August 22, 2014 - Issue #750

In This Issue

1. How to Apply Moving Averages as a Trading Tool

2. Hot Market Report: Stock Markets Outlook

3. Economic Calendar

1. How to Apply Moving Averages as a Trading Tool

A Great Tool to have in you utility belt.From our friend Senior Analyst Jeffrey Kennedy. Eliott Wave

A moving average (MA) is one of the simplest technical tools an analyst or trader can use. The most common one is the simple moving average (SMA). A 200-period SMA often determines trend, support and resistance. Dual moving averages, which are popular, are the basis of many trading systems.

In this 6-minute video lesson, Elliott Wave International's Jeffrey Kennedy explores different types of moving averages and how you can apply single, dual and multiple moving averages on your charts.

Please fill out the form below to watch the video on how to apply moving averages.

To Watch the 6 Minutes Video on "Watch Applying Moving Averages", please fill out this form.

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Stock Markets Outlook

By Our VP Ilan Levy-Mayer On Forexmagnates.com

With the events in Ukraine, Israel retaliating to terror attacks from Gaza and the concerning issue of the ISIS in Iraq and Northern Syria, one would think we should see some risk premium building into stock indices that would push stocks lower, yet after a brief sell off we are seeing a resumption of the strong uptrend.

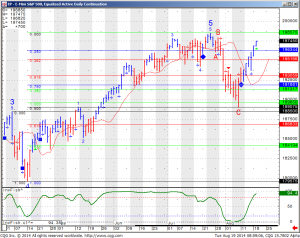

When looking at Stocks in general, I like to look at the SP500 as I feel this index is the leader amongst stock index futures. Looking at a daily chart below we see that the market has a LOT of respect to some timing symmetry.

To read the full article, please click on this link.

With the events in Ukraine, Israel retaliating to terror attacks from Gaza and the concerning issue of the ISIS in Iraq and Northern Syria, one would think we should see some risk premium building into stock indices that would push stocks lower, yet after a brief sell off we are seeing a resumption of the strong uptrend.

When looking at Stocks in general, I like to look at the SP500 as I feel this index is the leader amongst stock index futures. Looking at a daily chart below we see that the market has a LOT of respect to some timing symmetry.

To read the full article, please click on this link.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

| 08/25 Mon |

9:00 AM CDT - New Home Sales(Jul) | |

| 08/26 Tues |

7:30 AM CDT - Durable Orders(Jul) 7:30 AM CDT - Durable Goods-Ex Transportation(Jul) 8:00 AM CDT - Case-Shiller 20-City Index(Jun) 8:00 AM CDT - FHFA Housing Price Index(Jun) 9:00 AM CDT - Consumer Confidence(Aug) |

LT: Sep Copper Options(CMX) Sep Gold Options(CMX) Sep Silver Options(CMX) Sep Natural Gas Options(NYM) Sep RBOB & ULSD Options(NYM) |

| 08/27 Wed |

6:00 AM CDT - MBA Mortgage Purchase Index 9:30 AM CDT - API & DOE Energy Stats 3:00 PM CDT - Dairy Products Sales |

LT: Aug Copper(CMX) Aug Gold(CMX) Aug Silver(CMX) Aug Platinum(NYM) Aug Palladium(NYM) Sep Natural Gas(NYM) |

| 08/28 Thurs |

7:30 AM CDT - USDA Weekly Export Sales 7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - GDP-Second Estimate(Q2) 7:30 AM CDT - GDP Deflator-Second Estimate(Q2) 9:00 AM CDT - Pending Home Sales(Jul) 9:30 AM CDT - EIA Gas Storage 3:30 PM CDT - Money Supply |

FN: Sep Natural Gas(NYM) LT: Aug Feeder Cattle(CME) Aug Feeder Cattle Options(CME) |

| 0829 Fri |

7:30 AM CDT - PCE Prices-Core(Jul) 7:30 AM CDT - Personal Income & Spending(Jul) 8:45 AM CDT - Chicago PMI(Aug) 8:55 AM CDT - Michigan Sentiment-Final(Aug) |

FN: Sep 2,5,10 Year Notes(CBT) Sep Bonds(CBT) Sep Copper(CMX) Sep Gold & Silver(CMX) Sep Platinum & Palladium(NYM) Sep Wheat(CBT) Sep Oats(CBT) Sep Corn(CBT) Sep Rough Rice(CBT) Sep Soybeans,Soymeal,Soyoil(CBT) LT: Aug Fed Funds(CME) Aug Live Cattle(CME) Sep RBOB & ULSD(NYM) Aug Fed Funds Options(CME) Sep Lumber Options(CME) |

| 09/01 Mon |

LABOR DAY |

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!