Crude Oil Futures Market Opportunities | Support and Resistance Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Friday April 27, 2012

Hello Traders,

I spend a lot of time talking about stock index futures like mini SP, mini Russell etc.

However there more than a few other markets that have enough volume and volatility to attract daytraders. One of them is Crude oil.

I personally like Crude Oil futures because the “punishment or fulfillment” are pretty fast…and by that i mean that Crude Oil prices are volatile enough most of the times, that day-traders get stopped out with losses or exit with profits much quicker than other markets….Now if you are one of these daytraders who does not believe in stops…Crude Oil futures is not for you.

Each point on Crude Oil futures is $10, so a full $1 move or 100 cents is $1000 against you or in your favor.

We also have the mini Crude which is half the size.

If you have not traded crude before I recommend following it in demo mode, simulating some trades in demo mode before attempting to trade it live. As I said before, this is a volatile market which can work against you pretty fast if you are not disciplined.

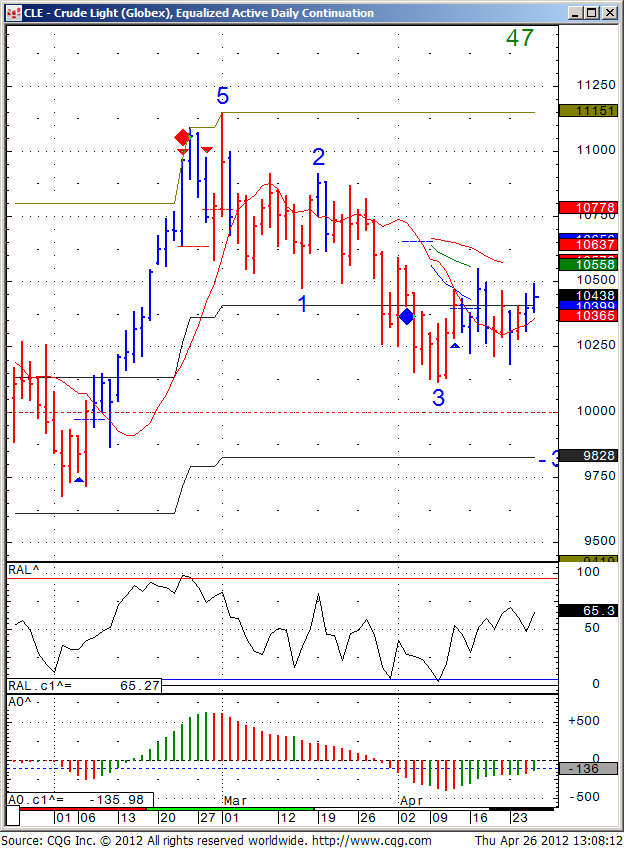

Below you will see my daily chart of crude oil futures where I think we may head lower unless we break above 105.50 ( That is $105.50 per barrel)

Friday is statistically better for SHORTS….

Below the daily chart of crude oil you will see an INTRA DAY chart from todays sessions, where you can get a feel for the market behavior.

Daily chart of June Crude Oil Futures:,

Intra day chart of Crude oil futures from today, April 26th 2012

GOOD TRADING!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (June 2012) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance 3 | 1416.83 | 2755.33 | 13352 | 833.13 |

| Resistance 2 | 1407.42 | 2741.17 | 13259 | 825.57 |

| Resistance 1 | 1401.83 | 2730.33 | 13210 | 820.83 |

| Pivot | 1392.42 | 2716.17 | 13117 | 813.27 |

| Support 1 | 1386.83 | 2705.33 | 13068 | 808.53 |

| Support 2 | 1377.42 | 2691.17 | 12975 | 800.97 |

| Support 3 | 1371.83 | 2680.33 | 12926 | 796.23 |

3. Support & Resistance Levels for Gold, Euro, Crude Oil, and U.S. T-Bonds

| Contract | June Gold | June Euro | June Crude Oil | June Bonds |

| Resistance 3 | 1685.6 | 1.3336 | 106.04 | 144 5/32 |

| Resistance 2 | 1673.8 | 1.3301 | 105.48 | 143 16/32 |

| Resistance 1 | 1666.1 | 1.3271 | 104.96 | 143 |

| Pivot | 1654.3 | 1.3236 | 104.40 | 142 11/32 |

| Support 1 | 1646.6 | 1.3206 | 103.88 | 141 27/32 |

| Support 2 | 1634.8 | 1.3171 | 103.32 | 141 6/32 |

| Support 3 | 1627.1 | 1.3141 | 102.80 | 140 22/32 |

4. Support & Resistance Levels for Corn, Wheat, Beans and Silver

| Contract | July Corn | July Wheat | July Beans | May Silver |

| Resistance 3 | 621.8 | 643.7 | 1505.67 | 3201.7 |

| Resistance 2 | 615.7 | 639.8 | 1494.08 | 3163.8 |

| Resistance 1 | 611.6 | 637.7 | 1487.17 | 3135.2 |

| Pivot | 605.4 | 633.8 | 1475.58 | 3097.3 |

| Support 1 | 601.3 | 631.7 | 1468.7 | 3068.7 |

| Support 2 | 595.2 | 627.8 | 1457.08 | 3030.8 |

| Support 3 | 591.1 | 625.7 | 1450.17 | 3002.2 |

5. Economic Reports

2:00am EUR

GfK German Consumer Climate

2:00am EUR

German Import Prices m/m

2:45am EUR

French Consumer Spending m/m

4:00am EUR

Italian Retail Sales m/m

Tentative ALL

G7 Meetings

8:30am USD

Advance GDP q/q

8:30am USD

Advance GDP Price Index q/q

8:30am USD

Employment Cost Index q/q

9:55am USD

Revised UoM Consumer Sentiment

9:55am USD

Revised UoM Inflation Expectations