August 25, 2017 - Issue #888

In This Issue

1. Trading 202: Recognizing Chart Patterns

2. Hot Market report: T-Bond Bulls in Technical Control

3. Economic Calendar

1. Recognizing Chart Patterns

Before Your next Trade, learn to recognize charts and patterns!

Learning the different types of charts and patterns will be another arsenal in your Trading Tools!

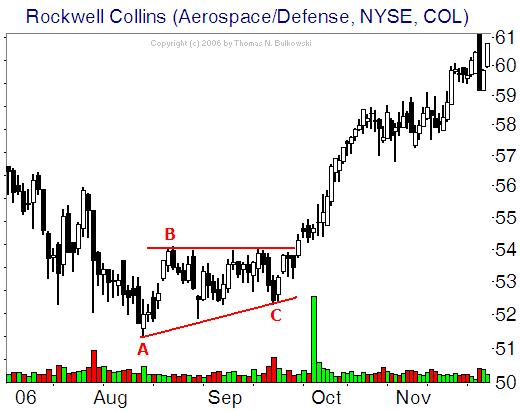

Ascending Triangle Futures Trading Chart Pattern

What is an Ascending Triangle Futures Chart Pattern?

An ascending triangle is a bullish futures pattern that can indicate a breakout in the upwards direction.

An ascending triangle is a bullish futures pattern that can indicate a breakout in the upwards direction.

How do I Recognize an Ascending Triangle Futures Chart Pattern?

An ascending triangle is formed when resistance remains flat and support rises.

See the example below:

What Does a Ascending Triangle Chart Pattern Mean?

The price will rise and fall within[-] the triangle until support and resistance converge. At that point, the apex, breakout occurs, usually upwards.

Broadening Top Futures Trading Chart Pattern

What is a Broadening Top Futures Chart Pattern?

A broadening top is a futures chart pattern that can occur on an upwards trend. It is generally classified as a reversal pattern but some traders argue that there is approximately a 50/50 split between whether it tends to move upwards or downwards upon completion of the pattern. For this reason, it can often be avoided by traders. It can be viewed as the opposite of a symmetrical triangle.

A broadening top is a futures chart pattern that can occur on an upwards trend. It is generally classified as a reversal pattern but some traders argue that there is approximately a 50/50 split between whether it tends to move upwards or downwards upon completion of the pattern. For this reason, it can often be avoided by traders. It can be viewed as the opposite of a symmetrical triangle.

How Do I Recognize a Broadening Top Futures Chart Pattern?

A broadening top is comprised of diverging support and resistance lines and resembles a megaphone. The rising resistance line and falling support line continue until the trend reverses.

To download the remaining PDFs on Recognizing Charts and Patterns, please fill out the form below.

Recognizing Charts & Patterns

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. T-Bond Bulls in Technical Control

From our friend Jim Wyckoff at JimWyckoff.com

Click on image below to enlarge

The U.S. Treasury bond futures market has been trending higher since early July and late this week hit a two-month high.

The bond market bulls are in near-term technical control, which means the path of least resistance for prices will remain sideway to higher in the near term.

Also, any geopolitical flare-ups will support flight-to-quality demand for U.S. Treasuries. .

The U.S. Treasury bond futures market has been trending higher since early July and late this week hit a two-month high.

The bond market bulls are in near-term technical control, which means the path of least resistance for prices will remain sideway to higher in the near term.

Also, any geopolitical flare-ups will support flight-to-quality demand for U.S. Treasuries. .

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 08/25 Fri |

7:30 AM CDT - Durable Goods-Ex Transportation(Jul)

7:30 AM CDT - Durable Orders(Jul) 2:00 PM CDT - Cattle On Feed |

LT: Sep 2,5,10 Year Notes Options(CBT)

Sep Bonds Options(CBT) Sep Canola Options(CBT) Sep Wheat Options(CBT) Sep Corn Options(CBT) Sep Rough Rice Options(CBT) Sep Oats Options(CBT) Sep Soybeans,Soymeal,Soyoil Options(CBT) |

| 08/28 Mon |

|

LT: Sep Copper Options(CMX)

Sep Gold & Silvers Options(CMX) Sep Natural Gas Options(NYM) Sep RBOB & ULSD Options(NYM) |

| 08/29 Tue |

9:00 AM CDT - Consumer Confidence(Aug)

3:30 PM CDT - API Energy Stocks |

LT: Aug Butter(CME)

Aug Milk(CME) Aug Copper(CMX) Aug Gold & Silver(CMX) Aug Platinum & Palladium(NYM) Sep Natural Gas(NYM) Aug Butter Options(CME) Aug Milk Options(CME) |

| 08/30 Wed |

6:00 AM CDT - MBA Mortgage Applications Index

7:15 AM CDT - ADP Employment Change(Aug) 7:30 AM CDT - GDP-Second Estimate(Q2) 7:30 AM CDT - GDP Deflator-Second Estimate(Q2) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Diary Products Sales |

FN: Sep Natural Gas(NYM)

|

| 08/31 Thu |

6:30 AM CDT - Challenger Job Cuts(Aug)

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - PCE Prices(Jul) 7:30 AM CDT - PCE Prices-Core(Jul) 7:30 AM CDT - Personal Income & Spending(Jul) 8:45 AM CDT - Chicago PMI(Aug) 9:00 AM CDT - Pending Home Sales(Jul) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

FN: Sep 2,5,10 Year Notes(CBT)

Sep Bonds(CBT) Sep Copper(CMX) Sep Gold & Silver(CMX) Sep Platinum & Palladium(NYM) Sep Wheat(CBT) Sep Oats(CBT) Sep Corn(CBT) Sep Rough Rice(CBT) Sep Soybeans,Soymeal,Soyoil(CBT) LT: Aug Feeder Cattle(CME) Aug Fed Funds(CME) Aug Live Cattle(CME) Sep RBOB & ULSD(NYM) Aug Feeder Cattle Options(CME) Aug Fed Funds Options(CME) Sep Lumber Options(CME) |

| 09/01 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Aug)

7:30 AM CDT - Nonfarm Payrolls(Aug) 7:30 AM CDT - Unemployment Rate(Aug) 9:00 AM CDT - Construction Spending(Jul) 9:00 AM CDT - ISM Index(Aug) 9:00 AM CDT - Michigan Sentiment-Final(Aug) 1:00 PM CDT - Auto & Truck Sales(Aug) 2:00 PM CDT - Cotton System 2:00 PM CDT - Fats & Oils 2:00 PM CDT - Grain Crushings |

FN: Sep Orange Juice(ICE)

LT: Sep Live Cattle Options(CME) Oct Cocoa Options((ICE) |

| 09/04 Mon |

LABOR DAY

|

|

| 09/05 Tue |

9:00 AM CDT - Factory Orders(Jul)

|

FN: Sep RBOB & ULSD(NYM)

|

| 09/06 Wed |

7:30 AM CDT - Trade Balance(Jul)

9:00 AM CDT - ISM Services(Aug) 1:00 PM CDT - Fed's Beige Book(Sep) 3:30 PM CDT - API Energy Stocks |

|

| 09/07 Thu |

7:30 AM CDT - Initial Claims-Weekly

7:30 AM CDT - Productivity-Rev(Q2) 9:30 AM CDT - EIA Natural Gas Report 10:00 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Consumer Credit(Jul) 2:00 PM CDT - Dairy Products Sales 3:30 PM CDT - Money Supply |

LT: Sep Nikkei(CME)

Sep Nikkei Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!