Futures Trading Levels, Costly Hiccups – Do YOU Have Any?

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Trading / E-Futures.com

Costly Hiccups – Do YOU have any?

by RealityTrader

Continuing our mini-series devoted to trading psychology, let’s look into another very common problem traders encounter.

One of the most frequent questions I get: “OK, I seem to have mastered a lot, I can extract money from the markets and I have stretch of winning days BUT… one day comes when I seem to be unable to follow my own rules, I start doing everything against what I learned, dig deeper and deeper hole… and when the day is over I find myself giving back all I made in a week before that! I feel groggy… then I remember everything I learned, pick myself up, glue pieces together, start trading carefully, start making money… only to have another blow-off just like the previous one in a week or two! What’s going on, why can’t I control myself and how do I avoid these frustrating days??”

If all above sounds familiar – it should. I haven’t met many traders who avoided this problem. Good news is, it’s a somewhat good problem to have since it appears at the stage where your method is good enough and mastered well enough so you are able to make money consistently inbetween those disgusting days. Bad news is, there is no other way to overcome this problem but to understand the root of it. This, however, is true for all psychological barriers we encounter in trading – no magic button to push and turn the problem off, have to understand where the problem stems from so you can recognize it when it re-appears and apply the right patch. And this problem is pure psychological – after all, what could change so drastically on the fifth day after four days of winning? Aside of your own behavior that is.

So, what gives? Why the Momentary Lapse Of Reason (yeah, I am old-fashioned enough to love Pink Floyd)?

Mechanics of this phenomenon are fairly intuitive. Remember the saying “When we succeed we tend to stop doing what made us a success in a first place”? This is exactly what happens here. As we make money day after day we start feeling invincible. Worst yet, subconsciously we start assigning the success to our genius. It’s not the rules we follow. It’s not the system we apply. It’s not the favorable market (God forbid market helps us, we BEAT the market, we WIN against it! Right? Right?). It’s US – we are above the rules, above the system, we are THE trader.

If you had to put all above in a single word, which one would you pick? Right. EGO. This eternal “enemy within” finds the way to undermine our success by convincing us that we are the second coming of Einstein. All this happens quietly, in the background, you don’t even notice how paradigm changes… but it does, and somewhere deep inside you don’t believe anymore that rules apply to you.

Catastrophe comes with the next losing trade. Instead of taking our usual pre-determined stop (which was what kept us safe during winning streak) we chose to ignore it. Why, we are the winner. We are having winning streak, uninterrupted for days or weeks. And since it’s our genius that makes it happen, we won’t lose this time too. Why take the loss, winning streak will continue. Rules are beneath us. Market be beaten and crying bitterly. We be laughing.

Know the rest, right? Stock continues against us. Either we take the loss finally, much bigger than the total of our losses for a week before… or we hold… oh, and by the way, while we fought this one, another trade came along, and we went for it, and it went in our favor, but we haven’t taken the profit where we normally would. Why, we needed the size of win to be a bit bigger, to compensate for this darn stubborn losing trade… and new one reversed on us and became a loser too.

Long story short – when this day is over, you dream of never waking up today. You think of how small your loss for the day would be should you take the stop. Worse yet, with that second trade you would even be positive for the day – providing you have taken the profit at your usual level. Instead, week worth of good careful trading is ruined. And why? Because you let your ego trade. It wasn’t you who made that decision to break the rules. It was your ego. But it were you who let it. Don’t. You are not above the market. You are not above the rules. When you win, it’s not because your greatness makes the rules irelevant. You win because you follow the rules. Little humility will go a loooong way. Self-irony helps. As one of the best traders in our trading room says every time when congratulated with winning trade – “Lucky.” And when pressed not to be so humble, adds: “Stops are skill. Wins are luck”. Whether or not it’s so is irrelevant, really. Self-irony and humility make a better trader.

Vadym Graifer is an author of the unique A Taoist Trader course devoted to trading philosophy and psychology

This is not a solicitation of any order to buy or sell, but a current market view provided by third party. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!

Make it a great trading week!!

GOOD TRADING!

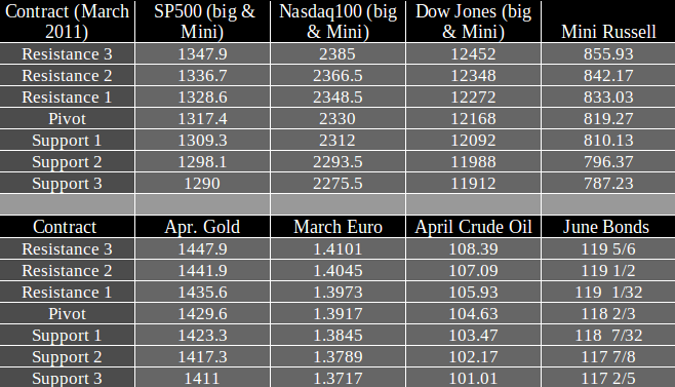

TRADING LEVELS!

Economics Report Source: http://www.forexfactory.com/calendar.php

Wednesday, March 9, 2011

Wholesale Inventories m/m

10:00am USD

Crude Oil Inventories

10:30am USD

Treasury Sec Geithner Speaks

1:30pm USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!