Weekly Newsletters, Futures Trading Tips & Insight, Commodity Trading Educational Resources & Much More.

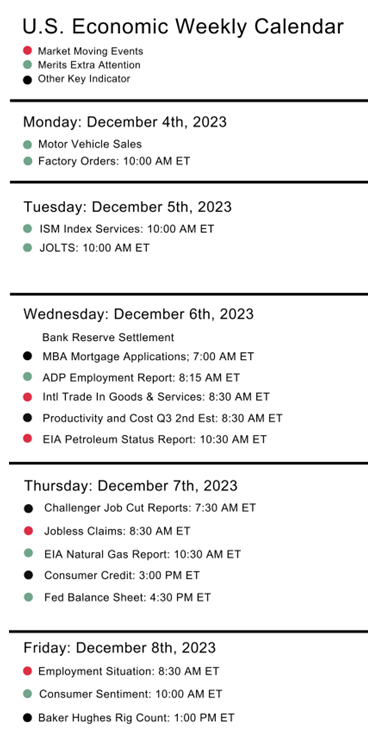

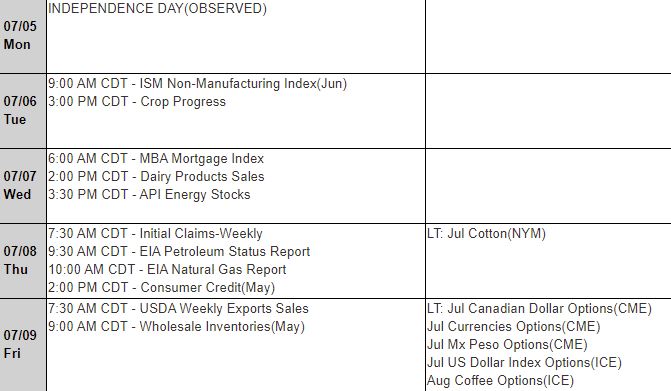

Important Notices – Next Week Highlights:

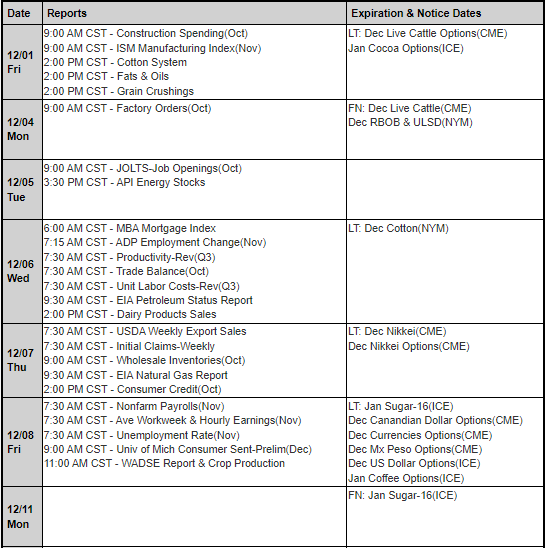

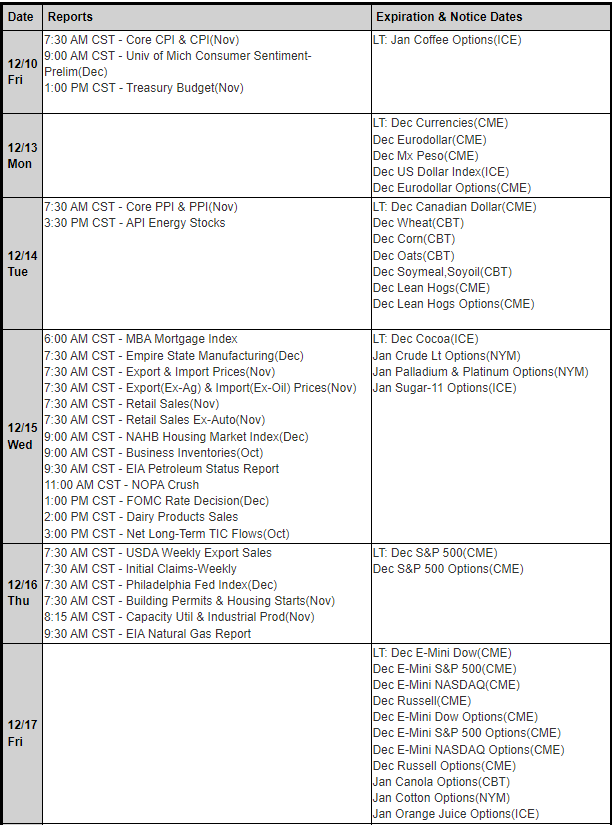

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

CPI Tomorrow! The CPI will be critical to the inflation outlook for Fed policymakers.

Previous CPI reports have created velocity logic events in the stock indices at the CME.

Please read more details about velocity logic and price banding HERE.

The above reports will Bookend the FOMC minutes release @1pm CT on tomorrow.

My previous notes suggest to do the following if you are an index day trader:

Get out before the 730 AM CPI.

Wait for the smoke to clear.

Resume trading.

Look at market volume and behavior after 9:30 AM Central time to decide if and how to resume trading.

I usually stop trading and resume after 1 PM once FOMC minutes are out.

AGAIN…This is just my PERSONAL preferences…

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

4 MIN READ

US TREASURY

By CME Group

05 FEB 2024

Although the Federal Reserve (the Fed) has been on pause when it comes to interest rate hikes since the summer of 2023, economic uncertainty still looms. The Fed is reducing the size of its balance sheet by decreasing holdings of Treasury and mortgage backed securities, and it is ambiguous on when the first rate cuts will take place.

Given the uncertain economic environment, it is as important as ever to manage Treasury yield curve risk.

The United States Treasury market stands as one of the largest and most crucial financial markets globally, playing a pivotal role in the functioning of the global economy. The magnitude of the U.S. Treasury market reflects its significance as a safe haven for investors, central banks and institutions seeking low-risk assets. Treasury maturities across the yield serve as an important reference point for risk management across various markets.

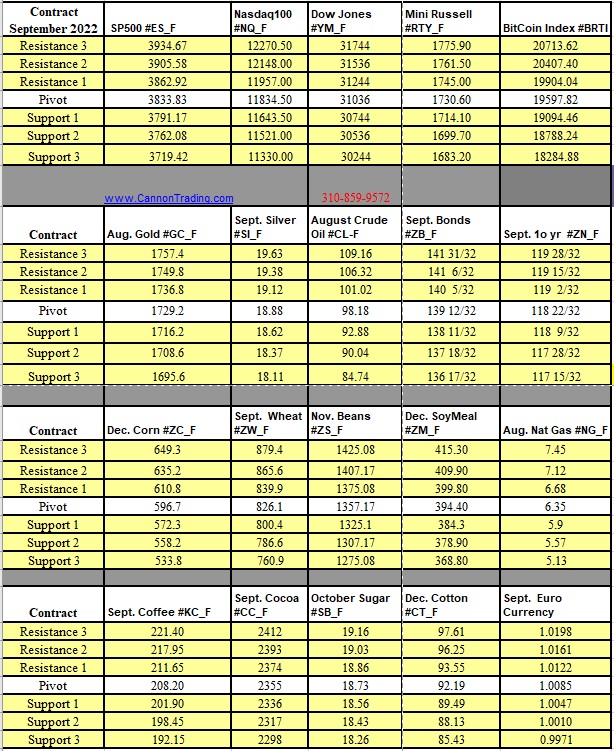

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our Private Facebook group

Subscribe to our YouTube Channel

By John Thorpe, Senior Broker

March (H24) Interest rate products, U.S. T-Bond Futures ZB, Ultra T-Bond Futures UB, 10-Year T-Note Futures ZN, 5-Year T-Note Futures ZF, 2-Year T-Note Futures ZT. are now front month

Earnings watch, Tuesday 12-5 Toll Brothers Builders NYSE (TOL), Thursday 12-7 chipmaker Broadcom NYSE (AVCO)

Reports a variety, Main Focus Friday, NFP 7:30am, WASDE 10am and 1st day of Hanukkah all times CST

The Role of Expectations for the NFP report

Expectations are typically baked into future prices. Rarely can a more direct correlation to this reality be found than in our futures markets as they are affected by expectations of NFP .

There are a number of indicators the Federal Reserve Board and investors watch prior to the NFP release, these all become reflected in asset prices and if there is a surprise NFP release, the market can adjust violently to the new perception of the health of the economy and therefore the affect on future Interest rate decisions. For instance, The Labor Department’s JOLTS report tracks monthly change in job openings and offers rates on hiring and quits. The reporting period lags other employment data including the employment situation report. Then there is the ADP report The national employment report from Automated Data Processing Inc. and is computed from ADP payroll data and offers advance indications on the U.S. private workforce. Are to name but two. Contact your broker for more detail.

This Friday @ 7:30 a.m. CST the BLS will release it’s monthly employment update called the NFP which stands for Non-Farm Payroll and this specific economic event is always released on the first Friday of every month. Rarely, the NFP figure may be postponed to the second Friday if the first Friday is the first of the month or a public holiday. This Friday is one of those rare exceptions. The NFP figure is a report which shows how many individuals are employed within the US but excludes specific industries such as agriculture.

Why is it important to the Dollar?

When individuals wish to invest in stocks, bonds and a currency, they prefer currencies backed by a strong economy with a robust employment sector. In addition, if employment is high, the Federal Reserve is also likely to increase interest rates or keep them high; again, this can support demand for the Dollar.

A higher-than-expected NFP figure is positive for the Dollar.

A lower-than-expected NFP figure is negative for the Dollar. The inverse would be true for the Euro currency

Why is it important to the US Stocks?

ESH24,NQH24,RTYH24,YMH24 + micros

The NFP figure can affect the US Stock Market in 2 ways. A higher-than-expected NFP figure can indicate a resilient economy and higher consumer demand. As a result, companies perform better; earnings are higher, as is investor confidence. This can cause the stock market to rise. But be wary as it can also trigger current belief by the FED that interest rate increases will be necessary to cool the employment trend.

