Futures Trading Levels, Types of Trading Days

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Trading / E-Futures.com

The following is taken from a guide I have written that helps subscribers to my daily chart service. You can have a 2 week free trial to the daily live charts service along with buy/sell triggers and get the full guide along with chart examples, rules and much more by signing up at:

Cannon Trading Inc. Day Trading Webinar

General Notes:

At any given day, one must understand the trading environment that specific day has to offer and adjust their trading style accordingly. In our case it relates more to the size of stops and target based on volatility. Some days the market gives us many opportunities; some not as much; and some days it provides us with mostly risks…….take what the market gives you and not what you want it to give…..

I think if a trader understands early enough what type of trading day it is, he or she can choose which tools from the webinar are most suited for that days trading. If one can do that successfully (which is not easy), I think that is half the battle.

Not taking a trade is better than a bad trade.

My opinion is that there are 3 main types of trading days.

- Most common is two sided trading action with swings up and down – this type of trading day is most suitable for the main aspect of this model, which is taking trades based on the arrows.

- Strong trending day, mostly one directional – this type of trading day is the least common, many times this will happen on Mondays and maybe 3-5 times a month at most – this type of trading day is most suitable for using the color scheme I have on the charts. Green bars mean strong up trend, red bars mean strong down trend. If you determined that this is a trend day, then use pull backs to enter with the direction of trend and use the parabolic (little dashes) as you trailing stop.

- Slow and/ or choppy trading day – this type of trading day is best suited for taking small profits from the market by either using the main model or taking the diamonds as entry signal, and going for quick profits and tight stops.

Assessing the Type of Trading Day

- A good question is how can one assess what type of trading day we will have while the market is still trading? I am doing some work about it and will be happy to hear feedback via email, but here are some initial observations:

1) Was the overnight session a wide, two sided trading range? If the answer is yes, good chances are for a similar trading day during the primary session (primary session is when the cash/ stock market is open).

2) Mondays have the highest chance for trending days.

3) The behavior of the first hour of trading can also suggests the type of action for the rest of the day.

4) If the first 30 minutes have good volume, better chances for type 1 or type 2 trading days.

5) Low volume during the first 30 minutes can suggest a choppy (type 3 trading day).

- Many times signals will come around the lows / highs of the day. Many traders get scared, but one must understand that this is a “counter trend/ turning point” model. If you use the stops described and stay disciplined, you will have the confidence of taking those trades.

- The nice thing about this model is that it allows you to use tight stops. It is MORE than OK to get stopped out, you will have plenty of signals each day.Don’t get married to every position. Stay nimble. Again, there are plenty of signals every day and the key is capital preservation so you have the ability and confidence to catch the good trades.

- This model does VERY well on days where we see two-sided, volatile action. It does not do very well on strong trend days OR slow, choppy, low volume days. Understand it, accept it and apply strict DAILY money management principles as I outlined in an article I wrote for SFO Magazine a few years back, called “Survivor Day-Trading” (please email me if you would like a copy).

- The way I recommend new clients and/or prospects to go about my charts is as follows: First read the notes and rules. Second observe for a day or two to get a feel. Third try to implement in demo mode for at least 10 days so you can experience good days, bad days and in between and last, then decide if this is something that can help you and if so then and ONLY then start trading live.

Trading on Economic Numbers:

Sometimes it’s a tough call if one should enter a trade right on the release of economic numbers. Most traders prefer NOT to trade on a release of numbers and would rather wait for the markets reaction first. You should have a daily email I send with what economic reports come out and what time.

Trading Journal:

One thing I recommend is to keep a trading journal. Make notes so when and if you are still trading next year (which will mean that you have increased your chances to succeed in trading tremendously) you can go back and refer to market behavior during the different times. I keep notes for FOMC, holidays, monthly unemployment reports, and different half days etc.

Another benefit of keeping a trading journal is that it helps “venting out” your emotions and frustrations on bad trading days and can help you keep in perspective on the good trading days.

Quick Pointers on the Vast Subject of Trading Psychology

Trading is SO MUCH MENTAL, once you have a concept you believe in, have confidence in it. After that there is a lot of psychological work….

Some examples:

- Ability to take losses and know not every trade will be a winner and not every day will be a winner

- Ability to stay patient and NOT feel that if you are NOT trading, you are NOT doing your job….

- The confidence to stay in winning trades and the discipline to get out of losing trades

- Allowing trades some time to work

- Not getting down on yourself for “could have should have etc”

Being a hard worker and keeping a journal after certain trading days can only be beneficial for yourself. Being a hard worker, putting in the time and effort to learn new approaches and set ups before deciding if it’s worthy or not. I WILL SAVE THIS LITTLE LIST AND ADD TO IT AS DAYS PROGRESS.

Money Management:

If I had to choose only one factor that is most important for success of a day-trader, I must say it is the ability to set daily stop levels and daily profit levels, be disciplined enough to follow it and say thank you and walk away when you have a good day and vise versa, say thank but no thanks when you have a bad day and hit your daily stop level. I detailed more about the topic in an article I wrote for SFO magazine few years back titled, “survivor day-trader” – be happy to email it if u have not read it, send me an email to ilan@cannontrading.com or trading@levex.net

You MUST BE DISICPLINED and wiling to take losses….we are only going for very quick profit, hence don’t risk too much…losing trades are part of trading, no one bats 100%…..

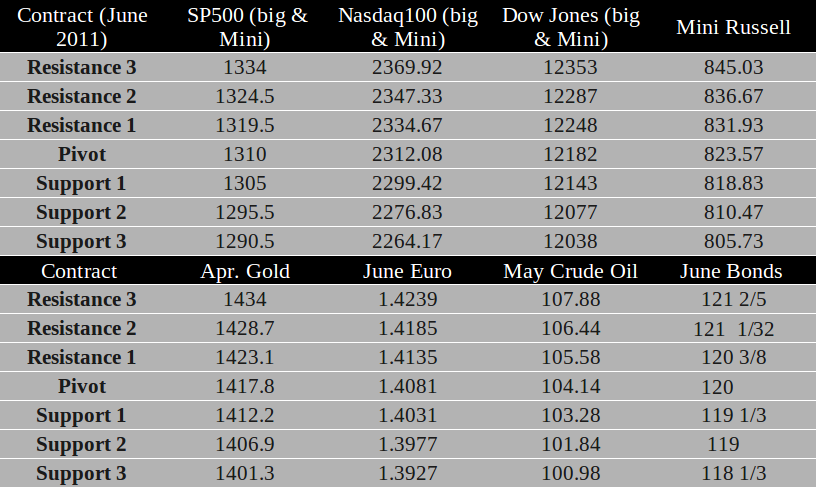

TRADING LEVELS!

Economic Reports Wednesday March 30, 2011

Challenger Job Cuts y/y

7:30am USD

ADP Non-Farm Employment Change

8:15am USD

Crude Oil Inventories

10:30am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!