 1746.2 | 1.3405 | 95.99 | 139 10/32 |

Industrial Production m/m

5:00am

Mortgage Delinquencies

14th – 18th

In this post:

1. Market Commentary

2. Support and Resistance Levels

3. Daily Mini Mini S&P 500 Futures Chart

HUGE upside move….

I mentioned last week that I expect a BIG move and provided two scenarios (please see blog from Oct. 21st)….If I could only know for sure which way the move will go….hindsight is 20/20

The big question is whats ahead for stock index futures ( mini SP500, Mini Dow, Mini NASDAQ 100, Mini Russell 2000 and the rest of the family…). It seems that right now, the main factor is Europe.

GOOD TRADING!

| Contract (Dec. 2011) | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell |

| Resistance 3 | 1320.77 | 2504.92 | 12745 | 825.87 |

| Resistance 2 | 1304.73 | 2456.83 | 12487 | 797.13 |

| Resistance 1 | 1292.87 | 2425.17 | 12323 | 780.17 |

| Pivot | 1276.83 | 2377.08 | 12065 | 751.43 |

| Support 1 | 1264.97 | 2345.42 | 11901 | 734.47 |

| Support 2 | 1248.93 | 2297.33 | 11643 | 705.73 |

| Support 3 | 1237.07 | 2265.67 | 11479 | 688.77 |

| Contract | Dec. Gold | Dec. Euro | Nov. Crude Oil | Dec. Bonds |

| Resistance 3 | 1792.2 | 1.4712 | 98.65 | 139 22/32 |

| Resistance 2 | 1770.8 | 1.4476 | 96.45 | 138 21/32 |

| Resistance 1 | 1757.4 | 1.4329 | 95.14 | 137 8/32 |

| Pivot | 1736.0 | 1.4093 | 92.94 | 136 7/32 |

| Support 1 | 1722.6 | 1.3946 | 91.63 | 134 26/32 |

| Support 2 | 1701.2 | 1.3710 | 89.43 | 133 25/32 |

| Support 3 | 1687.8 | 1.3563 | 88.12 | 132 12/32 |

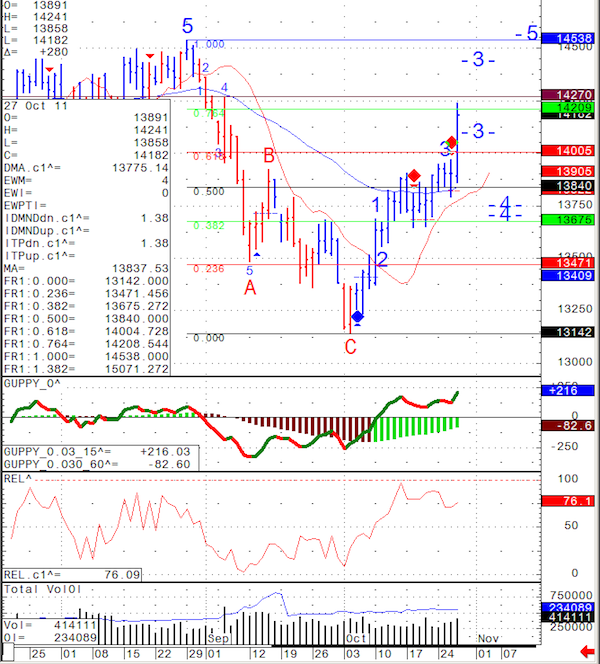

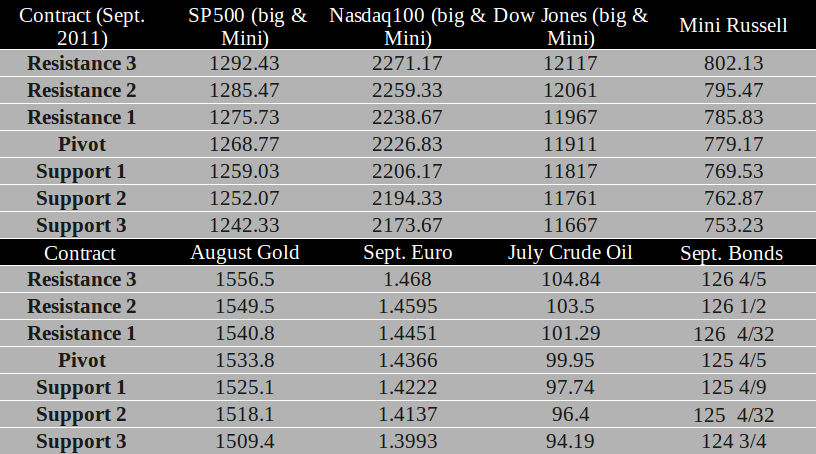

Below you will see a daily chart of the Euro Currency futures from today, Oct. 27th 2011.