On the other hand, if the Federal Reserve is increasing interest rates, positive employment figures may support a further increase. Interest rates can significantly pressure the stock market. A lower than expected figure during the current environment may rally stocks as the FED would NOT need to raise rates further yet as they wait and see if their tight money policy is being effective

Why is it important to the Gold?

GGCG24, GCG24 + micros

The price of Gold is largely inversely correlated with the cost of the Dollar. As a result, the NFP can influence the price of gold. Whether the horse leads the cart or the cart leads the horse is for you to determine as you lock those contracts onto your trading screens.

Why is it important to Interest Rates?

UBH24,ZBH24,ZTH24,FFF24 + minis

If the NFP is stronger than expectations Bond prices will go lower as the concern of “higher for Longer” persists

If the NFP is weaker than expected Bond Prices will go higher as anticipation for rate cuts sooner wash over the interest rate markets

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12-05-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

.

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

We look forward to having you join the CME tomorrow for Black-Scholes workshop.

View last week’s session here to see what kind of discussions you can expect.

Please read the below information for the session on November 15 and add the event to your calendar below.

Joining Instructions:

To join the online event, please use the following link:

Webinar number: 248 142 79084

Webinar password: d2GPM8kZc42 (32476859 from phones and video systems)

Helpful Tips:

Recording Disclaimer:

This online event will be recorded for the purposes of archived viewing for attendees unable to attend the live session. By participating in this online event, you are considered to have consented to the recording. All video and audio communications must remain professional and relevant to the topic and purpose of the online event. Personal views or opinions expressed during the online event are those of the participants and may not necessarily reflect the official policy or position of CME Group.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-15-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

General:

We have a new futures contract. It started trading on Monday. This is the Micro Henry Hub Natural Gas futures contract and corresponding options.

To quote directly from the CME Group web site, “The introduction of Micro Henry Hub Natural Gas futures and options responds directly to customer demand for a smaller, more precise instrument for managing natural gas price exposure. At one-tenth the size of the benchmark Henry Hub (NG) contract, Micro Henry Hub Natural Gas futures and options offer more granularity and smaller margin requirements with the same robust transparency and price discovery of the larger Henry Hub contracts.”

Follow the link below to the contract’s full contract specifications on the CME Group web site:

https://www.cmegroup.com/markets/energy/natural-gas/micro-henry-hub-natural-gas.contractSpecs.html

Heads up: most FCM’s / clearing firms, including the five FCM’s Cannon Trading Co. partners with, will monitor a new futures contract for sufficient liquidity before making it available to its clients. Give Cannon Trading a call to find out the availability of the contract.

Energy:

Incidentally, natural gas (basis Dec.) dropped ±50 cents (a ±$5,000 move) over the last six trading sessions to ±$3.10 /mmBtu. down to new 2-year lows on forecasts for above-normal temps. across the U.S. for the next fifteen days and continental U.S. production remaining near all-time highs,”

Financials:

Stock index futures are struggling today to extend their longest winning streak in two years – clocking seven straight daily gains – as we approach the close of trading. At this typing, the E-mini S&P 500 is trading just a few ticks either side of unchanged, while the E-mini Dow Jones and E-mini Nasdaq are slightly off.

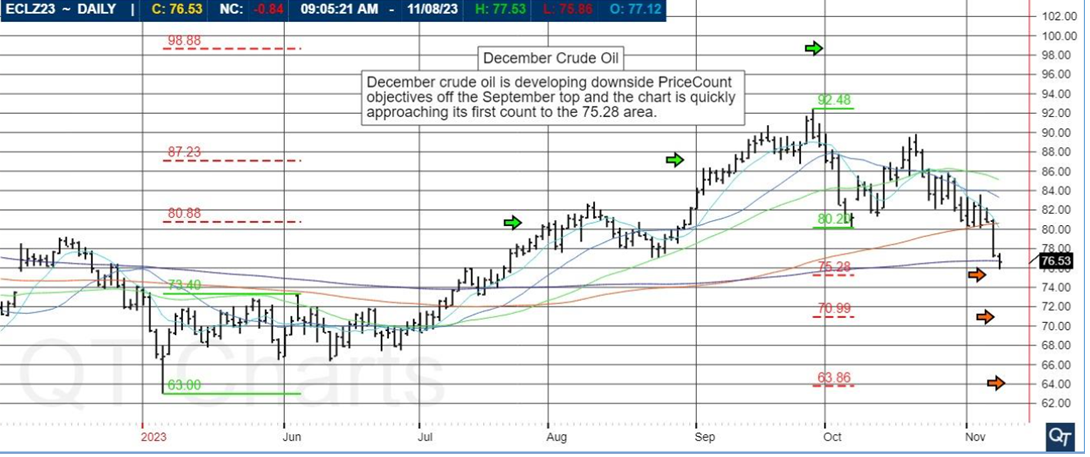

More energy:

Crude oil extended its more than 2-week sell-off to its lowest level in over three months. From an intraday high of $89.85 per barrel on Oct. 20, the front month traded through $75.00 per barrel this morning – a ±$15.00 per barrel / $15,000 per contract move.

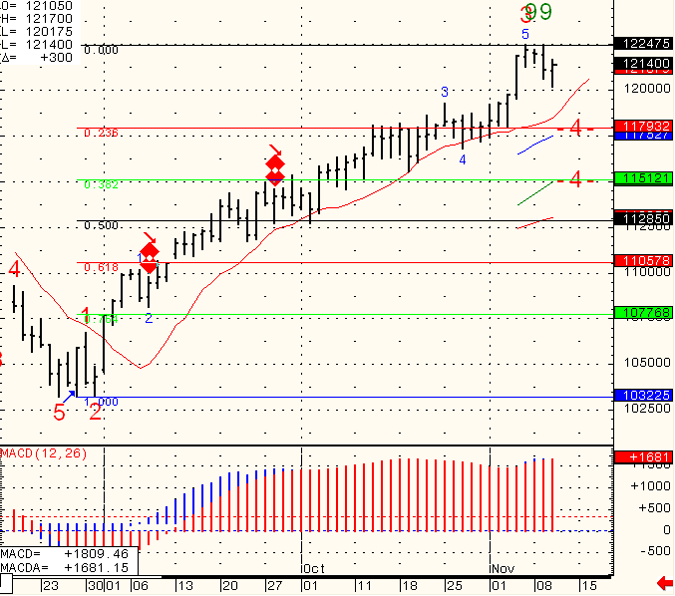

DAILY CHART BELOW

News pushing prices south include global demand worries, record U.S. production and ebbing supply concerns surrounding the Gaza conflict.

Given its ability to create a ripple effect, the ±15% price decline dragged U.S. pump prices down to levels not seen since March. It has also helped rein in inflation expectations and worrisome bond yields.

While this paints a picture that fears are subsiding that a wider conflict could be emerging in the Middle East and disrupt supplies, traders should remain on high alert for signs to the contrary.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-09-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By John Thorpe, Senior Broker

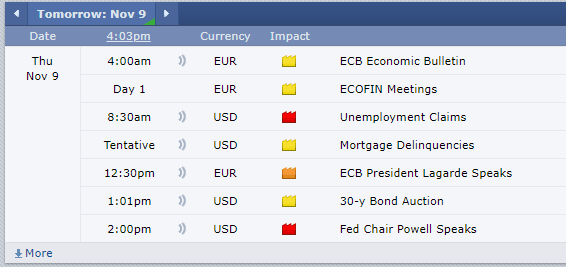

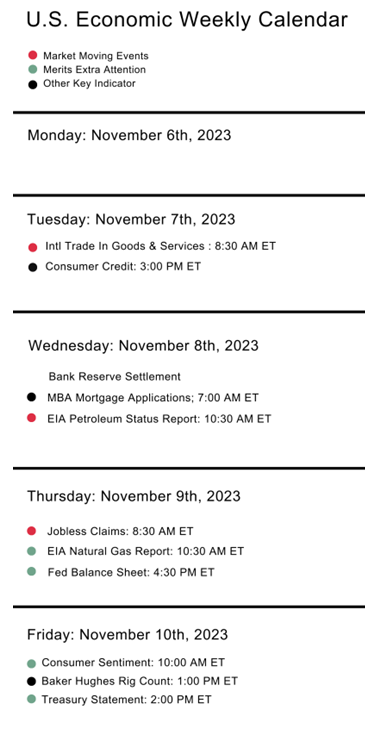

Earnings, Govt Reports, Powell Speech and any geopolitical wrangling’s, events or additional crises always have the potential to move markets away from their trading ranges.

First up are the earnings reports, This week, due to the fact we don’t have any big names ( FAANG) reporting. Those 5 stocks individually can swing the markets violently on their respective earnings days with any surprises.

Instead, this week, we have 1400 plus earnings reports out on some names you would certainly be familiar with like Disney. The market is looking this week at sector earnings since there is no large cap phenom reporting the week.

IF the biomedical group stumbles with earnings this week, or the retail sector shows signs of weakening, construction sector, finance, the market will be looking at the health of sectors this week as earnings are pumped out before the open, during and after the trading sessions. So don’t expect sharp movements in the stock index prices this week from Earnings, but you can expect markets turning over in a more measured manner as reports flow.

Governmental Reports: yes we have a few but they tend to by a bit more fringe than say NFP or CPI, we do have a Jobless claims number this week on Thursday @ 7:30 CST.

Claims for November 4 week are expected @ 220K vs 217K the week prior. If you are looking for strong undercurrents in the markets you may find that Wednesday and Thursday will be your best bets. FRB Chair Powell will be speaking both days at separate events, Wednesday very early @8:15 CST followed by a later 1PM CST Thursday talk.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-07-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Read more about futures trading platforms offered by Cannon Trading Company here.

Futures trading platforms have evolved significantly over the years, offering traders a plethora of options to cater to their specific needs. Cannon Trading, a prominent brokerage firm, recognizes the importance of providing a wide array of futures trading platforms to its clients. In this comprehensive overview, we will delve into the various futures trading platforms available at Cannon Trading, offering traders a comprehensive understanding of their options.

