____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Dear Traders,

Trade war with China, the Chinese Yuan and President Trump twits moving the markets.

There is a correlation, even if it changes all the time, between the different markets.

Currently it seems that if the US$ goes up too much, stocks may go lower and bonds, gold go higher.

Same scenario resulting in grain prices lower and at times the energy sector follows.

Again, this is just a current observation and the correlations, direct and inverse, will change as the time goes and new events dominate the markets.

it is good to know what the current “flow” is between the markets and pay attention to the different sectors and how they influence the markets you are trading.

If you are primarily a stock index trader, it would still be wise to monitor US bonds prices, gold and crude oil.

If you like to chat about market correlations, possible spreads between markets and much more –

feel free to contact us and a series 3 broker will be happy to chat or speak on the phone.

On a different note, lets take a look at extreme oversold situation in the mini NASDAQ, the below is from my colleague Dave Register of ExitPoints.com:

The swing turning points based on pattern, price support/resistance, and time-cycle ratios are especially important when the market is overbought or oversold. I use two indicators for overbought or oversold. First if the commodity-channel-index(5) is above 100 it indicates overbought.If below -100 it indicates oversold. Second the rsi(2) is averaged over the most recently completed two days. If above 85 it indicates overbought, below 15 indicates oversold. Both of these indicators must agree for the market to be overbought or oversold. i.e. a reversal signal on the swing trade time frame of one to two weeks. Each evening my software scans the futures and forex markets for overbought and oversold conditions. Beware that if the rsi(2) indicator averaged over the recently completed two days is above 99 or below 1. The momentum is so powerful it should be considered a continuation signal.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

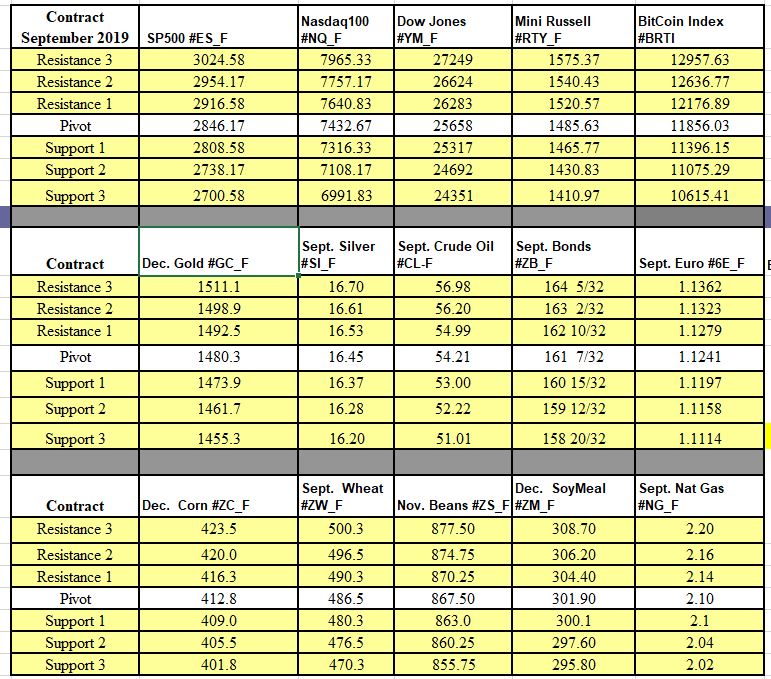

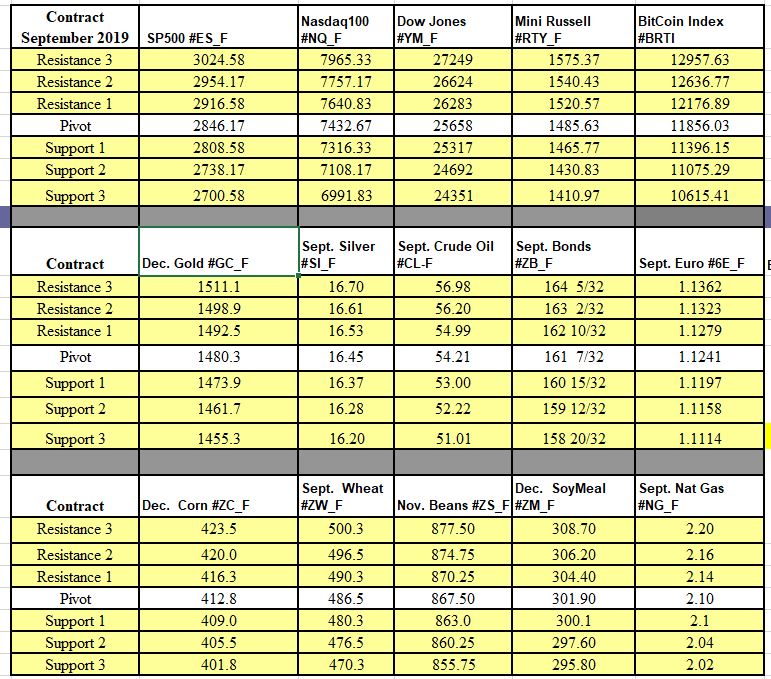

Futures Trading Levels

08-07-2019

Economic Reports, source:

bettertrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News