September 2nd 2016 - Issue #843

In This Issue

1. Where is the Trend?

2. Hot Market Report: Sugar Rally How Sweet?

3. Economic Calendar

1.Trading 102: Where is the Trend?

The number one question a trader must answer quickly before entering a trade: Where is the trend?

One way to answer this question quickly and effectively is with Trends in Futures. At Trends in Futures you will not only receive specific trade recommendations in 47 futures markets and 20 Forex pairs, but you will learn a strategy that can work in different market conditions and can help you maximize your trading results. Common Sense Trading, created by Gary Kamen, has helped day traders, swing traders, position traders, and option traders and it could help you.

To find out how a little “common sense” could possibly help you with your trading, just take a real 30-day trial to Trends in Futures and see for yourself. Along with your 30-day trial you will receive Gary’s popular e-book “What Lies Beneath ALL Trends”.

This is an information source you definitely will want to read as it gives you a picture of what really moves the markets and discusses how to analyze the Commitment of Traders report Instantly!

Sign up for a FREE trial and download Gary’s "What Lies Beneath" at once.Free Trial & eBook

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. Hot Market: Suagr Rally Nearing an End?

Published on Equities.com by our VP, Ilan Levy-Mayer Equities.com

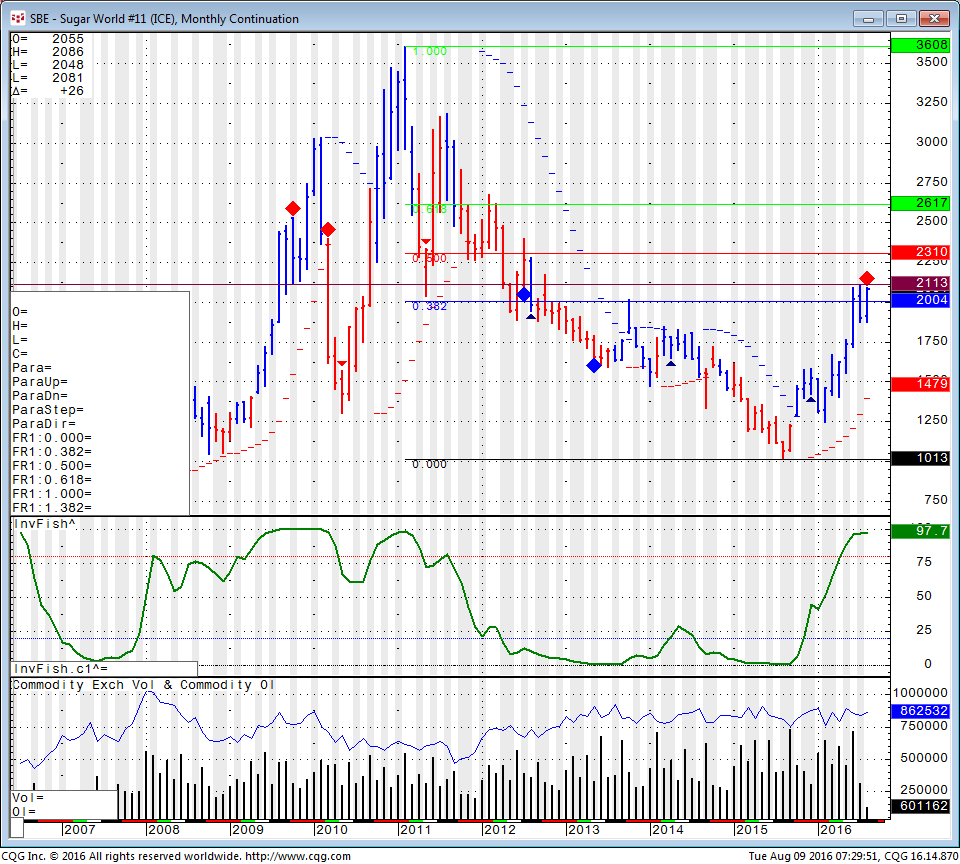

Click on image below to enlarge

The sugar market has made a significant upside move over the past few days and weeks. Weather concerns for part of the growing areas in Asia, as well as strength in the Brazilian Real contributed to this rally.