Sierra Charts

Sierra Charts is a renowned name in the futures trading industry. It is highly regarded for its advanced technical analysis tools, customizable charting options, and extensive historical data. Traders can execute orders, perform technical analysis, and backtest strategies efficiently with Sierra Charts.

Cannon Pro (Mac Compatible)

Cannon Pro is designed for Mac users, ensuring that traders using Apple devices have access to a powerful trading platform. It offers real-time market data, advanced charting tools, and order execution capabilities.

Volumetrica Trading

Volumetrica Trading is a specialized platform for traders focused on order flow and volume analysis. It provides detailed insights into market dynamics, helping traders make informed decisions based on order book data.

MultiCharts

MultiCharts is a popular trading platform known for its extensive back testing and automated trading capabilities. It supports multiple data feeds and brokers, making it a versatile choice for traders.

Tradingview

Tradingview is a web-based platform that offers advanced charting and social networking features. Traders can share ideas, collaborate with others, and access a wide range of technical indicators and drawing tools.

Overcharts

Overcharts is a user-friendly platform known for its intuitive design and advanced charting capabilities. It provides access to various data sources and features seamless order execution.

Bookmap

Bookmap is a unique platform that visualizes order book data in a clear and insightful manner. Traders can analyze market liquidity and order flow to make precise trading decisions.

MarketDelta

MarketDelta is designed for traders who focus on order flow analysis. It offers tools to track market profile, volume, and Delta, providing valuable insights into market sentiment.

MotiveWave (Mac Compatible)

MotiveWave is a Mac-compatible trading platform known for its advanced technical analysis tools, Elliott Wave analysis, and options trading capabilities.

Trade Navigator

Trade Navigator is a comprehensive platform that offers real-time data, advanced charting, and customizable indicators. It is suitable for both novice and experienced traders.

MT5 (MetaTrader 5)

MetaTrader 5, commonly known as MT5, is a versatile platform that supports not only futures trading but also forex and CFDs. It features automated trading options, customizable charts, and a wide range of technical indicators.

Additional Trading Platforms

Cannon Trading also provides access to several other trading platforms, each with its unique features and capabilities. These platforms include API (Application Programming Interface), Quantower, E-Futures, FireTip (Mac Compatible), CQG Trader, RTrader/Rithmic, CTS T4 (Future Spreads), AgenaTrader, eSignal, Ensign Software, QT Market Center, BarChart Trader, iSystems Automated Trading Platform, Investor/RT, Corn Futures, and Nasdaq Futures.

Futures & Options Trading

Cannon Trading’s platform offerings extend beyond futures trading to include options trading as well. Traders can explore a variety of options strategies and execute trades seamlessly on these platforms.

Cannon Trading’s commitment to offering a diverse range of futures trading platforms reflects its dedication to meeting the diverse needs of traders. Whether you are an advanced trader seeking in-depth technical analysis tools or a beginner looking for a user-friendly platform, Cannon Trading has a solution for you. The platforms mentioned above cover a wide spectrum of features, catering to traders with various trading styles and preferences. By providing access to these platforms, Cannon Trading empowers traders to make informed decisions and navigate the complex world of futures trading with confidence.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Read more about futures trading with Cannon Trading Company here.

In the realm of futures and commodity trading, having a reputable and reliable broker is paramount. Traders seek brokers who embody transparency, possess extensive market knowledge, execute trades swiftly, and maintain a strong rapport with regulators. Additionally, the ability to promptly address client concerns and offer support when needed is crucial. One such brokerage that epitomizes these qualities is Cannon Trading. With a rich history and a stellar TrustPilot rating of 4.9 out of 5 stars, Cannon Trading has gained widespread acclaim within the trading community. In this in-depth exploration, we will uncover the reasons why Cannon Trading is a top choice for futures and commodity traders.

Understanding Futures and Commodity Trading Brokers

Futures and commodity trading brokers act as intermediaries between traders and the futures or commodities markets. They provide the essential platform, tools, and expertise necessary for traders to engage in buying and selling futures contracts or physical commodities. These brokers play a crucial role in facilitating smooth and efficient trading, guiding traders with market insights, and ensuring compliance with regulatory requirements.

The Importance of Transparency, Knowledge, and Quick Executions

Transparency in operations is fundamental for any trading broker. It involves providing clear and accurate information regarding fees, order execution processes, and potential risks associated with trading. Knowledge, on the other hand, pertains to the broker’s understanding of the markets, enabling them to guide traders effectively. Swift order executions are vital for traders to capitalize on market opportunities in real-time.

Regulatory Standing and Compliance

Brokers need to adhere to stringent regulatory guidelines set by organizations like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the United States. Compliance with these regulations ensures that brokers maintain high standards of professionalism and fairness in their dealings.

Cannon Trading: A Trusted Name in Futures and Commodity Trading

Established in 1988, Cannon Trading has solidified its position as a trusted brokerage in the futures and commodity trading arena. The firm’s commitment to transparency, extensive market knowledge, swift executions, and regulatory compliance sets it apart. The endorsement of its services by the trading community, evident in its impressive TrustPilot rating of 4.9 out of 5 stars, underscores its excellence.

The TrustPilot 4.9 out of 5 Star Ranking: A Testimony to Excellence

TrustPilot is a platform that allows customers to provide genuine feedback and reviews of businesses. For prospective clients seeking a reliable futures or commodity trading broker, the TrustPilot rating offers valuable insights. Cannon Trading’s remarkable 4.9 out of 5-star rating is a result of the following factors:

Why Choose Cannon Trading for Futures and Commodity Trading

Cannon Trading’s reputation for transparency, market knowledge, swift executions, and regulatory compliance positions it as a top choice for futures and commodity trading. Here are some compelling reasons to choose Cannon Trading as your trading partner:

In the ever-evolving world of futures and commodity trading, finding a brokerage that aligns with your values and trading needs is crucial. Cannon Trading, with its long-standing legacy, unwavering commitment to transparency, extensive market knowledge, and stellar TrustPilot rating, is an excellent choice. As a trader, your journey in the futures and commodities markets can be greatly enhanced with a trusted partner like Cannon Trading by your side, empowering you to make informed decisions and navigate the markets with confidence.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

By John Thorpe, Senior Broker

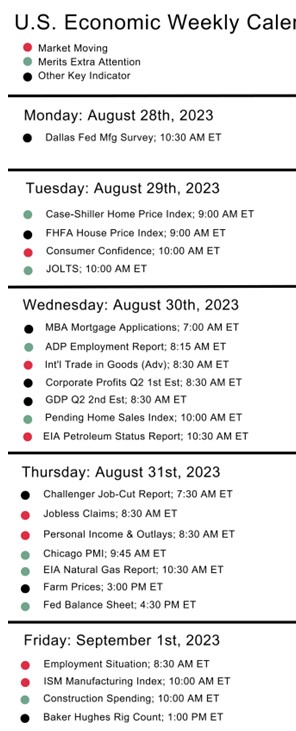

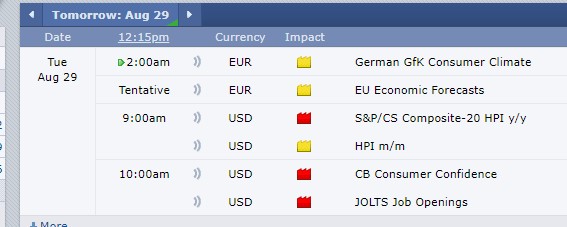

On the earnings front two additional AI equity plays report this week, both after their respective close. Oracle today is expecting a $1.14 per share increase (10.7% YoY) and Adobe on Thursday. Wallstreet analysts are expecting ADBE to report +3.98 per share (+17.0% YoY) These two earning factors could create directional change in the indices on the days following the releases. The Government reports being released this week could alter the course of the Fed’s short term interest rate decision making come September 20th.

The Fed has publicly stated in recent interviews and statements that the current string of rate increases used to assist in curbing inflation may be drawing to a close however, they will wait and see what the upcoming inflation numbers reveal. If the next two CPI reports show inflation running hot, especially in the service and shelter categories that the Fed is watching closely, then the chance of a November hike could increase.

The Fed Funds Futures (ZQU23) Market is assigning a 93 % probability that the Fed will not raise during the Sep 20 meeting. This viewpoint could change significantly after several important reports will be released this week. Circle your calendars for Wednesday the 13th @ 7:30 A.M. CDT for CP and Thursday the 14th @7:30 A.M. CDT for 3 numbers: PPI final, Retail sales and Jobless claims. Finally on Friday @8:15 A.M. CDT for Industrial Production.

Expectations for CPI from Econoday.com are: Core prices in August are expected to hold steady and modest at a monthly increase of 0.2 percent to match July’s as-expected 0.2 percent increase. Yet overall prices, reflecting food and energy, are expected to rise 0.6 percent after July’s 0.2 percent increase which was also as expected. Annual rates, which in July were 3.2 percent overall and 4.7 percent for the core, are expected at 3.6 and 4.4 percent respectively.

What is CPI (Consumer Price Index)? is a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses.

Scope: Urban Consumers How the data is obtained: Survey of Business, Survey of Households. Sample sizes : CPI Survey collects about 94,000 prices and 8,000 rental housing unit quotes each month.

If you would like to drill down further, you can find a few links provided by the Bureau of Labor Statistics to CPI Fact sheets: Consumer Price Index Factsheets : U.S. Bureau of Labor Statistics (bls.gov)

Volume in the September contracts will begin to drop off until their expiration Friday, September 15th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any September futures contracts through 8:30 A.M., Central Time on Friday, Sept. 15th, they will be offset with the cash settlement price, as set by the exchange.

Monday, September 18th is Last Trading Day for September currency futures. It is of the utmost importance for currency traders to exit all September futures contracts by Friday, September 15th and to start trading the December futures. Currency futures are DELIVERABLE contracts.

The month code for December is ‘Z.’ Please consider carefully how you place orders when changing over.

Watch the video below on how to rollover your market depth and charts!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-12-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Find out more about futures trading with Cannon Trading Company here.

