COVID and How it’s Affect the Futures Markets, Crude Oil Futures Chart & Support and Resistance Levels 1.06.2021

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Light at the End of the Tunnel?

by Mark O’Brien, Senior Broker:

As we transition into 2021, the overriding impact on the global economy and commodity prices remains the world-wide pandemic. Rising post-holiday infection figures in the U.S. from California to Rhode Island, in Europe, particularly the U.K., a return of the virus in China, and a newly discovered more contagious variant are all pointing to seeing January as the worst month in this now year-long scourge. Yet, a wide range of markets have been steadfast over the last 3-4 months in their ability to look past this crisis and price in demand improvement. Grains, metals, energies, gasoline, softs all have staged heady rallies. Soybeans are at 6-year highs. Crude oil traded through $50/barrel today, platinum trading above $1,100/ounce breached 4-year highs. Likely, as new and existing vaccines are made available and administered, as the holiday infection surge passes and hospital capacities come down, as we move toward the herd immunity that health officials have explained, the markets will take stock of the light at the end of the tunnel and assess these gains. Likely as well, overall price volatility across most if not all commodity asset classes will remain for the new year.

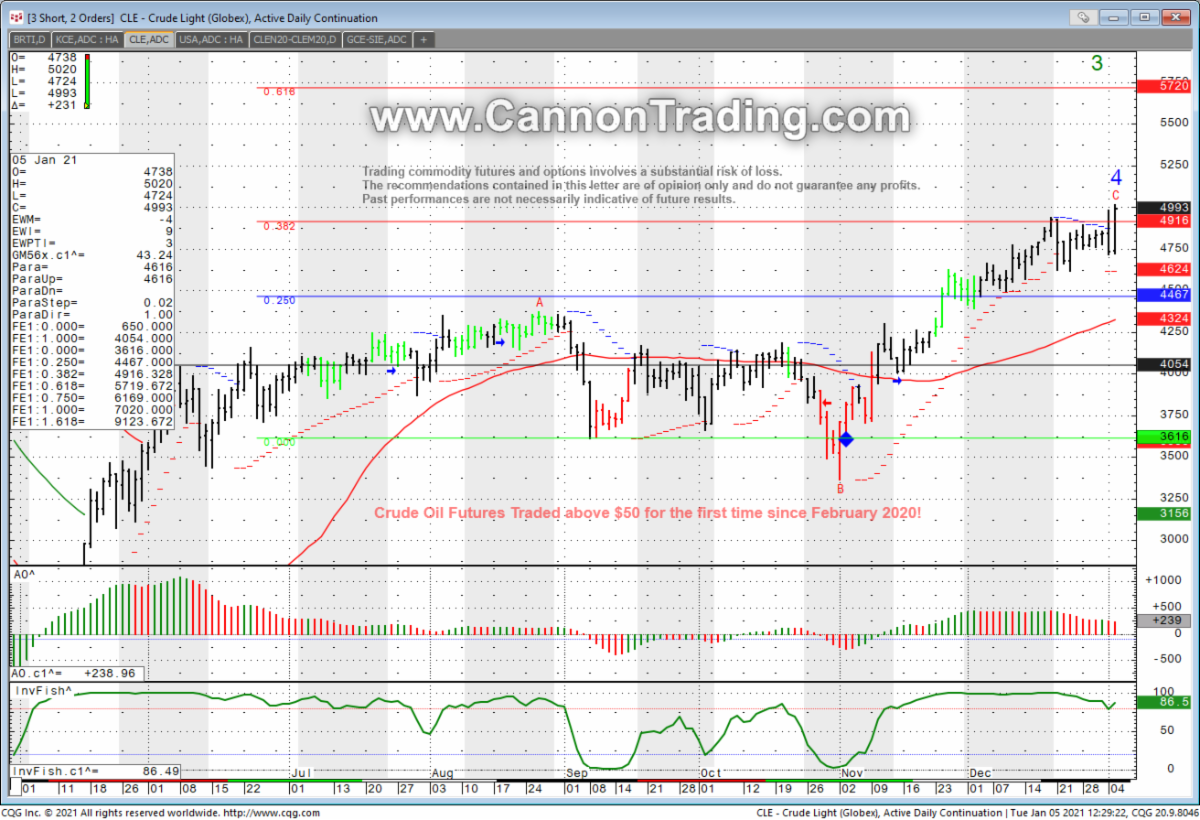

Crude Oil broke above $50 for the first time in almost a year on OPEC meeting.

