Keeping an Eye on Market Volatility in the Pit S&P | Support and Resistance Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

In this post:

1. Market Commentary

2. Support and Resistance Levels

3. Daily S&P 500 Futures Chart

4. Economic Reports

5. Earnings Releases

1. Market Commentary

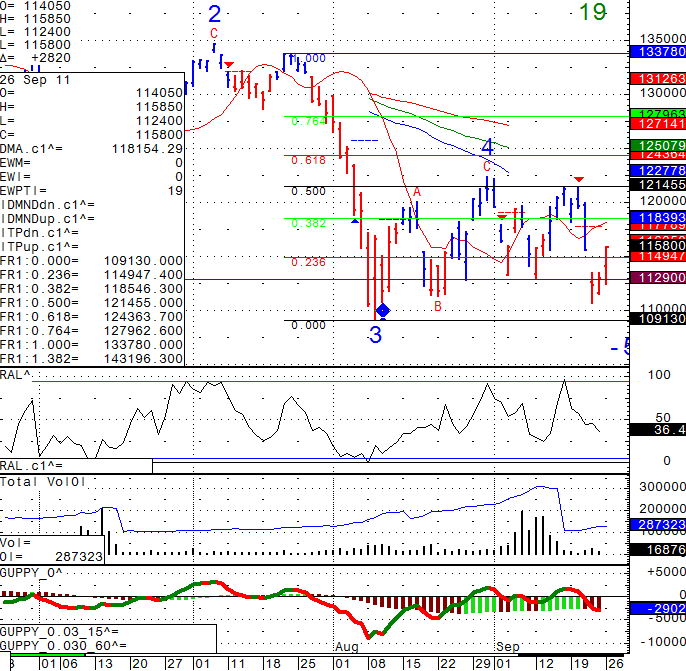

We closed the first gap on the pit session/ BIG SP as you can see below.

If market has more volume on the buy side, the next target is 1185, on the other hand if volume dries out up in these levels, I will be watching price action around 1149 and 1129 before deciding which way offers better risk/ reward.

At this point, I am neutral and will wait for market to give me some clues before deciding which way to attack.

Daily SP 500 chart for your review below:

GOOD TRADING!

2. SUPPORT AND RESISTANCE LEVELS!

| Contract (Sept. 2011) | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell |

| Resistance 3 | 1204.00 | 2322.33 | 11539 | 694.93 |

| Resistance 2 | 1181.25 | 2277.42 | 11259 | 678.67 |

| Resistance 1 | 1169.50 | 2252.08 | 11110 | 670.03 |

| Pivot | 1146.75 | 2207.17 | 10830 | 653.77 |

| Support 1 | 1135.00 | 2181.83 | 10681 | 645.13 |

| Support 2 | 1112.25 | 2136.92 | 10401 | 628.87 |

| Support 3 | 1100.50 | 2111.58 | 10252 | 620.23 |

| Contract | Dec. Gold | Dec. Euro | Nov. Crude Oil | Dec. Bonds |

| Resistance 3 | 1691.9 | 1.3769 | 86.97 | 145 18/32 |

| Resistance 2 | 1663.5 | 1.3657 | 84.16 | 144 31/32 |

| Resistance 1 | 1643.3 | 1.3581 | 82.72 | 144 |

| Pivot | 1614.9 | 1.3469 | 79.91 | 143 13/32 |

| Support 1 | 1594.7 | 1.3393 | 78.47 | 142 14/32 |

| Support 2 | 1566.3 | 1.3281 | 75.66 | 141 27/32 |

| Support 3 | 1546.1 | 1.3205 | 74.22 | 140 28/32 |

3. Daily S&P 500 Pit Chart from September 26, 2011

4. Economic Reports for Tuesday September 27, 2011

S&P/CS Composite-20 HPI y/y

9:00am

CB Consumer Confidence

10:00am

Richmond Manufacturing Index

10:00am

FOMC Member Fisher Speaks

1:20pm

Economics Report Source: http://www.forexfactory.com/calendar.php

5. Earnings Releases

| SYMBOL | COMPANY | EVENT TITLE | EPS ESTIMATE | EPS ACTUAL | PREV. YEAR ACTUAL | DATE/TIME (ET) |

| CALM | Cal-Maine Foods Inc | Q1 2012 Cal Maine Foods Inc Earnings Release | $ 0.20 | n/a | $ 0.09 | 26-Sep BMO |

| AMER.L | Amerisur Resources PLC | Interim 2011 Amerisur Resources PLC Earnings Release (for the 6 months ended 30 June 2011) | n/a | n/a | n/a | 26-Sep |

| 9977.OS | Aoki Super Co Ltd | Q2 2012 Aoki Super Co Ltd Earnings Release | n/a | n/a | n/a | 26-Sep AMC |

| ARU.AX | Arafura Resources Ltd | Preliminary 2011 Arafura Resources Ltd Earnings Release | n/a | n/a | n/a | 26-Sep AMC |

| ARYN.S | Aryzta AG | Full Year 2010/2011 Aryzta AG Earnings Release | n/a | n/a | n/a | 26-Sep 1:00 AM |

| ASTR.L | Astaire Group PLC | Interim 2011 Astaire Group PLC Earnings Release | n/a | n/a | n/a | 26-Sep |