In the world of finance, futures trading is a powerful tool for investors to speculate on the future price of various assets, including commodities, currencies, and financial indices. In recent years, with the advancement of technology, online futures trading has gained immense popularity among traders and investors. One company that stands out in this realm is Cannon Trading Company, offering a range of features that set it apart in the online futures trading industry. With multiple trading platforms, superb customer support, and a solid reputation on TrustPilot, Cannon Online Futures Trading has become a go-to choice for futures traders seeking reliability and efficiency.

Understanding Online Futures Trading

Futures trading is a financial strategy that involves speculating on the future price of an asset, such as gold, oil, or stock market indices. It allows traders to enter into contracts obligating them to buy or sell the asset at a predetermined price on a specified future date. This provides an opportunity to profit from price movements, whether they are rising or falling.

Online futures trading, as the name suggests, involves executing these transactions through online platforms provided by brokerage firms. This method offers numerous advantages, including accessibility, convenience, and the ability to execute trades in real-time. Traders can monitor market conditions, analyze charts, and execute orders from the comfort of their homes or offices.

The Importance of Choosing the Right Futures Broker

Choosing the right futures broker is a crucial step for any trader or investor. The brokerage you select can significantly impact your trading experience, affecting everything from order execution speed to customer support. Cannon Trading Company is a brokerage firm that has gained recognition for its exceptional services and features, making it a top choice for those engaged in online futures trading.

Cannon Trading Company: A Game-Changer in Online Futures Trading

One of the standout features of Cannon Online Futures Trading is its offering of multiple trading platforms. These platforms cater to a wide range of traders, from beginners to experienced professionals, ensuring that everyone can find a solution that suits their needs.

Having access to multiple platforms means that traders can select the one that aligns best with their trading style and preferences. This flexibility is invaluable in the dynamic world of futures trading.

In the realm of online futures trading, where time can be of the essence, having access to responsive customer support is critical. Cannon Trading Company excels in this regard. Their commitment to providing top-notch support has earned them the highest ratings on TrustPilot, a testament to their dedication to client satisfaction.

When a futures trader needs assistance or has questions about their trades, they don’t want to wait endlessly for the phone to ring or for an email response. Cannon Trading understands this and ensures that their customers have quick and easy access to knowledgeable professionals who can address their concerns promptly.

TrustPilot is a widely recognized platform for customer reviews and ratings. A high TrustPilot rating indicates a company’s commitment to customer satisfaction and trustworthiness. Cannon Trading Company’s status as the highest-rated futures brokerage on TrustPilot speaks volumes about the quality of service and support they provide to their clients.

With numerous positive reviews and testimonials from satisfied customers, Cannon Trading has demonstrated its ability to consistently meet the expectations of online futures traders. This solid reputation instills confidence in traders and investors alike, making Cannon a preferred choice in the highly competitive futures trading industry.

Why Online Futures Trading?

Online futures trading offers several advantages over traditional methods of trading futures contracts. Let’s explore some of these benefits:

Online futures trading has become a cornerstone of modern finance, empowering traders and investors with the ability to speculate on a wide range of assets. Cannon Trading Company has emerged as a leader in this field, offering a variety of features that cater to the diverse needs of traders. With multiple trading platforms, exceptional customer support, and a sterling reputation on TrustPilot, Cannon Online Futures Trading sets a high standard in the industry.

For those seeking to enter the exciting world of futures trading or looking for a reliable brokerage partner, Cannon Trading Company’s commitment to customer satisfaction and its dedication to providing cutting-edge trading tools make it a compelling choice. As technology continues to shape the financial industry, Cannon Trading stands at the forefront, ready to empower traders to make informed decisions and navigate the complex world of futures trading with confidence.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

by John Thorpe, Senior Broker

Earnings and NFP will be the markets focus.

The Earnings tail this week will include SalesForce on Wednesday and Dell, a dividend pick for tech stocks, on Thursday. LuLulemon reports on Thursday.

Friday the Big news will not come from the earnings front It is that time of the month again, time for NFP. Similar to the JOLTs release earlier in the week, watching how NFP comes out could have a strong impact on the market. The last two reports have been revised down in the following weeks and if this one follows suit could provide some sell pressure in the general market. If however, this comes in as a beat, it’s possible the market rallies on a strong jobs report.

Start trading December silver, copper, 30 year bonds and other treasuries!

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

08-29-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Join our private Facebook group for additional insight into trading and the futures markets!