The Euro currency crossed both the 50% Fibonacci retracement level as well as the 50 day moving average and as of now 142.70 is what standing in the way of this market to test previous highs around 145.38.

Support at 140 and 138.

I know many of you focus on day-trading stock index futures like the mini SP 500, so for now, it might be wise for you to keep an eye on the Euro currency as well for its correlation with the stock market.

Please be aware of the following margin requirement changes effective with the opening of business on Tuesday, September 27, 2011 and thereafter. The affected contracts are the US Dollar Index (DX), the Continuous Commodity Index (CI), and the RJ/ CRB Index (CR)

| Contract | New Margin | Change |

| US Dollar Index (DX) | 1,500 USD | +50 USD |

| Continuous Commodity Index (CI) | 16,000 USD | +8,000 USD |

| RJ/CRB Index (CR) | 700 USD | +200 USD |

In this post:

1. Market Commentary

2. Support and Resistance Levels

3. Daily Mini S&P 500 Futures Chart

4. Economic Reports

FRONT MONTH FOR EQUITIES IS DECEMBER. THE SEPTEMBER MINI SP ( AND OTHER MINIS WILL STOP TRADING TOMORROW MORNING!! ALSO CURRENCIES WILL ROLLOVER TO DECEMBER TOMORROW. PAY ATTENTION AS DELIVERIES AND MISTAKES CAN BE QUITE COSTLY.

SYMBOL FOR DECEMBER IS Z

As far as price direction, I am still not sure how to attack this market (outside of quick day-trades which I review live). We are against some resistance levels on the daily chart and I am curious to see the market reaction as the September contract is few hours from expiration.

When in doubt, it’s best to stay out, even more so in trading. I think that many successful traders will agree that the trades you DON’T take are probably more important than the ones you do.

GOOD TRADING!

| Contract (Sept. 2011) | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell |

| Resistance 3 | 1233.67 | 2348.50 | 11720 | 735.40 |

| Resistance 2 | 1219.58 | 2317.50 | 11550 | 723.50 |

| Resistance 1 | 1212.17 | 2301.25 | 11463 | 717.10 |

| Pivot | 1198.08 | 2270.25 | 11293 | 705.20 |

| Support 1 | 1190.67 | 2254.00 | 11206 | 698.80 |

| Support 2 | 1176.58 | 2223.00 | 11036 | 686.90 |

| Support 3 | 1169.17 | 2206.75 | 10949 | 680.50 |

| Contract | Dec. Gold | Sept. Euro | Oct. Crude Oil | Dec. Bonds |

| Resistance 3 | 1834.9 | 1.4221 | 92.40 | 141 23/32 |

| Resistance 2 | 1819.9 | 1.4079 | 91.27 | 141 |

| Resistance 1 | 1804.9 | 1.3986 | 90.26 | 140 4/32 |

| Pivot | 1789.9 | 1.3844 | 89.13 | 139 13/32 |

| Support 1 | 1774.9 | 1.3751 | 88.12 | 138 17/32 |

| Support 2 | 1759.9 | 1.3609 | 86.99 | 137 26/32 |

| Support 3 | 1744.9 | 1.3516 | 85.98 | 136 30/32 |

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

TIC Long-Term Purchases

9:00am USD

Prelim UoM Consumer Sentiment

9:55am USD

Prelim UoM Inflation Expectations

9:55am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

Cannon Trading / E-Futures.com

Please note that we are now trading September indices as well as September currencies.

Make sure you DO NOT HOLD ANY JUNE CURRENCIES in your account.

Should you have any further questions please contact your futures broker.

Daily chart of the DOW JONES CASH INDEX for your review below.

We have been trading lower on good volume and for now the trend points lower. Wishing you a great weekend and good trading week to come.

GOOD TRADING!

FOMC Member Fisher Speaks

7:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Cannon Trading / E-Futures.com

Wishing all of you a great weekend and successful trading month in May.

