Guide to Trading Dow Jones Futures

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

What are the Dow futures?

The E-mini Dow Jones $5 futures contract

( https://www.cannontrading.com/tools/futures-market/indices/E-mini-Dow-Jones-Futures ) is a derivative of the Dow Jones Industrial Average (DJIA), which is a stock index that conveys the value of thirty U.S. based, publicly owned companies. Since the Index’s value was first calculated in 1896 (then, only 12 companies comprised the index), its 30 components have changed 52 times and now include many companies of a non-industrial nature, including Apple, Goldman Sachs, IBM, Intel, and Microsoft. Today, “The Dow” is still one of the most commonly cited and recognized stock indexes in the world. As of Dec. 2018, its market capitalization was valued at $6.56 trillion.

The E-mini Dow Jones $5 futures contract represents a way to take advantage of market exposure to all 30 companies that make up the DJIA by trading a single futures contract. The “Mini Dow” trades electronically 23 hours a day, six days a week on the Chicago Mercantile Exchange ( via the CBOT Chicago Board of trade) division – the world’s largest derivatives exchange – with a ticker symbol YM. It allows the investor to take a position – long or short – in the market on an anticipated move in the DJIA. It also can be used as a hedge against a larger-scale exposure in the market.

Why Trade Dow Futures?

Dow futures (YM) is short for The Dow Jones Industrial Average. This stock market index is one of the three most popular along with ES- S&P 500 and NQ – Nasdaq. The Dow was launched in 1896 and is a group of 30 popular companies based in the United States. The Dow Jones futures are traded on CBOT- Chicago Board of Trade and currently has the lowest overnight margin ($6,050) and a tick size of $5. Recently the CBOT began offering a micro Dow contract symbol MYM, this is 1/10 the size of YM. Dow futures can be used to hedge your positions in the individual stocks you own within the basket.

A few reasons to trade the Dow Futures:

- For hedging purposes of your stock portfolio

- For speculation on the overall index rather than individual stocks.

Most retail clients will trade for speculation, and the rest of this article will detail more than a few ways to speculate on the Dow Futures also known in our commodity world and futures markets as the YM

Day Trading Future Dow Jones

One way to speculate with the Dow Futures is day-trading, or short-term trading. If a trader opens and closes the position in the same day, it is called day-trading. Day-trading futures allows for even lower margins than the already leveraged contract, and creates a situation where both profits and losses are magnified. For example, on a day where the Dow Jones moves 200 points, a trader can be up or down $1,000 per one mini-dow futures (200*$5 per point). A client with $5,000 account could, in theory, control 10 (yes 10!) mini-dow futures contracts if he or she wanted to be extremely aggressive, in that case a simple 10 point move against you or in your favor would translate to $500, some thing that can happen in seconds….( 10 contracts*$5*10 points).

Unlike day trading individual stocks, day trading the dow futures does not require a $25,000 deposit to one’s stock account. In fact, you can have a futures account as low as $1,000 and still trade the entire Dow futures index.

So now that you understand the attraction of day trading the mini Dow Jones futures contract, let’s take a look at a few ways one can day-trade the Dow futures:

Counter Trend: As the name implies, a trader will try to “fade” a current move or trend with anticipation of the market reverting to the mean.

