Get Real Time updates and more on our private FB group!

This weeks potential Market Movers

by John Thorpe, Senior Broker

Happy Monday all! I hope everyone had a safe and memorable 4th of July week. We are back to a full trading week. Here are a few of the report highlights traders should pay attention to beginning on Wednesday. A rather light first two trading days with only two FRB board members speaking. John Williams today at 1 pm CDT and Thomas Barkin on Tuesday at 11:30 am CDT on Friday we have Raphael Bostic, 7:45 am CDT.

Recession talk should be the feature as the market will be paying attention to any mention of going off the current script which has been “watching the data points, “we have the tools” to determine policy”. Speaking of data points

Wednesday will include the market volatility energizer :

CPI report, The CPI published by the Bureau of Labor Statistics will be early and pre cash market open for the equities. @7:30 am CDT. Consensus for the CPI is an 8.8 % inflation rate as measured by consumer prices with a 1.1% increase from the May reading( this is the June CPI reading) Two additional data points the FRB is interested in are released

Thursday morning simultaneously @7:30 am CDT,

Jobless claims and Producer Price Index (PPI) Weekly unemployment claims are expected to roll in around 234,000 , slightly above the moving average of 232,500 weekly claims and the PPI expectation is an increase of .8% m/m, with an annual increased rate of 10.4 % When we get to Friday the market will need to digest Retail Sales at 7:30 am CDT and

Industrial production 45 Minutes later at 8:15 am CDT The energy markets will almost always be impacted by the schedule of economic report and also have their own , industry specific reports.

Wednesday @ 8:30 am CDT the EIA Petroleum status report Highlights weekly changes in supply and demand for crude and it’s cracked products while on Thursday at 8:30 am CDT the

EIA Nat Gas report will reveal the supply and demand nature of the

Natural Gas sector of the energy market.

CannonTrading has a registered professional staff to talk about any and all of these reports and the potential impact on your positions in your account. If you are new to

Cannontrading, please use us a your first stop resource for order management, risk management as well as fundamental and technical viewpoints. Good trading! plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

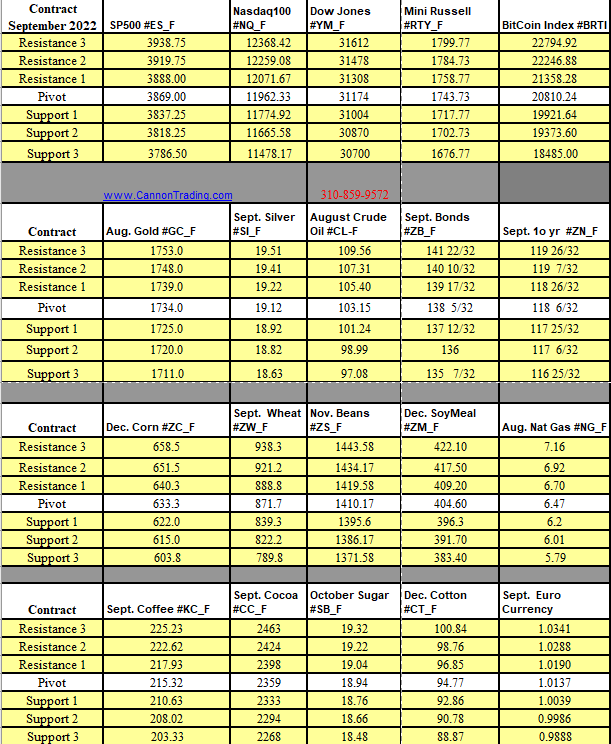

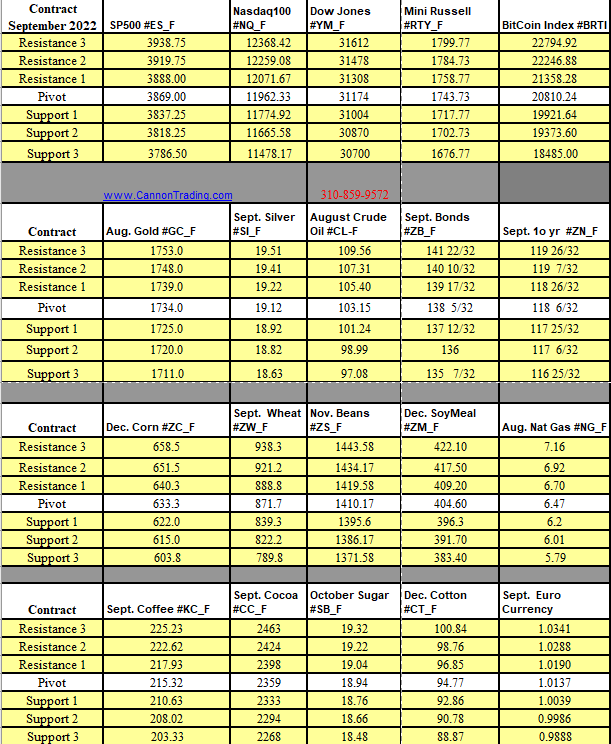

Futures Trading Levels

07-12-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.