Futures Trading Levels, Continued Debt Battle and More Volatility

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Our weekly futures trading newsletter was published today.

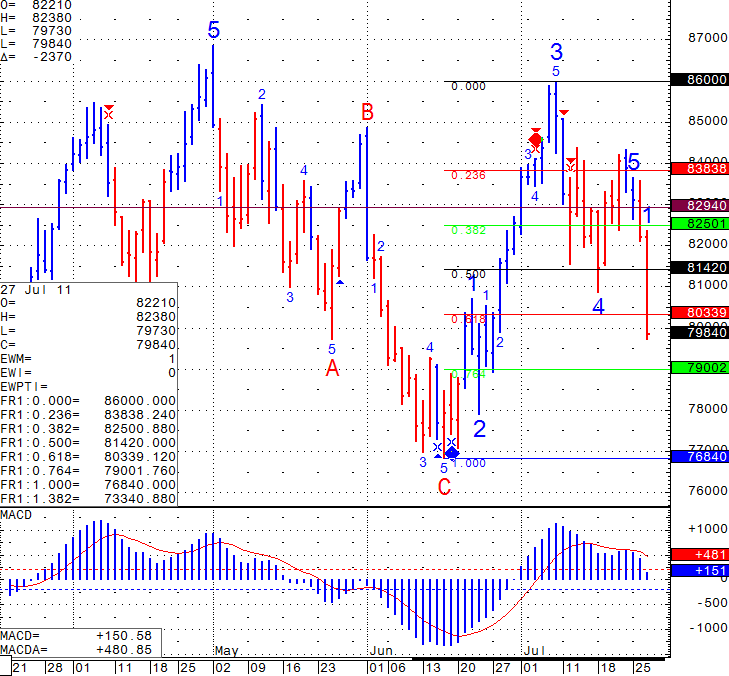

Daily chart of the mini Russell 2000 for your review below, volatility is INCREASING and one should always be ready for the unexpected with the US “debt battle” taking place. 890 seems to be next objective on the way down.

Daily Chart of the Mini Russell from July 27th 2011

GOOD TRADING!

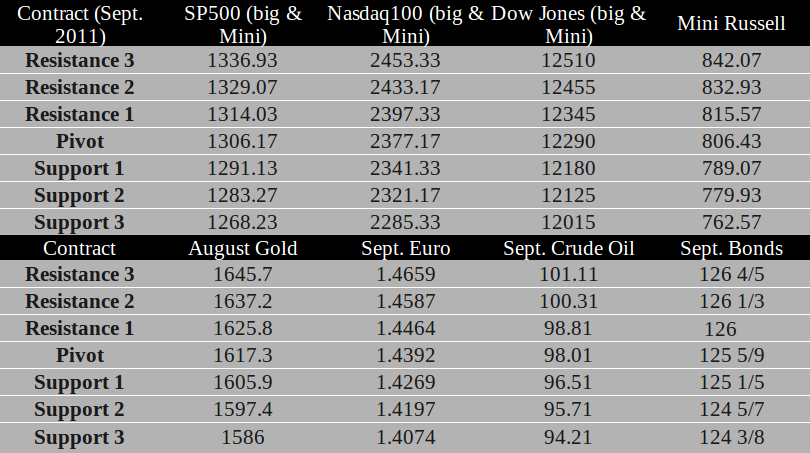

TRADING LEVELS!

Economic Reports Thursday July 28th, 2011

Unemployment Claims

8:30am USD

Pending Home Sales m/m

10:00am USD

Natural Gas Storage

10:30am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!