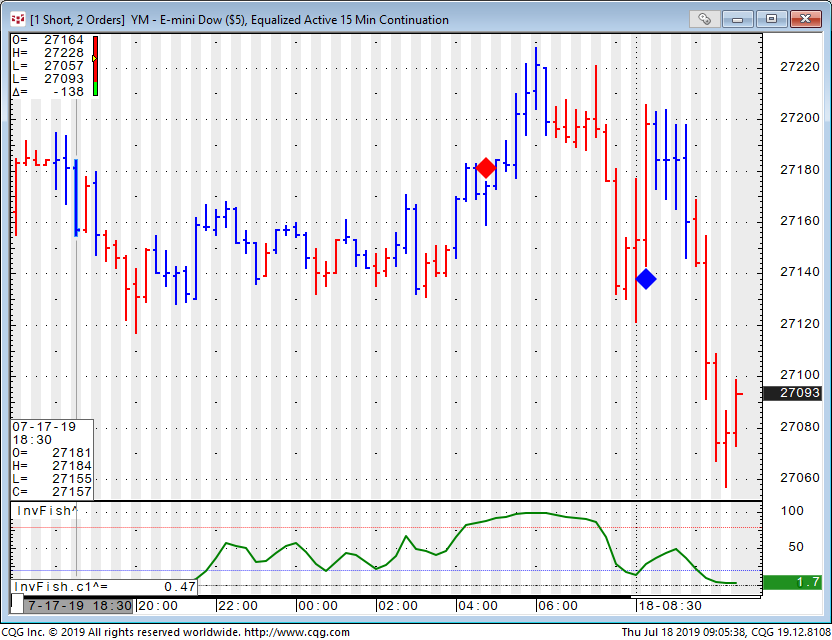

Here is a chart example of both a successful counter trend trade and a failed one…the red diamond suggests sell against current buy and vice versa with the blue diamond which said buy even though the market was going down.

You can read more about these counter trend signals and other signals at: https://www.cannontrading.com/tools/intraday-futures-trading-signals

Trend Following: Using this method, the trader tries to identify a current trend and then get in and capture part of the trend. As always in trading, things sound much simpler than they are when you are in the heat of the battle and there is real money on the line…

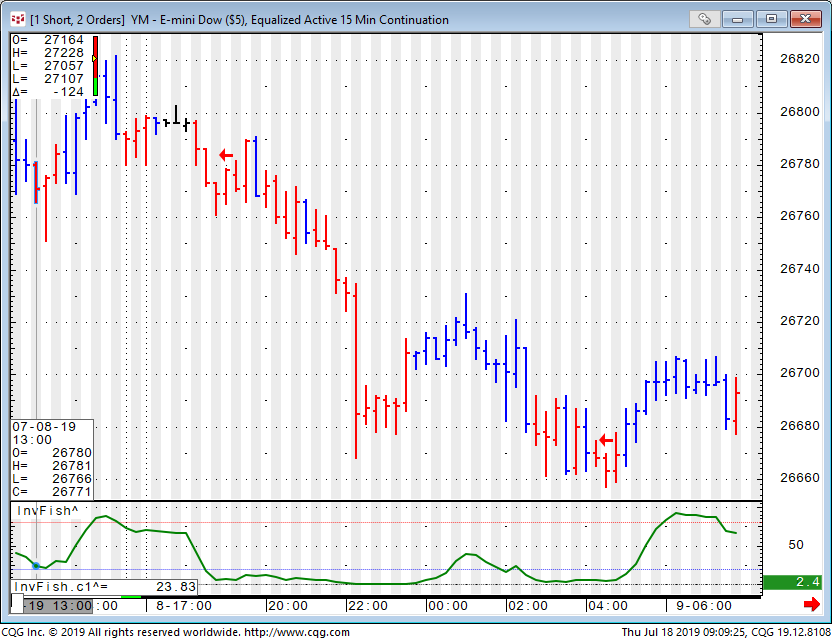

Here is a chart example:

Again, what you see are two examples, good and bad. The red arrow signals a down trend. The big question is where does one enter? How much does one risks? Where does one exit?

But the chart above does show a good example of an attempt to capture part of the trend.

Breakout: Breakout trading is a concept that is used and has been used in trading for years. The thought behind it is that once a market breaks a major support or resistance level, there should be follow through that will allow for further movement in that direction.