Have a safe Memorial Day Weekend. Trading Schedule HERE

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

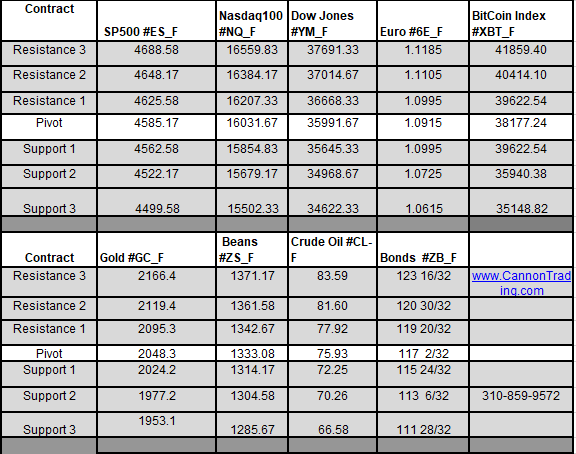

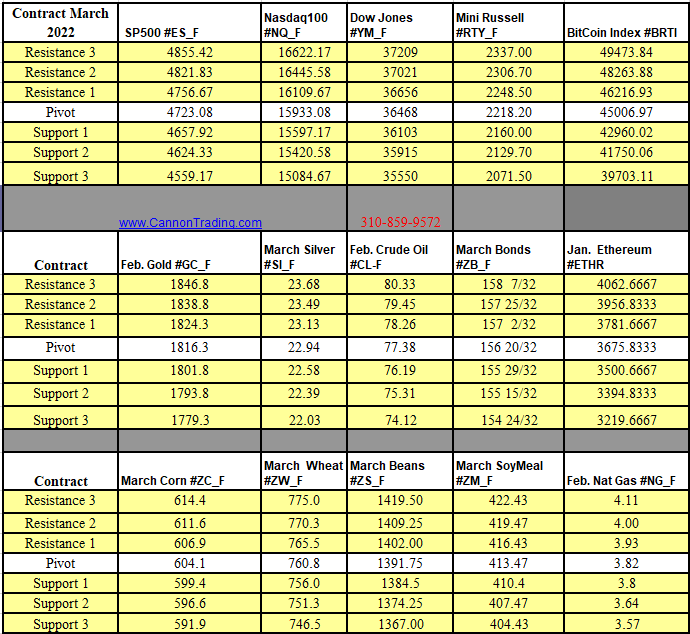

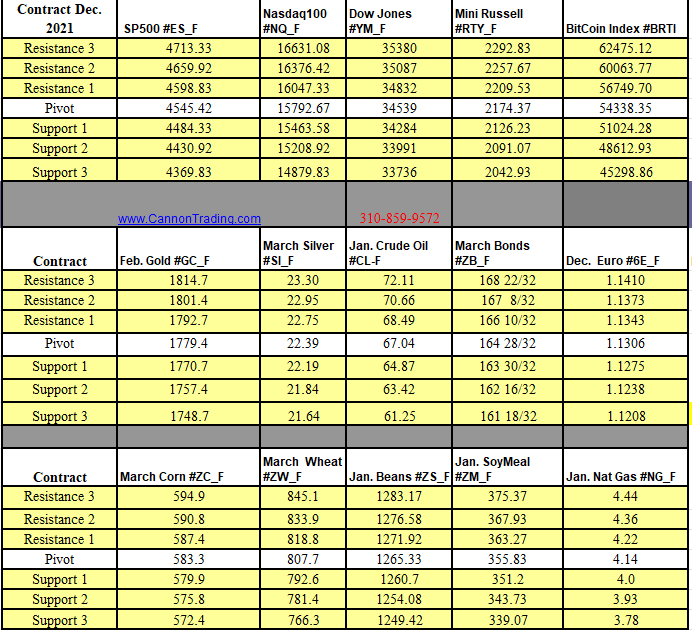

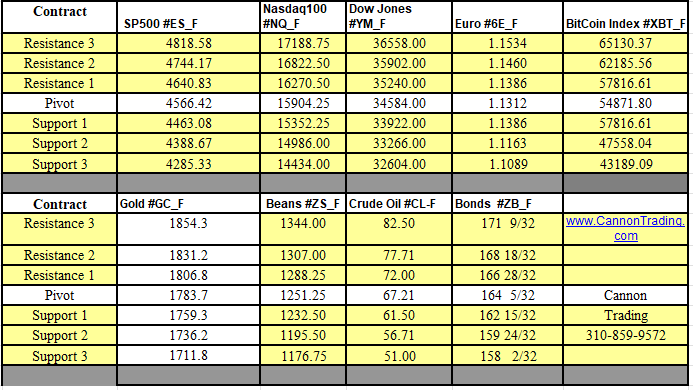

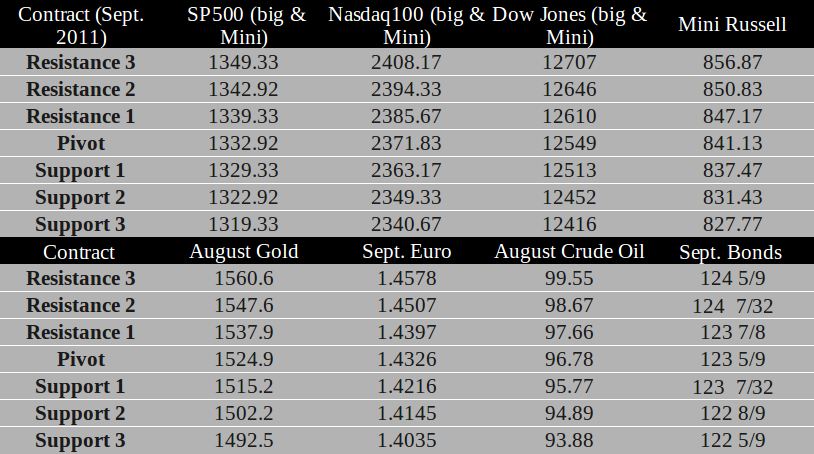

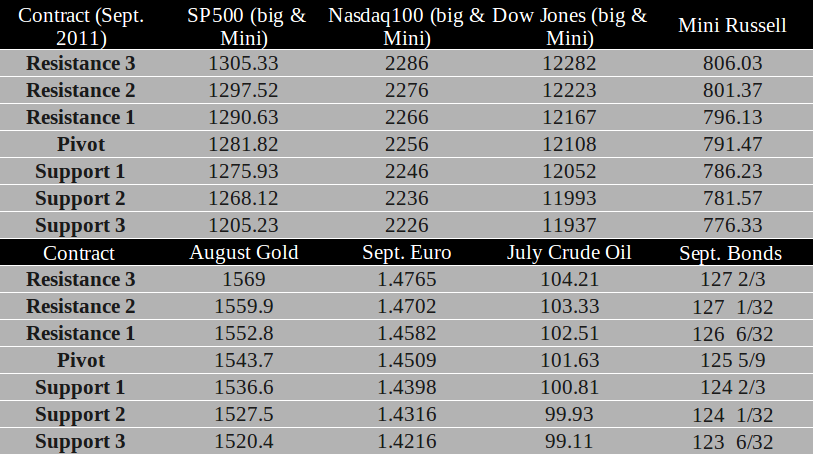

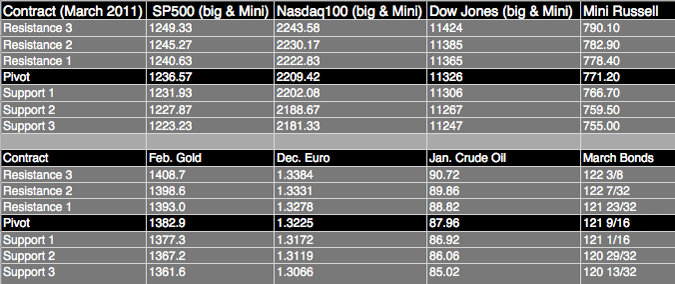

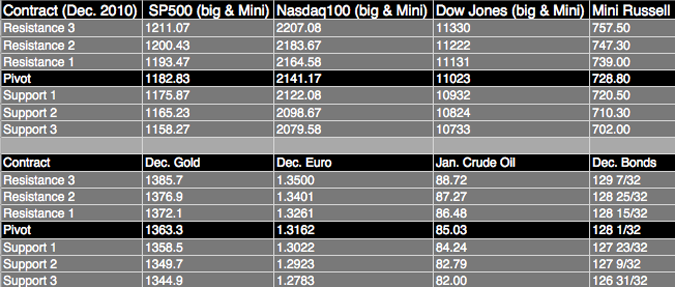

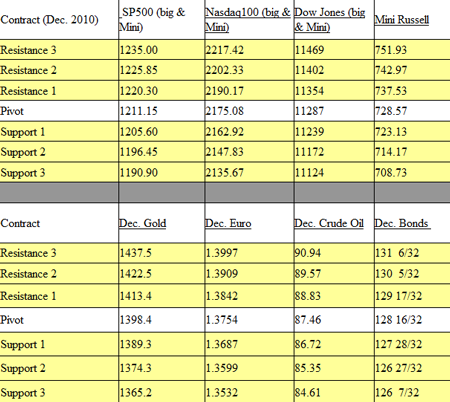

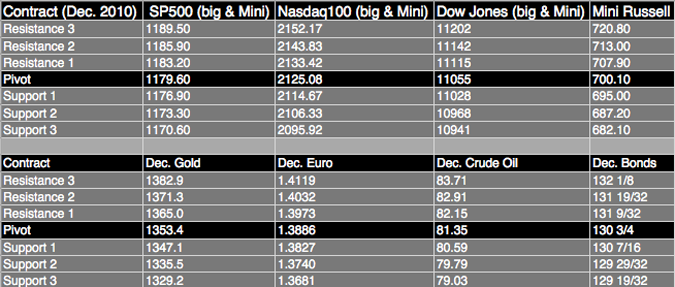

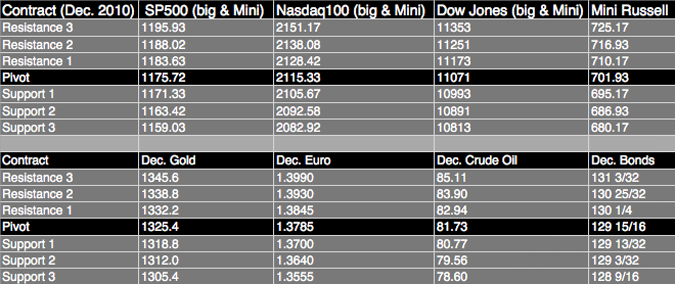

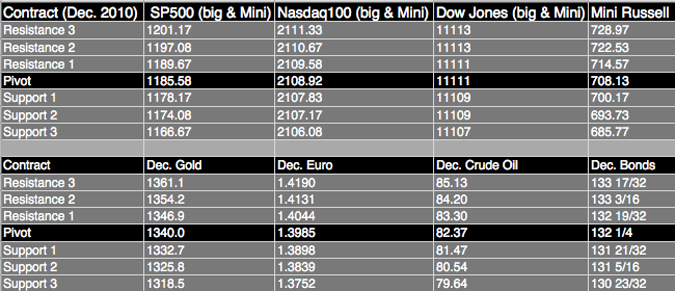

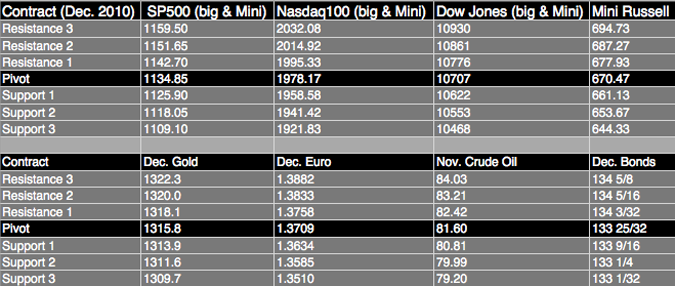

Weekly Levels

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

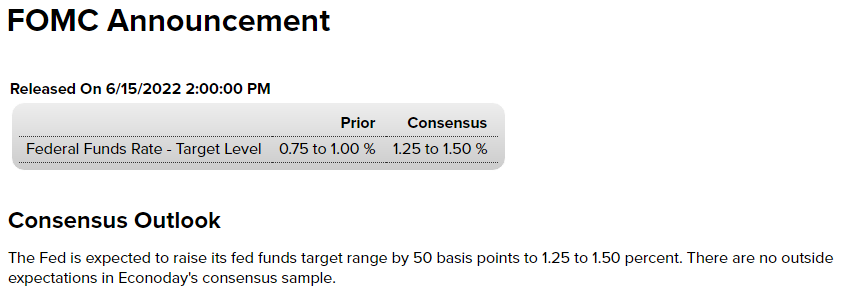

By John Thorpe, Senior broker

There is little doubt traders will be tightly focused on the FOMC meeting on Tuesday and Wednesday. The release of the meeting statement at 14:00 ET on Wednesday will settle speculation about whether Fed voters will pause interest rate hikes or take rates higher for the eighth meeting in a row. If the Committee raises rates, by how much? Will it be a 25 or 50 basis points?

Powell’s press briefing at 14:30 ET on Wednesday will be the first opportunity for the press to ask of the Fed Chair about recent turmoil in the banking sector. Most of the news became public just as Fed officials entered the communications blackout period for the next rate announcement (midnight, Saturday March 12 through midnight, Thursday, March 23). Unless there was an urgent need to alter the signals previously given about the direction of monetary policy, it is not a topic that Powell would speak about publicly until after the meeting. Powell is likely to get as many questions about the state of the banking industry in the US as he will about the FOMC decision and forecast. My Favorite tool is the CME FedWatch tool.

The bar graphs represent the fed fund futures prices and adjust daily. As of this writing, according to the tool, there is a 28% chance of no change and a 71% chance of .25 increase, although some economists do expect a .50% increase, the market is discounting that faction and focusing on Zero change or a .25 bump. CME FedWatch Tool – CME Group

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

03-21-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trade June indices as well as June currencies!

By Mark O’Brien, Senior broker

Crude oil futures prices plunged more than $5.50 a barrel intraday today – touching a low of $65.65 (basis April) – to their lowest in more than a year as news that Credit Suisse’s biggest shareholder, Saudi National Bank, said it would not make further investments in the firm, sending the Swiss lender’s stock plunging ±27% and adding to the already extreme turmoil in the banking sector from the collapse of Silicon Valley Bank and Signature Bank last week here in the U.S.

In turn, gold futures prices climbed over 1% intraday with the April contract topping $1,942.50 per ounce intraday, it’s highest price since early February. Conversely, Copper futures lost ±11 cents / pound – over 4% intraday – with the May futures contract touching $3.84 / lb. matching prices from early January and extending a near month-long ±40-cent / $10,000 decline.

Not surprisingly, with the banking sector hitting rough seas this last week, treasuries have once again assumed their safe-haven status with the 30-yr. T-bond futures contract soaring ±10 full basis points ±$10,000 over the last nine trading days to March 3 and sending the benchmark 10-year Treasury note yield tumbling to near 3.5%

Significant volatility looks to be the order of the day for the near term across the major financial futures sectors – stock indexes, interest rates, currencies – as well as metals and energies. Up next, the FOMC meeting this coming Tuesday/Wednesday.

Be Careful out there, Plan your trade and trade your plan!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

03-16-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

The below commentary about tomorrow’s FOMC minutes is provided by www.NewSquawk.com

FOMC MINUTES (WED): After economic data for January highlighted a hot economy where inflation appears to be sticky, traders will look through the minutes for clues about how the central bank could respond, specifically looking at any commentary that indicates officials have appetite for rate hikes to resume with jumbo increments above 25bps, or even expectations of a higher terminal rate for the cycle. As a reminder, the Fed hiked its FFR by 25bps to 4.5-4.75% at its February meeting, as expected.

