June 20, 2014 - Issue #742

In This Issue

1. Crude Oil Outlook by Ilan Levy-Mayer

2. Dealing with Losing Trades

3. Economic Calendar

1. Crude Oil outlook

Is Crude Oil Breaking Higher?

by Ilan Levy-Mayer, VP of Cannon Trading

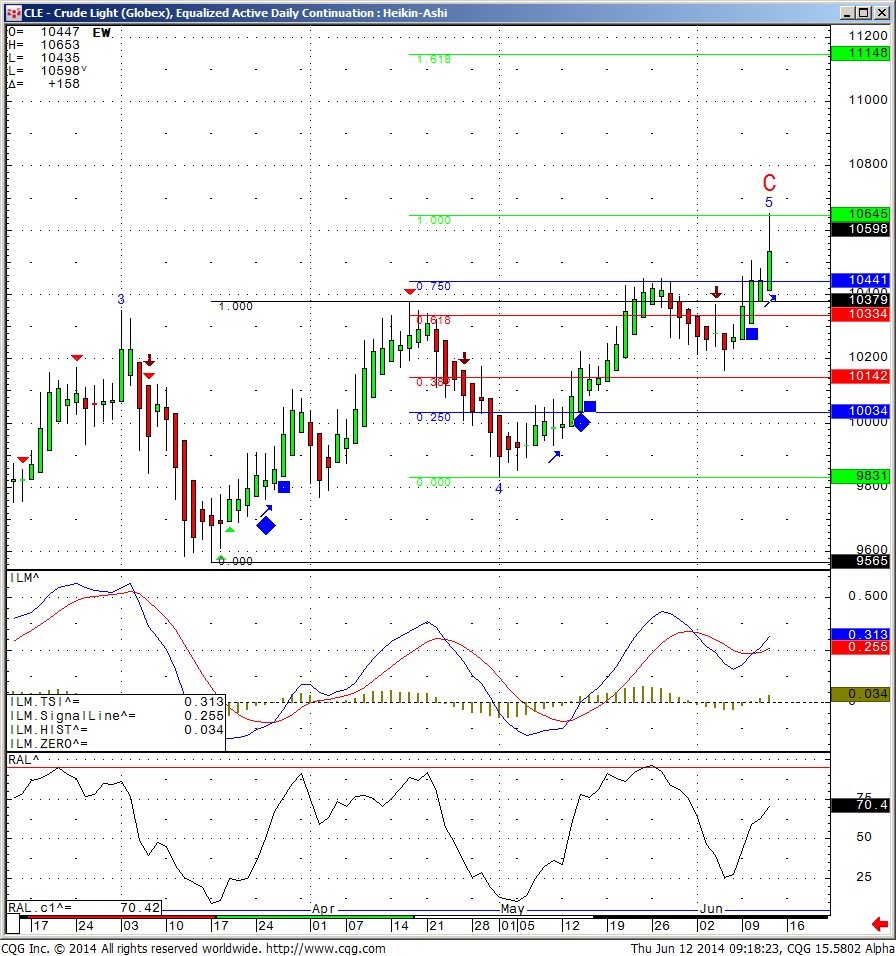

This was an article was highlighted on the popular Investing.com click on image below to enlarge

This is a quick overview Ilan Levy-Mayer , Cannon Trading VP provided for Investing.comAt the time I am writing this, June 12th, July Crude Oil futures are up $1.40 which is a big move. Main reason behind this move is renewed unrest in Iraq, where some El Qaida related organizations have actually taken over two major cities in Iraq. Iraq is a major oil producer and the fear factor is now kicking in to this market. From a much longer perspective, I think crude oil will trade lower and I am talking about months/ years mainly because of increased production here in the USA along with the "fracking" technology growth. As futures trader, I am much more focused on the short term, the next few days/ weeks and this is where I see a potential for higher prices BUT with the price of higher volatility and bigger swings, so if your stomach is sensitive, better stay out of this one or perhaps consider options.

Click on this link to read the remaining article.