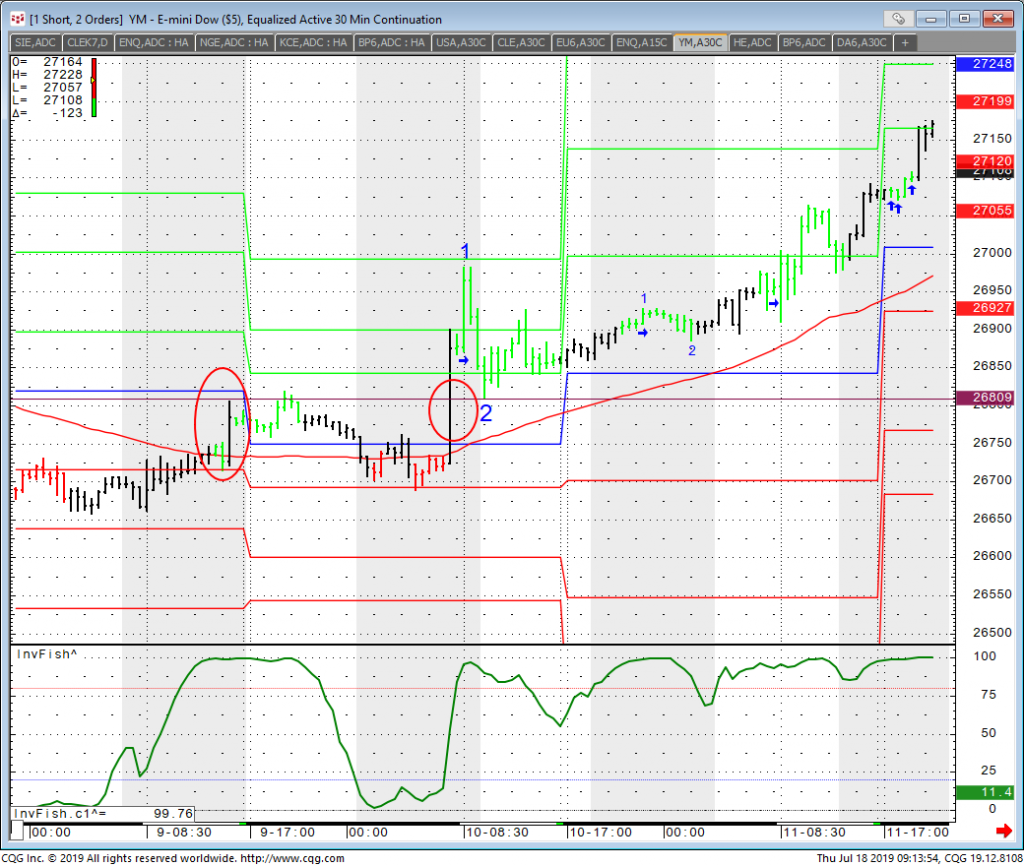

Here is a chart example of a breakout move, again two samples, the first circled example shows a breakout above the 26809 level that FAILED, followed by a breakout, also circled, that had a strong follow through.

Various other ways:

There are many other ways for traders to both lose and make money while trading futures and other financial instruments in general and in Dow Jones futures specifically.

Order flow analysis, market profile, chart patterns are just a few of the ways that traders approach day-trading in general as well as trading the YM, the mini Dow Jones Futures.

Swing Trading Dow Futures

The same techniques discussed above can also apply for swing trading. The difference between day-trading and swing trading is that the trader will enter a position with the intent of holding it over few days to a few weeks in anticipation of larger moves. This will usually correlate to higher possible risk and higher desired profit.

With the intent of holding the position more than a few hours comes what we call overnight margins. In the case of the Dow futures, the overnight margins for holding one mini Dow Jones Futures contract are $6,000. That is quite different than the $500 required for day-trading.

That means that for every YM a trader plans to trade ( short or long) he will need to have $6,000 in the account.

You can read more on margins at: https://www.cannontrading.com/services/futures-trading-margins