Daily chart below.Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

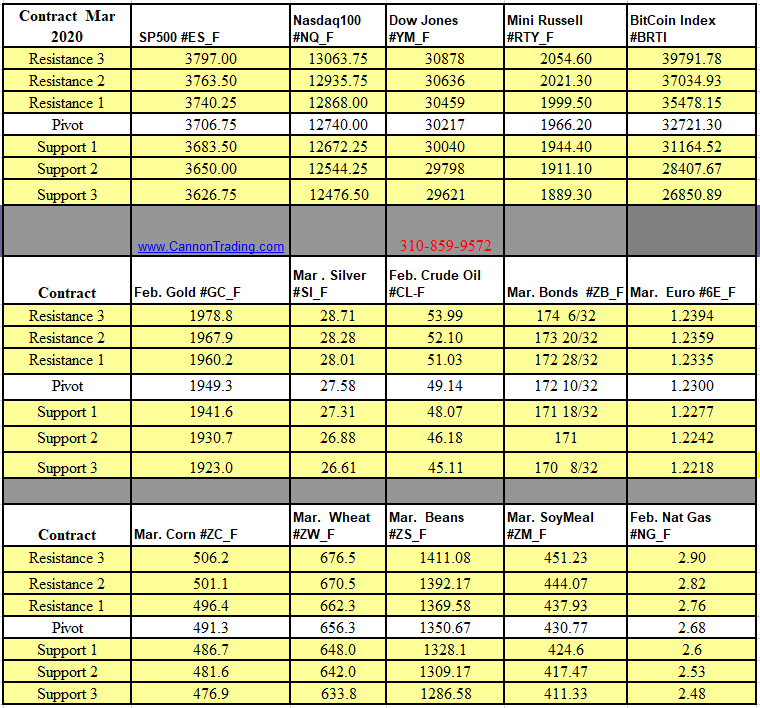

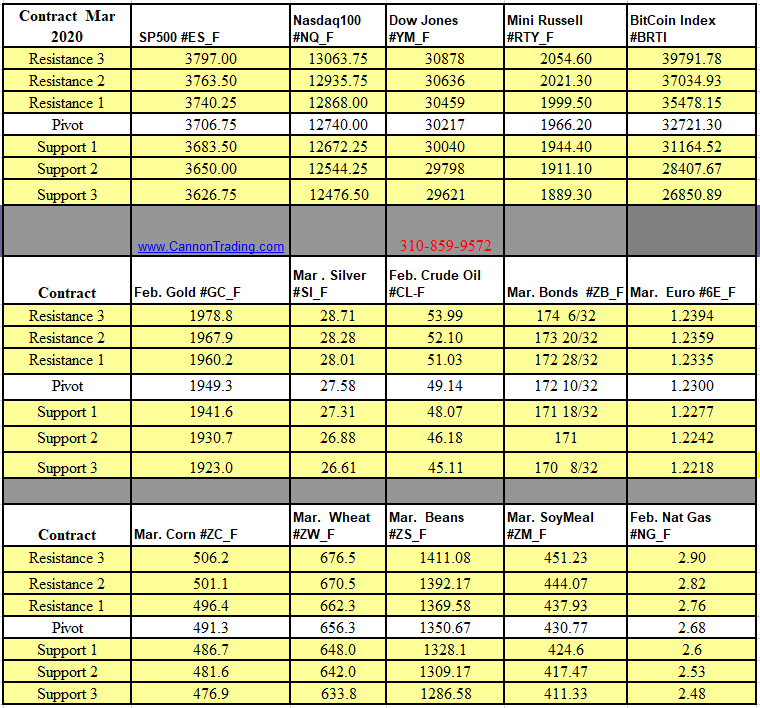

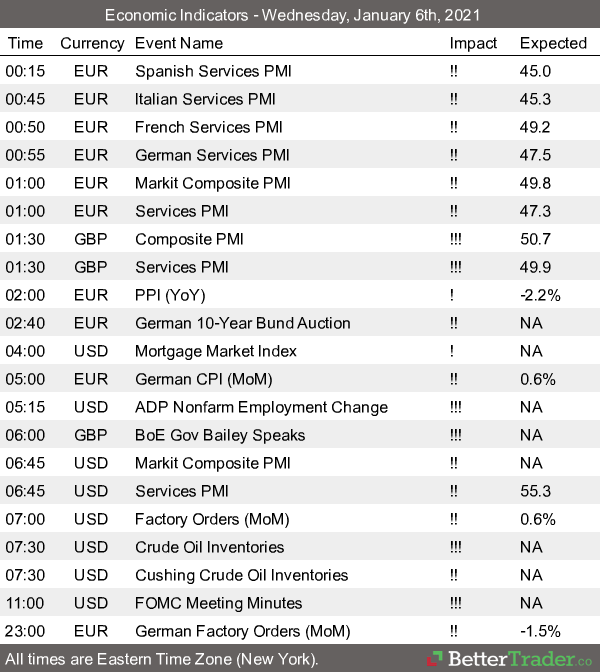

Futures Trading Levels

1-06-2021

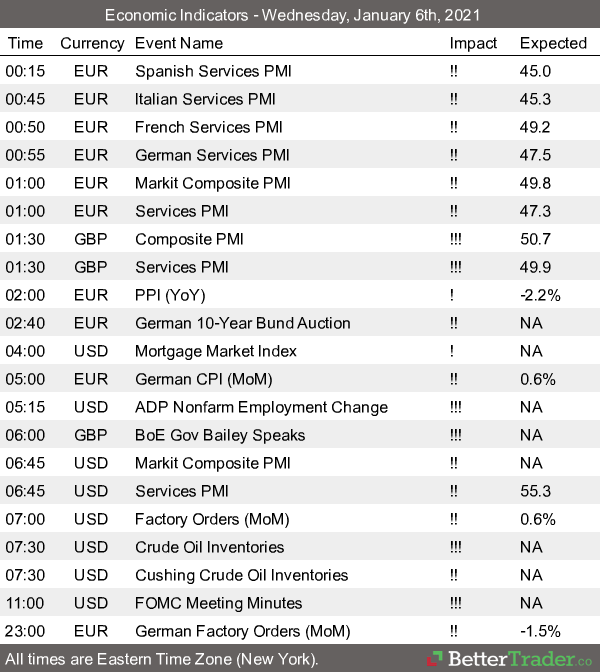

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Tags: COVID > COVIDE-19 > Crude Oil trading > Discount Trading > futures trading

Posted in: Crude Oil