The statement said the central bank continues to see “ongoing increases” in the Fed rate as being appropriate, coming against some expectations that the line could be dropped in order to give optionality for a lower terminal rate than the 5-5.25% median dot in the December SEPs. While that didn’t happen, we did see a switch in language on guidance from the “pace of future increases” to the “extent of future increases,” suggesting that debate is moving from the size of hike increments to how many hikes remain in the cycle, a dovish offset to the continued use of “ongoing increases”. Elsewhere in the statement, the Fed acknowledged that inflation had eased

somewhat, but remained elevated. Chair Powell sat on the fence on many topics he was asked about in his postmeeting press conference, rather than cut off his options.

The Fed Chair confirmed that the disinflation process was underway, albeit he was eager to highlight that core services inflation, ex-housing, had not shown progress. He believes that policy is still not ‘sufficiently restrictive’, but left optionality by stressing data dependence, later saying that it is possible that the Fed updates its policy path if the data came in differently to what it expects. Powell said the Fed has not yet made a decision on the terminal rate, and that it will look at the data between now and the March SEPs.

The Fed chief sees a path to getting inflation to 2% without significant economic decline, though it could take more slowing in the economy than it expects.

The below commentary about tomorrow’s FOMC minutes is provided by www.NewSquawk.com

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

02-22-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien, Senior Broker

General: albeit the eighth straight interest rate hike by the Federal Reserve since last March, today’s 25-basis point increase was the smallest move of the streak – with its target range now set to 4.5 – 4.75 percent. In its policy statement, Central Bank officials signaled that while “inflation has eased somewhat,” the fight against inflation has not come to an end and that the Fed “will stay the course until the job is done.” Translation: more hikes are on the way.

Yesterday, the International Monetary Fund raised its 2023 global growth outlook slightly, from their last projected contraction to 2.9% form 2022, to a slightly less discouraging 2.7%. They pointed to “surprisingly resilient” demand in the United States and Europe, an easing of energy costs and the reopening of China’s economy after Beijing abandoned its strict COVID-19 restrictions.

Tomorrow the European Central Bank will meet to determine their own next move in that region’s battle against inflation. They’re almost certain to notch rates up another 50 basis points up to 2.5 percent on their deposit facility, as it’s termed. And similar to the attention paid to Fed chair Jerome Powell’s words, all ears will be honed in on ECB President Christine Lagarde’s communications on the central bank’s guidance and future decisions.

All this is taking place amidst the backdrop of slight improvements in U.S. and Chinese economic expectations. One could make the case that the green shoots indicating signs of improvement for the economy mentioned in the Jan. 18 blog at the very least haven’t withered.

And speaking of not withering, while the outlook for the South American soybean crop remains a concern, traders have started removing the weather premium from prices.

This could contribute to an asset-wide decline in volatility and leave markets prone to trending – up or down.

A Cannon broker will be able to assist, provide feedback and answer any questions.

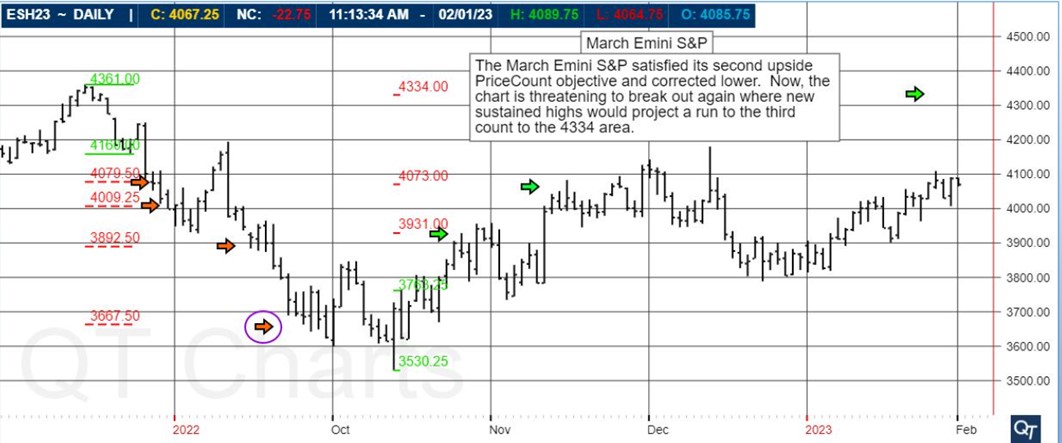

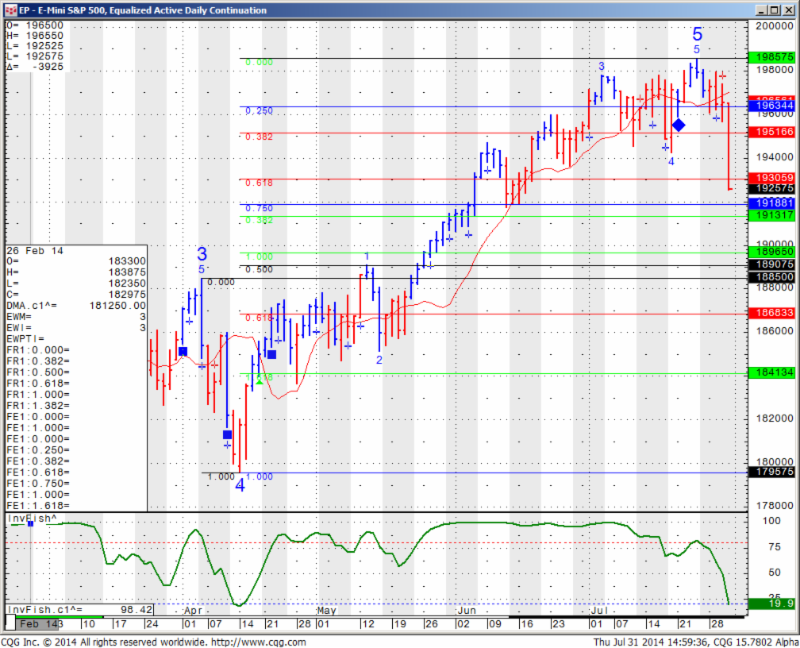

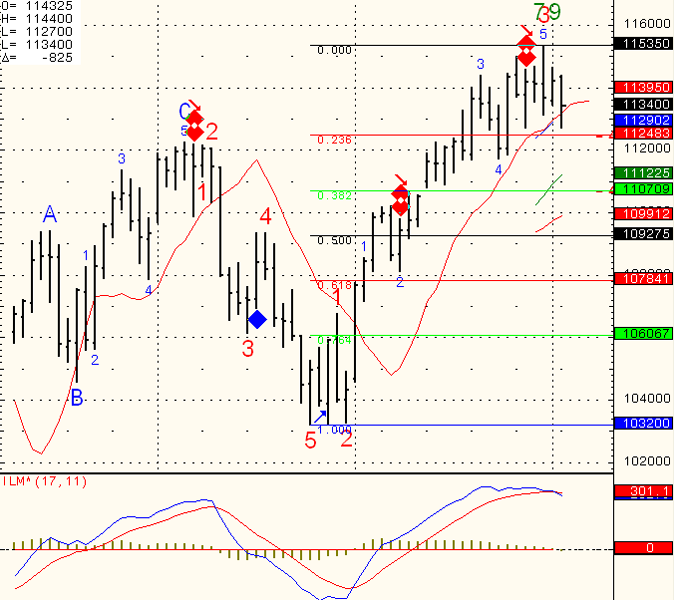

Chart below is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

PriceCounts – Not about where we’ve been , but where we might be going next!

March mini SP 500 possible PriceCounts Scenario below

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

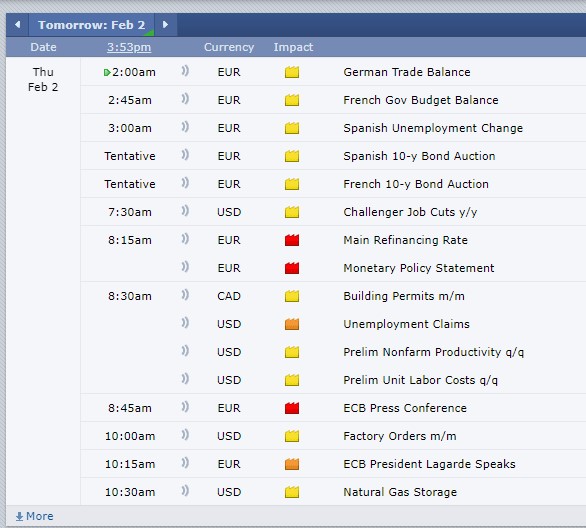

for 02-02-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Start trading March grains, March silver, March bonds and other interest rates, February gold. First notice day is Wednesday.

Tomorrow is also the last trading day of the month – busy day with different reports and Fed’s Powell speaking..