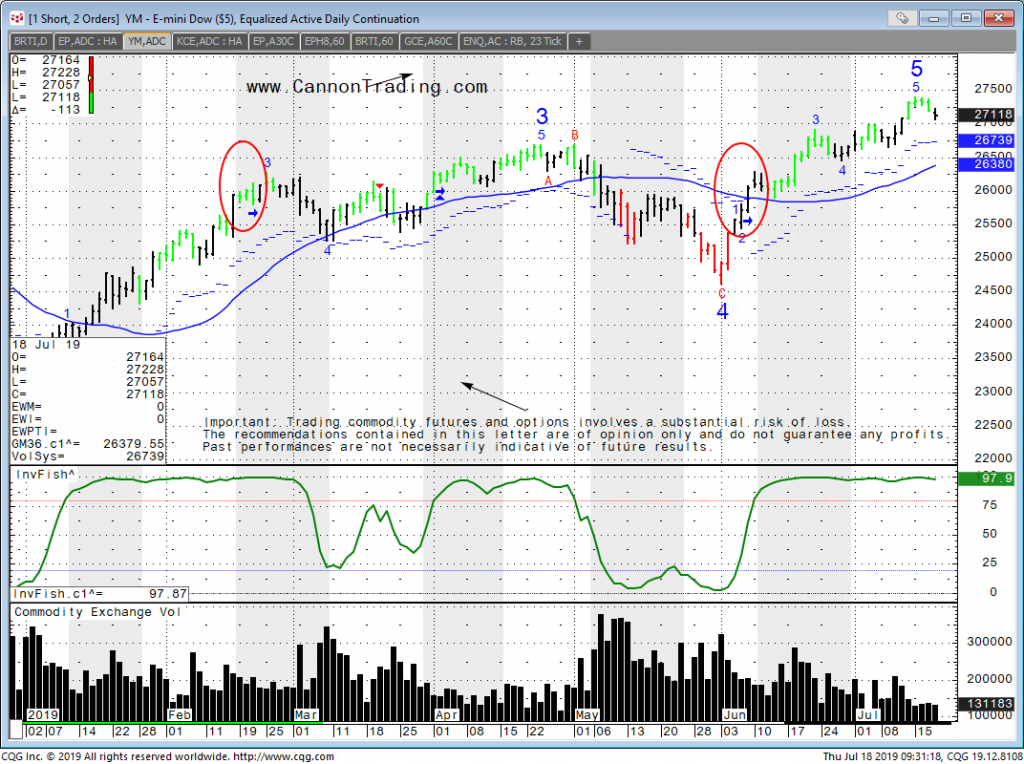

Here is a chart example for swing trading using trend following techniques, once again failed example and a better one to follow:

Trading Dow Jones using options on futures

There are several books written on options in general and futures options in specific. We have also written our own here at Cannon, outlining some of the strategies we like to use with future options.

https://www.cannontrading.com/tools/education-futures-options-trading-101

Options on the Dow Futures are no different than options on other futures and commodity contracts. The same strategies apply. In my opinion when it comes to options you either have to be correct on where the market is moving to or be correct of where the market is not going to reach…..

When it comes to trading options on the YM, here are few ideas and pointers to evaluate and take into consideration:

YM has weekly options. Weekly options are a great alternative for short traders as a way to speculate by buying calls (if you think the market is going up) or puts (if you think the market is going down). When buying options, your risk is limited to the premium paid + trading fees, which appeals to many. Therefore, the weekly option can be a good alternative to day trading and/ or swing trading, but one can also use weekly options on the Dow futures as a hedge for a long or short position.

In addition to the weekly options, Dow futures also have quarterly options and end-of-month options. A more advanced option is the strategy of either buying vertical spreads or selling vertical spreads.

If a trader thinks the Dow futures are heading lower (and in this example the Dow Futures are trading at 27150) , they can do one of the following:

- Buy a vertical put spread, where they buy the 27000 put and on the same transaction sell the 26500 put.

- Pay the difference between the premium of the two strikes and profits are maxed at 500*$5 or $2500 if the Dow Futures are below 26500 at expiration.

On the same token, another strategy is selling vertical spreads. As long as 3 of 4 scenarios happen, one can make some profit, but one may lose a larger amount if one of the four scenarios happens. So in the same example of above, the trader could sell or collect premium by selling the 27500 call and buying the 28000 call. The trader will receive premium (also requires margin) and will get to keep all the premium if Dow futures go down, hover around the same price, or go up slightly by the time the options expire. Of course, one could offset the trade at any time before the expiration as well.

Selling premium is a much higher risk strategy and I recommend talking to a professional first.

Using Automated Trading and Systems to trade the YM

If your focus is the Dow Jones futures, then you can do one of the following and be involved, sometimes even if you are too busy to trade:

- Subscribe to a trading system that trades the mini Dow Jones Futures. https://cannon.isystems.com

- Create your own strategy and automate it.

- Look for a CTA ( Commodity Trading Advisor) who offers a program that focuses on trading the YM.

Again, I recommend that you speak with a broker who can give you insight into the different factors you need to consider, how to evaluate results, differences between back-testing and live trading, and provide you with feedback that will allow you to consider the right solution based on your risk capital, experience, and preference for risk (or lack thereof).

Summary

The Dow Futures are a very popular tool for traders and everyday people to get a feel for the stock market. Many times before the stock market opens, you will hear on the news that “Dow futures are pointing to a higher opening on Wall Street” or “ Dow futures are sharply lower in overnight trading”.

Many use the Dow Futures as a tool to gauge what stocks are doing. In this article I hope I opened your eyes to more than a few ways one can participate in trading the Dow futures and options and perhaps provided you with some ideas to explore on trading the YM – Mini Dow Jones Futures Contract.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.