2. Dealing with Losing Trades

From our friend Jim Wyckoff

Jim has an excellent daily newsletter where he reviews different markets, alerts you for potential trades and much more. Included is his great bi-weekly newsletter with charts and a little longer term outlook. We recommend checking out his website, educational CDROM, and services at www.jimwyckoff.com

(Note: This feature is a favorite of mine, and I believe all traders need to address this issue every once in a while.) A main tenet of success in futures trading is the ability to accept losing trades as part of the overall trading process. This is not an easy undertaking--especially since many futures traders tend to be of a more competitive nature in the first place. Traders certainly don't have to enjoy losing trades, but they must accept the fact and move on. Those who can't accept the fact that losing trades are a part of futures trading usually don't stay in the business very long. My wife is a school teacher, and one of her favorite acronyms--ADM--can be applied to losing futures trades. "Accept" it. "Deal" with it. "Move" on. (This is a part of the important psychological aspect of trading, and deserves much more discussion than I can provide in this feature.) I had lunch with one of my trading mentors a while back. We discussed losing trades. I asked my mentor how many losing trades in a row he has had to endure during his long and successful trading career. His reply was 13 in a row. I asked him how he coped with that. He said that while it was certainly not easy, he knew that losing trades are a part of the business and that he was in the business "for the long haul," and that his trading methodology was sound. He added, "Ninety-percent of futures trading profits are made on 10% of the trades, which means most of the other trades are either small losers or break-even-type trades." This is an important fact for all traders to keep in mind. My lunch meeting with my mentor was good for me because, even though we made no "break-through" discoveries on the path to increased futures trading success, we did reaffirm our own philosophies on trading and markets. My passion for trading and market analysis is fed immensely every time I talk with people in my profession, or attend the quality trading seminars. For many of you, the futures trading arena can be more fulfilling (and more fun) if you have someone, or some support group, with which to share your thoughts and strategies. If you are passionate about futures trading and markets, finding someone who shares that passion is a great trading tool within itself!

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 06/23 Mon |

9:00 AM CDT - Existing Home Sales(May) 2:00 PM CDT - Cold Storage |

|

| 06/24 Tues |

8:00 AM CDT - Case-Shiller 20-City Index(Apr) 8:00 AM CDT - FHFA Housing Price Index(Apr) 9:00 AM CDT - Consumer Confidence(Jun) 9:00 AM CDT - New Home Sales(May) |

FN: Jul Cotton(NYM) Jul Crude Lt(NYM) May Milk(CME) |

| 06/25 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 7:30 AM CDT - Durable Goods-Ex Transportation(May) 7:30 AM CDT - Durable Orders(May) 7:30 AM CDT - GDP-Third Estimate(Q1) 7:30 AM CDT - GDP Deflator-Third Estimate(Q1) 9:30 AM CDT - API & DOE Energy Stats 3:00 PM CDT - Dairy Products Sales |

>LT: Jul Copper Options(CMX) Jul Gold Options(CMX) Jul Silver Options(CMX) Jul Silver Options(CMX) Jul RBOB & ULSD Options(NYM) |

| 06/26 Thurs |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - PCE Prices-Core(May) 7:30 AM CDT - Personal Income & Spending(May) 9:30 AM CDT - EIA Gas Storage 3:30 PM CDT - Money Supply |

LT: Jun Copper(CMX) Jun Gold(CMX) Jun Silver(CMX) Jun Platinum(NYM) Jun Palladium(NYM) Jul Natural Gas(NYM) |

| 06/27 Fri |

8:55 AM CDT - Michigan Sentiment-Final(Jun) 2:00 PM CDT - Quarterly Hogs & Pigs |

FN: Jul Natural Gas(NYM) |

| 06/30 Mon |

8:45 AM CDT - Chicago PMI(Jun) 9:00 AM CDT - Pending Home Sales(May) 11:00 AM CDT - Grain Stocks 11:00 AM CDT - Planted Acreage |

FN: Jul Wheat(CBT) Jul Corn(CBT) Jul Oats(CBT) Jul Rough Rice(CBT) Jul Soybeans,Soymeal,Soyoil(CBT) Jul Copper(CMX) Jul Silver,Gold(CMX) Jul Platinum,Palladium(NYM) LT: Jun 2,5 Year Notes(CBT) Jun Fed Funds(CME) Jun Live Cattle(CME) Jul RBOB & ULSD(NYM) Jul Sugar-11(ICE) Jun Fed Funds Options(CME) Jul Lumber Options(CME) |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!