From a technical point of view, I feel this market is overbought and over-extended, but when fundamentals take over, you can use the charts for wall decoration. That being said, I will be looking for signs of exhaustion on

the daily and weekly charts. The chart below is a monthly chart of sugar, and you’ll notice we’re trading right against recent highs; I received a sell signal in the shape of my red diamond.

But, because I don't have a crystal ball, I will look on the daily chart for a similar clue before trying to go against the trend and go short.

The sugar market has made a significant upside move over the past few days and weeks. Weather concerns for part of the growing areas in Asia, as well as strength in the Brazilian Real contributed to this rally.

From a technical point of view, I feel this market is overbought and over-extended, but when fundamentals take over, you can use the charts for wall decoration. That being said, I will be looking for signs of exhaustion on

the daily and weekly charts. The chart below is a monthly chart of sugar, and you’ll notice we’re trading right against recent highs; I received a sell signal in the shape of my red diamond.

But, because I don't have a crystal ball, I will look on the daily chart for a similar clue before trying to go against the trend and go short.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 09/01 Thu |

6:30 AM CDT - Challenger Job Cuts(Aug)

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Productivity-Rev(Q2) 7:30 AM CDT - Unit Labor Costs-Rev(Q2) 9:00 AM CDT - Construction Spending(Jul) 9:00 AM CDT - ISM Index(Aug) 9:30 AM CDT - EIA Gas Storage 1:00 PM CDT - Auto & Truck Sales 2:00 PM CDT - Fats & Oils 2:00 PM CDT - Grain Crushings |

FN: Sep Orange Juice(ICE)

|

| 09/02 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Aug)

7:30 AM CDT - Nonfarm Payrolls(Aug) 7:30 AM CDT - Trade Balance(Jul) 7:30 AM CDT - Unemployment Rate(Aug) 9:00 AM CDT - Factory Orders(Jul) |

FN: Sep RBOB & ULSD(NYM)

LT: Sep Live Cattle Options(CME) Oct Cocoa Options(ICE) |

| 09/05 Mon |

LABOR DAY

|

|

| 09/06 Tue |

9:00 AM CDT - ISM Services(Aug)

|

|

| 09/07 Wed |

6:00 AM CDT - MBA Mortgage Index

1:00 PM CDT - Fed's Beige Book(Sep) |

|

| 09/08 Thu |

7:30 AM CDT - Initial Claims-Weekly

9:30 AM CDT - EIA Gas Storage 10:00 AM CDT - API & DOE Energy Stats 2:00 PM CDT - Consumer Credit(Jul) 2:00 PM CDT - Dairy Products Sales |

LT: Sep Nikkei(CME)

Sep Nikkei Options(CME) |

| 09/09 Fri |

7:30 AM CDT - USDA Weekly Export Sales

9:00 AM CDT - Wholesale Inventories(Jul) |

LT: Sep Canadian Dollar Options(CME)

Sep Currencies Options(CME) Sep Mx Peso Options(CME) Sep US Dollar Index Options(ICE) Oct Coffee Options(ICE) |

| 09/12 Mon |

11:00 AM CDT - WASDE Report & Crop Production

|

LT: Sep Orange Juice(ICE)

|

| 09/13 Tue |

1:00 PM CDT - Treasury Budget(Aug)

|

|

| 09/14 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Export & Import Sales(Aug) 9:30 AM CDT - API & DOE Energy Stats 2:00 PM CDT - Dairy Products Sales |

LT: Sep Wheat(CBT)

Sep Corn(CBT) Sep Oats(CBT) Sep Rough Rice(CBT) Sep Soybeans,Soymeal,Soyoil(CBT) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!