A Cannon broker will be able to assist, provide feedback and answer any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

for 11-30-2022

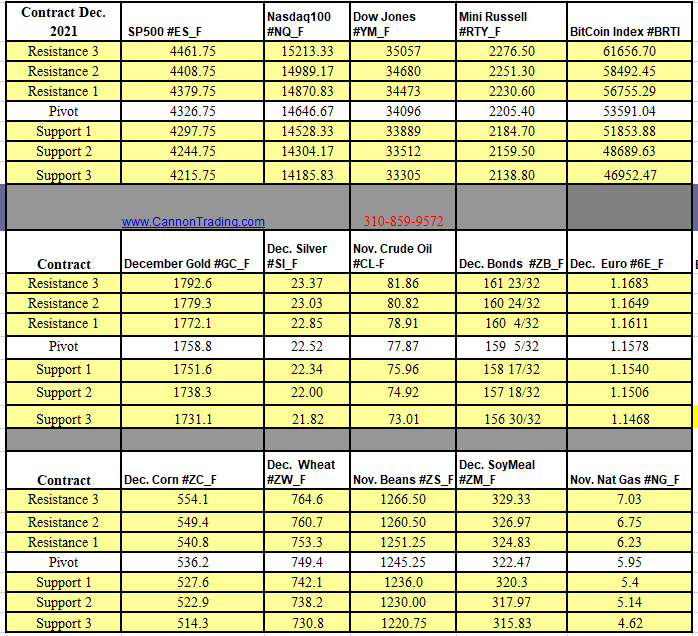

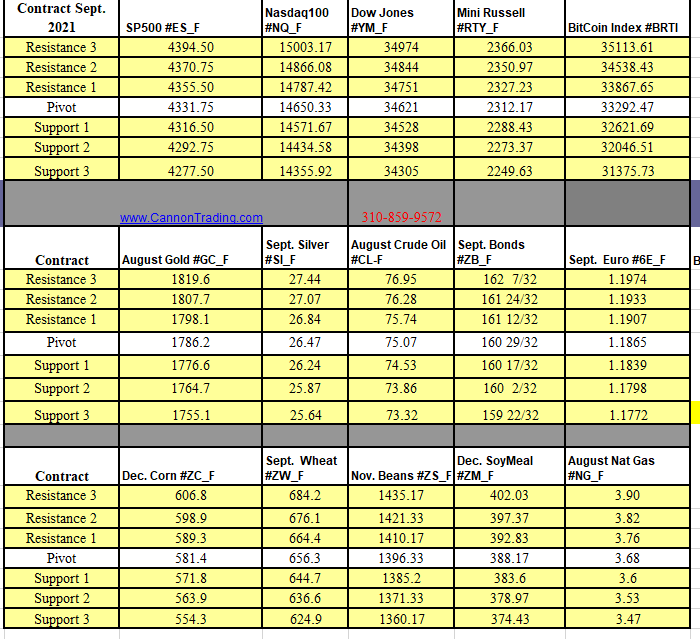

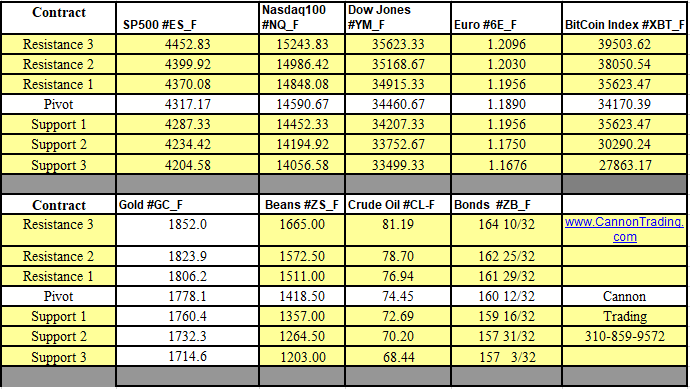

SP500 #ES_FNasdaq100 #NQ_FDow Jones #YM_FMini Russell #RTY_FBitCoin Index #BRTI SP500 Dec. Gold #GC_F Dec. Silver #SI_F Oct. Crude Oil #CL-F Dec. Bonds #ZB_F Dec. 10 yr #ZN_F Dec. Corn #ZC_F Dec. Wheat #ZW_F Nov. Beans #ZS_F Dec. SoyMeal #ZM_F Oct. Nat Gas #NG_F Dec. Coffee #KC_F Dec. Cocoa #CC_F October Sugar #SB_F Dec. Cotton #CT_F Sept. Euro Currency

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien Senior Broker

Financials: Given Federal Reserve Board Chairman Jerome Powell’s statements at last week’s Economic Policy Symposium in Jackson Hole, where he reiterated the Fed.’s commitment to halting inflation and that “some pain” will come to the U.S. economy as a result, U.S. and other global stock markets, while lower this week, have been measured and arguably not anxiety-filled. At least for the time being, traders seem to have factored in continued interest rate hikes by our central bank and other countries’ and slower, possibly even recessionary conditions. That was read into Wednesday’s ADP private payrolls report that showed a deceleration in jobs creation (132,000 in August).

Next up: the closely watched Non-farm payrolls report this Friday, widely considered to be one of the most important measures of the U.S. economy. A survey of economists forecast an increase of 318,000 new jobs (median estimate).

Metals: Dec. gold traded through $1,700/oz this morning, marking its longest monthly losing streak in four years, and Dec. silver tumbled to $17.40 intraday – a more than two-year low – as traders expect rising interest rates will persist making Treasury bonds and the U.S. dollar more attractive.

Lumber: Rising interest rates and a strong U.S. dollar have weighed on other commodity prices. Basis the Nov. futures contract, lumber prices have been slashed by more than half since their early-Feb. highs of ±$1,000/board foot, trading to $460/board foot intraday today – to its life-of-contract low. Credit weak demand as well, with a cooling housing market and falling new home construction.

Energy: Crude oil (Dec.) continued it’s steep sell-off this week – losing ±$10/barrel over the last three days – returning to near its mid-August/5-month lows near $86.00/barrel. The market seems dogged by softening demand with several major cities in China seeing new Covid restrictions, including the total lockdown of Chengdu with ±20 million people.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

09-02-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By Mark O’Brien Senior Broker

Energy: September Natural gas touched $10.028 per million British thermal units intraday yesterday, a 14-yr. high. It closed at $9.193 – a ± $9,000 per contract correction off its highs, yet still more than twice the price a year ago.

Financials: If you turn to any financial news source, you’d think the only thing traders are thinking about this week is the Federal Reserve Bank of Kansas City’s annual Economic Policy Symposium. This is a 3-day gathering of about 120 economists and policy makers from government agencies and academia – including many central bankers – from around the world. It all takes place in Jackson Hole, Wyoming starting tomorrow.

Why is it important? The symposium kicks off with a speech given by the Chairman of the U.S. Federal Reserve, currently Jerome Powell. While not an FOMC meeting where central bank policy is communicated and interest rates are set, the speech has become an opportunity to define the Fed’s. comprehensive policy approach on a global stage to a far-reaching audience. Thus, it has become highly anticipated – arguably more so than past symposium speeches given the current historic rise in inflation globally, and particularly in the U.S. and Europe. Probably the overarching question traders are listening for Chair Powell to answer (he almost certainly will not come right out and say it) is whether the Fed will raise rates by 50 or 75 basis points when Federal Reserve members meet in September to consider monetary policy.

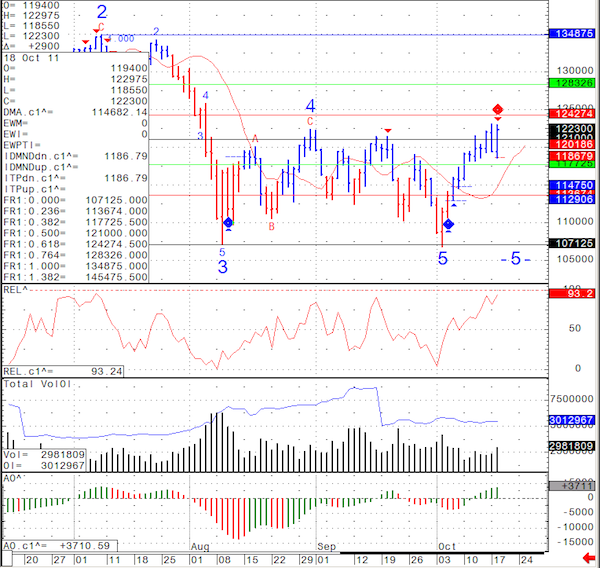

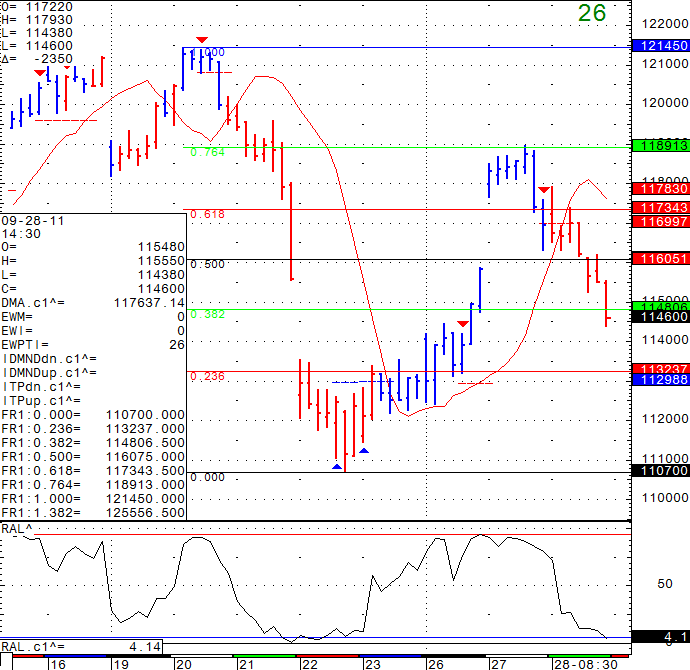

Ten Year Notes Daily Chart below ( click image for larger chart):

Ten year notes downside pressure. Close below 117.070 on an hourly basis cam trigger 116.060 pretty quick. My speculation.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

08-25-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

07-13-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

06-14-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

05-18-2022

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

01-06-2022

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

12.13.2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading

Dear Futures Trader,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

11-12-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Dear Traders,

Who Trades Futures?

What Types of Traders are There?

What Makes Futures Trading Different?

How Does a Trade Work?

How Do I Get Started?