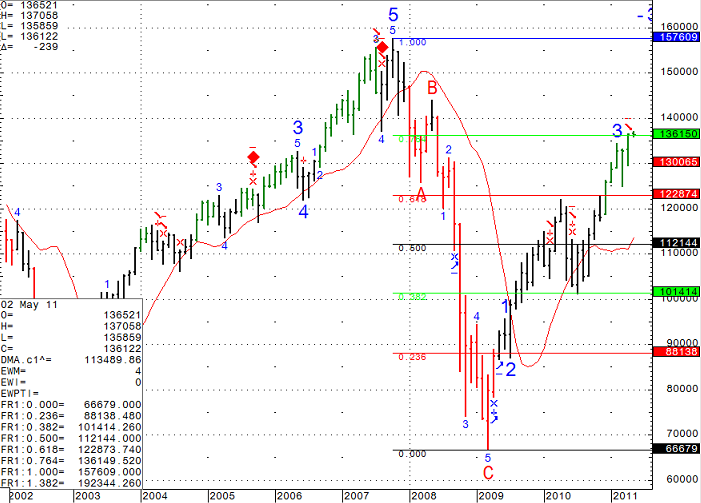

Since it is a new month, I thought it would be appropriate to share a monthly chart of the SP500 CASH INDEX for much longer term prospective…..

GOOD TRADING!

Factory Orders m/m

10:00am USD

Total Vehicle Sales

All Day USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Cannon Trading / E-Futures.com

We are NOW TRADING JUNE FOR INDICES< EMINIS and CURRENCIES!!!

Daily chart of ES below. Todays sell off stopped almost exactly on the 50% retracment level from lows from Nov. 16th 2010 to the highs we made Feb 21st this year

Building Permits

8:30am USD

PPI m/m

8:30am USD

Core PPI m/m

8:30am USD

Current Account

8:30am USD

Housing Starts

8:30pm USD

Crude Oil Inventories

10:30am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Join us for a Webinar on January 5th

Space is limited.

Reserve your Webinar seat now at:

https://www2.gotomeeting.com/register/834358098

This Wednesday, January 5th , Ilan Levy-Mayer, Vice President of Cannon Trading and President / AP of LEVEX Capital Management Inc., a registered commodity trading advisor, will hold a live educational day trading webinar starting at 8:15 AM central time.

During the webinar, Ilan will:

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Title: Live Day-Trading webinar with real time mini SP, Crude Oil and Euro Currency set ups

Date: Wednesday, January 5, 2011

Time: 6:15 AM – 10:00 AM PST

After registering you will receive a confirmation email containing information about joining the Webinar.

System Requirements

PC-based attendees

Required: Windows® 7, Vista, XP or 2003 Server

GOOD TRADING!

Trading Levels

Economics Report Source: http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

Tuesday, January 4, 2011

Factory Orders m/m

10:00am USD

Total Vehicle Sales

All Day USD

FOMC Meeting Minutes

2:00pm USD

Treasury Currency Report

Tentative USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Please note that Equity Indices products; TF, ES, NQ, EMD and YM roll on Thursday the 9th at 8:30 am Chicago time from the December 2010 contract to the March 2011 contract. The month code for March is ‘H1’.

It is recommended that all new positions be placed in the March contract as of Thursday’s trade date.

Please close any open December Currencies positions by the close on Friday the 10th.

Should you have any further questions please contact your broker.

View the Rest of Our Weekly Futures Market Newsletter at:

**************************************************************

https://www.cannontrading.com/community/newsletter/

**************************************************************

GOOD TRADING!

Trading Levels

Economics Report Source: http://www.forexfactory.com/calendar.php

Thursday, December 9th, 2010 — All reports are EST time

Unemployment Claims

8:30am USD

Wholesale Inventories m/m

10:00am USD

Natural Gas Storage

10:30am USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

I wanted to share some of today’s activity we had in the daily webinar service I hold. The “webinar” is a service I offer, where I share mostly the mini SP chart but also other markets like Euro currency, Crude Oil and Mini Russell.

In the webinar I display my charts, trading indicators, trading algorithm, trade management philosophy, risk management and more.

Some days i also provide live trading examples using my demo, like I did today.

Below you will see a segment from today’s webinar where the DIAMOND algorithm provided us with more than several trade set ups for 2 mini SP points each time.

For free trial and more information, visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals

( NO REPEAT TRIALS )

SP 500 Day Trading

DISCLAIMER:

Futures trading involves substantial risk of loss and is not suitable for all investors.

The past performance of any trading system or methodology is not necessarily indicative of future results.

Rule 4.41 – Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

FUTURES TRADING LEVELS!

FUTURES TRADING LEVELS

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Thursday, September 30th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

Weekly Bill Settlement

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!