Will the Mini S&P 500 See a Meaningful Bounce? | Support and Resistance Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

In this post:

1. Market Commentary

2. Support and Resistance Levels

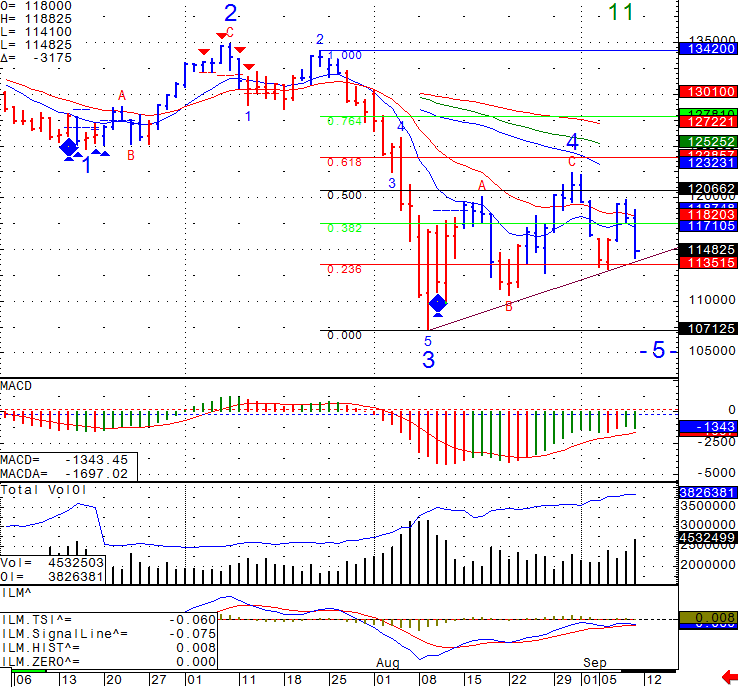

3. December Mini S&P 500 Continuous Futures chart

4. Economic Reports

5. Highlighted Earnings Releases

1. Market Commentary

FRONT MONTH FOR EQUITIES AND BONDS IS DECEMBER

SYMBOL FOR DECEMBER IS Z

From a technical perspective, Dec. Mini Sp must hold above 1130.00 to have a chance of a meaningful bounce, a break below that level and we should test 1071.25 which is the equivalent for the Sept. lows of 1077.

Have a great weekend and be ready for a full, volatile trading week coming up.

Dec. mini SP continuous chart for your review below:

GOOD TRADING!

2. SUPPORT AND RESISTANCE LEVELS!

| Contract (Sept. 2011) | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell |

| Resistance 3 | 1193.67 | 2286.92 | 11639 | 728.60 |

| Resistance 2 | 1181.48 | 2255.08 | 11470 | 713.60 |

| Resistance 1 | 1165.37 | 2208.67 | 11192 | 692.20 |

| Pivot | 1153.18 | 2176.83 | 11023 | 677.20 |

| Support 1 | 1137.07 | 2130.42 | 10745 | 655.80 |

| Support 2 | 1124.88 | 2098.58 | 10576 | 640.80 |

| Support 3 | 1108.77 | 2052.17 | 10298 | 619.40 |

| Contract | Dec. Gold | Sept. Euro | Oct. Crude Oil | Dec. Bonds |

| Resistance 3 | 1916.5 | 1.4167 | 93.15 | 144 |

| Resistance 2 | 1894.1 | 1.4051 | 91.32 | 142 25/32 |

| Resistance 1 | 1876.8 | 1.3857 | 89.29 | 142 |

| Pivot | 1854.4 | 1.3741 | 87.46 | 140 25/32 |

| Support 1 | 1837.1 | 1.3547 | 85.43 | 140 |

| Support 2 | 1814.7 | 1.3431 | 83.60 | 138 25/32 |

| Support 3 | 1797.4 | 1.3237 | 81.57 | 138 |

3. December Mini S&P 500 Continuous Futures chart from September 9th, 2011

4. Economic Reports Monday September 12th, 2011

FOMC Member Fisher Speaks

4:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

5. Today’s Highlighted Earnings Releases

| SYMBOL | COMPANY | EVENT TITLE | EPS ESTIMATE | EPS ACTUAL | PREV. YEAR ACTUAL | DATE/TIME (ET) |

| KR | Kroger Co | Q2 2011 Kroger Co Earnings Release | $ 0.43 | n/a | $ 0.41 | 9-Sep BMO |

| DMF.BE | Del Monte Foods Co | Q1 2012 Del Monte Foods Co Earnings Release | n/a | n/a | n/a | 9-Sep |

| HURC | HurCo Companies Inc | Q3 2011 HurCo Companies Inc Earnings Release | $ 0.43 | n/a | -$ 0.18 | 9-Sep BMO |

| OPTT | Ocean Power Technologies Inc | Q1 2012 Ocean Power Technologies Inc Earnings Release | -$ 0.36 | n/a | -$ 0.61 | 9-Sep BMO |

| PNY | Piedmont Natural Gas Co Inc | Q3 2011 Piedmont Natural Gas Co Inc Earnings Release | -$ 0.12 | n/a | -$ 0.13 | 9-Sep BMO |

| ACET | Aceto Corp | Q4 2011 Aceto Corp Earnings Release | $ 0.12 | n/a | $ 0.17 |