Futures Quiz

10-07-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

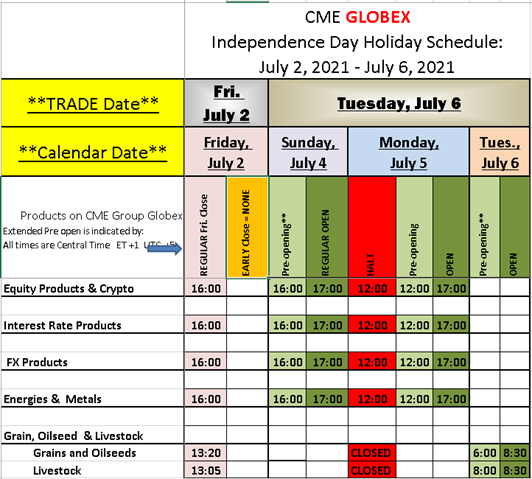

7-05/06-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

07-18-2019

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

By John Thorpe, Senior Broker

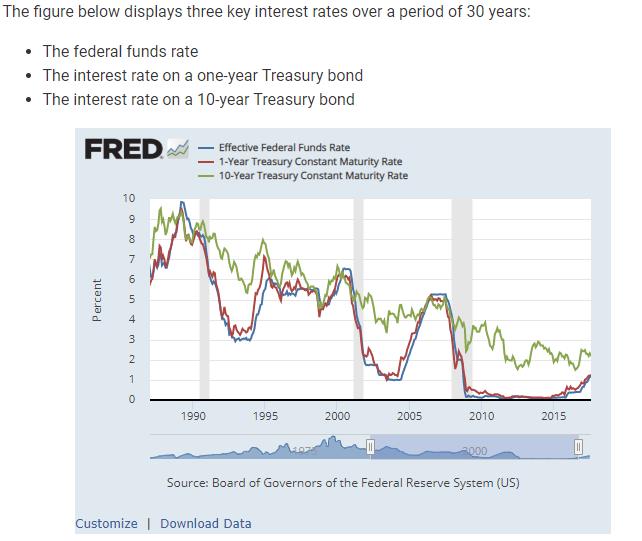

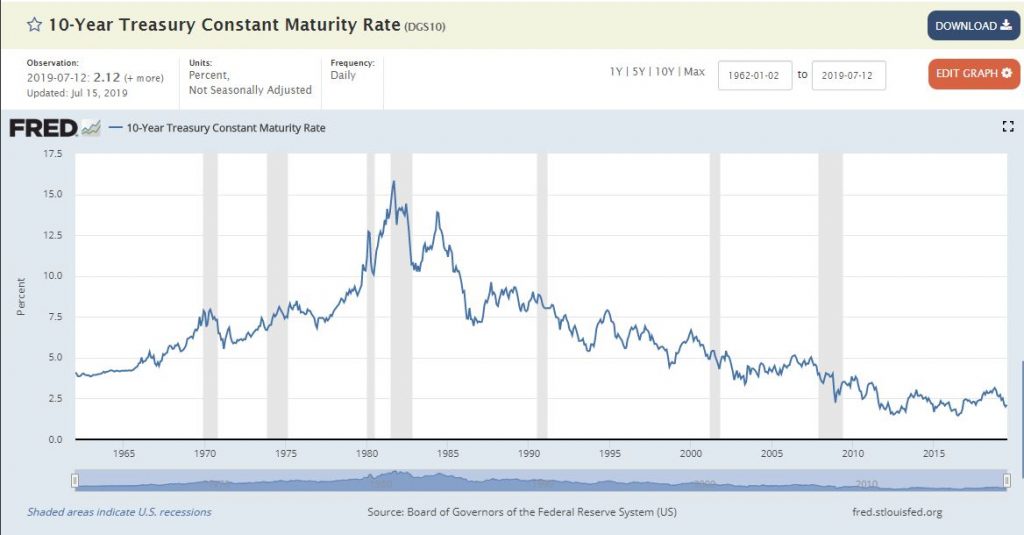

Over the course of the last 45 years, whether you own a small monopoly of commercial buildings or a condo on Oak street U.S.A. your investments are subjected to the actions of the Federal Reserve Bank.

The Federal Reserve Bank seeks to provide stability in the largest world economy through interest rate regulation. Its mandate is to use financial tools to satisfy two congressional mandates, 1: Full Employment and 2: Moderate Inflation to a 2% annualized rate; Move too far too fast in any direction with policy shifts and financial perils for all! may be in the offing. The economy could move too fast in the wrong direction or too fast in the right direction which can lead to an overheating and a bursting of an economic bubble. Look no further than Savings and Loan crisis in the 1980’s and 90’s, the Japanese housing market collapse in 1989 (Japan is currently still struggling with a zero interest rate environment 30 years later) the Dot Com bubble after Y2K and most recently , the housing market collapse, which began with the bankruptcy of Iceland, no one paid attention, then the bankruptcy of Ireland, again, no one paid attention, then the bankruptcy of Bear Stearns, some paid attention (what did any of these entities have to do with the value of our homes, we thought) then Lehman brothers collapsed in September of 2008 and everyone paid attention as our home prices collapsed.

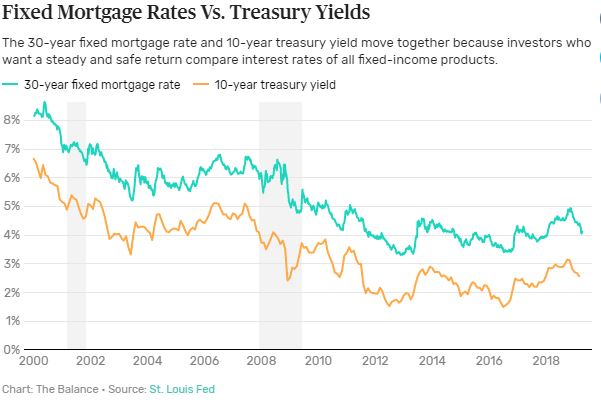

Use Google, DuckDuckGo, Bing or any of your favorite search engines and type in

10 yr. correlation with mortgage rates

You will find search pages full of information about the importance of interest rate policy and its effect on mortgage rates, specifically the Fedfunds rate.

Whether you have a 30 yr fixed, a 15 yr fixed or a 5/1 ARM (usually capped after 5 years) you need to protect your largest investments by first understanding the tools available to the public to monitor these markets and second, knowing you can contact a professional to discuss the myriad of ways to hedge your real estate portfolio and be ready when you need to by utilizing the futures markets to protect your investments.

The hypothesis: Generally speakingand largely from region to region diversity, when interest rates go lower, home prices go higher. Lower interest rates lead to increases in the value of real assets. Mortgage rates are sensitive to changes in Fed Policy, the 10yr note being the reference financial instrument moves in response to market reactions to Fed policy shifts.

When interest rates go higher, a definite time lag exists in the long run may make home prices move lowerand real asset prices lower.

Watch futures market prices in the interest rate futures. Get comfortable watching the interest rate futures contracts.

I am by no means offering a pure hedge or even a short-term hedge in my analysis.

I believe what you will see and get a sense of the ebbs and flows of these markets from a visual perspective while you are learning about the base currency (US Dollar) valuation of real assets changing and thereby affecting not only the value of the real assets you hold but also the cost to maintain those assets. The interest rate futures markets give you the clearest picture of how policy equates to real rates for you, the mortgage holder. 10yr Note Futures prices and chart

Major trends that are a serious harbinger of future housing price changes are important to understand so you may act to preserve, maintain and profit from potential shifts in policy.

Between 2008 and 2012 during the last recession, a major fed policy tool used was a series of fed fund rate reductions (net effect is the cost of money becomes cheaper relative to real asset prices), these calculated moves lowered the interest rate on longer term debt obligations 10Yr. Note Futures Prices and Chart as well as all dollar denominated Treasuries.

As you can see, Mortgage rates, I mean the 10yr Treasury Note rates (Freudian slip, sorry), are still at or near all-time lows.

In Summary, Familiarizing yourself with the interrelationships among Mortgage rates, 10 year treasuries and fed fund policy shifts are an important starting point for a conversation with a professional about protecting your family’s biggest investment.

A Cannon Trading professional is available between 8:30am to 5:00pm Eastern to answer your questions Call Now

Disclaimer – Trading Futures, Options on Futuresand retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledgeand financial resources. You may lose all or more of your initial investment. Opinions, market dataand recommendations are subject to change at any time.

Futures Options Writing

Have you ever wondered who sells the futures options that most people buy? These people are known as the option writers/sellers. Their sole objective is to collect the premium paid by the option buyer. Option writing can also be used for hedging purposes and reducing risk. An option writer has the exact opposite to gain as the option buyer. The writer has unlimited risk and a limited profit potential, which is the premium of the option minus commissions. When writing naked futures options your risk is unlimited, without the use of stops. This is why we recommend exiting positions once a market trades through an area you perceived as strong support or resistance. So why would anyone want to write an option? Here are a few reasons:

https://www.cannontrading.com/tools/education-futures-options-trading-101

Cannon offers SPAN margins for options sellers.

Many brokers will restrict or increase the margins required for options sellers, or traders who like to “collect premium”, but here at Cannon we can find you the best set up utilizing the multiple clearing arrangements we have with more than a few FCMs.

How much margin is required to sell a futures option?

That is a question we get asked often. The exact number is an output of SPAN margins. SPAN deserves a post on its own, but what it stands for is: Standard Portfolio Analysis of Risk. The formula takes into consideration volatility, time value, distance of strike price from current underlying future, and more.

Outright options may be easier to “guesstimate” margin than more complex strategies and spreads, but our free platform, E-Futures Int’l (https://www.cannontrading.com/software/e-futures-international )has a margin calculator built in so you can calculate the margin you will need for different strategies.

Commission for selling options on futures?

Commissions will vary based on the following:

Are you trading online or with a broker?

Trading volume

Account size

Risk responsibility.

The rates for selling options will vary from as low as $0.25 per side + fees for HIGH VOLUME, institutional accounts to $30 per side + fees for retail, broker assisted accounts.

Selling options is NOT for newcomers as it involves higher risk than buying options.

However, selling options and trading option spreads may offer an edge if done with proper risk management. No guarantees are made here.

Our strength at Cannon is our ability to offer CUSTOMIZED trading solutions, so contact a broker at:

https://www.cannontrading.com/company/contact

and learn more about risks and opportunities in futures trading (https://www.cannontrading.com/riskopportunity), what software you can use, consult with a broker on margin, commissions and strategy questions and much more!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

______________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

|

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

06-03-2019

|

|

|

|

|

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Time sure does tick a bit different in the commodities and futures world….